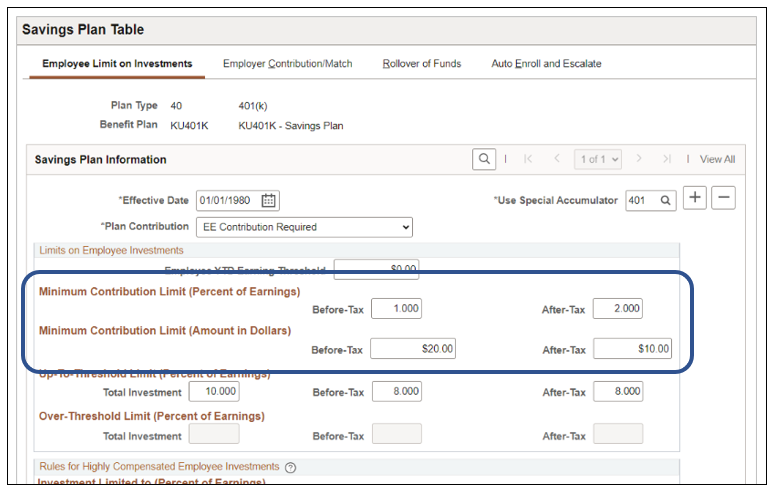

Benefits customers can now configure a minimum contribution limit on Savings Plans for the Employee. In Image 51, new boxes were added on Employee Limits on Investments.

Many third-party savings plan providers have a minimum payroll contribution requirement so that the administrative cost of receiving money is not more than the actual contribution. This new design allows customers to configure for before and after-tax contributions made by the employee. This includes a percentage or amount contribution. The employee receives an error message during enrollment if they try to enter a contribution less than the amount entered on the Savings Plan table.

If the Plan Contribution is EE Contribution Optional, the employee can still select $0 but if they do voluntarily contribute, the amount must be at least the minimum listed on the page. Conversely, if the Plan Contribution is set to EE Contribution Required, $0 would not be allowed but could not be less than the minimum amount listed.

Customers have shared that in the past they ran queries and reports to ensure that employees did not attempt to contribute below the plan’s minimum. They had to manually contact the employee and made the changes. Now customers can fully control the minimum contribution without intensive manual intervention.

Subscribing to our blogs is a great way to stay in the know.