The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, reinstated 100% bonus depreciation for qualifying assets placed in service after January 19, 2025.

If you’ve already read Part I of this series, you’ve added the new OBBBA bonus depreciation code in PeopleSoft Asset Management. Now it’s time to apply it retroactively to any qualifying assets that were placed in service on or after January 19, 2025, but were assigned the older 40% bonus under the TCJA.

Step-by-Step: Update Existing Assets to 100% Bonus

- Launch the Bonus Extract/Report Process

Navigation: >Asset Management >Depreciation >Bonus Retro Calculation >Bonus Extract/Report

- Enter these run control values:

- Run Mode: Extract/Report

- Select the Include Assets with Bonus checkbox

- Business Unit From/To: Enter the BU range

- Book Name: Select the tax book with bonus depreciation

- Profile ID: Enter the Profile ID associated with bonus

- Depreciation Bonus: Code for 2025 Tax Cuts & Jobs act (40% bonus)

- Depreciation Bonus Percent: 40

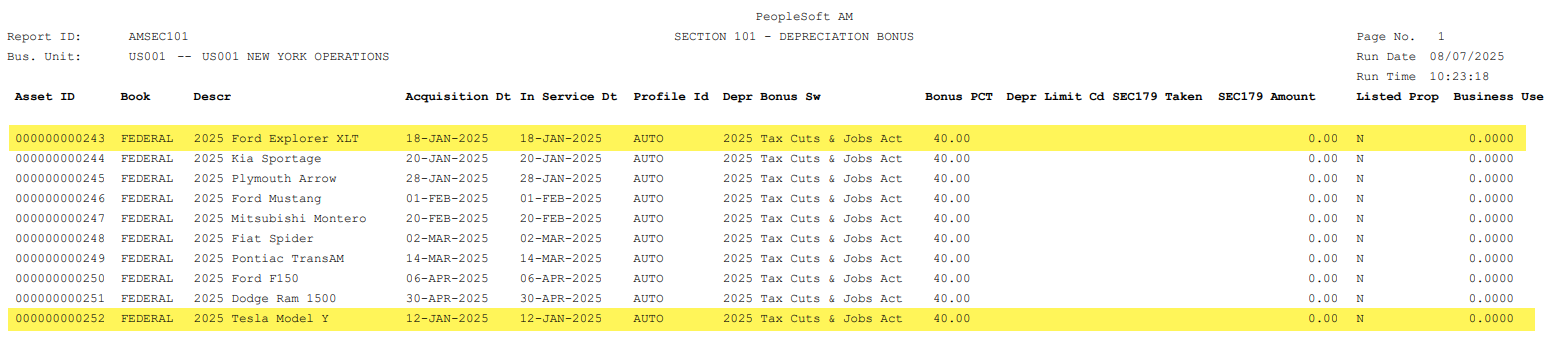

- Run the AMSEC101 process and open the PDF report. Highlight any assets that were created before 01/20/2025.

Clean Up Ineligible Assets

- Review and edit the asset list

Navigation: >Asset Management >Depreciation >Bonus Retro Calculation >Bonus Review

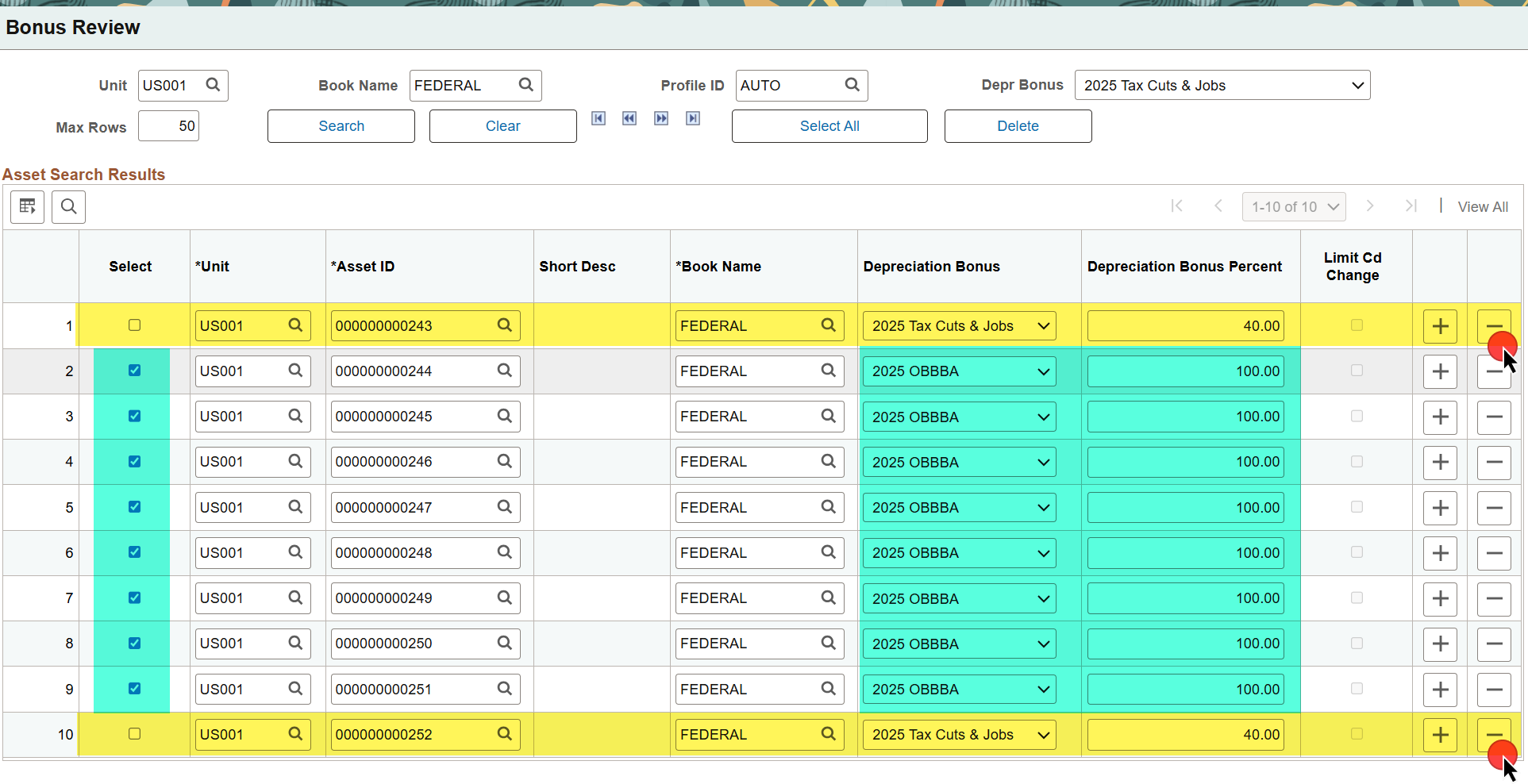

- Remove any ineligible assets (those created before 01/20/2025) by clicking the ‘-‘ button on the asset row. These rows were highlighted in Step 3.

- Select the checkbox for eligible assets

- Update the following:

- Depreciation Bonus: Enter the new OBBBA Code

- Depreciation Bonus Percent: 100

- Save. This creates book transactions that update the bonus depreciation to 100%.

Finalize Bonus Depreciation Application

- Return to the Bonus Extract/Report to prepare the asset for bonus depreciation

Navigation: >Asset Management >Depreciation >Bonus Retro Calculation >Bonus Extract/Report

- Use these run control values:

- Run Mode: Prepare for Depreciation

- Select the Include Assets with Bonus checkbox

- Business Unit From/To: Enter the BU range

- Select the Run button to run the AMSEC101 process again

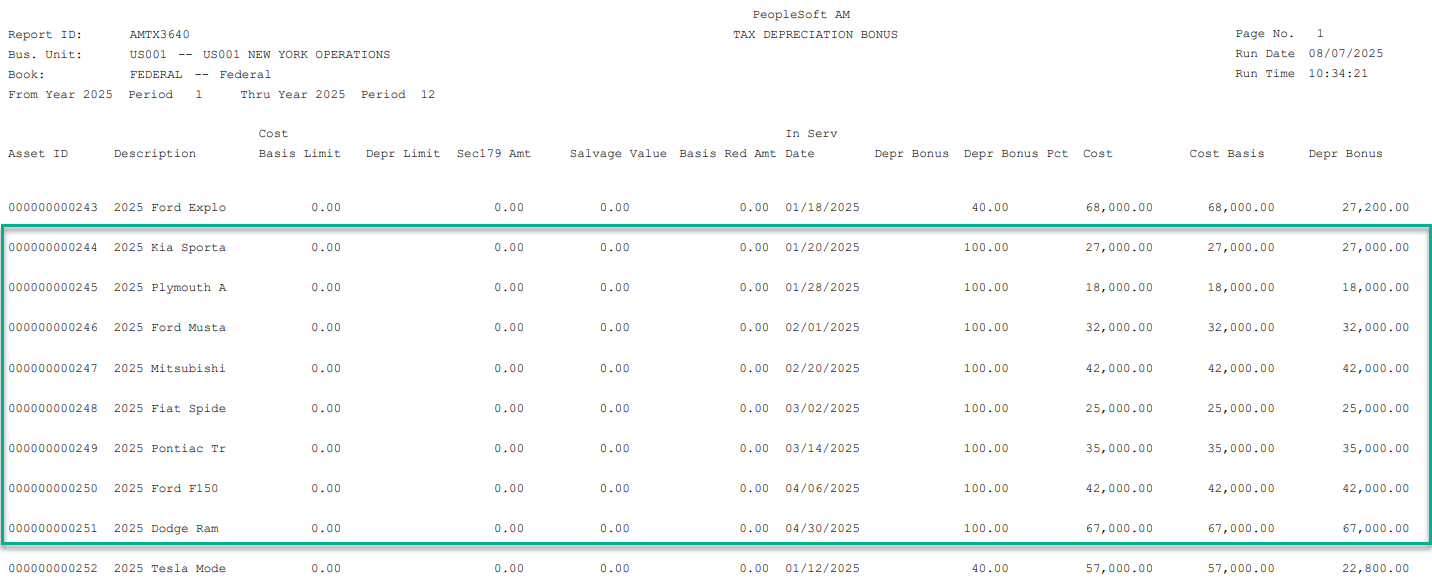

- Confirm via Tax Reports

Navigation: >Asset Management >Taxes >Reports >Gain/Loss Tax Reports

Run AMTX3650 for listed property

Run AMTX3640 for non-listed property

Up Next: Part III

Next, in Part III, we’ll cover how to update Asset Profiles to default to the new OBBBA bonus code going forward—so future assets are assigned correctly the first time. Stay tuned!