Open period is a feature which allows business to enter/import transactions in their ledger. This is one of the critical activity for every business at start of each month and year. As, once period is in Open state, Application will allow users to post entered and/or imported transactions which will help business to capture financial details of their day to day activities.

Opening first period of any Year is very crucial as it gives accurate picture of financial health of any Organization and allows Organization to calculate their Retained Earning amount which in turns help them calculate their Profit/Loss.

Retained Earnings are the amount of net income left over for the business after paying all its expenses. Thus, It is utmost important that Retained Earnings should be calculated accurately. In Oracle E-Business Suite, when first period of year is opened then retained earning YTD (Year to Date) balances gets updated for first period. Here in this post, we’ll be discussing how retained earning calculation can be validated with precision.

There are two parts to validate retained earning calculation.

- Identify Retained Earning Account

- Validate Retained Earning Amount Calculation

Identify Retained Earning Account

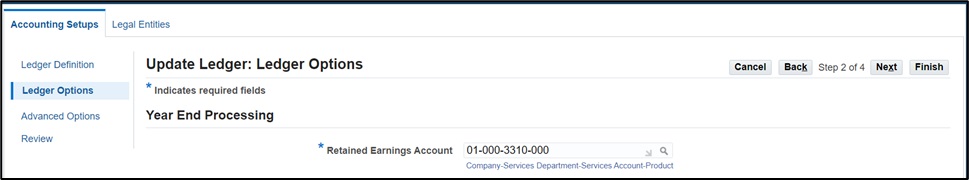

Please navigate to General Ledger responsibility: Setup > Financials > Accounting Setup Manager > Accounting Setups.

Query for ledger and click on Update Accounting Options. Click on Update icon against primary ledger.

Click on Ledger Options. Here users can identify Retained Earning Account.

Note: Even though in ledger setup only one retained earning account appears. Based on balancing segment, one ledger can have multiple retained earning accounts for multiple balancing segments.

E.g. Ledger Setup is showing retained earning account as 01-000-3310-000. If ledger has two balancing segments 01 and 02 then there will be two retained earning accounts for that ledger 01-000-3310-000 and 02-000-3310-000.

Validate Retained Earning Amount Calculation

Once first period is opened for any financial year, following activities take place with respect to balances.

- Balances are carried forward from previous year to next year for balance sheet (asset & liability) accounts.

- Balances of income statement (revenue & expense) accounts become zero.

- Balances of income statement (revenue & expense) accounts from previous year will move to retained earning account.

There are four scripts mentioned in KM Note: 1365597.1 which can be utilized to validate above activities.

- First script validated that the balances of the Assets and Liabilities accounts are carried forward correctly. These types of accounts must have the opening balances equal to the closing balances of previous year.

- Second script validates that in the new year there are no opening balances for any Revenue and Expense accounts.

- Third script will provide the figure of profit or loss for all the combinations of currencies and balancing segments.

- Fourth Script provides balances of retained earnings accounts.

These scripts can be run based on Ledger ID, First Period of Current Year and Last Period of Previous Year and require GL or Apps schema access for execution.

Note: As per some countries April period would be first period of financial year. Scripts mentioned in KM Note: 1365597.1 is significant to understand if retained earnings are calculated properly or not.

In case of any discrepancies in retained earning balances, please contact Oracle Support through Service Request and upload General Ledger Analyzer output using KM Note: 2117528.1 in Service Request.