Updated 27-May-25

This post outlines the Accounting Hub’s features and highlights its business benefits. It concludes with common Oracle customer use cases.

Subledger Accounting vs Fusion Accounting Hub

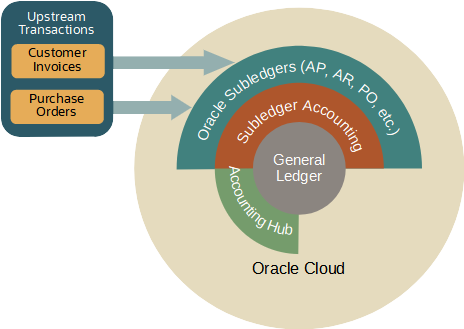

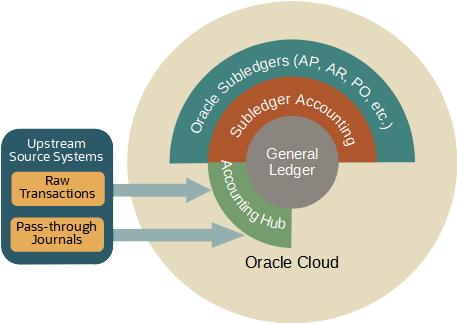

Subledger Accounting delivers accounting services to all Oracle cloud subledgers (Payables, Receivables, etc.). Fusion Accounting Hub makes the same features available to non-Oracle applications and ERPs.

Key Components

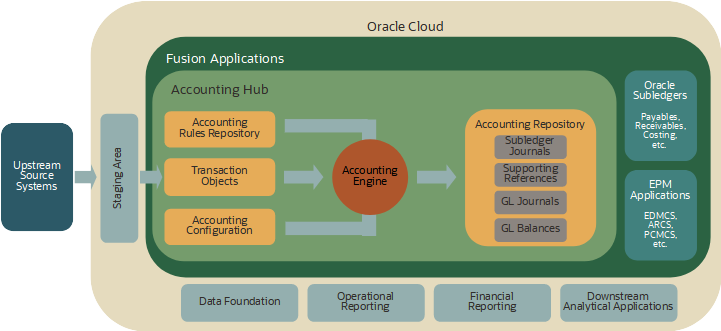

The Accounting Hub comprises the following key components:

Subledger Accounting Policies

Together, accounting rules, accounting configuration, and chart of accounts (COA) constitute your corporate, management, and regulatory accounting policies. They apply to Oracle and non-Oracle subledgers.

The Accounting Hub empowers your business users to define, maintain, and review their own accounting rules using the source system’s own data items. For example, a consumer loan’s natural account could depend on the type of loan, loan schedule or customer risk profile. An insurance claim’s natural account on the item insured, customer location or deductible. The Accounting Hub calls these data items “sources”.

The accounting rules use literals, mappings, complex conditions, and formulas. They govern all aspects of a journal entry: debits & credits; accounts; currency amounts; and descriptions; etc. Advanced features such as multi-period accounting deliver formula based accrual reversals across accounting periods. One-time accrual and transaction reversals are also available.

Accounting Engine

Typically, interface programs send transactions to a staging area. A pre-processor prepares them for upload to the Accounting Hub. The staging area can also play the role of an operational data store.

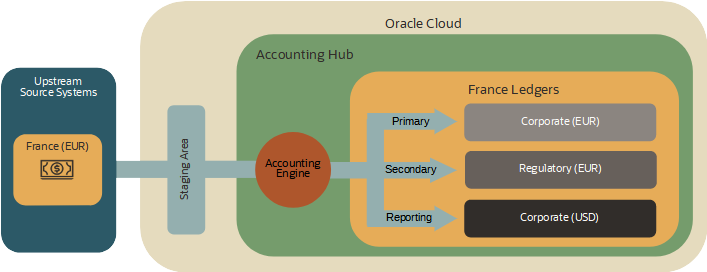

After upload, the accounting engine applies the accounting rules to your transactions. It generates individual journal entries for each subledger transaction. Secondary ledgers can use a different accounting methods, calendar, and accounting currency. Reporting currency ledgers use only a different accounting currency.

The accounting engine processes each transaction’s primary, secondary, and reporting currency ledgers in parallel. This guarantees consistency and completeness by creating valid accounting for all ledgers; or none of them.

Audit, Reconciliation and Enrichment

For each transaction processed, the accounting engine generates:

- Complete and balanced subledger journal entries for each source transaction and ledger.

- Subledger journey entry analysis. An optional diagnostic that demonstrates how the accounting engine applied accounting rules to each transaction line.

- Distribution links and import references. These track which transaction lines contributed to which journal lines and balances.

- Supporting references. You can configure the Accounting Engine to capture source attributes on subledger journal lines. Supporting reference balances are also available.

Reporting, Inquiries and Extraction

The Accounting Hub delivers reports and inquiries for audit, reconciliation, and financial reporting. You can also benefit from out-of-the-box integration with EPM applications including Financial Close and Enterprise Data Management.

Business Intelligence Cloud Connect (BICC) extracts journals and balances from the Accounting Hub. Supported targets include Fusion Analytics Warehouse (FAW) and external reporting platforms.

Value Proposition

The Accounting Hub presents opportunities to:

- Boost agility. Reduce dependence on the IT department and source system owners. Your business users can maintain accounting rules centrally and hence, improve reactivity and consistency.

- Limit risk. the Accounting Hub lends itself to incremental changes to mission critical systems and interfaces.

- Enhance visibility and control. Eliminate accounting rules dispersed in interface programs and remote source systems. Instead, centralize accounting rules in a business user friendly repository.

- Benefit from traceability and audit. The accounting engine retains a source system transaction line to GL balance audit. Diagnostics detail how the accounting engine evaluated every transaction line.

- Align financial and management reporting. the Accounting Hub traceability and supporting reference features offer unprecedented opportunities for you to align management and financial reporting.

Source System Feeds

The Accounting Hub’s value depends on source system and integration tool’s accounting capabilities. Consider three options:

1. Upload to Cloud Subledgers.

In this scenario, you upload source system transactions to an Oracle subledger.

We recommend this approach when an Oracle Cloud subledger supports the transaction type. For example, a billing or order entry application creates invoices in Cloud Receivables. It is especially relevant when Cloud ERP manages the corresponding downstream transaction flows. For example, when Cloud Receivables also manages customer payments.

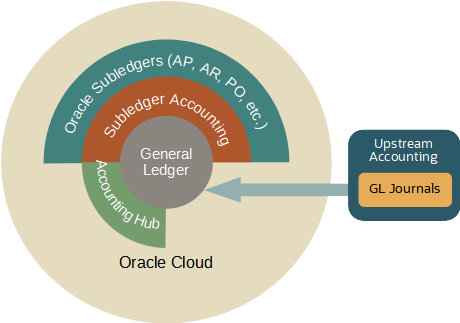

2. Upload to General Ledger.

Here, you upload journal entries or balances directly into General Ledger.

We recommend this approach when source systems or ETL tools can generate valid accounting. That is, complete and balanced journal entries which, at the very least, use the primary ledger’s COA.

3. Uptake the Accounting Hub.

The Accounting Hub consumes raw transactions or pass-through journals. We recommend that you consider the Accounting Hub for the following feeds:

- Raw transactions. No Oracle subledger supports the transaction type and the source system cannot generate its own journal entries.

- Pass-through journals. The source system generates journals balanced in transaction currency, but its COA is incompatible with your accounting policies.

Common Accounting Hub Use Cases

Several real-world use cases lend themselves to an Accounting Hub solution.

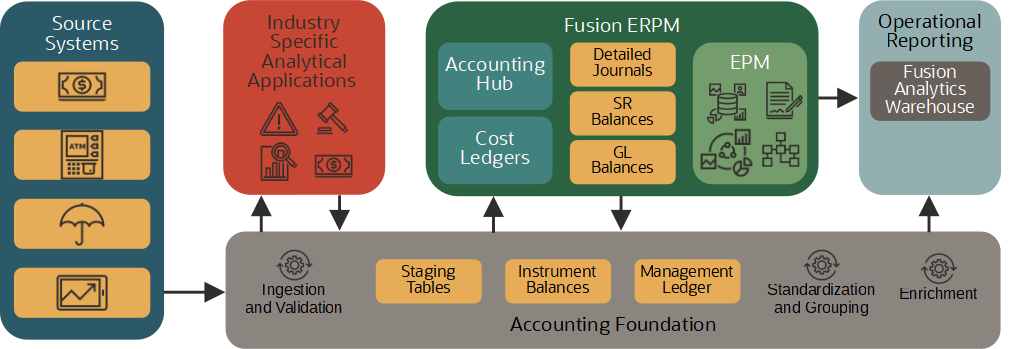

Financial Services and Similar Industries

Financial Services companies are characterized by high transaction volumes and complex IT infrastructures. Accounting logic resides in source systems, legacy platforms, and ETL applications. Banks embark on finance transformation initiatives to rationalize the current architecture, boost agility, limit risk, and ultimately, reduce cost. The Accounting Hub contributes by centralizing accounting in a flexible and modern platform.

Financial services customers adopt a phased approach to implementation. First priority are systems subject to regulatory changes or reliant on components approaching their end of life.

Large telecommunications companies face similar challenges albeit with fewer source systems than banks.

The Accounting Foundation Cloud Service (AFCS) is a key component of this architecture. It collates, validates and prepares remote source system transactions for their upload to the Accounting Hub.

Post accounting, the Accounting Foundation enriches source system transactions with financial detail extracted from the Accounting Hub. The enriched (instrument grain) results form the basis further processing including revaluation and feeds to analytical applications such as risk and profitability. Operational data, financial balances and analytical application results are fed to corporate operational reporting platforms.

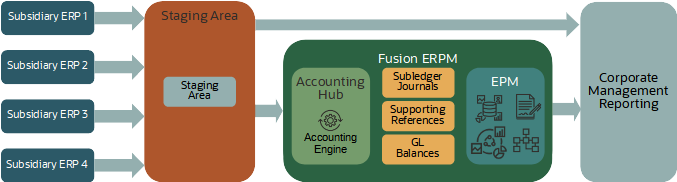

Enterprise Accounting Platform

Many multinationals that grow by acquisition do not consolidate new subsidiaries’ IT functions. Subsequently, they face challenges to deliver reliable and timely enterprise wide reporting. Inconsistent reporting dimensions and poor data quality result in weakened visibility and control.

The Accounting Hub centralizes mapping of subsidiary ERP’s accounting to the corporate COA and safeguards the corporate GL by validating feeds. It can generate multiple representations when needed.

Supporting references are used to reconcile summarized management dimensions with financial reporting.

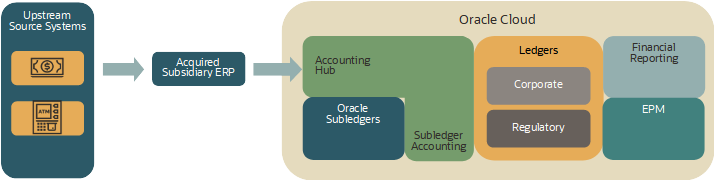

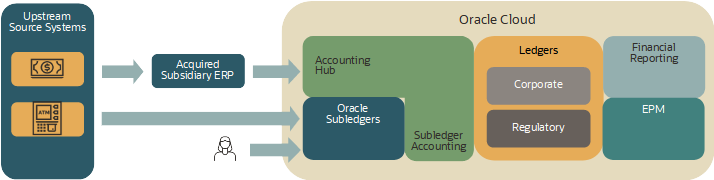

Rapid Onboarding of Acquisitions (Journey to Cloud)

Companies that do consolidate acquisitions’ IT functions can also benefit from the Accounting Hub.

In the medium term, a recently acquired subsidiary’s ERP functions will be absorbed by corporate. But, immediately after the takeover, the Accounting Hub is used to map the subsidiary’s legacy COA to the primary ledger’s COA. Multiple representations and financial reporting are immediately available. Supporting references aid management reporting and reconciliation.

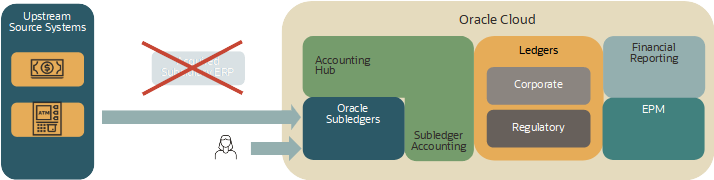

The subsidiary’s users migrate to the corporate solution in phases. As they do so, the IT department can retire interfaces and eventually, the legacy ERP.

Phase I. The subsidiary’s accounting feeds the corporate Cloud via the Accounting Hub. the Accounting Hub maps the legacy COA and accounting policies to corporate standards.

Phase II. The subsidiary uptakes Oracle Cloud subledgers in phases depending on complexity and business priorities. As each business process migrates to Oracle Cloud, feeds from the acquired subsidiary ERP are retired.

Phase III. The IT department decommissions the legacy ERP and its feeds to the Accounting Hub.

Conclusion

The Accounting Hub is an advanced accounting aware transformation tool. It addresses challenges posed by upstream source systems no matter how rudimentary their accounting capabilities.

For industries with a large number of source systems, the Accounting Hub is an important part of finance transformation initiatives. It can also play an important role in a staggered journey to Cloud.