The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, delivers major tax relief by reinstating 100% bonus depreciation for qualifying assets placed in service after January 19, 2025.

For PeopleSoft Asset Management (AM) users, this change requires system updates to ensure both retroactive and prospective compliance with the new rules.

Bonus Depreciation: Before vs. After OBBBA

Prior Law (TCJA Phase-Out Schedule):

- 2017–2022: 100%

- 2023: 80%

- 2024: 60%

- 2025: 40%

- 2026: 20%

- 2027+: 0%

After OBBBA:

- 01/01/2025 – 01/19/2025: 40%

- 01/20/2025 – No End Date100%

Key Takeaway:

OBBBA overrides the previous TCJA phase-out for any asset placed in service after January 19, 2025, restoring full 100% expensing indefinitely.

What You Need to Do in PeopleSoft AM

To stay compliant, you’ll need to update configurations in PeopleSoft AM. This blog (Part I) focuses on creating the new Bonus Depreciation Codes. Parts II and III will guide you through applying the bonus to existing assets and updating asset profiles for future asset additions.

Required Steps:

- ✅ Add New Bonus Depreciation Codes (covered below)

- 🔜 Retroactively Update Assets (see Part II)

- 🔜 Update Asset Profiles for Future Assets (see Part III)

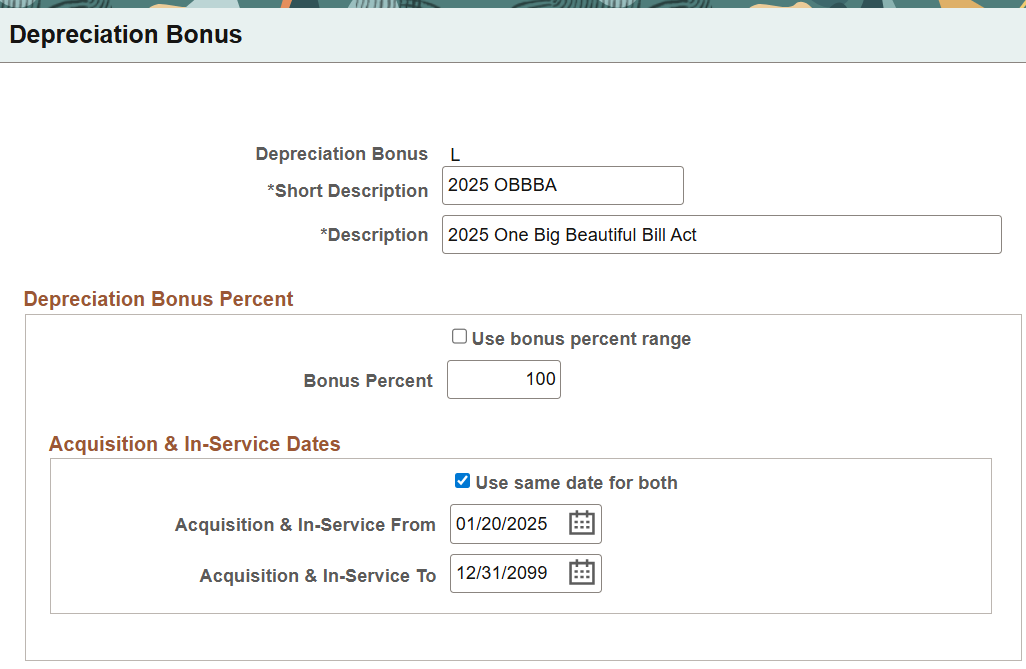

Add New Bonus Depreciation Codes for OBBBA

Navigate to:

Setup Financials/Supply Chain >Product Related >Asset Management > Depreciation > Bonus Depreciation

Create a Depreciation Bonus code for the 01/20/2025 – 12/31/2099 100% bonus depreciation.

Coming Soon

This is Part I of a three-part blog series. Stay tuned for:

- Part II: How to retroactively apply the OBBBA bonus to assets already added

- Part III: How to update asset profiles so future assets automatically apply the new bonus codes

Both follow-up blogs will be published over the next week. Be sure to check back so you don’t miss any steps.