In response to multiple requests from our Expenses User Community, we’ve introduced a game-changing enhancement to our expense reporting system. In PeopleSoft Update Image #50, those organizations that allow multiple individuals to share a corporate credit card, can now grant access to the credit card owner’s Wallet. We’ve provided the ability to seamlessly access and transfer corporate credit card charges directly into an expense report, by each user “claiming” their own charges from the Wallet. Say goodbye to cumbersome manual processes on the part of the card “owner” and hello to unparalleled efficiency. With this feature, authorized users can effortlessly access shared corporate credit card charges posted in the owner’s Wallet and select their own charges to transfer them into their expense reports.

The feature requires a few set-up steps, but once configured your users will have much more flexibility in creating Expense Reports. This also relieves the credit card owner of the responsibility of reconciling Wallet entries or constantly chasing down charges and the individuals who made them.

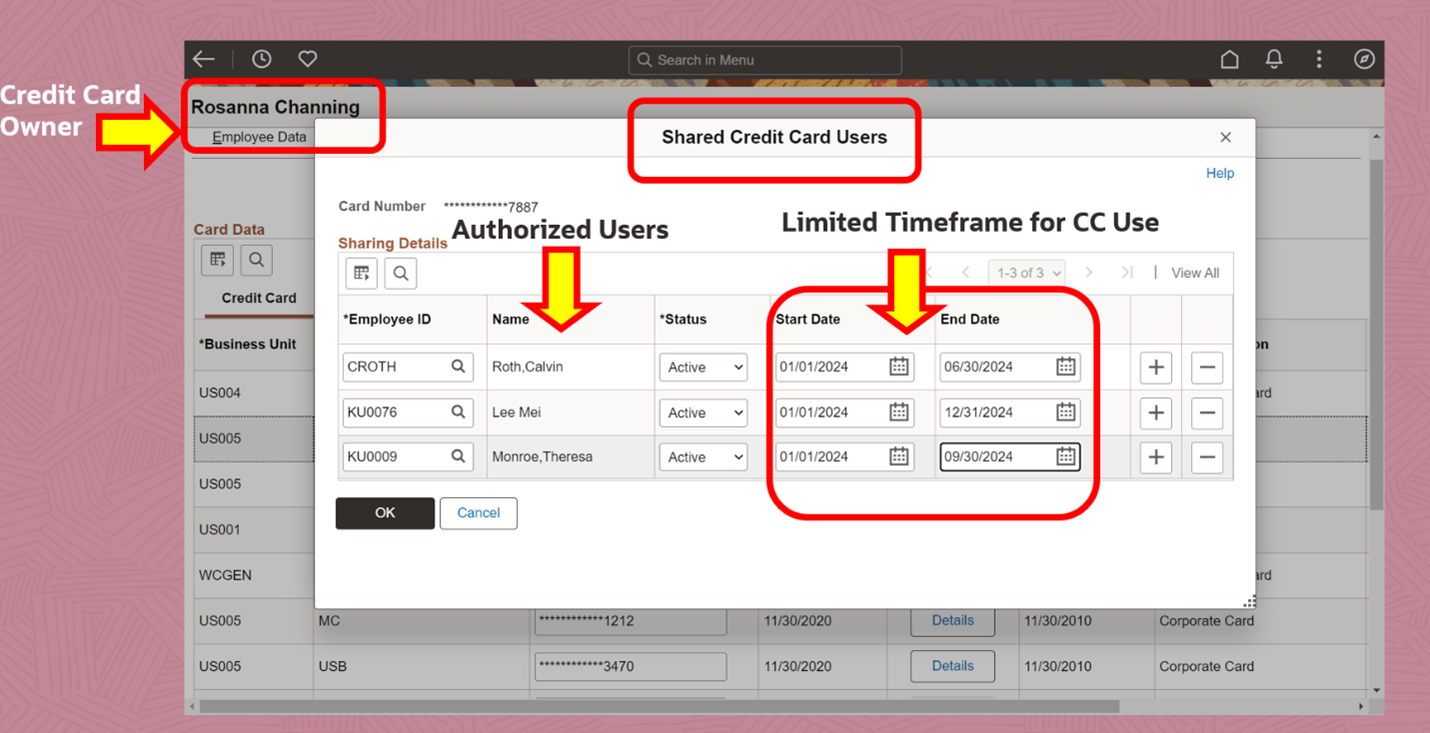

Set Up the Authorized Users for a Corporate Credit Card:

Note: The above page can only be edited by an Expenses administrator. When the credit card owners and shared credit card users access this page using Employee Self-Service, all fields will be display only. This page is the primary configuration needed to indicate that your organization uses shared credit cards and allows only the credit card owner and the employees added to use the card and access the charges in the Wallet.

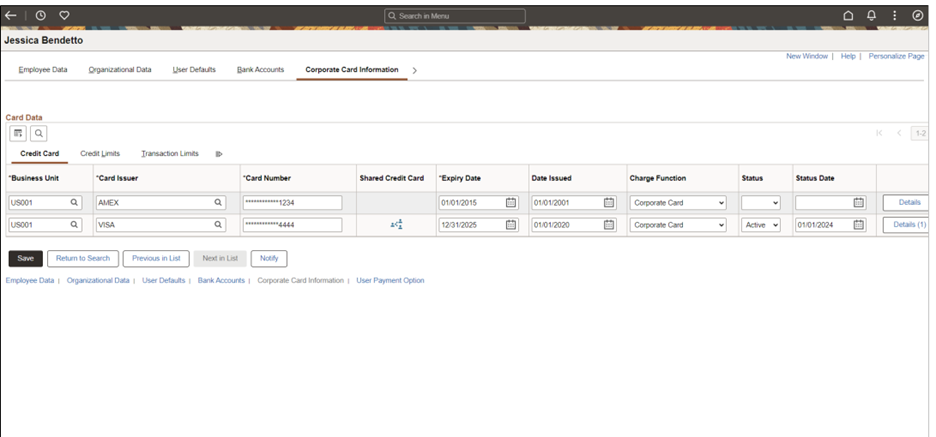

Employees may be assigned multiple corporate credit cards, perhaps one for their own personal use and one that may be shared with the members of a department. For sharing, we’ve implemented a start and end date for those authorized users. This capability allows organizations to extend charging privileges for a limited time as in the case of students or interns who may be employed for a school year or during a seasonal break.

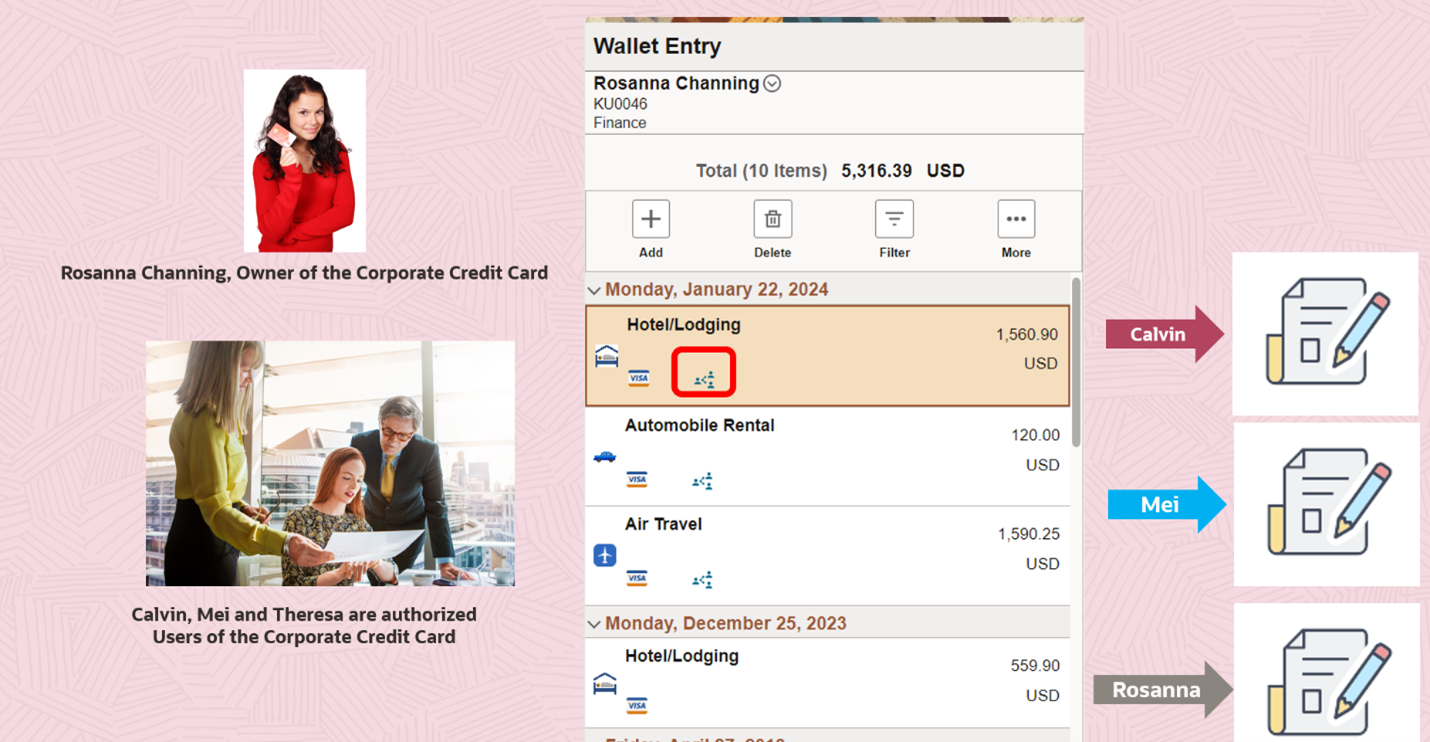

Once the sharing of a credit card is established, when authorized users and the credit card owner access the Wallet, they will see all charges from all sources: from a credit card feed and manually entered. Only the authorized users of the shared card may see the charges in the Wallet. Those charges from the shared card are flagged with this icon image:

Once a credit card charge is “claimed” from the Wallet and added to an Expense Report, it no longer appears in the Wallet for anyone else to see or claim.

We would also like to take the time to remind our Expense users about a feature we released in PeopleSoft Update Image #48 where we allow linking a Wallet entry to an existing Expense Report even if it has been approved and paid. This allows a user or an administrator to “clean-up” Wallet entries and tie them to the appropriate Expense Report. With these 2 features, there should be no unapplied Wallet transactions.

Please do check out PeopleSoft Update Image #50, and the introduction of shared credit cards and visibility into shared Wallets. This feature marks a significant advancement in PeopleSoft expense management. By providing authorized users with access to shared corporate credit card charges and the ability to seamlessly incorporate them into their expense reports, your organization can enable timely expense report creation, improve transparency, and enhance collaboration.

Read our blog on PeopleSoft Travel and Expenses Features Released in 2023