Updated February 26th, 2025

Introduction

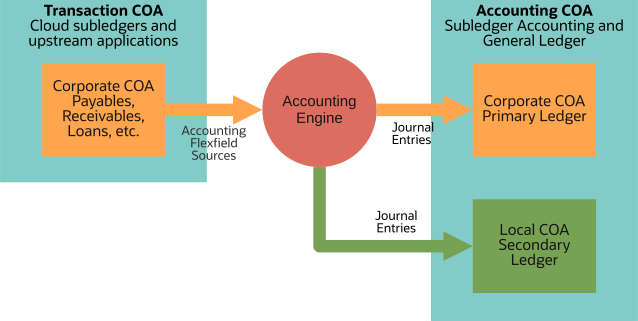

Subledger Accounting (SLA) / Fusion Accounting Hub generates accounting for upstream applications and Oracle subledgers such as Payables, Receivables and Cost Management. It consists of an accounting rule repository, an accounting engine, and results in the form of journals and balances. It also provides accounting reports and online inquiries.

SLA addresses requirements to generate accounting according to more than one accounting standard and currency. It does this by applying different accounting methods (sets of accounting rules) to subledger transactions and storing the resulting journals and balances in separate ledgers.

In this post, we explore how SLA processes account combinations passed to the accounting engine by upstream applications and Oracle subledgers.

Business Requirements

To understand the features in context, it will help to consider the underlying business requirements.

Startup Data for Accounting Methods

Deliver startup data accounting methods unconstrained by the chart of accounts (COA). A related requirement is to support accounting methods eligible to be assigned to any ledger, irrespective of its COA.

Configurable Accounting Rules

Allow you to define your own accounting rules that leverage implementation specific COA design and segment values.

Account Combinations

Enable the accounting engine to use account combinations passed to the accounting engine by Oracle subledgers and upstream applications.

Multiple Representations

Generate accounting according to one or more accounting standards and COAs.

Transaction COA and Accounting COA

To understand why the accounting rules user interface (UI) often displays accounting flexfields differently from Oracle subledgers, we must distinguish between the transaction and accounting COA.

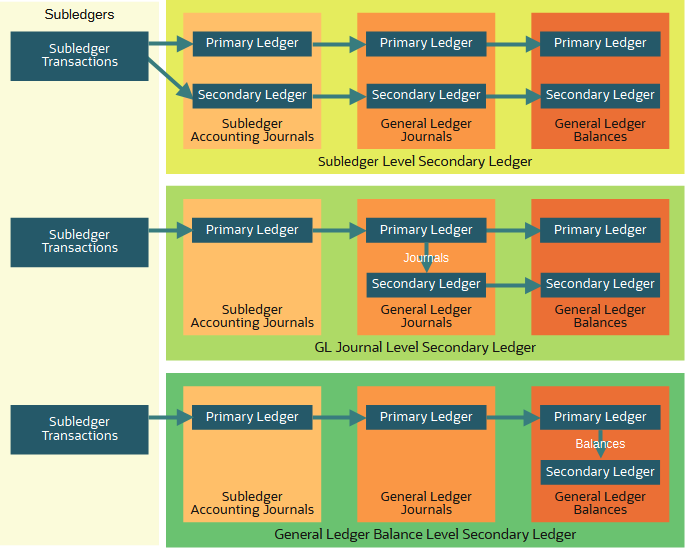

The primary ledger is mandatory for all subledgers that generate accounting. Secondary ledgers are optional. Their accounting can differ in every respect from the primary: accounting method, ledger currency, calendar, and chart of accounts (COA).

SLA sources are subledger transaction and upstream application attributes passed to the accounting engine. Along with ledger options and accounting rules, they control every aspect of journals and balances. Accounting flexfield sources are a special type of SLA source that contain account combinations. We refer to the COA of accounting flexfield sources as the transaction COA.

The accounting engine generates journal line account combinations using the COA of the primary or secondary ledger. We refer to the COA of journals and balances as the accounting COA.

The transaction and accounting COA are always the same for primary ledgers, reporting currency ledgers and valuation method secondaries. But, when the secondary ledger’s COA differs from the primary, the transaction and accounting COAs also differ.

When you assign a COA to an accounting method, you specify the accounting COA. Because a secondary ledger’s COA may differ from that of the primary ledger, the accounting rules UI cannot assume that accounting flexfield sources use the same COA. In effect, the accounting rules can never know the transaction COA.

Therefore the accounting rules UI uses segment labels to display accounting flexfield sources and their individual segments.

COA Neutral and COA Specific Accounting Methods

Another key concept is the difference between COA specific and COA neutral accounting methods.

COA neutral accounting methods (without a COA) can only use accounting rules that are also COA neutral. Any ledger, irrespective of its COA can leverage them to generate accounting. Most Cloud subledgers deliver startup data COA neutral accounting methods. For example, the Standard Accrual accounting method designed to meet most common accounting requirements is COA neutral and therefore can be assigned to any ledger.

COA specific accounting methods (with an accounting COA) can mix COA specific and COA neutral accounting rules. Only ledgers with the same COA can leverage them to generate accounting. As we shall see, they offer more powerful features to configure account combinations. For example, you can only use mapping sets and constant account rules with COA specific accounting methods.

When you specify an accounting COA, the accounting rules UI can display its segments in the same way as Oracle subledgers. But, when accounting rules are COA neutral, it uses segment labels to identify individual segments of the accounting COA.

Individual Segments of the COA

As we have seen, the accounting rules UI can never know the transaction COA and, for COA neutral rules, the accounting COA. What are segment labels and how do they help?

Segment labels assign a business meaning to a COA segment irrespective of its COA. Cloud ERP delivers segment labels in startup data and drives features based on them. For example, Cloud ERP ensures that journal entry debits and credits are balanced by the value of the Primary BSV segment.

You can configure your own segment label, assign it to one or more COAs and use it in accounting rules irrespective of the transaction or accounting COA. For example, you could configure a “Department” segment label and use it to define segment specific accounting rules.

How Accounting Flexfield Sources are Used

Accounting rules and the accounting engine use accounting flexfield sources in two ways:

- Like every other SLA source: as criteria that control which journal lines and account combinations the accounting engine generates depending on its value. For example, in a journal line condition or as a mapping set input source. Accounting flexfield sources used in this way are in the transaction COA. The accounting rules UI obliges you to select an individual segment label since formulas or conditions using a complete account combination would be unwieldy.

- In account rules to generate account combinations stored on journal lines and balances. When the accounting engine generates account combinations using accounting flexfield sources, if necessary, it converts them to the accounting COA.

How to Recognize Accounting Flexfield Sources

When you include an accounting flexfield source in a condition, formula or description, the UI will ask you to select an individual segment identified by a segment label. If it does not do this, then no matter the source name, it is not an accounting flexfield source.

Note that some subledgers pass individual segments values to the accounting engine as alphanumeric sources. The accounting rules and accounting engine interpret them as standard (non-AFF) sources rather than recognize them as account combinations.

COA Mapping

Why doesn’t Subledger Accounting rely exclusively on the COA mapping to convert account combinations to the accounting COA?

Cloud GL offers chart of accounts (COA) mapping to define how to convert account combinations from one COA to another. It is a powerful feature that meets most COA conversion requirements. Startup data accounting methods use the COA mapping to convert account combinations from the transaction COA to the accounting COA.

Nevertheless, COA mapping cannot meet all COA conversion requirements. Examples include:

-

Three or more transaction COA segment values determine an accounting COA segment value. If the mapping would need thousands of accounting combination mappings, it may become cumbersome to maintain. SLA mapping sets can easily address the requirement with a minimal number of rules.

-

Where the conversion depends on an attribute not available in the transaction COA. For example, if the accounting COA segment value varies based on the name of the upstream source system or a descriptive flexfield. Again, an SLA mapping set can easily address the requirement.

-

Where the conversion depends on a partial segment value. For example, if the transaction COA has overloaded a segment with two or more concepts that exist separately in the accounting COA. A formula can apply a substring function to extract a partial value.

-

When a target segment value depends on a segment value (or combination of segment values) not found among the transaction and setup AFF sources passed to the accounting program. If no AFF source contains the necessary “from” segment values, the COA mapping cannot derive the desired target value or combination.

As we shall see, COA specific accounting methods allow you to combine COA mapping with SLA accounting COA specific accounting rules to achieve a performant and maintainable conversion between COAs.

COA Mapping and Journal Level Secondary Ledgers

When processing secondary ledgers, the accounting engine always generates SLA journals by applying accounting methods and COA mapping to SLA sources passed to it by Cloud subledgers or upstream applications. It never references account combinations generated by the accounting engine for primary ledger journals. There are no dependencies between subledger level primary and secondary ledgers and no implied order of processing.

If you wish to use the COA mapping to convert account combinations generated for primary ledger journals into the COA of the secondary ledger, consider GL journal level secondary ledgers. Note that this option applies only to non-Oracle subledgers.

This diagram illustrates how the level option controls how secondary ledgers are populated.

Account Rules

Account rules determine exactly how the accounting engine will build journal line account combinations. They form a bridge between transaction COA and accounting COA.

COA Specific Rules

You select an accounting COA and, for segment rules, one of its segments.

COA Neutral Rules

You leave the COA blank and, for segment rules, select a segment label. Note that the label identifies a segment of the accounting COA rather than the transaction COA.

Account Rule Priorities – Value Type

The value type of account rule priorities drives the derivation of journal line account combinations. The options vary depending on whether the account rule defines account combinations or individual segment values.

Account Combination Account Rules

Constant

The UI displays constant value type only for COA specific account combination rules. You enter an account combination for the accounting COA.

Source

You can assign only accounting flexfield sources to an account combination rule. If the transaction and accounting COA differ, the accounting engine converts the accounting flexfield source to the accounting COA using the COA mapping.

Mapping Set

You can assign only mapping sets whose output is an accounting COA specific account combination to account combination rules. No COA conversion is necessary.

Segment Account Rules

Constant

The UI displays constant value type only for COA specific segment rules. You enter a value for the account rule’s COA and segment. No COA conversion is necessary.

Source

You can assign any alphanumeric source to a segment rule.

Accounting flexfield sources receive special treatment.

- If the transaction and accounting COA match, the accounting engine extracts the segment value from the account combination using either its label or the account rule’s segment name.

- If the transaction and accounting COA differ, the accounting engine converts the account combination to the accounting COA before extracting the segment value using either its label or the account rule’s segment name.

Mapping Set

You can assign only mapping sets whose output is an accounting COA specific segment value to a segment rule. No COA conversion is necessary.

Formula

You can assign formula with alphanumeric results to an segment rule.

Summary

The following table summarizes places where accounting rules reference the COA.

| Accounting Rule |

COA |

Comment |

| Account Rule |

Accounting COA. Optional |

Segment account rules specify the segment of the accounting COA to be populated. COA neutral account rules identify the segment by a label. |

| Account Rule Priorities |

Not specified. |

Depending on the value type, you can assign account rule priorities an accounting flexfield source, a standard source, a mapping set, formula, or constant. See above section for details. |

| Conditions |

Not specified. (transaction COA) |

Conditions are shared by descriptions, journal line rules and account rules. Conditions support individual segments of an accounting flexfield source identified by a label. |

| Descriptions |

Not specified. (transaction COA) |

The accounting engine does not convert accounting flexfield sources displayed in descriptions. Descriptions support individual segments of an accounting flexfield source identified by a label. |

| Formula Expressions |

Not specified. (transaction COA) |

Formula expressions support individual segments of an accounting flexfield source identified by a label. |

| Mapping Set Input |

Not specified. (transaction COA) |

You can assign an accounting flexfield source to the first mapping set input value. Mapping sets support individual segments identified by a label. |

| Mapping Set Output |

Accounting COA. Mandatory |

Mapping set outputs support account combinations or individual segments identified by name. They are always in the accounting COA. |

| Accounting Methods |

Accounting COA. Optional |

|

| Journal Entry Rule Set (JERS) |

Accounting COA. Optional |

COA specific JERS identify the overlay segment of the accounting COA. COA neutral JERS identify the overlay segment by a label. |

Bringing it all Together – Subledger Journal Entry Rule Sets

Journal entry rule sets (JERS) link account rules to journal line rules. You assign account combination account rules and overlay segment account rules to journal lines using journal entry rule sets.

Below you will find a logical representation of account rules assigned to a journal line rule. The horizontal bars represent account combination rules. The vertical bars represent segment account rule priorities that override individual segments of the account combination.

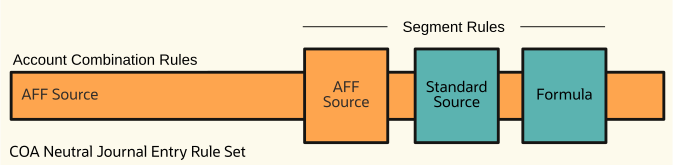

COA Neutral JERS

You can assign only flexfield sources, standard sources, and formula results to COA neutral JERS. Individual segments are identified by segment labels. You can control which segment labels the UI displays in the Journal Lines region via View > Columns > Segment Rules.

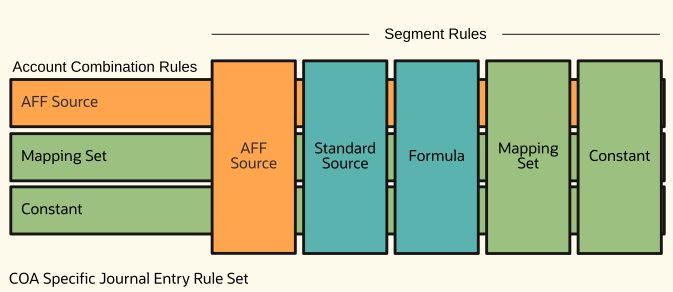

COA Specific JERS

COA specific JERS offer you more choices including constants and mapping sets. Individual segments are identified by their segment name.

The colors represent three different “classes” of account rule.

![]()

The account rule has been assigned an accounting flexfield (AFF) source. When the transaction and accounting COA differ, the accounting engine converts the account combination using the COA mapping. For segment account rules, it will then extract the segment value. Note that when a journal line has been assigned both account combination and segment rules, the accounting program applies the COA mapping to them separately. It does not merge the individual segment values with the account combination before applying the COA mapping.

![]()

The account rule has been assigned a standard (non-AFF) alphanumeric source or formula result. The value cannot be validated until the accounting engine attempts to generate an account combination.

![]()

The account rule has been assigned a constant account combination or individual segment value. Since you have specified account combinations or segment values selected from accounting COA, no COA conversion is necessary.

Note that each box represents an account rule priority. An account rule can mix different account derivation methods depending on rule priority conditions.

The point is that, when the transaction and accounting COA differ, Subledger Accounting allows you to create accounting methods that mix COA mapping with constants, formula or standard sources as needed.

Account Combination Validation

Account combination account rules will usually result in journal lines with valid account combinations. They are constants or combinations converted using the COA mapping.

Segment account rules may be

- Segment values extracted from accounting flexfield sources and converted using the COA mapping.

- Alphanumeric source values or formula results.

- Constants you entered in the accounting COA

The accounting engine builds a candidate account combination and invokes validation.

It searches for an existing enabled combination with the same segment values. If it finds one, the accounting engine assigns it to the journal line.

If it finds no existing combination, it validates the candidate combination. It checks not only whether the individual segment values are valid but also whether the combination is allowed. See ERP-ACE blog post Cross Validation Combination Sets and Other Account Combination Validation Features

Conclusion

Subledger Accounting offers considerable flexibility when a secondary ledger’s COA differs from the primary ledger. You can leave conversion to the COA mapping, not use it at all, or mix and match depending on your business requirements.