If you are a United States federal contractor or subcontractor who employs veterans under provisions of the Vietnam Era Veteran’s Readjustment Assistance Act (VEVRAA), and you have contracts or subcontracts totaling $100,000 or more, you need to submit your VETS-4212 report to the Department of Labor (DOL) by September 30, 2025.

The Office of Federal Contract Compliance Programs (OFCCP) requires employers to take affirmative action to recruit, hire and promote U.S protected veterans – the hiring benchmark for 2025 is 5.1%.

Under VEVRAA, the term protected veterans is defined as 1) disabled veterans, 2) veterans who served on active duty during war or campaign for which a campaign badge was authorized, 3) veterans who were awarded an Armed Forces Service Medal, and 4) recently separated veterans.

Employee Veteran Status Self-Identification page

Employees can self-identify their veteran status in the Personal Details in employee self-service or a HR Administrator can update an employee’s veteran and disability status in Personal Data/Disabilities pages.

To assist customers with their VETS4212 reporting, PeopleSoft has a VETS4212 component to help with 1) collection of employee veteran statuses 2) analysis of data and 3) creating the extract file to send to the Department of Labor.

The first step is to run the process to identity protected veteran new hires and current employees. Depending on the size of your organization and number of establishments, VETS4212 reporting can be very complex and time consuming, to streamline the process we separated out the process of collecting the data (stored in temp tables) from the report – so no report is generated in this step.

Navigation – Workforce Monitoring > Meet Regulatory Rqmts > VETS Reports > Veterans Employment Report

Reporting Date – For purposes of completing VETS-4212 Reports, enter the end date for the 12 month “reporting period” used as the basis for filing the VETS-4212 Report. The “reporting period” is the 12 months preceding the selected payroll period ending date. To determine the “reporting period,” the contractor should select a date in the applicable year between July 1 and August 31 that represents the end of a payroll period. For example, if a contractor’s payroll period ends on August 15, 2025, it would then go back one year to August 16, 2024. This is the year that would represent the reporting period for the 2025 filing cycle. In addition, you can use December 31 of the previous year.

Recommendation – Run the VETS4212 Process during non-peak times (report can take hours to run depending on your server speed and volume of data).

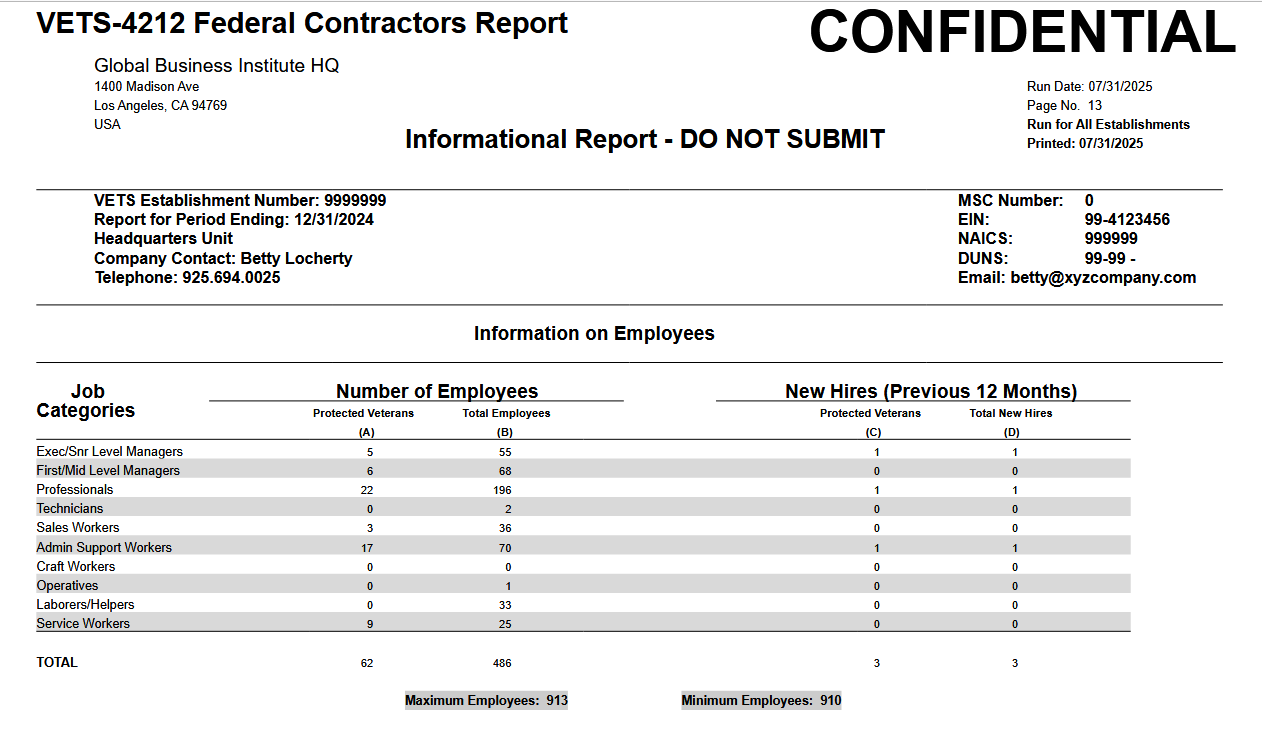

The second step is to review your veteran data once this process completes. The VETS4212 report can be accessed using the Report Manager hyperlink.

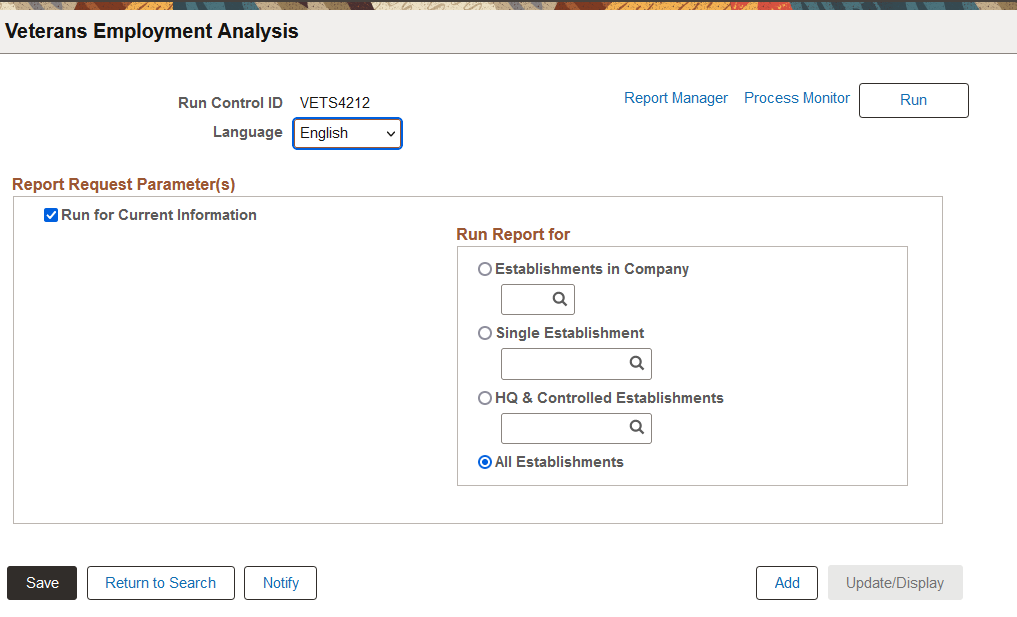

Navigation – Workforce Monitoring > Meet Regulatory Rqmts > VETS Reports > Veteran’s Employment Analysis

The VETS4212 Analysis process generates an informational, easy-to-read .pdf version of the veteran’s employment report for analysis and referencing purposes.

Note: Data will not get deleted or overwritten unless you run it AGAIN for the same establishment, same reporting year.

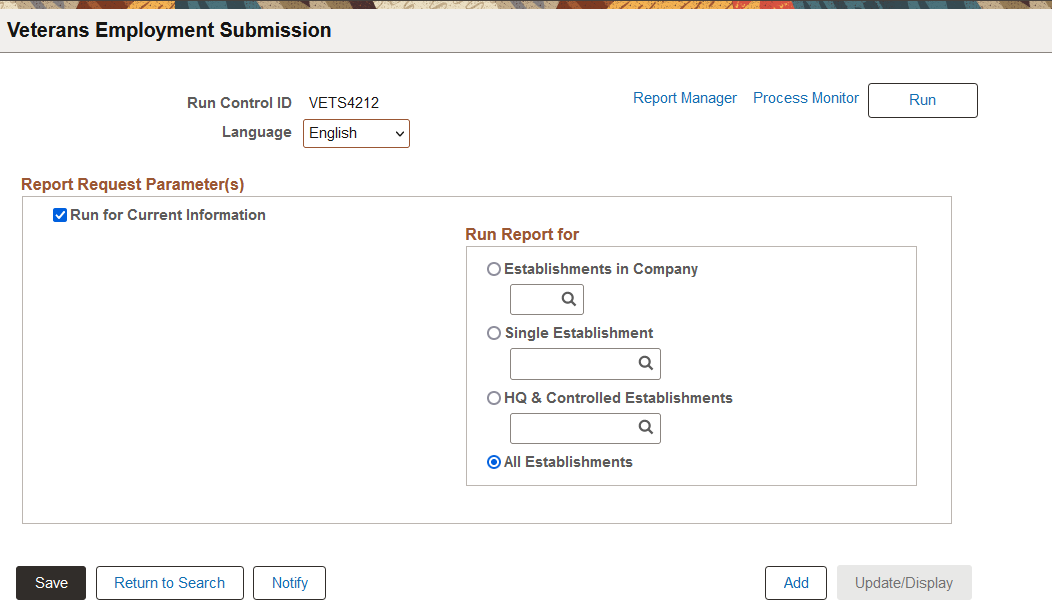

The Last Step is to generate the file- the VETS4212 Submit process creates a digital VETS4212 file, that can be submitted to Department of Labor. Using the data in the temporary table, this process also transfers the data from the temporary table to a history table.

Navigation – Workforce Monitoring > Meet Regulatory Rqmts > VETS Reports > Veteran’s Employment Submission

For more information on the VETS4212 Report, visit the Dept of Labor – VETS4212 Reporting website.

For more information on running the VETS4212 process, visit PeopleBooks – VETS4212 Processing