Lease accounting for lessees applies to any enterprise in any industry that leases in properties and equipment.

This blog post gives an overview of lease accounting requirements for lessees. It highlights how Oracle Cloud ERP helps lessees address these requirements.

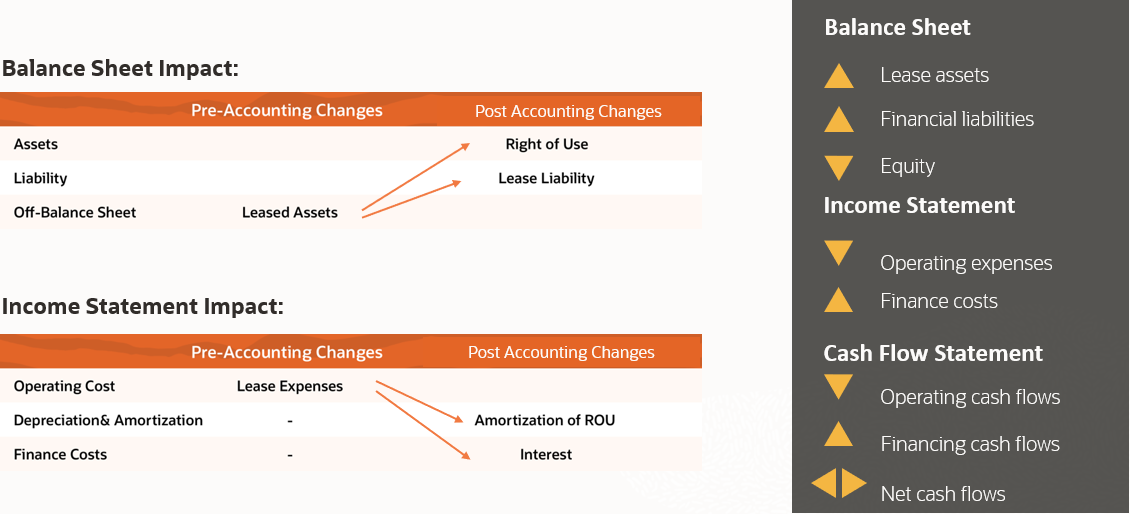

ASC 842 and IFRS 16 require lessees to record leases on the balance sheet to reflect right-of-use assets and lease liabilities.

Lessees must also track amortization of right-of-use assets separately from interest expense on lease liability.

ASC 842 requires you to classify all reportable leases as either operating or finance leases. For operating leases, after the changes, the outcome is an increase in reportable assets and liabilities on the balance sheet.

IFRS 16 requires a single classification of all leases as finance leases for lessees.

You break down expenses for leases for lessees into interest and amortization expenses.

Note: You can exempt low value and short-term leases from your reporting.

Your enterprise needs to manage complex leases and their dynamic lease life cycle effectively.

Lease Accounting enables you to manage complex leases.

You can:

- quickly adopt lease processes to comply with ASC 842 and IFRS 16.

- enforce lease accounting policies consistently across the organization.

- seamlessly account from lease creation and expense recognition to termination and renewals.

- automate payment processing from creation and approval to disbursement through integration with Payables.

- automatically calculate rent increases based on indexes, percent, or fixed amounts.

- review lease exceptions to ensure best-practice compliance and consistency.

- manage and track amendments, obligations, milestones, options, and end of term decisions.

- leverage standardized lease repository and Lease Disclosure Report for reporting and analysis.

- streamline planning with a single view of all lease contract obligations.

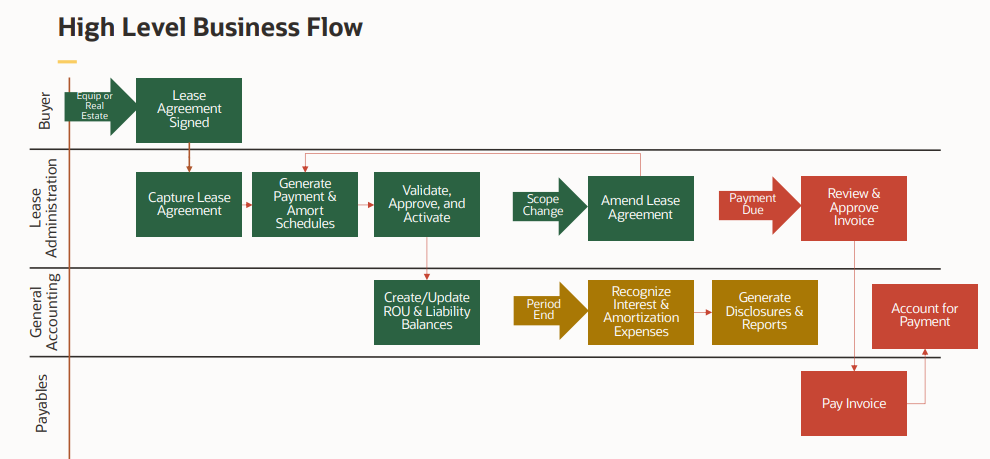

The business flow diagram below illustrates how you can manage leases easily with Lease Accounting.

Use Case Example on Impact of Accounting Change

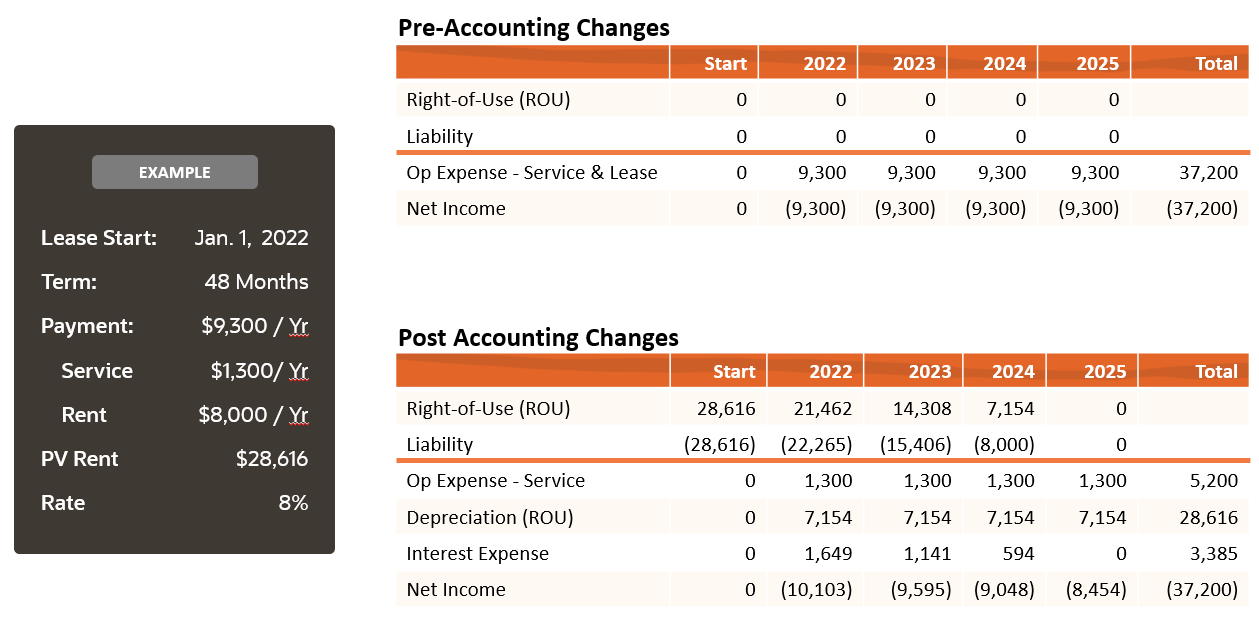

The operating lease use case example below shows the impact of the ASC 842 accounting change.

The example shows a 48-month operating lease that consists of service and rent. The interest rate that applies to the lease contract is 8% annually. The present value (PV) for the rent portion is calculated as USD 28,616.

A table for Pre-accounting Changes shows the lease recorded in the income statement as operational expense. The lease is expensed straight-line with the same amount each year.

A table for Post-Accounting Changes shows two balance sheet amounts for Right of Use Asset (ROU) and Lease Liability for the rent recorded in 2022. The ROU balance reduces over the 48 periods as the ROU asset is amortized. The interest is added to the lease liability balance. The lease liability balance reduces with the rent repayment. The interest expense is tracked separately from the service and ROU depreciation expense in the income statement.

Lease Accounting automates lease calculations and accounting entries based on flexible setup options. With its multi-GAAP solution, you can address your ASC 842 and IFRS 16 lease for lessee requirements.

Conclusion

You can automate the lease processes, increase productivity, and reduce the risk of error with Lease Accounting.

Useful Oracle Documentation and Webcasts

To gain more insight into Lease Accounting capabilities, refer to the useful webcasts and documentation links below:

What’s New Release Readiness Documentation:

https://www.oracle.com/webfolder/technetwork/tutorials/tutorial/readiness/offering.html?offering=financials-financials-19

Recorded release readiness training for Lease Accounting:

https://www.oracle.com/webfolder/technetwork/tutorials/tutorial/readiness/offering/index.html?product=financials-21

Oracle Cloud Customer Connect webcasts on Lease accounting:

March 23, 2022: ERP – Oracle Lease Accounting: Deep Dive into Recent Innovations:

https://community.oracle.com/customerconnect/events/603810-erp-oracle-lease-accounting-deep-dive-into-recent-innovations

Lease Accounting Implementation Guide:

https://docs.oracle.com/en/cloud/saas/financials/23a/faila/overview-of-lease-accounting-implementation.html

Lease Accounting User Guide:

https://docs.oracle.com/en/cloud/saas/financials/23a/faula/overview-of-lease-accounting.html

Migration of lease data – High level guidance in technical brief in My Oracle Support Doc ID 2821741.1