While initiating any project, planning phase is very essential and should be taken into account before starting execution phase of project. Thus, planning team plan their deliverables through various activities to meet project’s contractual obligation and cost for each of these activities should be estimated and should be spanned across the project timeline. Process of cost estimation is called “Cost Budget”.

Cost Budget is one of the key contributors in deciding whether project is getting executed in right direction or not thus it is vital for project execution team to adhere to the cost budget as any deviation from cost budget could lead to overspend of funds, delay in schedule and quality compromises which eventually will lead to dissatisfied customers. So, it is very essential to control expenses as per cost budget.

Oracle Project allows users to control their project related supplier expenses against project/task/resource. Project team using budgetary control feature within Project costing can continuously evaluate incurred costs against cost budget and if control level is selected as Absolute then system will not allow users to incur cost which goes beyond cost budget.

In recent Release 12.2.11, Oracle Project is enhanced to incorporate budgetary control functionality for expenses coming from other source as well.

Earlier Budgetary Control Scope:

Supplier related expenses

- Purchase Requisition

- Purchase Order

- Supplier Invoice

Current Budgetary Control Scope:

Supplier related expenses

- Purchase Requisition

- Purchase Order

- Supplier Invoice

Custom source expenses

- Costed and Accounted Transactions (Expenses whose cost calculation already happened in source application and expenses are already accounted through source module)

- Non-Integrated Cost Budgets (Project Budgets which does not integrate with General Ledger Budget)

This new enhancement will also allow users to capture encumbrances and perform funds check in the legacy system which is not yet imported to project costing. There is a new API introduced which is utilized for fulfilling this requirement.

Encumbrances captured by new funds check API are stored in two different buckets.

- Labor Cost: Stores expenses incurred for labor related activities.

- Other Cost: Stores expenses incurred for usage activities, inventory activities work in process activities, miscellaneous activities etc.

Pre-requisite Setup

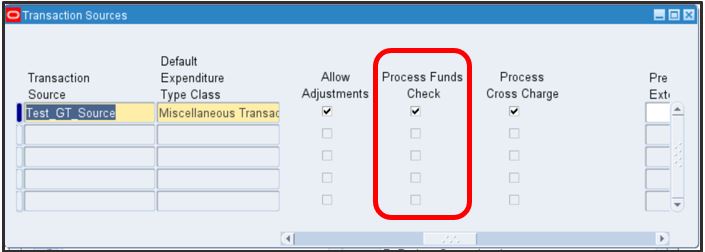

In order to implement this functionality, A provision is required for business to choose funds check should occur for which transaction source and for which funds check is not required. Transaction Source Form is modified, and a flag Process Funds Check is introduced, If Process Funds Check flag is enabled for specific transaction source, then budgetary control will be applicable for that transaction source.

Process Flow

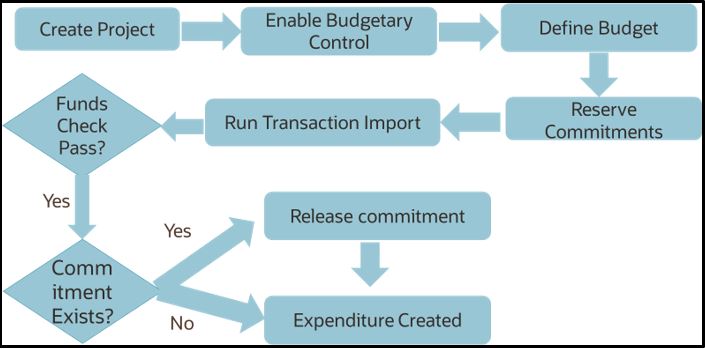

Following diagram gives high level of process flow related to this functionality.

There are few nodes on the above diagram which was as it is, and no changes happened to them after introducing budgetary control for custom transaction sources however there are few notes which got impacted.

Unaffected Nodes:

- Create Project

- Enable Budgetary Control

- Define Budget

- Expenditure Created

Though new functionality did not have any impact on above steps but these are mandatory steps within this process flow.

Impacted Nodes:

- Reserve commitments: This is a new process introduced which helps capturing encumbrances before transaction is imported to project costing.

- Transaction Import: This existing process modified to perform funds check operation on legacy system for which Process Funds Check flag is enabled.

- Release Commitment: If commitment is reserved then commitment will be released before creating expenditure. This step is incorporated in concurrent program PRC: Transaction Import.

As part of this enhancement below processes are introduced and modified

- API PA_FC_API package is introduced which can be used to reserve commitments in legacy system.

- PRC: Transaction Import process is modified to verify budgetary control for transactions coming from third party legacy system.

- Costing processes are modified to incorporate funds control from third party legacy system.

- Budget Baseline process is modified.

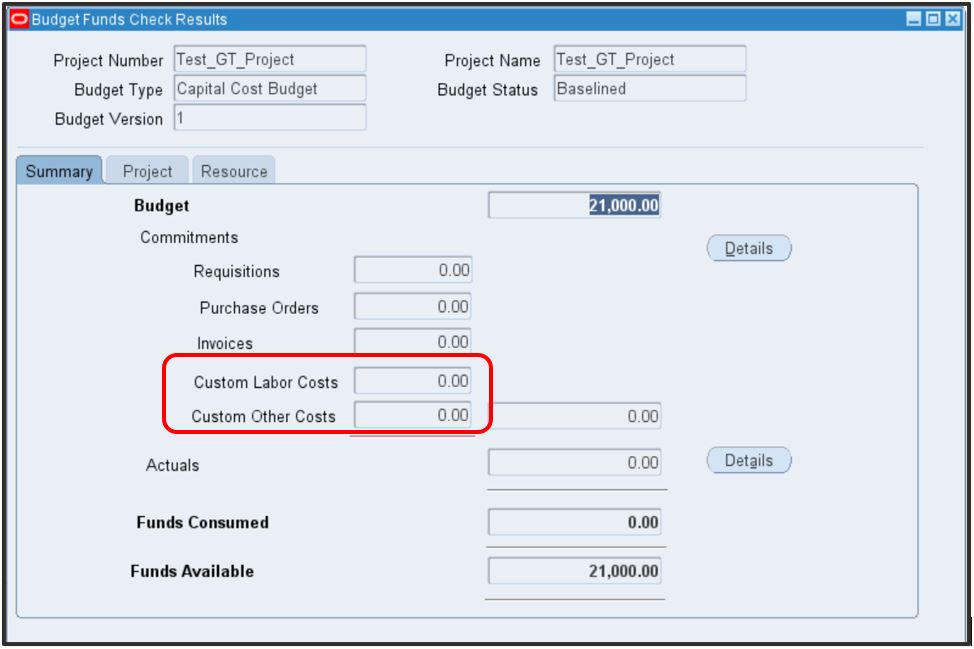

- Funds check related forms and OAF pages are modified to display funds consumed from legacy system in two different buckets (Labor Cost and Other Cost).

Please find screen of Budget Funds Check Result form to understand how funds consumption appear for different buckets.

Business Value

After implementation of this feature, following benefits can be utilized.

- Expenses can be controlled not only for supplier related expenses but for other expenses which are getting imported from legacy system. Thus, it’ll allow project team to regulate costs in accordance with cost budget and eventually results in customer delight.

- Provides insight on expenses incurred in legacy system before they are getting imported to Project Costing. Through API PA_FC_API, Expenses incurred in legacy system can be captured as an encumbrance in Project Costing module.

- No need to maintain multiple budgets. Earlier business has to maintain two different budgets, one budget to control expenses related to supplier commitment transactions (Requisition, Purchase Order and Supplier Invoice) and one budget for tracking total expenses occurring from different source. Thus, this feature can remove burden of maintaining two separate budgets if business is using only supplier related expenses and third party accounted expenses.

Please review KM Note: 2908610.1 for more details.