Reimagining Payment Operations with Oracle Analytics

Managing payment operations in financial institutions can feel like navigating a maze. From delays and compliance checks to fraud detection—and with data scattered across different systems, challenges emerge at every turn. In this article, we explore how Oracle Analytics demonstrates the potential of Intelligent Payment Operations—a powerful approach that combines AI, machine learning (ML), and natural language processing (NLP) to help financial institutions tackle payment challenges.

Here’s a Preview of What’s Possible

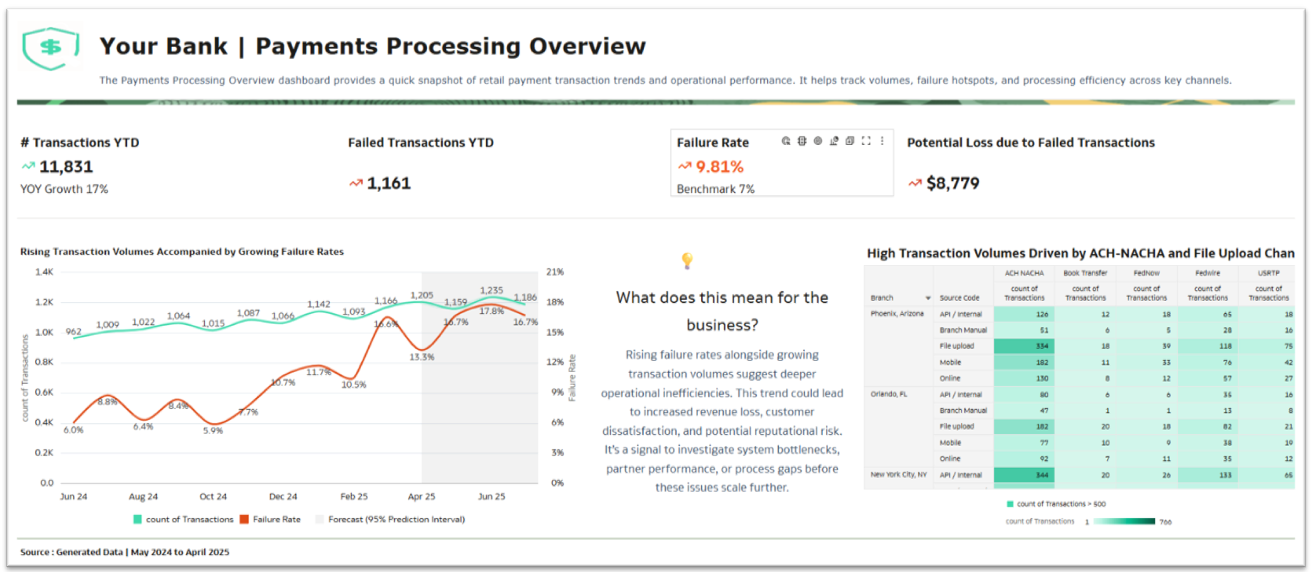

Let’s begin with a visual preview from Oracle Analytics that sets the stage for what’s possible. This dynamic dashboard brings real-time payment data to life, showcasing key metrics such as transaction volumes, failure rates, fraud alerts, and revenue impact—all in one place.

The executive summary provides decision-makers with the ability to spot trends, identify risks, and make proactive decisions—all with just a quick glance. It’s the perfect starting point for understanding the broader landscape of payment operations.

From Overview to Contextual Insights

While a high-level summary offers a valuable snapshot, digging deeper into the “why” behind the numbers is where Oracle Analytics truly shines.

With just a few clicks, organizations can uncover contextual insights powered by AI. These insights reveal not just where the issues occur, but also why they’re happening—helping teams move from reactive problem-solving to proactive optimization.

This layer of intelligence transforms raw data into actionable understanding, helping teams take targeted actions to address issues.

Breaking Data Silos for Unified Monitoring

One of Oracle Analytics key strengths lies in its ability to seamlessly blend fragmented data from multiple systems—whether it’s payment networks, fraud detection tools, compliance checks, or customer records.

This integration breaks down data silos, enabling comprehensive monitoring of payment operations, all in one place. On top of that, Oracle Analytics supports low and no code calculations and last-mile data preparation, enabling teams to refine metrics and tailor analyses to their unique business needs.

This seamless blending of data enables organizations to gain a unified, real-time view of payment operations, bringing together all key metrics and insights into a single, actionable platform.

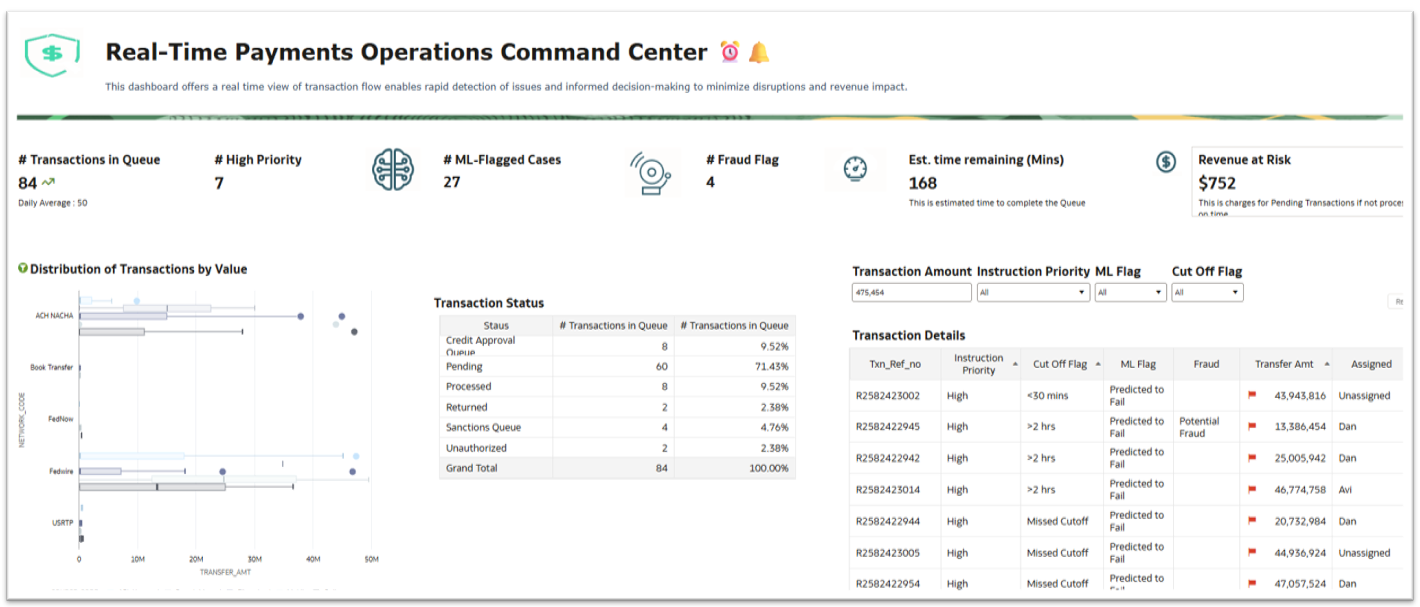

Real-Time Monitoring with AI and Machine Learning

With a unified dataset in place, real-time monitoring and predictive analytics come to life. Oracle Analytics applies embedded ML models that dynamically score transactions for fraud risk and anomalies as they happen, empowering teams to prioritize high-risk cases and focus on the transactions most likely to fail.

Empowering Teams with AI-Powered Assistance

What makes Oracle Analytics stand out is its AI-powered assistant, which transforms how business users interact with data. Instead of writing complex queries or waiting for technical teams, anyone can simply ask natural questions such as:

- Which transactions are nearing cut-off times?

- Show top 10 high-risk transactions today.

- Highlight branches with the highest delays.

Using natural language processing (NLP), the assistant returns contextual, real-time answers—enabling faster, smarter decision-making across roles.

This democratization of analytics empowers business users to act on insights, eliminating bottlenecks and improving operational agility.

Wrapping Up: Transforming Payment Operations

By integrating executive-level dashboards, contextual insights, real-time monitoring, and AI-powered natural language interaction, Oracle Analytics creates a comprehensive platform for Intelligent Payment Operations.

Discover how Oracle Analytics can help your organization unlock real-time insights, mitigate risks, and elevate payment operations to a new level—watch our video demo to see it in action!

Call to Action

- Explore Oracle Analytics capabilities:

- Join the discussion on the Oracle Analytics Community.

- Learn more about Oracle Analytics on the Product Page.