SECURE 2.0 contains 92 provisions that affect retirement savings plans. Section 101, effective January 2025, is just one of these. The Savings Plans Automatic Enrollment and Automatic Escalation are critical processes for this section. The enhancements were originally provided in a PeopleSoft Release Patch (PRP) and are now available in Image 51. It is important to note that this feature is only for Benefits Administration customers. To fully understand Section 101, organizations should work with their legal staff and third-party saving plan vendors to understand how and if it affects your organization.

The Savings Plans Automatic Enrollment and Escalation feature provides you the ability to:

- automatically enroll employees into Savings Plans

- set a default contribution rate

- allow a defaulted rate to be increased each year up to the maximum rate

- send notifications to your employees

Here is what you need to know:

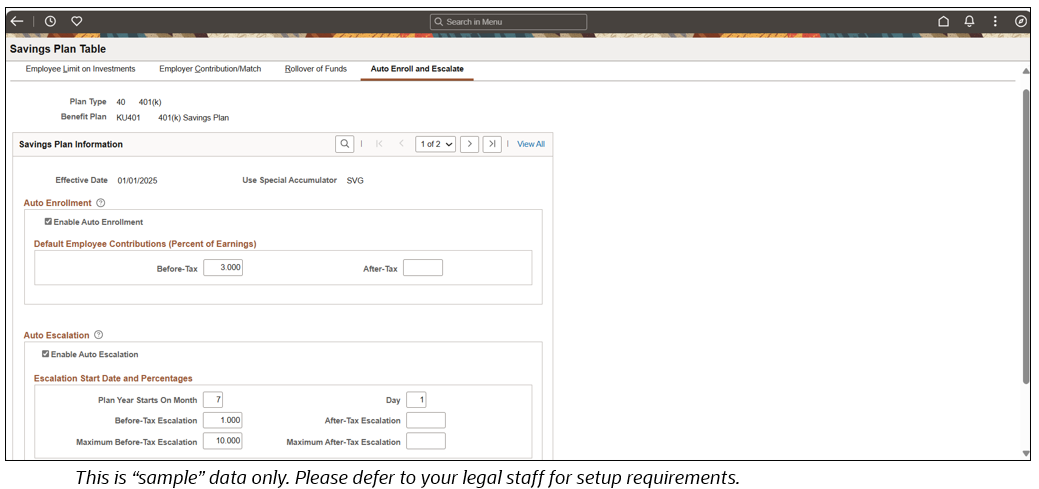

- A new Savings Plan Table > Auto Enroll and Escalate setup page that allow you to configure the automation of enrollment and escalation for savings plans

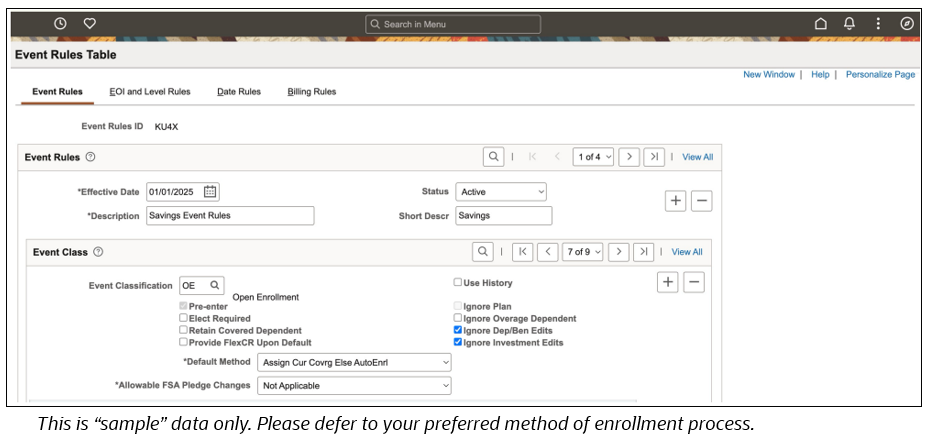

- A new Default Method, Assign Cur Covrg Else AutoEnrl, on the Event Rules Table has been created to allow auto enrollment for required event classes such as Open Enrollment, Snapshot, and Hire. This default method should only be used for Savings Plans. A Supplemental User Document, How to Implement the SECURE 2.0 – Section 101 Auto Enrollment in and Escalation of Contributions for Savings Plans (Doc ID 3060273.1), provides you examples of on how to create your events.

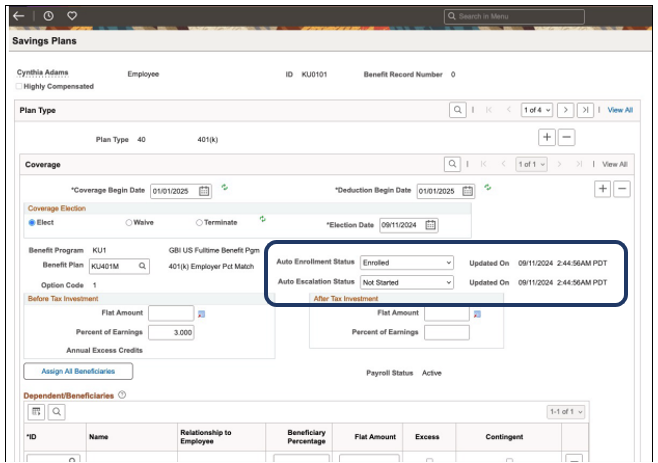

- New status fields and timestamps on the employees’ Savings Plans pages to track the auto enrollment and escalation. This is useful for audits and determining if the employee is eligible for enrollment or escalation. It can be updated via the Benefits Administration process or manually.

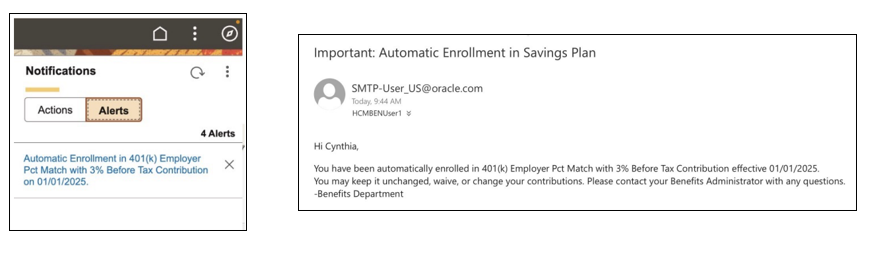

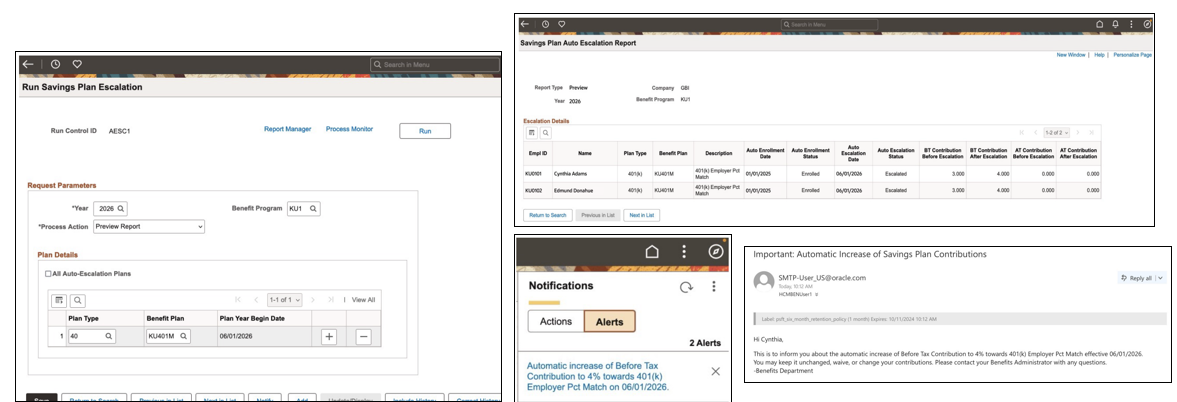

- New Auto Enrollment or Escalation Alert and Email Notifications, built on the Notification Composer Framework, notify employees of their enrollment.

- A new Application Engine, Run Savings Plan Escalations, has been created. This process also includes a preview and confirmation report, Savings Plan Auto Escalation Report, to assist the Administrator in understanding the details for each affected employee. A notification and/or email can be automatically sent to the employee. For easy navigation, these processes can be found on the Benefits WorkCenter.

Another important requirement of Section 101 is the ability to allow employees to change their auto enrollment and escalation. PeopleSoft Benefits Administration provides configuration for the employee to make changes in the Benefits Summary for Savings Plans or also allows customers the ability to configure additional Life Events. In talking to the Benefits Customer Focus Group, many customers use one of the two methods now or your Savings Plan Third Parties handle this directly for you. For your convenience, the Supplemental User Document, How to Implement the SECURE 2.0 – Section 101 Auto Enrollment in and Escalation of Contributions for Savings Plans (Doc ID 3060273.1), also includes example data on how you might want to set up your own life event.

Our next deliverable planned for SECURE 2.0 will be Section 603. The IRS released new information in January 2025 that I would encourage you to read, Federal Register :: Catch-Up Contributions and Guidance on Section 603 of the SECURE 2.0 Act with Respect to Catch Up Contributions. We are considering processes to identify those employees that meet the FICA wage limit and processes to roll over catch up savings plan contributions to a Roth account. Customers will need to be using Payroll for North America (PNA) for us to determine the limit. We will share more as we refine the processes.

Keep up with the latest information by subscribing to Oracle PeopleSoft Apps Strategy Blog and PeopleSoft Videos updates.