When you plan to migrate data, it is an essential aspect of a software implementation. It is not just about moving data from point A to point B.

You need a thorough plan that encompasses all steps from data compilation to validation and reconciliation.

Review this blog post for best practices and tools for migration of lease data for lessees to Lease Accounting in Oracle Cloud ERP. The migration approach covers two scenarios:

- migration of data for lessees from external system into Lease Accounting

- migration of data for lessees from Assets to Lease Accounting within Oracle Cloud ERP

Oracle released Lease Accounting in calendar year 2020 as its leasing flagship application. While Assets has offered a leasing solution to lessees for several years, Oracle’s development now focuses its investments on leasing with the Lease Accounting application.

Lease Accounting is a centralized, automated lease accounting and management application.

Migrating lease data for lessees to Lease Accounting

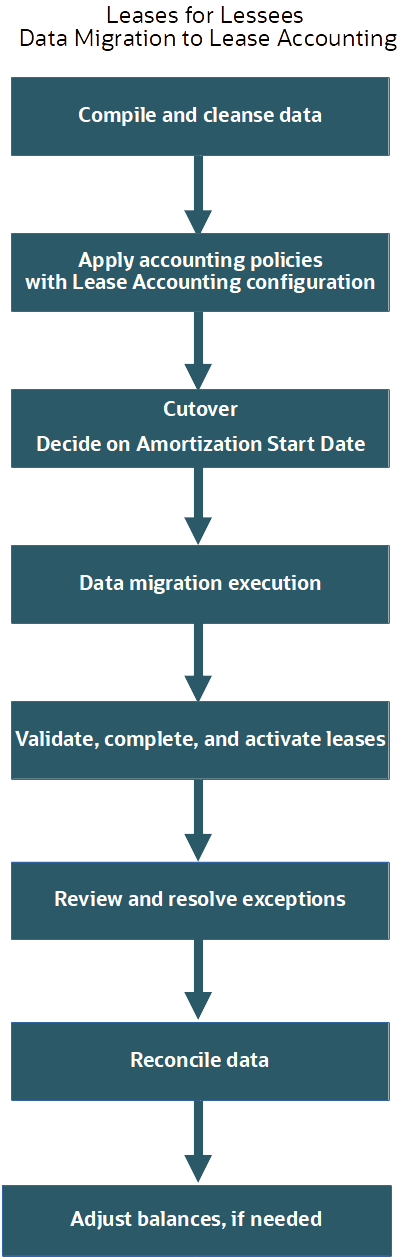

Figure 1 below illustrates the main tasks you execute to migrate lease data for lessees to Lease Accounting.

Compile and cleanse data

You need to gather the lease information to convert to Lease Accounting.

You must perform thorough data quality checks to ensure a high-quality lease data is prepared. Assess legacy data quality. Filter, cleanse, and protect good data. Enrich poor data or eliminate duplicate data.

Use a foreign exchange rate (Forex) for Forex leases to migrate Forex ROU. You use this rate to convert ROU balances as of the Cutover Date. The future Amortization Expense also takes this Forex rate. For more information refer to My Oracle Support Doc ID 2967229.1.

The guiding principle is that the information you compile is consistent with the underlying lease documents.

Apply accounting policies with Lease Accounting configuration

Your organization adheres to accounting policies to address lease accounting standards, be they ASC 842, IFRS 16, or GASB 87. You deploy these policies through Lease Accounting configuration and processing. You model most configuration through System Options and Payment Templates to address leases for lessee requirements.

Cutover

The cutover date you select for migration is fundamental to determine what parts of the lease data you need to convert.

The cutover date is an input in the calculation of Right of Use (ROU) and Liability conversion balances. It also determines payments and accruals already processed in your legacy systems and which to process in Lease Accounting after leases are migrated.

In Lease Accounting, for migrated leases, the amortization start date represents the migration or cutover effective date.

Lease Accounting will stamp payments and accruals before the Lease Amortization Start date as ‘Externally Processed’. This is to ensure that these schedules are not re-processed.

Data migration execution

Once you have staged your lease data, the import process is straightforward with the Lease Import spreadsheet. It is divided into eight tabs, and you need to fill in the relevant lease data. The eight tabs are:

- Instructions – guidance on how you fill in the excel sheet

- Leases (mandatory)

- Assets (mandatory)

- Serial Numbers (equipment leases only) – (optional)

- Payments (mandatory)

- Payment Lines (optional)

- Options (optional)

- Option Lines (optional)

Once you have populated the relevant fields, upload the data, and import it into Lease Accounting.

You can access the log and output files from the process request page. You verify the process completed as expected and review errors for each lease, if any.

Validate, complete, and activate the leases

When you migrate leases to Lease Accounting, you can indicate target status of each lease in the import spreadsheet. The status values you can select are either Draft, Completed, or Active.

Depending on the target status of the import process, you will have to complete the process online.

Review and resolve Exceptions

Review the Lease Accounting dashboard for any import errors. Resolve any errors and re-process as needed.

Reconcile Data

You can run reports and queries to ease the review of the process of both lease information and lease balances.

- Run the Lease Transactions and Balances Report in Lease Accounting to cross-validate the balances. For more information, refer to this blog post here: https://blogs.oracle.com/erp-ace/post/address-lease-reporting-and-disclosure-for-lessees

- Opening Balances and Lease Expenses query – you extract accounting balances as entered and calculated in Lease Accounting. This helps you identify differences with your expected balances. More information is available through Oracle Support Doc ID 2775002.1.

- Reports described in the reconciliation report chapter of the Assets user guide help track ROU and Liability balances.

Adjust balances, if needed

You may identify differences between balances in Lease Accounting and your Oracle Cloud Assets or third-party source system data. Differences could be due to rounding and calculation factors, for which you need to make adjusting journal entries in the General Ledger.

Close-out Migrated Leases in Oracle Cloud Assets

This is an additional step not illustrated in figure 1 above as it is specific to the data migration from Oracle Cloud Assets to Lease Accounting.

Let us say the cutover or migration date is November 1st, 2023. Then, execute the following steps:

- Close the October 2023 period and open November 2023 in Oracle Cloud Assets.

- Terminate the lease in Oracle Cloud Assets with a termination date of 01-Nov-2023. Set the ‘Period End Liability’ option to NO so the lease liability balance at the start of the period is retired.

- Run create accounting for November 2023 and transfer to the General Ledger.

- Reconcile that the account balances closed in Assets match the balances transferred to Lease Accounting.

- Inactivate the asset book only if the asset book is for leased assets alone. This will prevent users from accidentally entering transaction in this book after migration.

- If the asset book is for owned assets too, then uncheck ‘Allow leased assets’ checkbox in the book setup. This prevents new lease creation for this book.

- Adjust balances if needed.

For detailed guidance, on each of the summarized steps above, refer to the technical brief documents on My Oracle Support as follows:

For migration of lease data for lessees from third party source systems to Oracle Cloud Lease Accounting refer to My Oracle Support knowledge article:

Migration to Lease Accounting: Lease Accounting Migration Tools and Best Practices (Doc ID 2821741.1)

For Oracle Cloud Assets migration of lease data for lessees to Oracle Cloud Lease Accounting, refer to My Oracle Support knowledge articles:

• Assets to Lease Accounting Migration Tools and Best Practices (Doc ID 2950254.1)

• How to Migrate FLA Lease Accounting Leases with Gross ROU and Accumulated Amortization Balance (Doc ID 2958541.1)

Conclusion

We hope the guidance within this blog post and related My Oracle Support articles help you jumpstart your migration of lease data for lessees to Lease Accounting.