Over the last 9 months, SECURE 2.0 always pops up in conversations about Benefits. Just like the legislative act, the questions vary from simple to very complex.

If you have been following my blogs, listened to the podcast I did with Robbin Velayedam, or the Quest Webinar, you know that the most burning questions have been about Section 603. This section is the provision that requires certain employees’ catchup to be contributed to a Roth account and had an effective date of January 1, 2024.

On August 25th the IRS issued a Notice that provides a two-year administrative transition for Section 603. They also outlined some of the outstanding questions they plan to answer in the future. While this does give us an opportunity to understand more about how this one provision will work, it is important to remember that there are other provisions to consider as well. To assist customers in understanding what Oracle/PeopleSoft is working on I have created a FAQ based on the questions I have heard from you.

Disclaimer: The information in the documents may not be construed or used as legal advice about the content, interpretation or application of any law, regulation, or regulatory guideline. Customers and prospective customers must seek their own legal counsel to understand the applicability of the law or regulation.

1. What is SECURE 2.0?

SECURE 2.0 is relatively new legislation that was signed into law by President Biden on December 29, 2022. SECURE 2.0 builds upon the 2019 SECURE Act (“SECURE 1.0”) which was signed by President Trump in December 2019. The “SECURE” acronym stands for “Setting Every Community Up for Retirement Enhancement”.

The original legislation created changes for long-term retirement savings for Americans of every age. The new provisions in SECURE 2.0 are designed to make it more attractive for employers to offer retirement plans and easier for all employees to start saving. Here is a link to the Congressional Bill.

2. Why does it matter to customers?

Employers are responsible for complying with these legislative changes.

There are 92 provisions in Secure 2.0. Some of the legislation may require customers to make changes to their existing savings plans and offerings. Of the 92 provisions, many do not affect the enrollment and collection of funds and do not require any enhancements or changes in the PeopleSoft Benefits product but may require action by the employer.

Originally, SECURE 2.0, Section 603 had an effective date of January 1, 2024 and was one of the first provisions that organizations were scrambling to comply with and for which Oracle PeopleSoft was working to provide enhancements. On August 25, 2023, the IRS released an announcement of a two-year administrative transition period for the requirement that certain catch-up contributions be designated as Roth contributions.

Section 603, in layman’s terms, requires employees, who participate in 401, 403, or 457 plans, who are over the age of 50, and who made more than a specific amount in FICA earnings in the prior year, may only contribute their catch-up dollars to a Roth after tax fund.

IRS guidance also stated that they plan to provide more details in the future for some open questions. It is important to remember that this delay is ONLY for Section 603 and does not address the other 91 provisions of SECURE 2.0. Continue to read this document for information about a few of the provisions we plan to address.

3. What are some of the enhancements that PeopleSoft anticipates to deliver outside of Section 603 requirements?

Section 109

Section 109 provides for a “super” catch-up contribution for individuals who are age 60-63. This is effective after December 31, 2024.

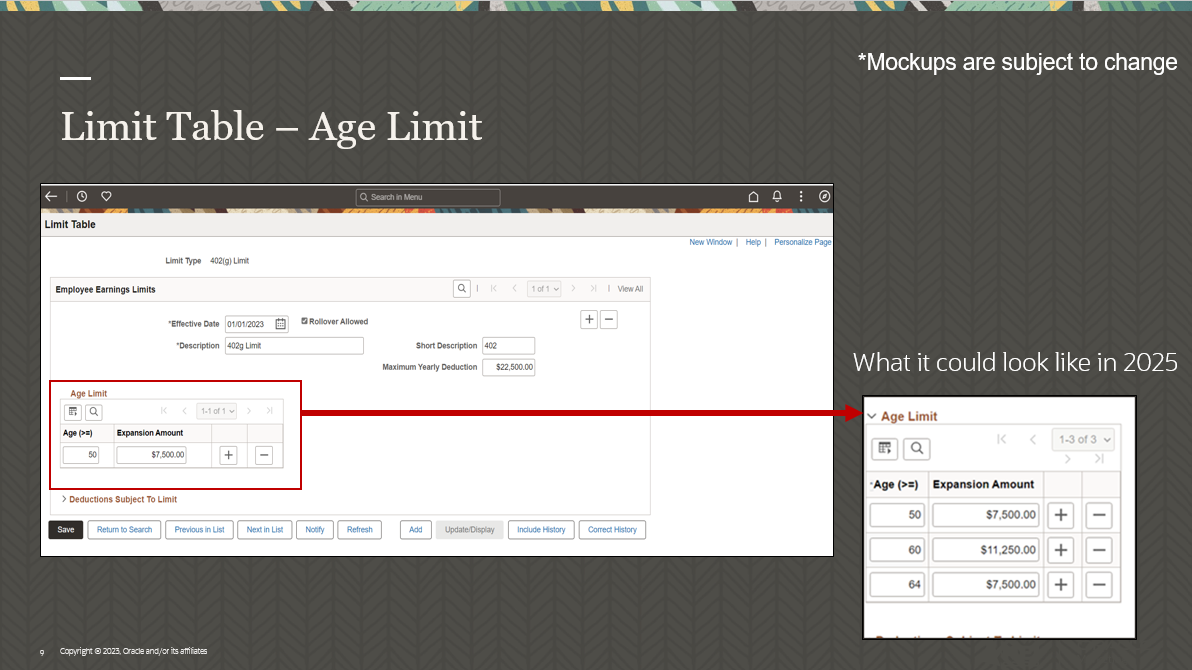

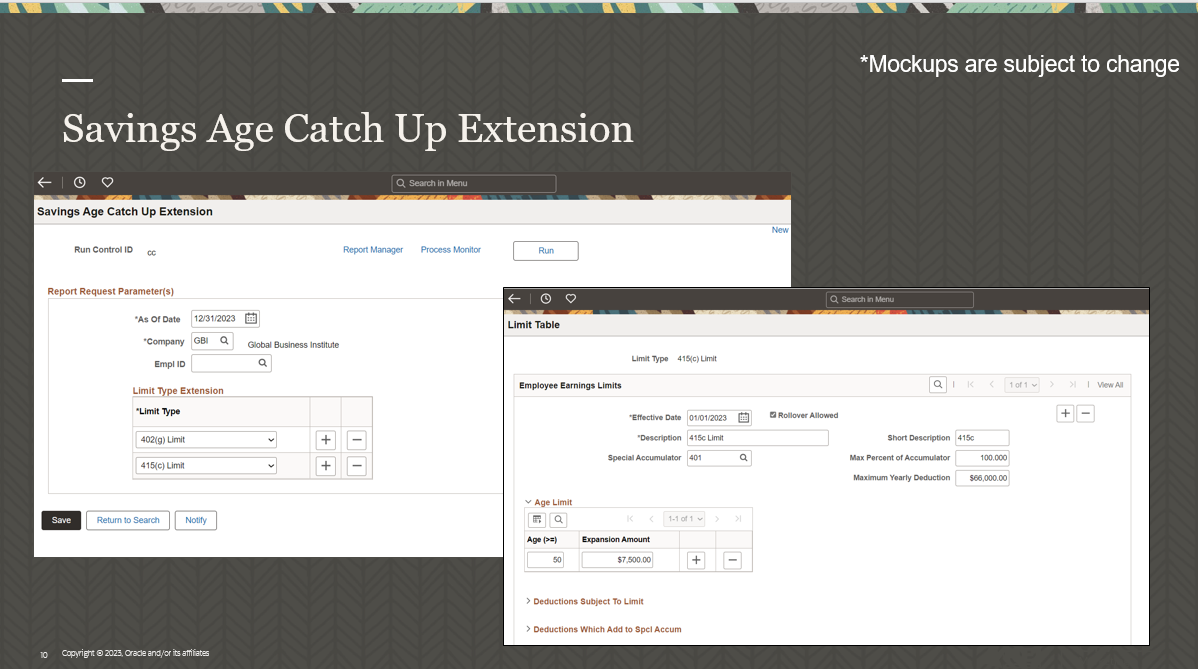

In order to provide different catch-up contribution limits, our strategy is to provide a new Age Limit grid on the Limit Table that may look something like the below. Then update the Savings Age Catch Up Extension run control and application engine to use these limits to populate the current Benefits Savings Management page for each eligible participant.

Benefits is only providing this functionality for customers that utilize Savings Plans. If you are only using General Deductions to take savings contributions, you will have to configure the general deduction limits and manually track other functionality.

415(c) Age Limit Type Extension

While not a part of the SECURE 2.0 Act, we also are looking at the delivery of a 415(c) Age Limit Type Extension. This is an Ideas Lab suggestion that customers have requested. We felt this was a good opportunity to provide this enhancement as we were working on the run control and application engine.

Section 101

We are also looking at additional functionality to capture a minimum contribution limit on the Savings Plan Setup table. This would provide a range for the minimum and maximum percent of earnings and contribution amount for employee contributions to assist employers in meeting Section 101. This provision will require companies with new 401(k) plans to automatically enroll employees into Savings Plans at a minimum contribution rate of 3% but no more than 10%. Just like Section 603, there are outstanding questions that will need to be addressed by the IRS. The current effective date is January 1, 2025.

4. How will PeopleSoft deliver the enhancements?

With the two-year administrative transition period for Section 603 the need to provide enhancements before the end of 2023 is no longer necessary. At this time we are looking at our first release of the enhancements to be included in an Image release. We also anticipate that not all enhancements will be delivered in the same image. We plan to deliver them as the work is completed to give you the most time for testing. Please note that Benefits changes will NOT be delivered with Tax Updates.

5. Is my organization’s saving plans part of this requirement?

We believe that the majority of our customers will be affected by this legislation in some form. We do know that some 457 plans can be tricky so we suggest that you work with your own legal staff and plan providers to determine your requirements. It is incumbent on every organization to determine if their plans are affected.

6. What are some of the outstanding questions to the IRS about Section 603?

While this is not an exhaustive list, here are some issues that we have or have heard you ask:

- Clarification about participants who do not have FICA wages

- Guidance about whether an employee must separately elect the Roth contribution

- Address aggregation of wages from other employers and FEINs

- Clarification about plans that do not include a qualified Roth contribution program

- Clarification on whether Section 603 impacts the 15 year catch-up for 403(b) plans

- Guidance about how an employee’s regular Roth contributions impact a required Roth catch-up

- Guidance on whether regular and catch-up contributions can continue to be made concurrently

7. Where can I get more information on the current Savings Plan functionality?

Some of you had asked about setting up plans, how the limits work, and identifying employees age 50 and over. PeopleBooks offers a number of chapters that may be helpful. Use the search feature to find the topic you are looking for. Here are a few to get you started.

- Setting Up Savings Plans (oracle.com)

- Understanding Savings Plan Management (oracle.com)

- Managing Savings Plan Limits (oracle.com)

- Identifying Age-50 Extensions (oracle.com)

8. If my organization only uses Base Benefits, how can I enroll my employees into Savings Plans?

Benefits Administration is required for Employee Self Service enrollment. Base Benefits would require manual enrollment or a customization. Using a PeopleSoft Partner could provide assistance if you are planning to make customizations.

9. Are there other key provisions?

Currently, we believe that the Benefits setup is flexible enough for customers to configure other key provisions without additional enhancements.

This includes the SECURE 1.0 requirement that 401(k) plans extend participation to any employee who completes at least 500 hours of service during each of three consecutive 12-month periods (Long-Term Part-Time Employee) for purposes of making contributions to the plan. Only periods of service beginning on and after January 1, 2021 must be counted (which means that the earliest date a Long-Term Part-Time Employee would be eligible for participation under SECURE Act 1.0 is January 1, 2024). SECURE Act 1.0 Long-Term Part-Time Employee provisions do not apply to 403(b) plans (but please read further).

Secure 2.0 Section 125 requirements establishes a shorter two-year eligibility period for long-term part-time employees plan years beginning after December 31, 2024 and also applies the eligibility rules to 403(b) plans.

There are many other provisions that we did not point out or cover in this document that you may be responsible for complying with or may be a voluntary change. Again, this is why we continue to suggest that you work with your legal team and savings plan providers.

10. What should customers do to prepare for SECURE 2.0?

First, read the bill and work with your benefits legal team and your third party savings management partners to understand what your responsibility is even outside of what PeopleSoft is doing. We also urge you to continue to monitor legislative updates.

Second, start thinking about how you will educate your employees. These changes are not always easy for employees to understand.

Third, to understand what PeopleSoft is doing please continue to monitor our blogs for updates.