In your organization, how often are Expense Reports being submitted for Approval without the accompanying required documentation or receipts? This could cause bottlenecks in the approval process with Receipt Reviewers and Managers having to deal with incomplete Expense Reports that need to be returned to the submitters. In the past, Expense Reports could be submitted with no receipts and no explanation as to why if a Receipt or backup document is missing. If during the approval process, someone in the approval chain decides this is against policy or unacceptable, it is returned to the submitter to address the problem before submitting it once again. This creates needless work on everyone’s part and no value-add to the approval and reimbursement process.

One of the top requested ‘Idea’ in the Idea Space, which we addressed In PeopleSoft Update Image #43, was the enhancement to the receipt requirements for expense reports. With this new feature, you can configure the system to prevent the submission of an Expense Report if Receipts are required for the detail lines and none are detected. The user is able to SAVE the Expense Report but depending on the configuration of the Receipt Required policies, may not be able to submit it into the approval queue until specific information is provided.

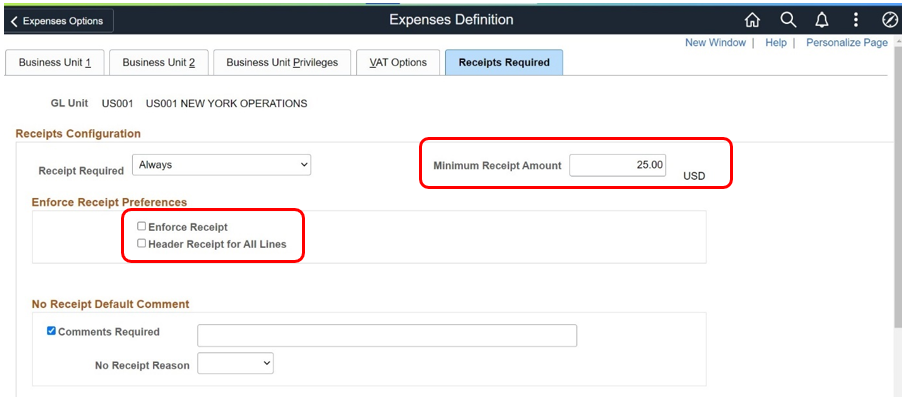

To support flexible configuration of the Receipt Required Travel and Expense policy, we’ve added a new tab of information on the Business Unit setup page, so you can configure how the system responds to your policy for enforcement of required receipts on Expense Reports.

Figure 1: New Expenses Definition Tab for Receipt Management on Expense Reports

The configuration page allows you to configure how you wish the system to react to the absence of required receipts. You have the option of indicating whether or not receipts are required before submission of an Expense Report which differs from past behavior. Additionally, you can elect to only require receipts for those charges that weren’t charged on a corporate travel card and imported into the Expense System. You can also indicate the option of whether or not comments are required to explain the absence of a receipt and provide a default Reason Code for allowing the submission with a missing receipt. In lieu of a receipt attachment on the Expense Line, if the Reason Code or Comment is provided, the system considers the Receipt requirement to be fulfilled and will allow the submission of the Expense Report.

For the Enforce Receipt Preferences, we added two new options to further control whether or not an attachment at the Header may fulfill the Receipt Requirements for the Expense Report Lines. If this checkbox Header Receipt For All Lines is enabled, and the system detects an attachment at the Header, it will assume the attachment contains copies of the receipts for all the Expense Lines that require one. It will then not subsequently check to see that each Expense Line has an attachment or a Comment and/or Reason Code. Users will be able to submit their Expense Reports with the Header Attachment in lieu of individual attachments at each detail line.

You can also indicate Receipt Required defaults on this setup page that pertain to any employee submitting an Expense Report. If the Business Unit Minimum Receipt Required amount is set to a value, you can configure exceptions to that rule.

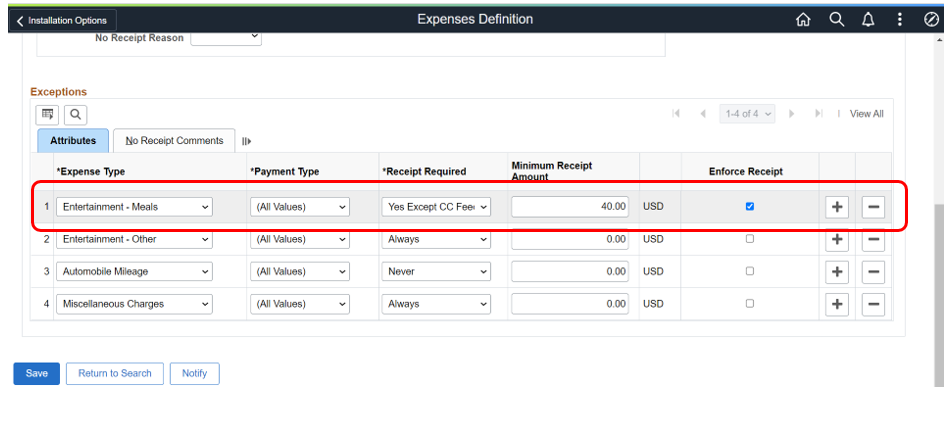

Figure 2: Business Unit Expense Exceptions for Required Receipts

In the example above, the configuration indicates that any Meal expense, over $40.00 USD requires a receipt. The exception to that rule is if the charge for meals has come through the corporate credit card feed. In that case, the system will consider the Receipt requirement fulfilled via the entry from the Credit Card detail and not require an attachment, Reason Code or explanation of why a receipt has not been provided.

When the flag on the Business Unit is set to enforce the Receipt Required Rules either at the Header or Expense Detail Lines, a check is made if the user clicks the Expense Report “Submit” button. At that time a review is made of the contents of the Expense Report to ensure the required attachments OR an explanation comment of why there are missing receipts is made. If any of the rules are violated, the system presents the user with an error indicating what is missing and what they need to do to fix before another submission attempt.

Another new configuration feature we added, is the ability to indicate on the User Profile whether these new stricter Receipt Required rules apply to an individual. You may excuse a certain level of user in your organization from having to provide receipts according to your Travel and Expense policies. You can set this flag on the Expenses User Profile level, and it will override all the configurations you established for Receipt Required enforcement options on the Business Unit.

Figure 3: User Profile to indicate a User is exempt from providing receipts with their Expense Reports.

With this new Expense feature, your approvers aren’t wasting time reviewing non-compliant Expense Reports and users will be provided with capabilities to ensure they are promptly reimbursed for expenses they’ve incurred. In addition, your organization will be able to implement and configure the desired document checks and balances leading to better travel and expense policy compliance.

For more information, go to www.peoplesoftinfo.com