When a Property or Equipment lease is booked with catch-up accruals and with payment terms starting in future, is terminated in such a way that the future payment term falls outside the new lease tenure, then the termination event thus created, will have the below lines related to the future payment term:-

- Reversed Accrued Amortizations

- Reversed Accrued Interest

- Reversed Beginning Liability and ROU balances.

- Reversed Catch-up Liability related to the future term

If the catch-up liability generated during booking of lease was not used in accrual accounting, is later reversed (d) in the above scenario, it is creating unreconcilable differences.

Thus, the reversal of catch-up liability in case of a termination event causes unbalanced journal, thus resulting in the termination event to fail.

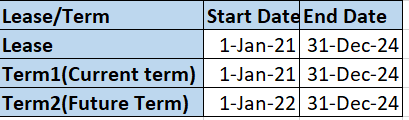

In below example lease is created with below terms:

RFI: Yes

Lease Termination Date: 31-Dec-21

Here term2 is future dated term so lets see the effect and accounting post termination.

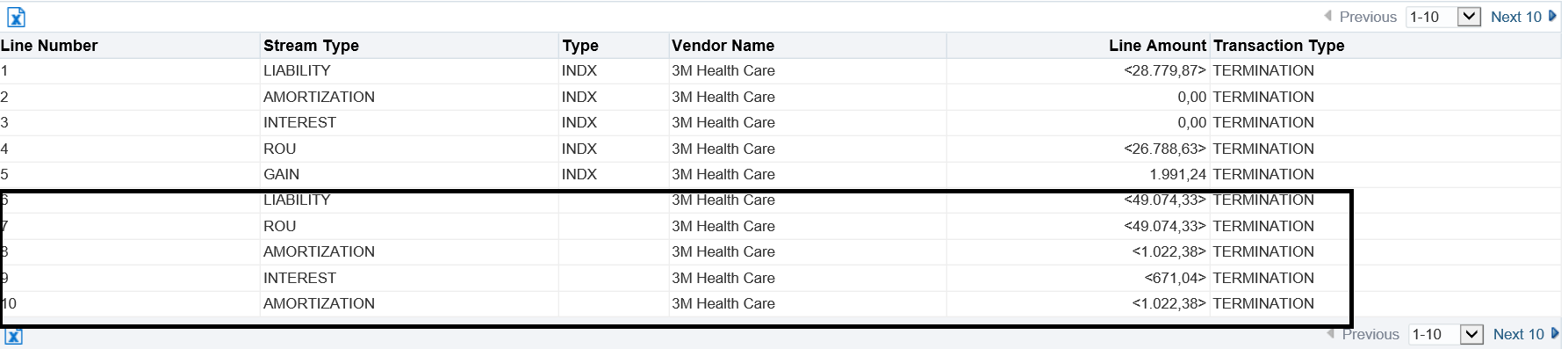

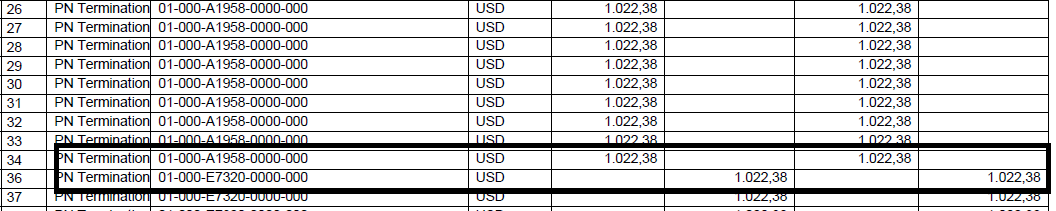

Term2 where start date was 1-Jan-22 will be deleted but it still have hanging Catchup Amortization and Catch up Interest which has bene charged, that needs to be reversed and accounted along with ROU and Liability reversal. Please refer below screenshot:

Now in create accounting run catch up interest and amortization is generated for term2

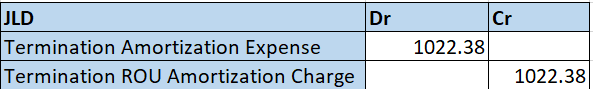

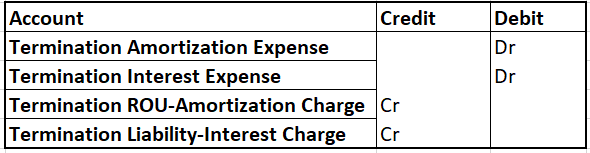

Above will create unbalanced journals to accommodate need to have below JLDS defined for termination event:

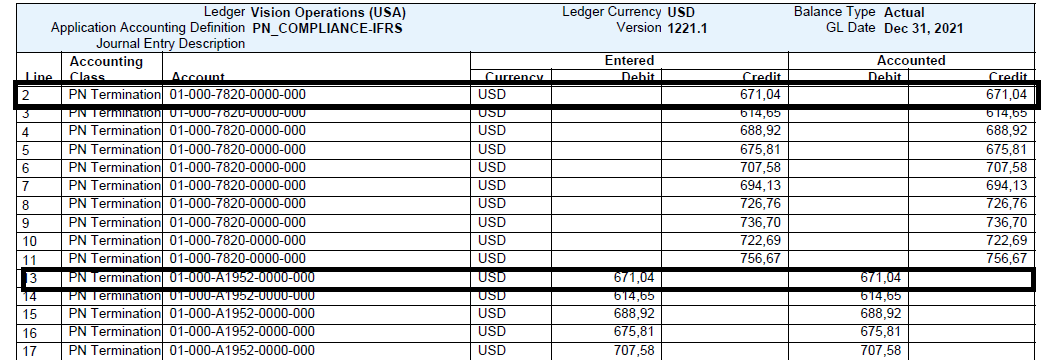

So accounting will be as below: