Last updated 23-May-25

Introduction

The Accounting Hub (AHCS) provides accounting services to Oracle subledgers and other source systems. It consists of an accounting rule repository, an accounting engine, and results in the form of journals and balances. AHCS also includes diagnostics, reports, and online inquiries.

AHCS addresses requirements to generate accounting compliant with multiple accounting standards and reporting currencies. It does this by applying different accounting methods (sets of accounting rules) to source system transactions and storing the resulting journals and balances in separate ledgers.

Examples of differences between accounting standards include:

- Charts of accounts: for example, local regulation may dictate a specific natural account numbering scheme.

- Monetary valuation (transaction currency amounts): different asset depreciation or inventory costing methods result in different monetary valuations of an accounting event.

- Timing: different events in a transaction’s lifecycle result in accounting. For example, a disbursement may be recognized when sent to the supplier or when cleared by the bank.

Management ledgers represent another use case for multiple representations. They store an alternate accounting representation used for non-financial and off-cycle management adjustments and reporting.

In this post, we consider the different ways AHCS generates multiple accounting representations. You will recognize accounting treatment and valuation method secondary ledgers used by the Oracle subledgers. We highlight Accounting Hub adjustment-only ledgers as an opportunity to streamline AHCS processing.

Accounting Treatment Secondary ledgers

Use accounting treatment secondary ledgers when financial accounts differ between accounting standards but, accounting event timing and monetary valuation do not vary. A classic example of accounting treatment secondary ledgers arises when a supplier invoice uses a different liability account depending on the accounting standard.

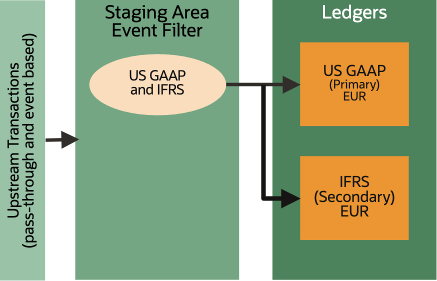

When you have configured subledger level secondary ledgers and not checked the valuation method checkbox, the accounting engine applies multiple accounting methods to each transaction to generate two or more complete sets of accounting in separate ledgers.

Noteworthy characteristics of accounting treatment secondary ledgers include:

Full representation. Accounting treatment secondary ledgers generate a complete set of journals and balances in each ledger.

Shared valuations. Accounting treatment secondary ledgers lend themselves to transactions whose timing and monetary valuation does not vary by accounting standard. You can leverage Accounting Hub formula to take care of accruals and small valuation or timing differences. But AHCS cannot be considered a subledger capable of generating its own transactions.

Flexibility. All aspects of accounting treatment secondary ledgers can differ from the primary ledger: chart of accounts (COA), accounting currency, accounting method, and calendar.

Valuation Method Secondary ledgers

Use accounting treatment secondary ledgers when accounting standards dictate different timing and / or monetary valuations of accounting events. Differences between asset or stock valuations constitute a common use case for valuation method secondary ledgers.

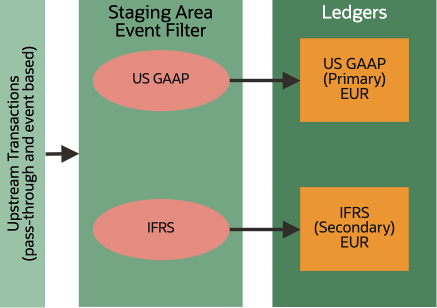

When you have configured subledger level secondary ledgers and checked the valuation method checkbox, the Accounting Hub allows independently valued transactions to be fed directly into primary and secondary ledgers.

Noteworthy characteristics of valuation method secondary ledgers include:

Full representation. Valuation method secondary ledgers generate a complete set of journals and balances in each ledger.

Disparate valuations and events. Valuation method secondary ledgers lend themselves to cases where monetary valuation or timing of most accounting events varies between accounting standards.

Flexibility. Valuation method secondary ledgers can differ in every respect from the primary ledger: chart of accounts (COA), accounting currency, accounting method and calendar.

Combining Approaches

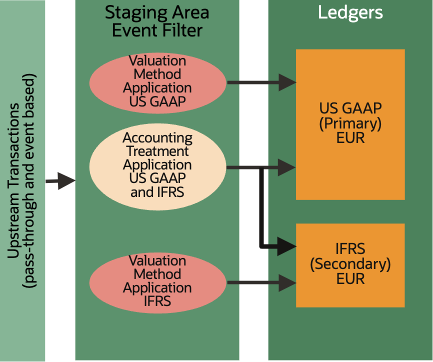

You can mix accounting treatment and valuation method approaches in a single accounting configuration. A subledger application-level option controls how the secondary ledger is populated.

Accounting Hub Adjustment-only Ledgers

Customers with high volumes and narrow processing windows can reduce Accounting Hub processing time without compromising requirements for automation and consistency using adjustment-only ledgers. They work best when only a small proportion of transactions require a different accounting treatment.

Here we describe two approaches to adjustment-only ledgers which, for the purposes of this explanation, we shall call common ledger and dominant primary. They exhibit slightly different characteristics and hence, favor slightly different business requirements.

Common Ledger

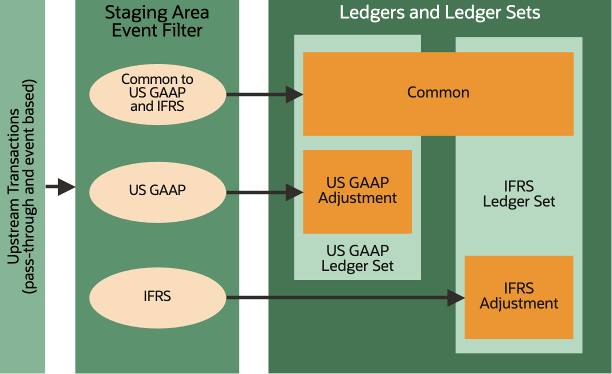

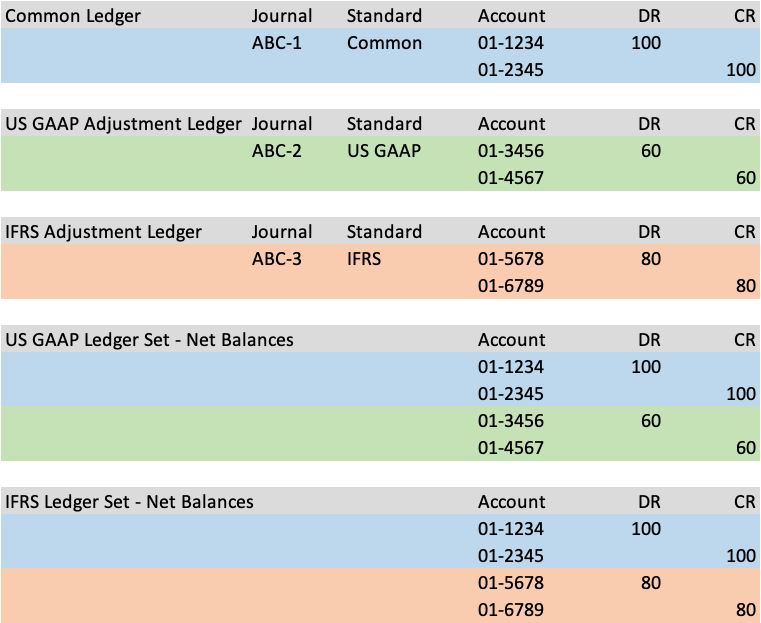

Common ledger uses three ledgers to generate two complete accounting representations. A common ledger stores journals and balances whose accounting treatment is the same for both accounting standards. Two ledgers store journals and balances specific to each accounting standard. Ledger sets combine the common ledger with one of the accounting standard specific ledgers to build complete accounting representations.

Since the common ledger’s journals, balances, and processing are shared between accounting representations, the Accounting Hub consumes less time and resources.

The approach relies on an event filter, accounting rules, and ledger sets.

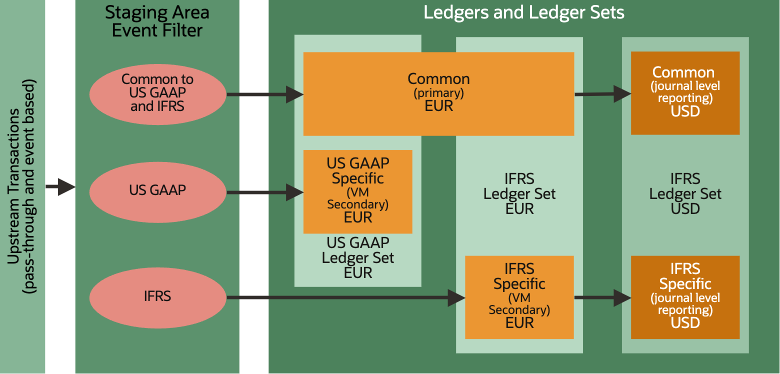

Event filter

The event filter directs accounting accounting events and pass-through journals to different ledgers for processing.

- Common: transactions and pass-through journals whose valuation and accounting treatment is common to US GAAP and IFRS.

- US GAAP: transactions and pass-through journals that require accounting under US GAAP only; or whose accounting treatment differs between accounting standards.

- IFRS: transactions and pass-through journals that require accounting under IFRS only; or whose accounting treatment differs between accounting standards.

The event filter’s design will depend on the way upstream systems send transactions or pass-through journals to the Accounting Hub. Consider transactions that impact both US GAAP and IFRS but whose accounting treatment differs. A single transaction or pass-through journal could store both US GAAP and IFRS details and be directed to both accounting standard specific ledgers. Alternatively, the source system could send separate transactions or pass-through journals that the event filter directs to the corresponding adjustment ledgers.

Accounting Rules

The common ledger does not need special versions of accounting rules since the event filter determines which transactions are fed into which ledger. You could, for example, assign the same US GAAP accounting method to the common and US GAAP ledgers. Similarly, you could assign a complete IFRS accounting method to the IFRS specific ledger.

Ledger Sets

Ledger Sets effectively merge two or more ledgers into a single entity for the purpose of reporting and downstream processing. The US GAAP and IFRS ledger sets include the common ledger and their respective accounting standard specific ledgers.

Notable characteristics of common ledgers include:

COA. Ledger sets combine ledgers with the same COA and accounting calendar. You can only implement common ledgers if the accounting standards can share the same COA.

Pass-through accounting. Both event based and pass-through accounting can leverage dominant primary. Both assume that transactions and pass-through journals passed to the Accounting Hub indicate whether their amounts and account determinants apply to Common, US GAAP, or IFRS.

Reporting currencies. To accommodate subledger level reporting currencies, you should define the common and accounting standard specific ledgers as primary ledgers. However, note that you cannot assign a legal entity to more than one primary ledger. The upshot is that subledger level reporting currencies and common ledgers work together only if you assign no legal entities to ledgers. Journal level reporting currency ledgers offer an alternative that avoids this drawback since they can be linked to a secondary ledger. Define the accounting standard specific ledgers as valuation method secondaries and ledger sets to combine the reporting currency ledgers.

Ledgers and ledger sets. Common ledger increases the number of ledgers and ledger sets. If you plan to have multiple secondary ledgers and reporting currencies, the number of ledgers could increase substantially.

Accounting rule independence. Accounting rules for the common and accounting standard specific ledgers are independent of each other.

Downstream applications. The BI Cloud Connector (BICC) extracts journals and balances to downstream applications. To fully benefit from the approach, downstream applications should avoid extracting the common ledger more than once.

Dominant Primary

Dominant primary is alternative approach that favors the primary ledger’s accounting representation. It uses fewer ledgers and ledger sets but relies on more complex accounting rules.

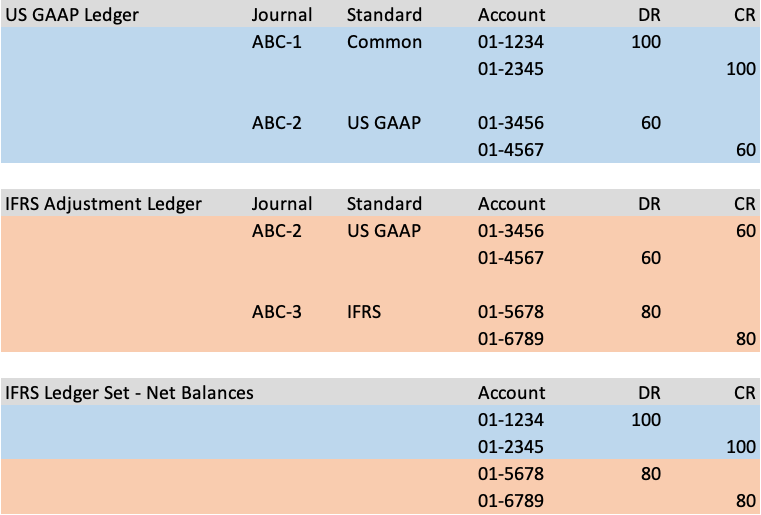

The primary ledger’s accounting representation is no different from an accounting treatment or valuation method primary. All transactions subject to its accounting standard are fed into the primary ledger. Its accounting method has a complete set of accounting rules.

The secondary, adjustment ledger’s journals convert the primary ledger’s accounting to comply with the alternate accounting standard.

Like, common ledger, dominant primary relies on an event filter, accounting rules and ledger sets.

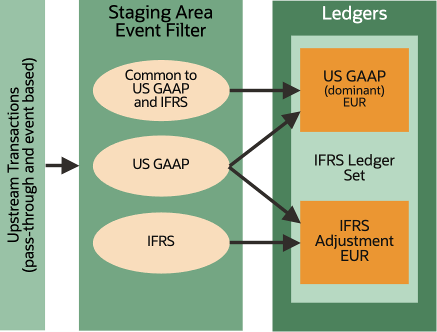

Event filter

The event filter directs transactions to different ledgers for processing.

- Common: transactions and pass-through journals whose valuation and accounting treatment is common to US GAAP and IFRS. The event filter directs them to the US GAAP ledger.

- US GAAP: transactions and pass-through journals that require accounting under US GAAP only; or whose accounting treatment differs between accounting standards. The event filter directs them to both the US GAAP and IFRS adjustment ledgers.

- IFRS: transactions and pass-through journals that require accounting under IFRS only; or whose accounting treatment differs between accounting standards. The event filter directs them to the IFRS ledger.

As with common ledger, the event filter’s design will depend on the way upstream systems send transactions or pass-through journals to the Accounting Hub. With the dominant ledger approach, the event filter directs transactions that impact US GAAP only to both the US GAAP and IFRS adjustment ledgers.

Accounting Rules

The dominant standard’s accounting rules generate a complete US GAAP accounting representation without further processing or combination.

The IFRS adjustment-only ledger’s accounting rules convert US GAAP into IFRS:

- Transactions and pass-through journals that impact US GAAP only or whose accounting treatment differs between accounting standards. The accounting rules reverse the US GAAP accounting of the transaction or journal.

- Transactions and pass-through journals that impact IFRS only or whose accounting treatment differs between accounting standards. The accounting rules generate accounting applicable to the IFRS accounting standard.

Ledger Sets

Since the US GAAP ledger stores a complete accounting representation, no ledger set is necessary. The IFRS ledger set stores the US GAAP and the IFRS Adjustment ledgers. The IFRS ledger’s journals convert US GAAP into a full IFRS accounting representation.

Noteworthy characteristics of the dominant ledger approach include:

COA. Like common ledger, you can only leverage the dominant primary if the accounting standards can share the same COA.

Pass-through accounting. Both event based and pass-through accounting can leverage dominant primary. Both assume that transactions and pass-through journals passed to the Accounting Hub indicate whether their amounts and account determinants apply to Common, US GAAP, or IFRS.

Ledgers and ledger sets. Dominant ledger relies on fewer ledgers and ledger sets than common ledger.

Accounting rules. Dominant ledger does not need a special configuration of accounting rules for the primary ledger. However, the adjustment ledger’s accounting rules must reclassify US GAAP’s accounting to IFRS. They reverse the US GAAP accounting and generate the IFRS equivalent.

Downstream applications. Downstream applications that consume the dominant ledger’s accounting representation need not be aware of the approach. Downstream applications that consume the alternate accounting standard must combine ledgers to generate a full representation. They should also avoid extracting the dominant primary ledger more than once.

Reporting currencies. Subledger level reporting currencies for the dominant primary ledger present no issues. If you need reporting currencies for the alternate accounting standard, you can adopt a similar approach to that recommended for common ledger: use a valuation method secondary ledger combined with journal level reporting currency ledgers.

Conclusion

Adjustment-only ledgers offer an opportunity to optimize AHCS processing without compromising business requirements to report using alternate accounting standards.