Fintech (financial technology) companies continue to disrupt the financial services industry. According to a report from Boston Consulting Group (BCG) and QED Investors, in 20241, Fintech revenues surged 21%, outpacing the 6% growth rate of incumbent financial services players. The report goes on to state that emerging disruptors are leveraging next-generation AI technologies and pioneering new business models, pushing established players to continuously innovate.

To succeed, fintech companies tend to serve an underserved segment of the population and/or to deliver a cost-effective service faster and with greater convenience than what customers are accustomed to from traditional financial institutions. The technology they rely on is paramount; it often determines their ability to deliver an innovative solution exhibiting the performance, scalability, security, reliability, and cost-efficiency that will sway customers.

MySQL database has served as the preferred choice for digital-native application development and many companies in the financial services field have adopted it as the core of their technology innovations. The key benefits companies are experiences include:

Let’s consider why 3 fintech startups migrated to HeatWave MySQL (HeatWave), and the results they achieved:

- Lower total cost of ownership – up to 90% TCO savings compared to traditional database solutions, such as Microsoft SQL Server.

- Agility and Speed to Market – supports microservices architecture, enabling financial services companies to develop and deploy modern, innovative applications quickly.

- Improved Customer Experiences – features like instant transactions, real-time data access, and personalized recommendations enhance customer satisfaction, leading to increased loyalty and retention.

Figure 1: multiple studies and surveys show MySQL is a favorite

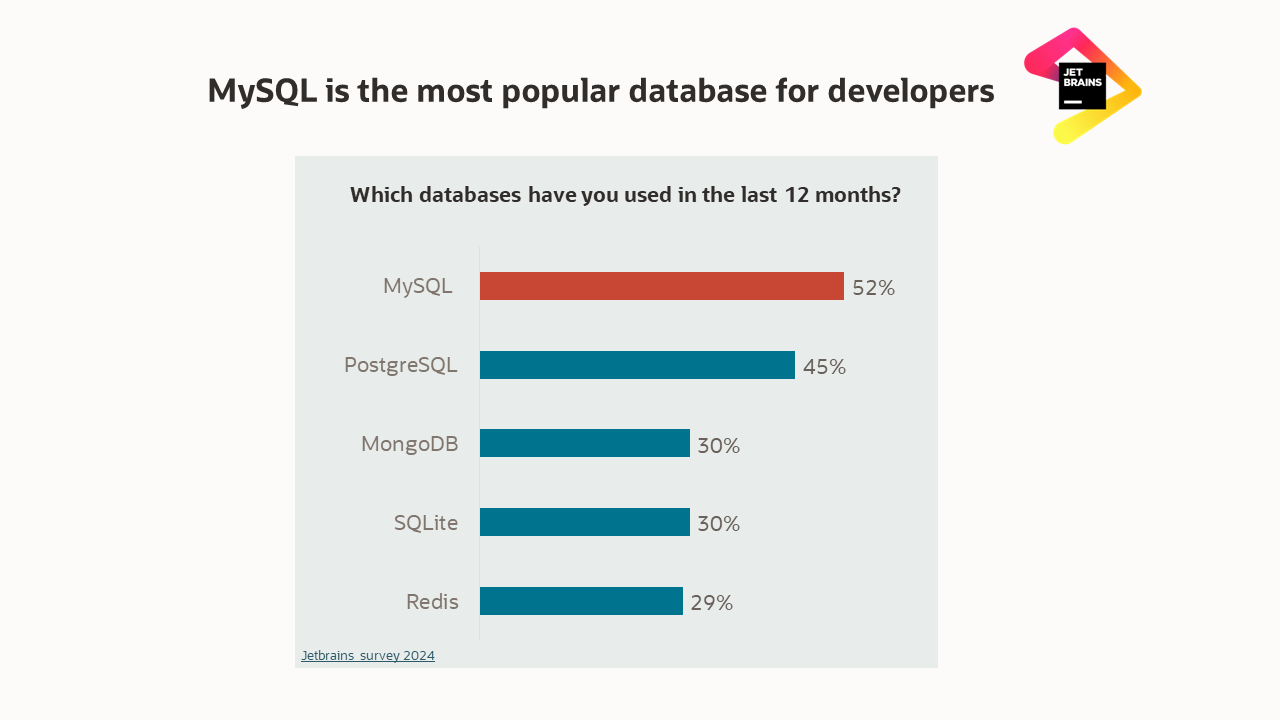

Figure 2: 2024 study by Jet Brains shows MySQL is the top choice for developers

Even as MySQL delivers outstanding results, traditional deployment models continue to impose challenges that are not easily overcome. These include:

- Cost and complexity of maintaining on-premises infrastructure

- Cost and complexity of manual database management

- Protecting Sensitive Data – Average cost of data breach is $4.88M

- Meeting industry and government regulatory requirements (GDPR, DORA, PCI, etc.)

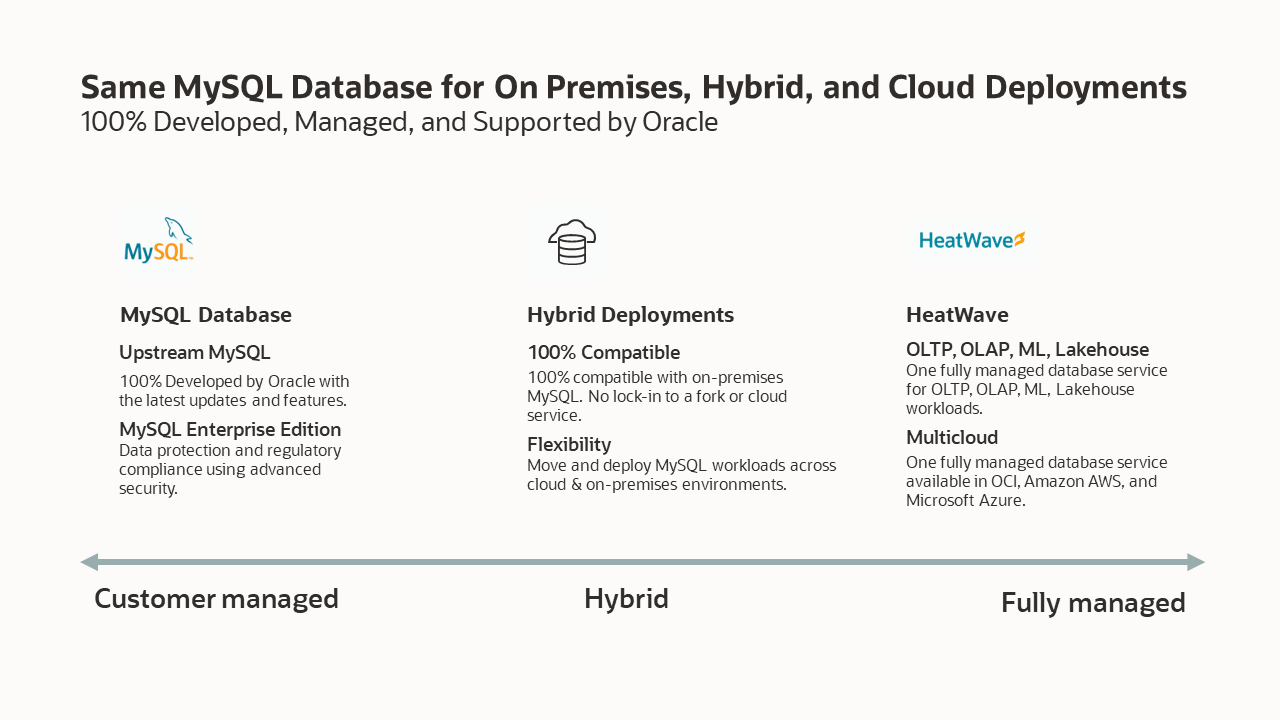

Oracle offers a set of unique MySQL offerings that helps our customers do what they love – innovating with MySQL technology – while having the choice and freedom to adopt the right deployment model to match their needs.

Figure 3: MySQL deployment models

HeatWave has become a very popular choice among fintech companies. HeatWave is a fully managed database service, powered by the HeatWave in-memory query accelerator. HeatWave uniquely combines transactions, real-time analytics across data warehouses and data lakes, generative AI, and machine learning in one cloud service—without the complexity, latency, risks, and cost of ETL duplication. It’s available on OCI, AWS, and Azure.”

Let’s consider why the following fintech companies migrated to HeatWave, and the results they achieved:

Fintechs improve results and reduce costs with HeatWave

Aicoll improves loan default prediction using machine learning in HeatWave

Aicoll – Artificial Intelligence Collection System – provides AI solutions for managing the risk of customers defaulting on loans. In Colombia, 60% of institutions providing loans in the retail, microservices, or cooperative finance sectors are not equipped with this technology. Aicoll needed an automated way to massage all the data into machine learning (ML) models that would allow its customers to create predictions covering the credit life cycle from loan origination to debt default. The company migrated from MySQL on-premises to HeatWave—with the built-in HeatWave AutoML—and obtained the following results:

- Reduced the time to build ML models from three months to one week

- Accelerated data preparation from one day to minutes

- Executes ML-generated default predictions for millions of users in real-time, without having to extract data outside of the MySQL database

- Empowered their operations team to independently create new ML models

- Improved liquidity by 20% across their client portfolios

“Without a doubt, Oracle has helped us sell our loan default solutions to credit institutions throughout Colombia and beyond thanks to the automated machine learning engine within HeatWave, and to the high availability and scalability of Oracle Cloud Infrastructure.”

—Yelitza Romero, CEO, Artificial Intelligence Collection System S.A.S

Credify experiences 4X faster time to market for its instant loan application with HeatWave

To meet their financial needs, 77% of India’s workforce relies on personal loans. By offering Creditt, an instant loan application that uses non-traditional credit scoring and artificial intelligence, Credify Technologies has become a key player in driving financial inclusion. The company’s applications and MySQL databases were hosted on HostGator. The management team recognized the need to upgrade the company’s technology platform to scale to demand, strengthen compliance processes, and accelerate decision-making. Credify evaluated Amazon RDS, Aurora, and Oracle’s HeatWave, and selected HeatWave as the most technically and commercially viable solution. For example, application performance was 4X higher with HeatWave vs. Amazon RDS. Credify achieved the following:

- Migrated its applications and data to HeatWave on OCI in only 8 days

- Accelerated time-to-market by 4X, being able to focus on core development

- Saved 25% of the time needed to prepare data for LOB owners

- Increased its ability to scale to demand, with a threefold increase in loan origination capacity

- Established end-to-end data security. As a result, Credify enjoys stronger compliance with the Reserve Bank of India’s data regulations and protection laws

“Oracle’s HeatWave Database Service is truly a game changer. It delivers faster performance than other MySQL cloud services while eliminating data copies and ETLs. And the cost of Oracle HeatWave Database Service is a fraction of other cloud providers.”

—Namra Parikh, Cofounder and CTO, Credify Technologies

Tamara cuts costs and improves the performance of its “buy now, pay later” solution with HeatWave

Tamara is a leading fintech in the Middle East and North Africa with a “buy now, pay later” solution. As a startup, Tamara needed to find a platform for application development and data management that was cost-effective, easy to use, and scalable. The company was growing fast and quickly adding data sources. Demand for its detailed, segmented business analysis was increasing from business users and merchants. Tamara migrated to HeatWave from another cloud provider and obtained the following results:

- The IT staff no longer needs ETL tools to move data from the MySQL database

- With real-time intelligence, Tamara can better analyze and understand customer behavior to continuously improve its application with rapid development

- Reduced costs by more than 60%

- 3X performance improvement

“We migrated our production workload from another cloud solution to HeatWave. Doing so reduced our costs by 60% and tripled the speed for many of our complex queries, which were not executing in a reasonable amount of time before Oracle Cloud. The real-time intelligence helps us better understand customer behavior to continuously enhance our application.”

—Chien Hoang, Director of Engineering, Tamara

As demonstrated by the above examples, HeatWave can help fintech companies improve customer experience, accelerate time-to-market, enhance security, increase productivity, and reduce costs. HeatWave delivers the best price-performance in the industry for data warehouse and data lakehouse workloads, enabling Fintech companies to cost-effectively scale operations.

Whether you’re an early-stage fintech or an established company, we encourage you to consider how you could benefit from HeatWave, and to contact us for any questions you may have.

Additional resources

1 https://www.bcg.com/press/2june2025-fintechs-next-chapter