Processing Payment Cards Payments

This blog post is the second and concluding part of the How to improve supplier payment processes with payment card series. Part I covered the setup and this post will focus on the inbound, outbound and reconciliation processes.

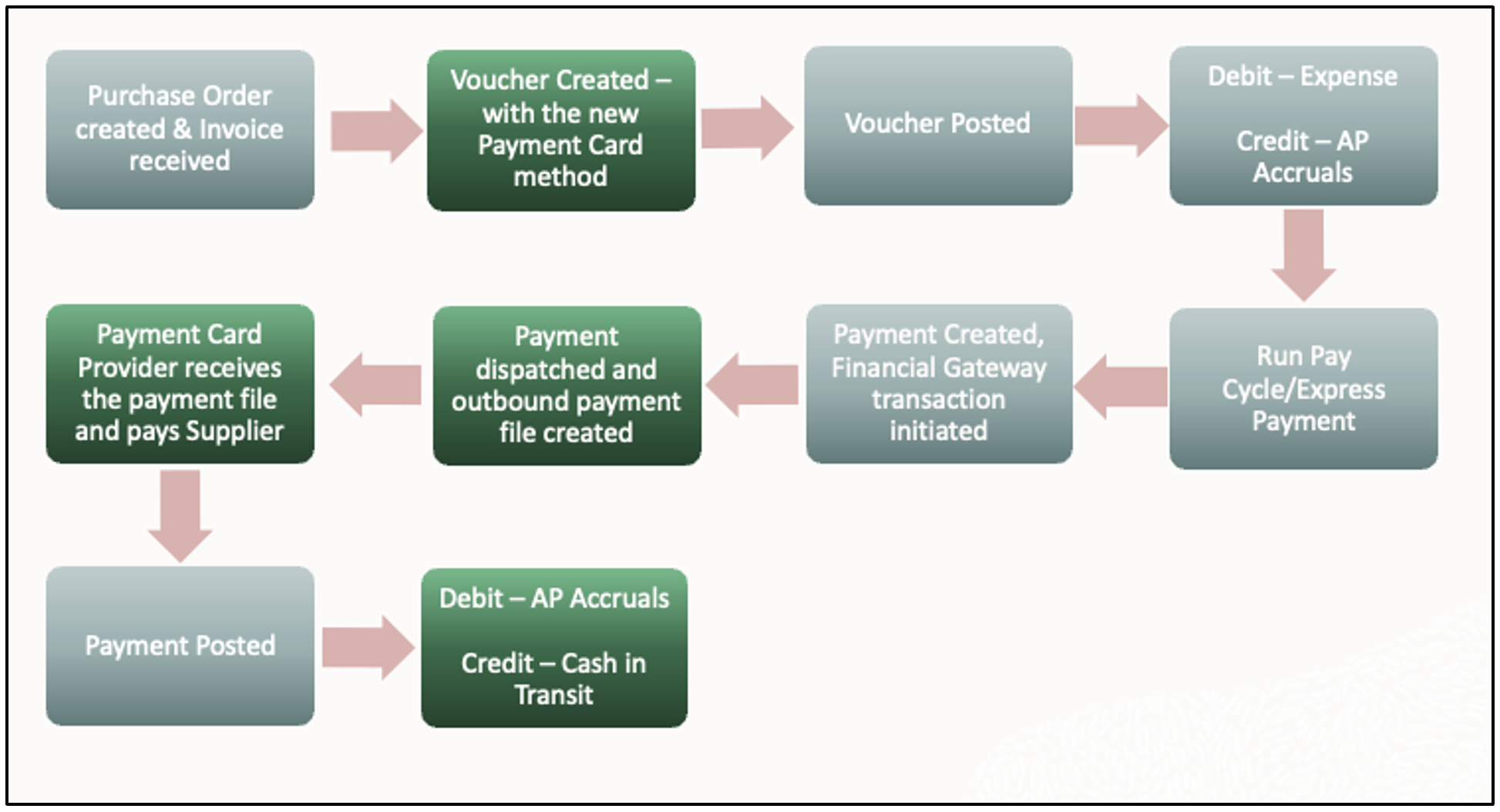

There are 2 process flows for processing supplier payments through this new payment cards method.

- Outbound process to pay the suppliers

This process flow is the same as what is supported today for ACH and check payments from Accounts Payable. The enhancements to support payment cards include:

- Enhancement to voucher create process to recognize the new payment cards payment method – Based on the supplier setup, if payment card is defined as the payment method for the supplier, voucher will be created with the new Payment Card method.

- Enhancement to payment file creation process – Financial Gateway payment file creation process has been enhanced and will use the new layout, as outlined in the setup, to generate the outbound payment file.

- Enhanced Payment posting to create accounting for Cash in Transit – Payment posting process has been enhanced to create accounting for “Cash in Transit”

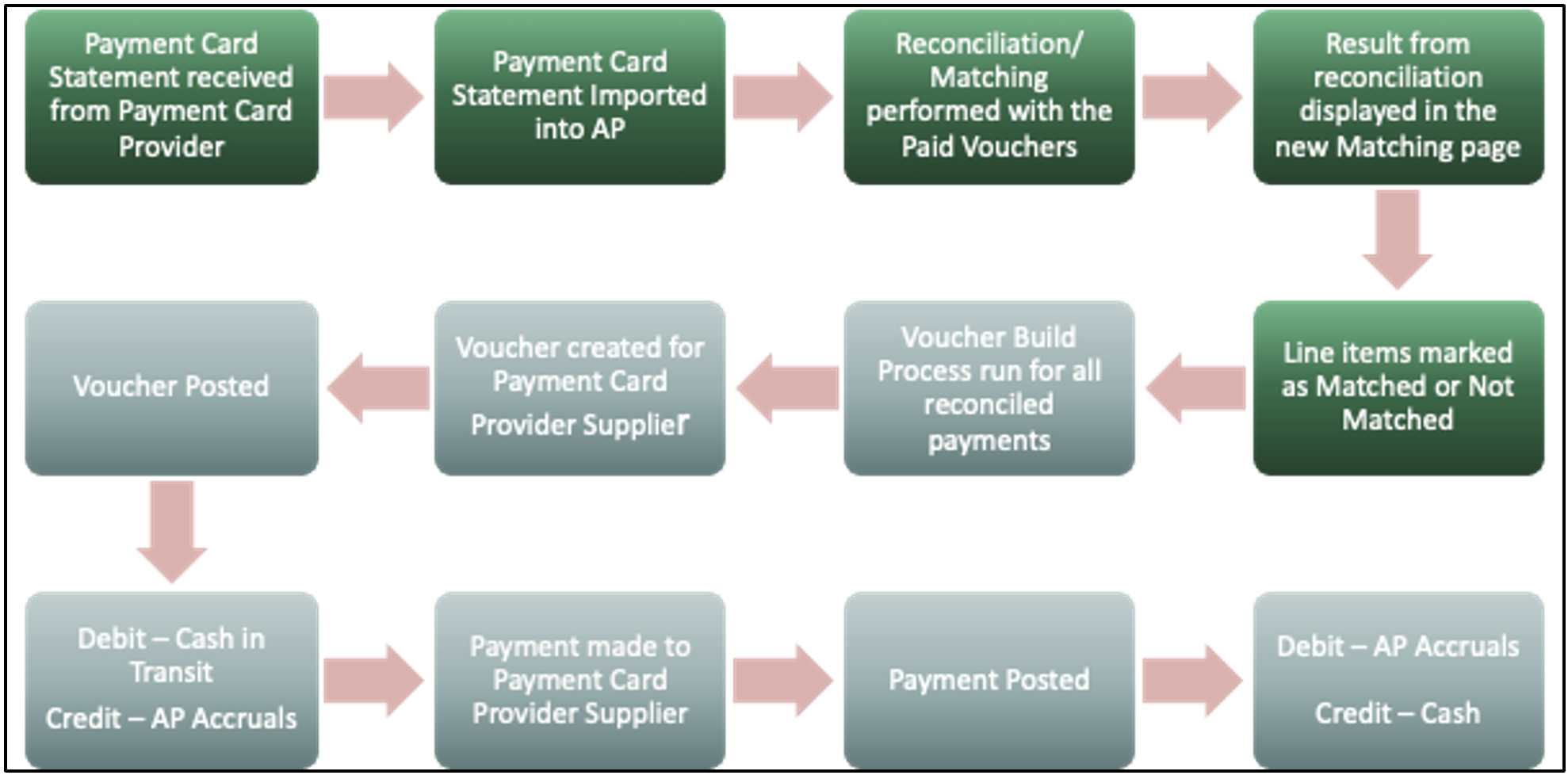

- Inbound process to receive payment card statement from bank, reconcile payments and pay payment card provider

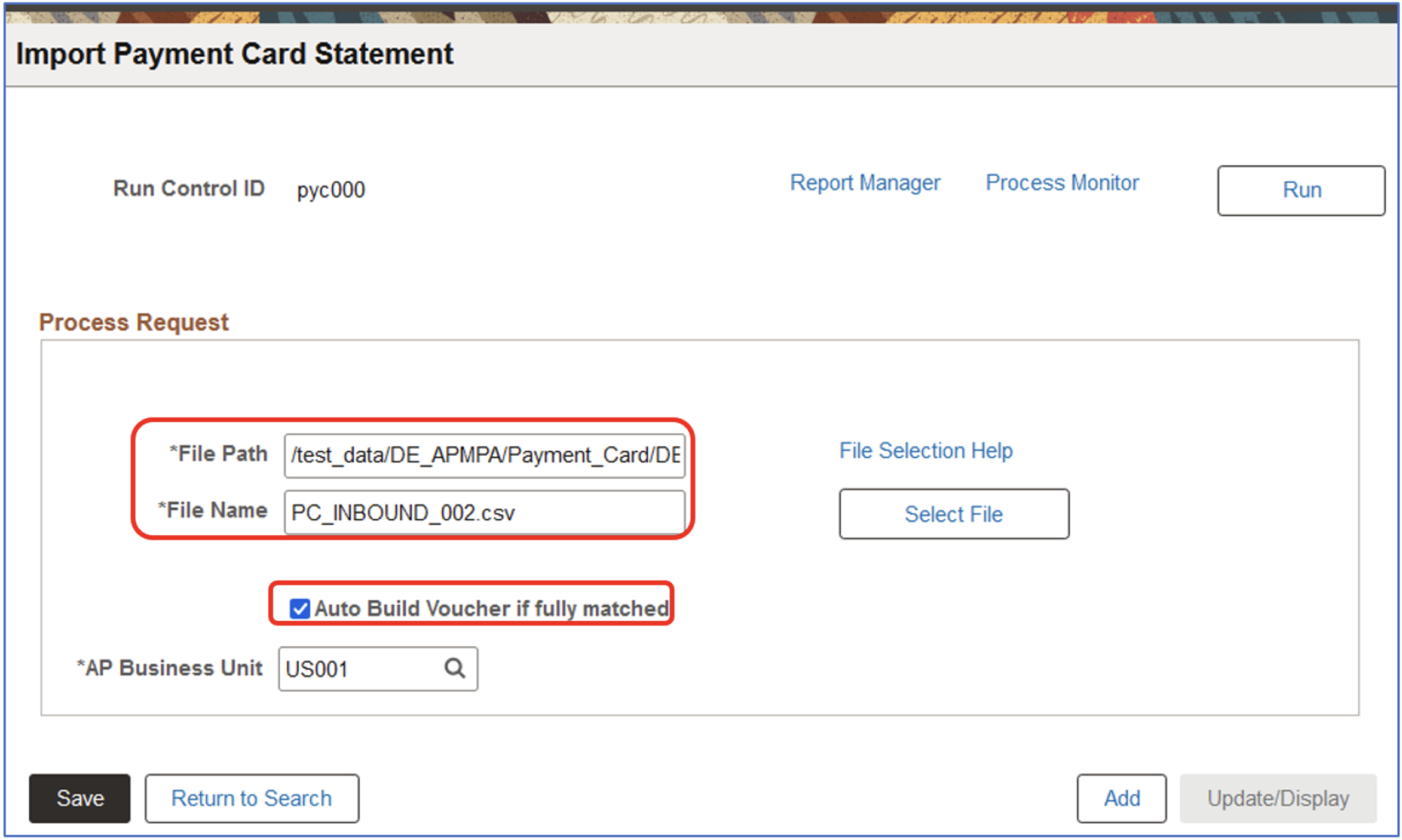

- Importing the payment card statement file – You will need to define the process of receiving payment card statement file. Typically, organizations log into their payment card provider website to download payment card statements on a weekly or monthly basis. Once you have this file you will import the payment file using the Import Payment Card Statement page.

For importing payment card file:

- Specify the file path and file name for the payment card file.

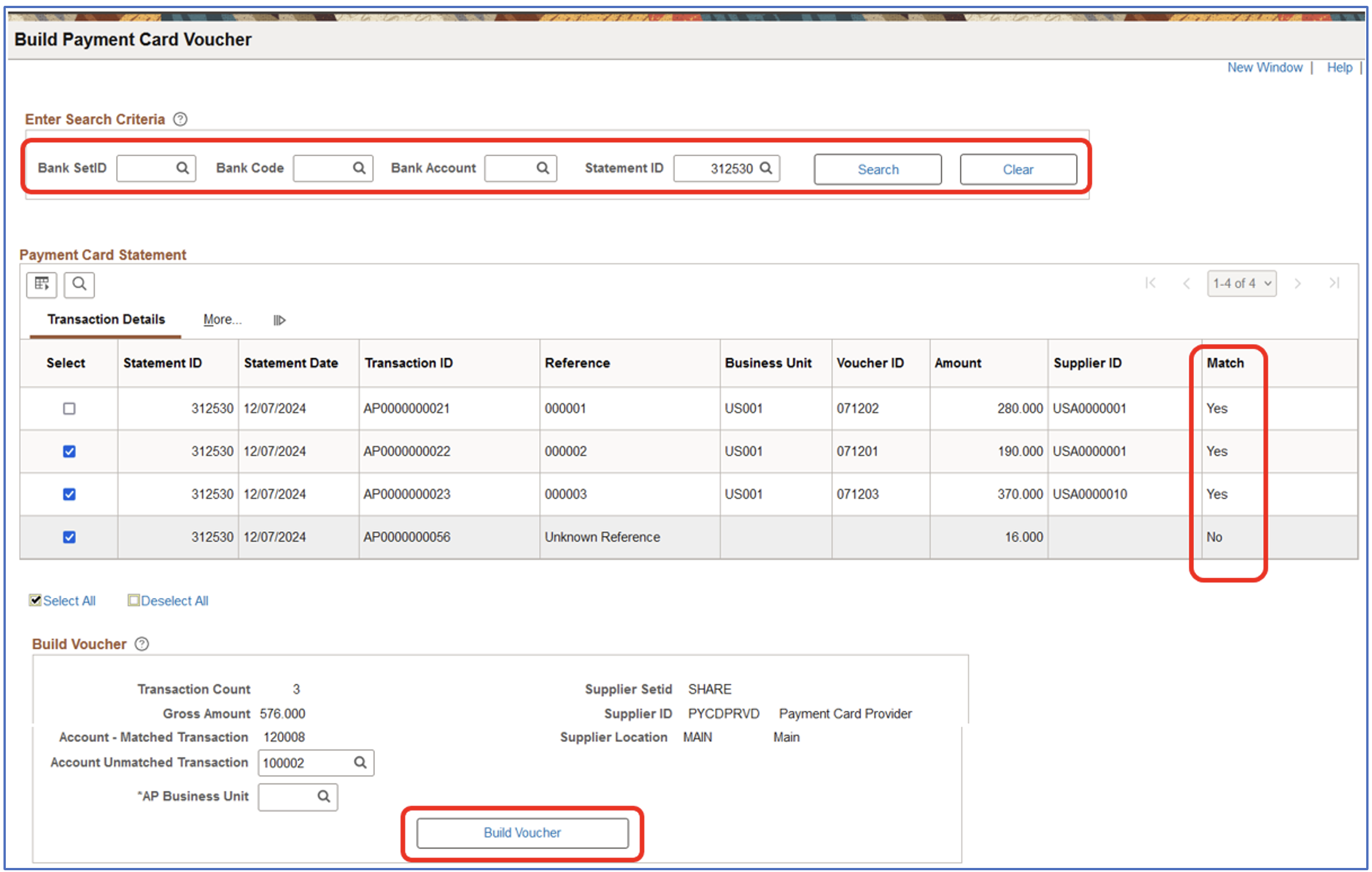

- Select “Auto Build Voucher if fully matched” flag to create the voucher to pay the payment card provider. Your payment provider would have paid multiple suppliers for multiple vouchers. The inbound file should include those details. The import and the matching process will import the payment details and match the payments against the vouchers. The process will then create a single voucher to pay the payment provider for all payments made.

- For unmatched payments or in cases where amounts are not fully matched, you will need to verify and approve payment on a on case-by-case basis.

- If “Auto Build Voucher if fully matched” flag is not checked, you will have to create the voucher to pay payment card provider manually.

For more information on how to use the DEIU tool and details on delivered maps, refer to Peoplebooks.

Payment Cards will simplify the process of paying suppliers who accept credit card payments for accounts payable invoices. The secured delivery will expedite payments to supplier, reduce internal processing and transaction costs, help eliminate paper-based processes, improved reconciliation efforts and ultimately improve cash flow.