Fraud detection is a primary requirement of every financial organisation. Let’s take an example of an automotive insurance company which receives thousands of claims every day, including some percentage of fraud claims as well. Few customers provide misleading information and false documents to submit these fraud claims. Insurance investigators spend a number of hours detecting these fraudulent claims. With the automation of the fraud detection process, insurance companies can handle fraud claims more efficiently and take corrective actions in a timely manner.

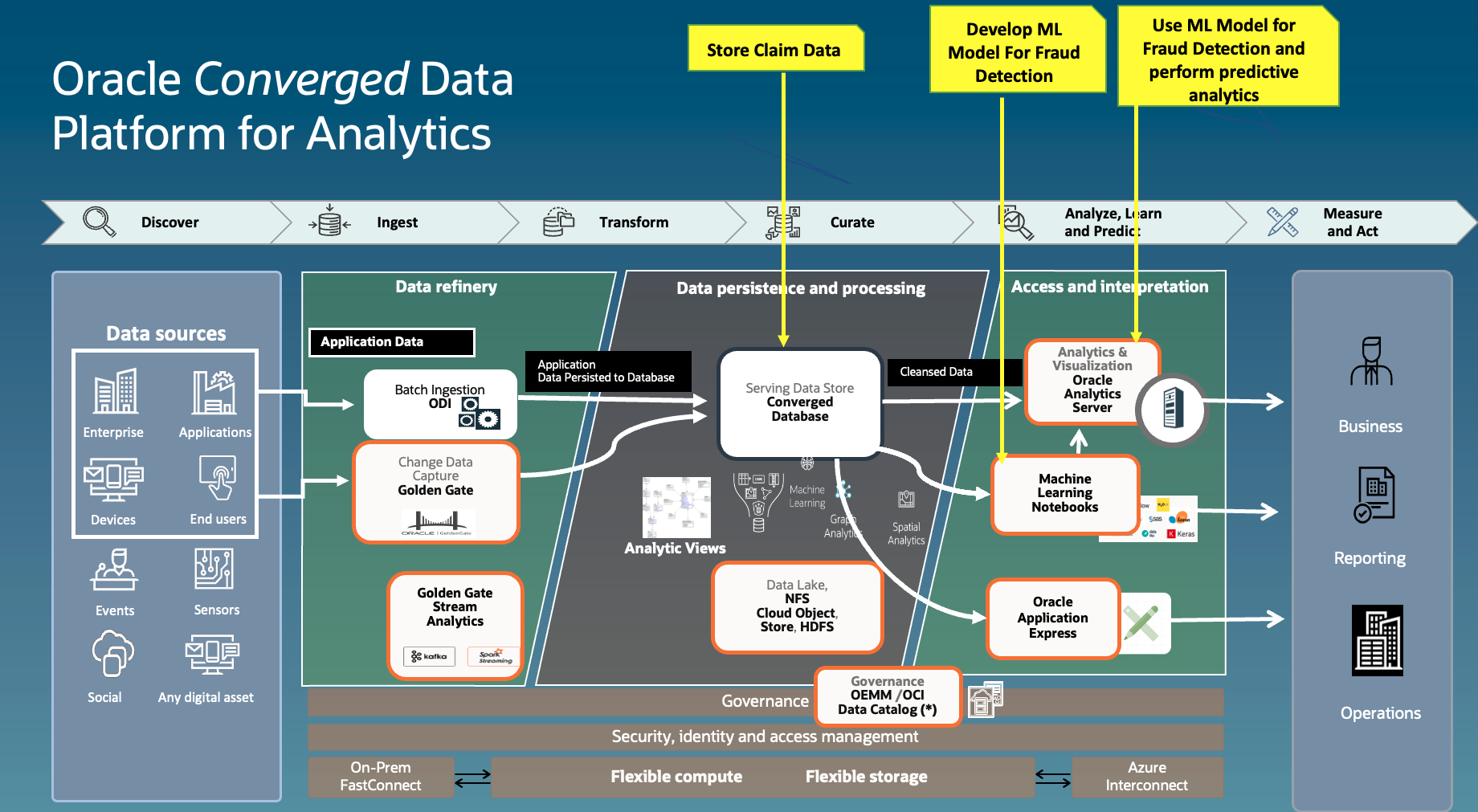

An automated Fraud detection process can be developed using Oracle Analytics(Oracle Analytics Cloud & Oracle Analytics Server) and Oracle Machine Learning, which are core components of the Oracle converged data platform.

With Oracle Analytics and Oracle Machine Learning, this process can be implemented in two steps.

Step-1

- Developed an unsupervised machine learning model using anomaly detection that will detect all suspicious claims out of thousands of submitted claims.

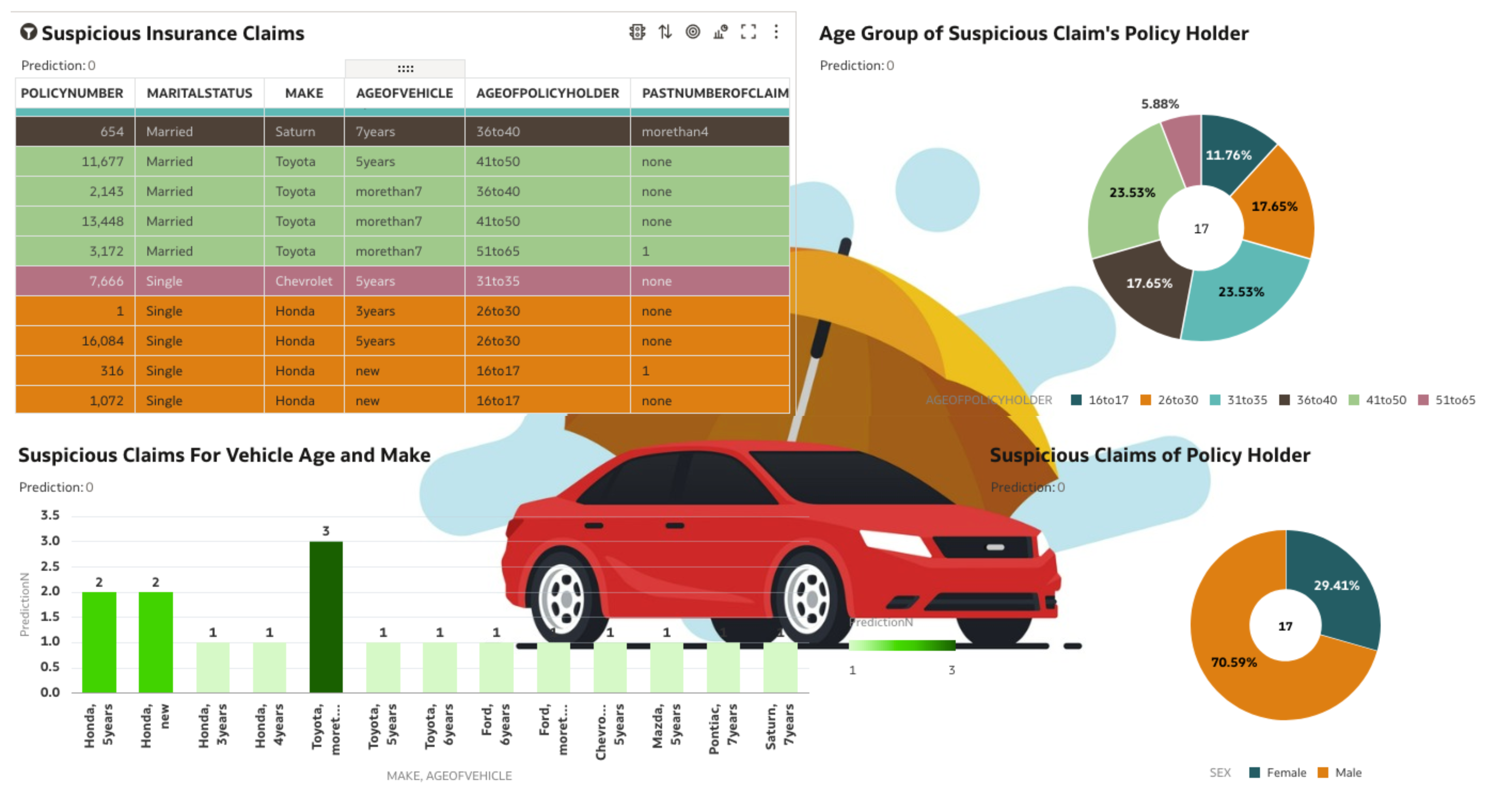

- Insurance investigator will focus only on these suspicious claims and analyse them on Oracle Analytics Dashboard.

- And finally, investigators use their expertise to mark these claims as “fraud” or “legit,” which will create fraud-labeled data for further automation in step 2.

Step-2

- Train a supervised machine learning model with fraud claim historical data (generated from step 1) that will detect the fraudulent claims.

- Run this machine learning model on daily claims data to identify all fraudulent claims.

- Analyze these fraud claims on the Oracle Analytics Dashboard.

Identify the suspicious claims with an unsupervised machine learning model

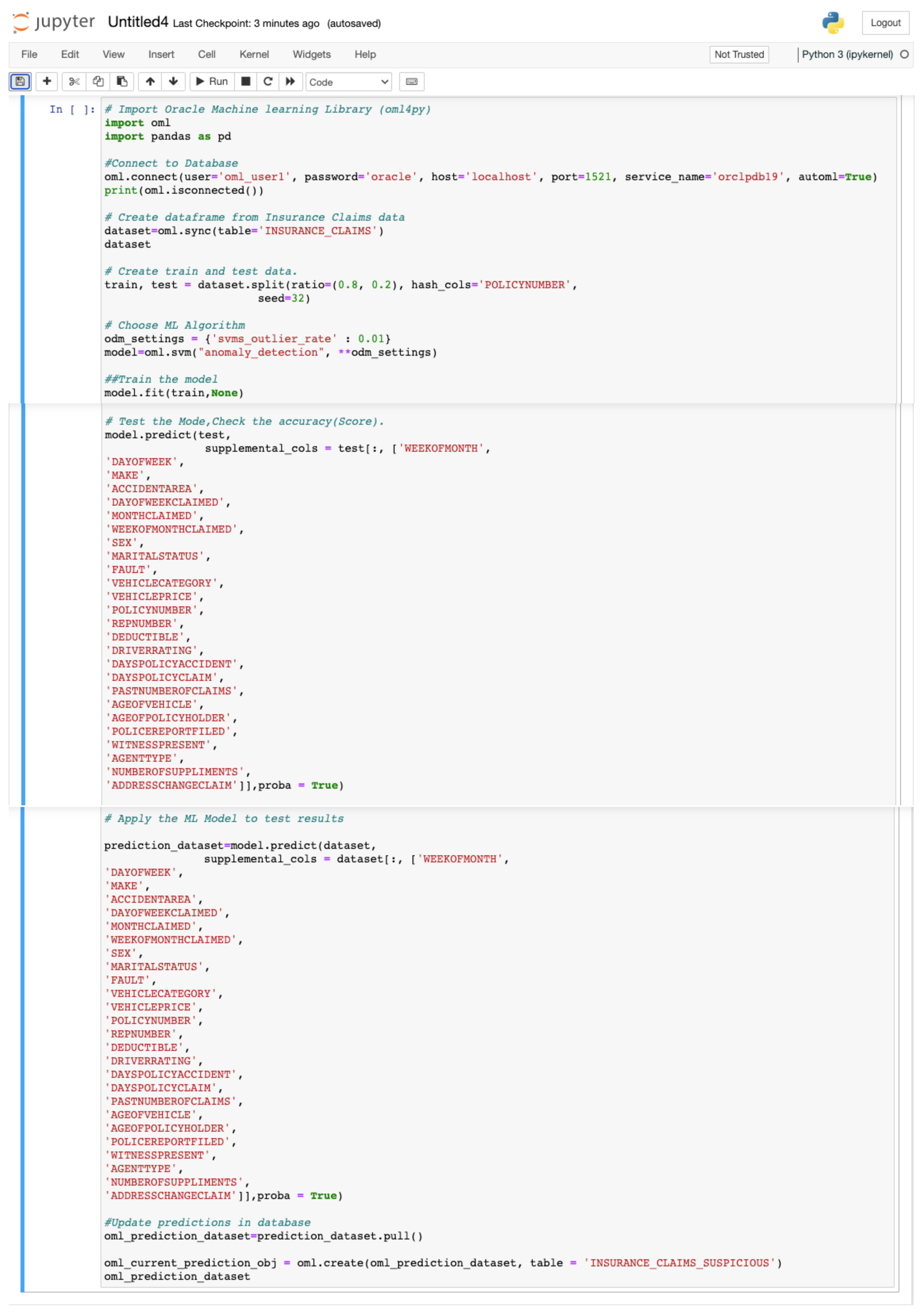

- Train an Oracle Machine Learning model on all submitted claims using the OML notebook.

- Use the OMl Support Vector Machine anomaly detection algorithm to detect these suspicious claims (Prediction = 0 (suspicious), 1 (non-suspicious)).

- Register this machine-learning model on Oracle Analytics.

- Create a data flow in Oracle Analytics and apply this ML model on submitted claims to identify all suspicious claims.

- Create a dashboard on the suspicious claim dataset for insurance investigators to analyze further.

- Investigators will identify the fraud claims using their expertise and flag them as fraudulent (yes or no).

Target the fraudulent claims using a supervised machine learning model

Over a period of time, there will be sufficient fraud labeled data generated from step 1 that can be used further to develop a supervised machine learning model.

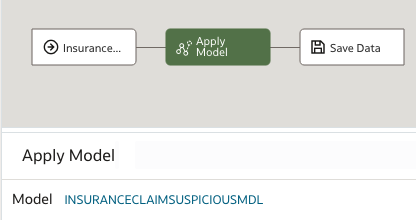

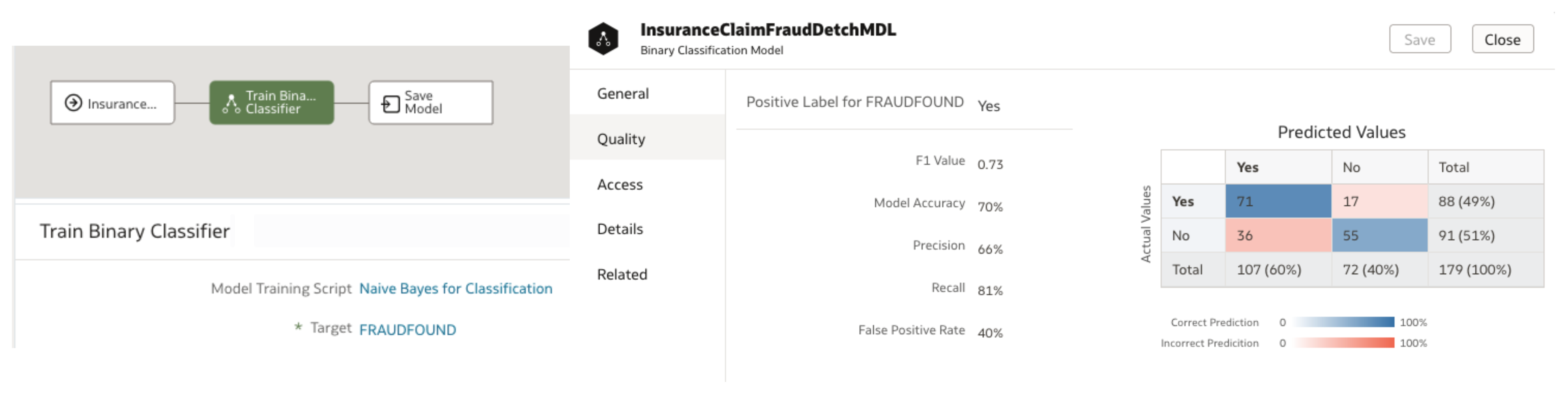

- Train a supervised machine learning model on fraud labeled data. This model can be trained using OML or Oracle Analytics data flow. In this blog, we are using Oracle Analytics data flow.

- Use the binary classifier algorithm in the data flow.

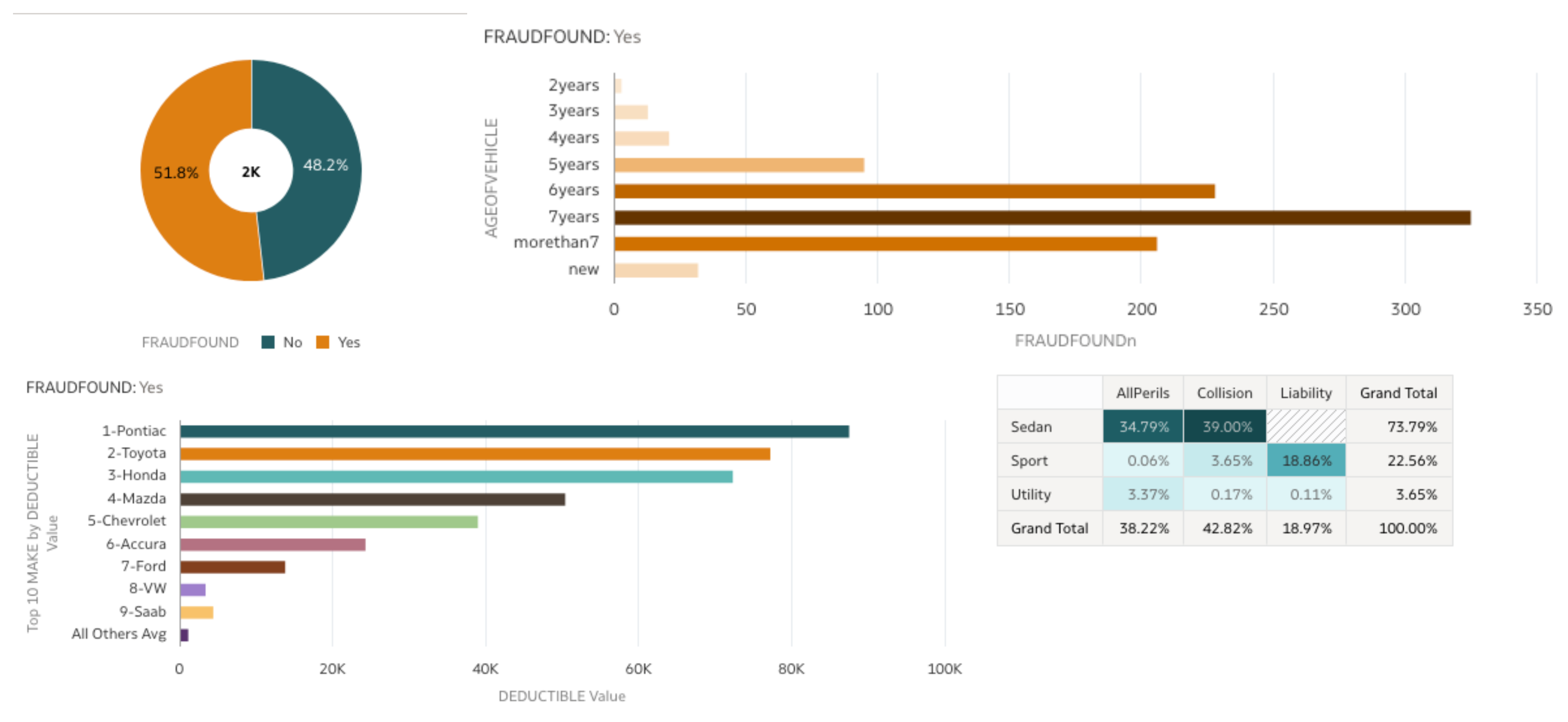

- Apply this model to daily claims data to identify all fraud claims.

- Analyze these fraud claims on the Oracle Analytics dashboard to take corrective measures or actions.

Wants to know more about Oracle Analytics and Machine Learning

To explore more on Oracle Analytics and Machine Learning, you can refer to this blog, the Oracle Analytics product videos library, and the documentations.

Key Features of Oracle Analytics Platform

Oracle Analytics Product Videos

Oracle Analytics Server Documentations