The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, reinstated 100% bonus depreciation for qualifying assets placed in service after January 19, 2025.

In Part I and Part II of this series, we covered how to configure the new OBBBA bonus depreciation codes and apply them retroactively to eligible assets. Now, in Part III, we’ll walk through how to update your existing asset profiles to ensure that newly added assets are automatically assigned the correct 100% bonus depreciation going forward.

Updating asset profiles streamlines compliance with the OBBBA and reduces the risk of incorrect depreciation setup in the future. This step is essential for organizations looking to automate and simplify ongoing asset additions under the new rules.

Let’s get started.

Step-by-Step: Update Asset Profiles with OBBBA Bonus

- Launch the Bonus Update Profile process

Use this process to insert new effective-dated rows for OBBBA bonus depreciation directly into existing asset profiles.

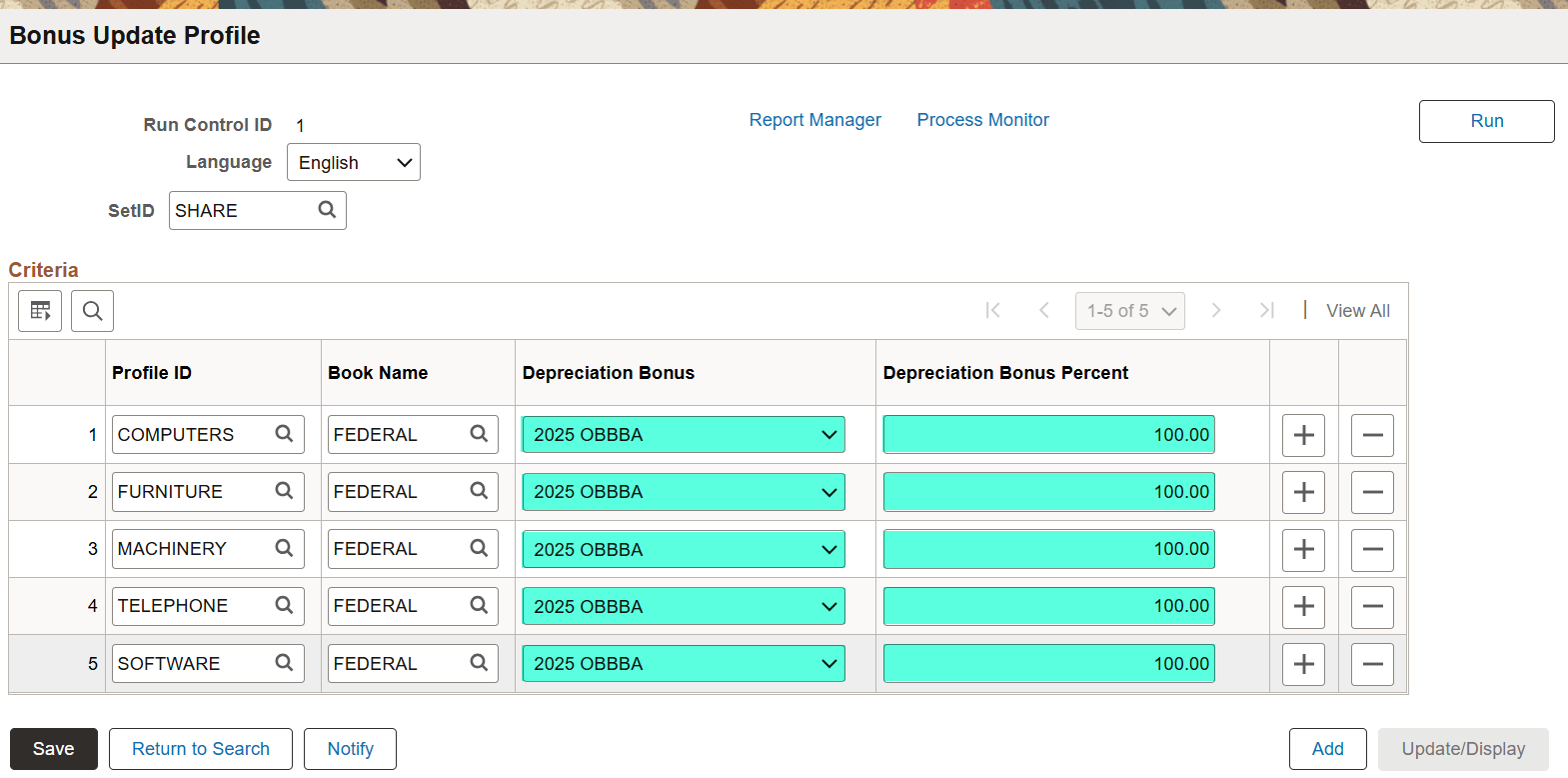

Navigation: >Asset Management >Depreciation >Bonus Retro Calculation >Bonus Update Profile

- Select your SetID and enter the profile details

- Enter your SetID.

- Add each Profile ID and Book that needs to be updated with the 2025 OBBBA 100% bonus depreciation.

- Click Run to initiate the process.

- Review and clean up existing profile rows

Manually remove prior bonus rows related to the TCJA bonus depreciation to avoid conflicts.

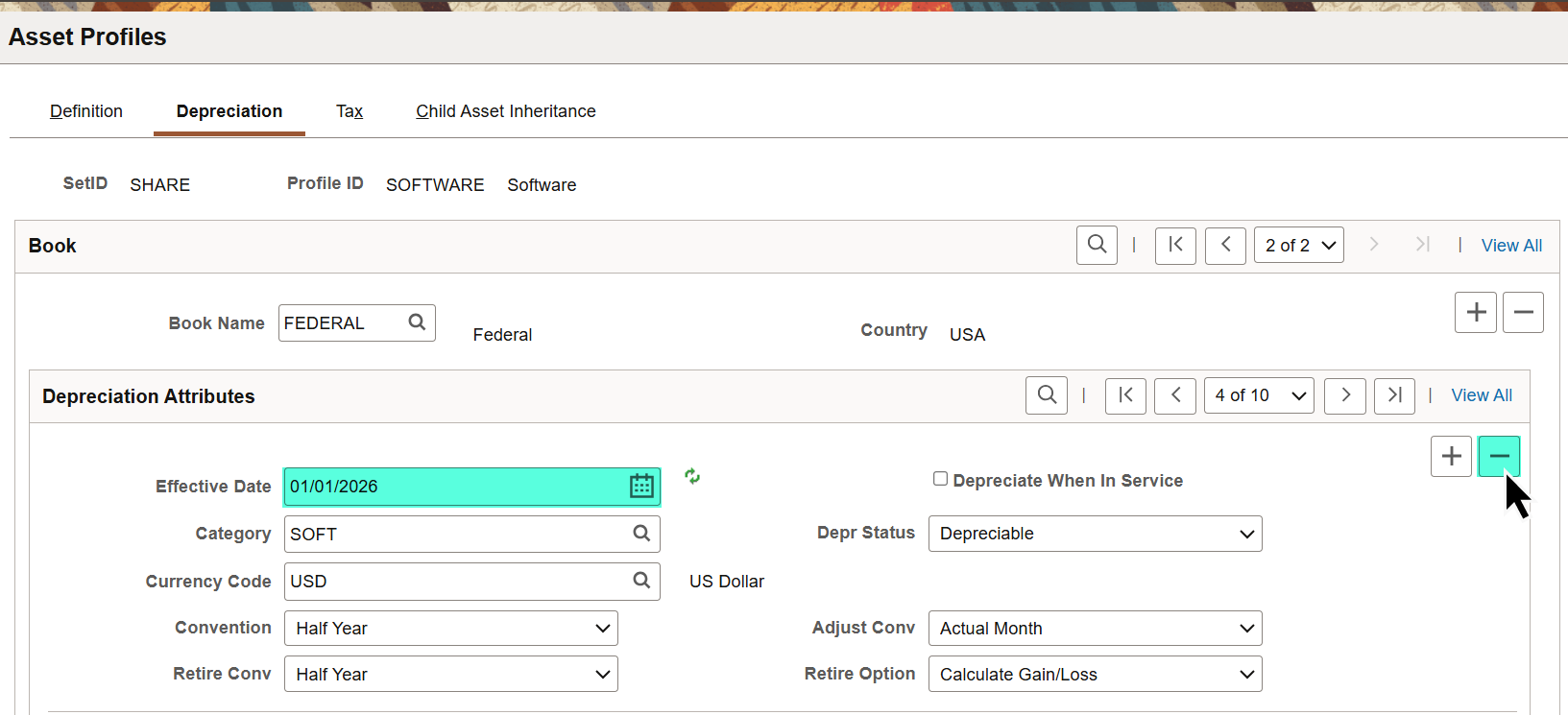

Navigation: >Setup Financials/Supply Chain >Product Related >Asset Management >Profiles >Asset Profiles

- For each asset profile and applicable tax book, delete the bonus rows effective dated 01/01/2026 and 01/01/2027

- These rows reflect outdated TCJA bonus percentages and should no longer apply

After cleanup, you should see these rows for 2025 going forward:

- 01/01/2025 – 2025 Tax Cuts & Jobs – 40%

- 01/20/2025 – 2025 OBBBA – 100%

- 01/01/2100 – No Bonus

Final Notes

With asset profiles now updated, your PeopleSoft Asset Management system is fully aligned with the new bonus depreciation rules introduced by the One Big Beautiful Bill Act. These changes ensure both retroactive compliance and future consistency—reducing manual intervention and improving accuracy for asset additions moving forward.

If you haven’t yet read Part I and Part II, we recommend reviewing those to complete the full configuration process. And as always, keep an eye out for future updates as tax guidance evolves.

To see the full configuration in action, join me for a live demonstration during the Advisor Webcast on September 9, 2025.

Advisor Webcast Title: How to apply the OBBBA Bonus Depreciation in Asset Management

Description: Join us for a 90-minute webcast designed for PeopleSoft Asset Management users who need to configure and apply the new Bonus Depreciation rules introduced by the One Big Beautiful Bill Act (OBBBA). We’ll walk through how to add new bonus codes, retroactively apply the changes to eligible assets, and update asset profiles for ongoing compliance.

Topics Include:

- Overview of OBBBA Bonus Depreciation Changes

- Adding New Bonus Depreciation Codes

- Applying Bonus Depreciation Retroactively

- Updating Asset Profiles for Future Use

- Live Q&A