“The desire to fly is an idea handed down to us by our ancestors who, in their gruelling travels across trackless lands in prehistoric times, looked enviously on the birds soaring freely through space, at full speed, above all obstacles, on the infinite highway of the air.”

– Wilbur Wright

The Wright Brothers not only introduced the world to powered flight—they ignited a vision that reshaped humanity’s boundaries. Airplanes have since become catalysts for economic integration, cultural exchange, and global connectivity. They shrank the world, transformed how we celebrate festivals, reimagined leisure travel, and enabled businesses to innovate beyond physical borders.

Yet, despite rising passenger numbers, full flights, and bustling airports, a paradox persists: commercial aviation remains a notoriously thin-margin business. Many airlines report losses even in peak demand periods. For industry veterans and financial analysts, this contradiction is both baffling and persistent.

The Paradox Behind Airline Profitability

A closer look reveals a critical truth—airlines operate in a highly constrained environment, with limited control over both costs and revenue.

1. Cost Constraints

- Fuel Costs: One of the largest cost components, often dictated by global oil markets and government regulations.

- Aircraft Costs: Driven by manufacturers or leasing companies, leaving airlines with minimal flexibility.

- Airport & Navigation Fees: Controlled by airport authorities and government agencies.

- Passenger Service & Safety Costs: Non-negotiable and governed by strict regulatory standards.

2. Revenue Constraints

- Highly Competitive Markets: Airlines must respond in real time to price wars and dynamic demand.

- Alternative Modes of Transport: Rail and road networks compete heavily in domestic sectors.

- Economic Sensitivity: Global economic shifts heavily influence travel demand.

- Geopolitical Uncertainty: Conflicts, regulations, and regional tensions directly impact routes and loads.

This intricate web of dependencies makes airline profitability analysis exceptionally challenging.

Introducing the Airline Route Profitability Solution (ARPS)

Powered by Oracle Fusion Cloud Enterprise Performance Management (EPM)

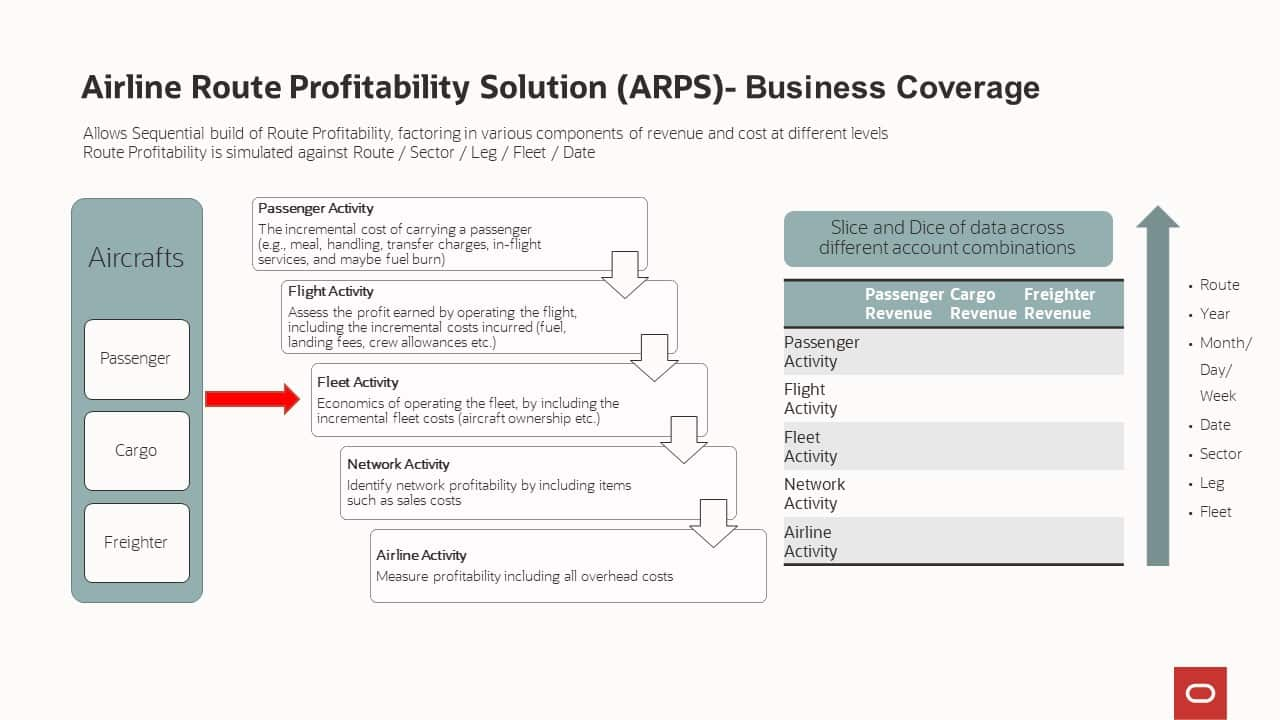

At Oracle Consulting, we are deeply engaged with this challenge. Our mission is to empower airlines with visibility into their complex cost and revenue structures and help them simulate profitability under various operational scenarios. To achieve this, we have developed the Airline Route Profitability Solution (ARPS)—a comprehensive framework built on the world-class capabilities of Oracle Enterprise Performance Management (Oracle EPM).

What ARPS Delivers

1. A True Picture of Airline Profitability

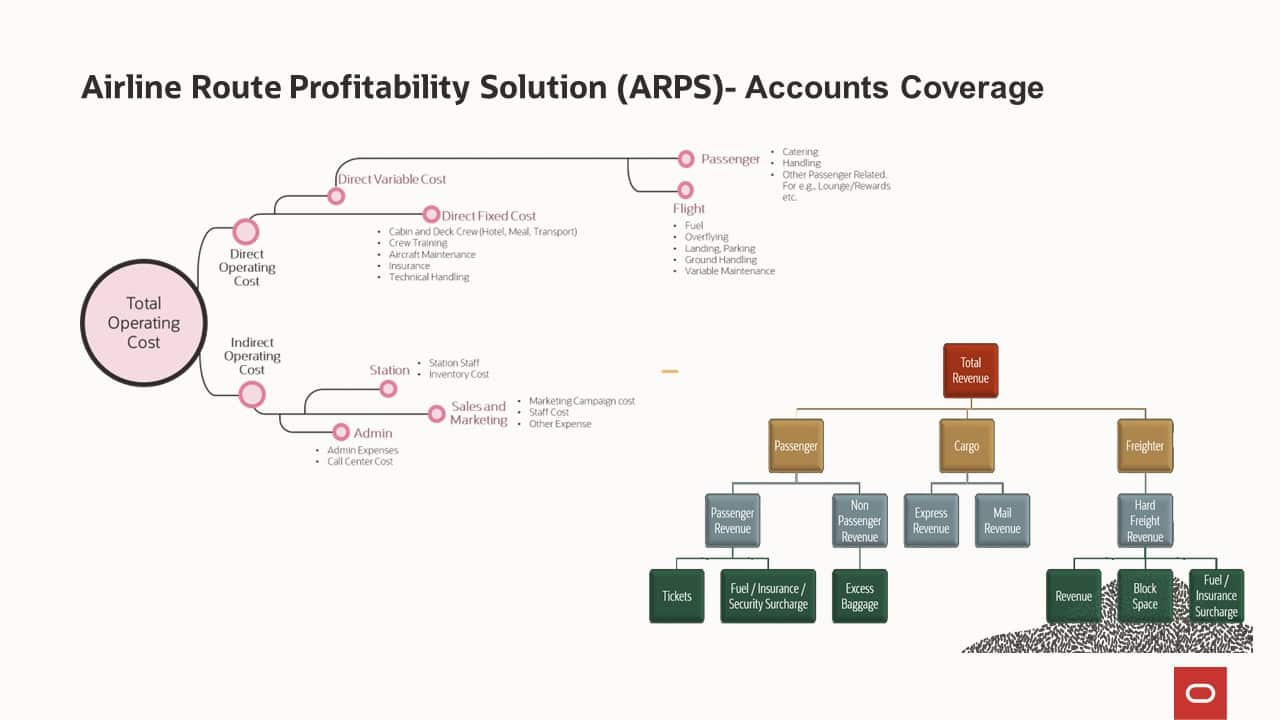

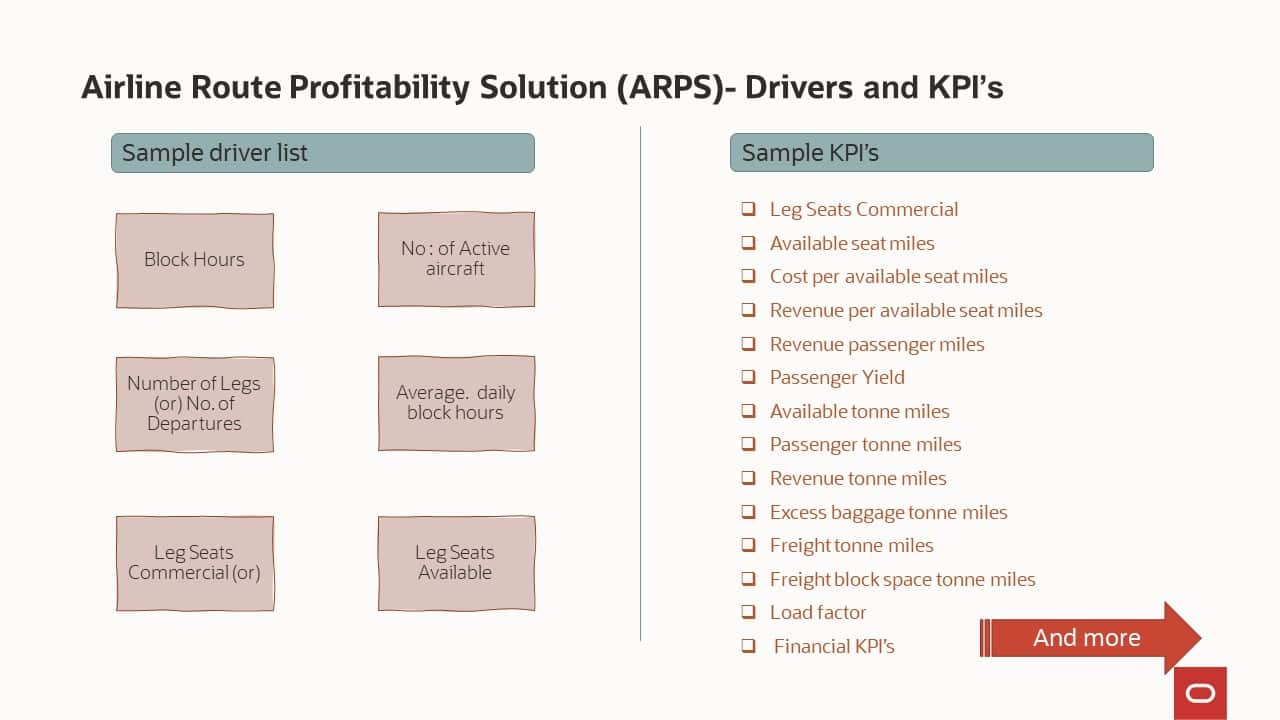

ARPS models the full complexity of airline economics. It links operational parameters with financial outcomes to deliver insights at multiple levels—service line, route, operation, and activity.

2. Scenario Modeling & “What-If” Simulation

Airlines can evaluate the impact of fluctuating fuel prices, demand changes, new route launches, macro-economic factors, and other dynamic variables—all in a controlled, intuitive environment.

3. Rich Dashboards & Narrative Reporting

Using Oracle EPM Planning, Oracle EPM Narrative Reporting, and other EPM capabilities, ARPS provides interactive dashboards and industry-standard KPIs for benchmarking against competitors.

4. AI-Driven Insights

Embedded artificial intelligence provides proactive recommendations, uncovering hidden trends and enabling faster, more informed decision-making.

5. Integration with Oracle ESG Solutions

ARPS can be seamlessly extended to Oracle Enterprise Performance Management for Environmental, Social & Governance (Oracle EPM – ESG). This allows airlines to incorporate emissions data directly into profitability analysis—enhancing both accuracy and sustainability reporting.

Beyond Aviation: Expanding to the Wider Transport Ecosystem

While ARPS is tailored for airlines, the same methodology and technology extend naturally to shipping, fleet operations, and transportation businesses—anywhere profitability depends on complex route, cost, and operational variables.

Conclusion

At Oracle Consulting, we bring the full power of Oracle Enterprise Performance Management (Oracle EPM) to solve one of the aviation industry’s most persistent challenges: accurate, actionable profitability measurement.

If you are interested in transforming how your airline (or transport business) understands and manages profitability, please reach out to gaurav.f.gupta@oracle.com to engage further.