DZ Bank is a leading German bank recognized for technical excellence and forward-thinking operational strategy. Faced with budgetary strain from ongoing regulatory demands and the rising cost of supporting its legacy infrastructure, the organization sought a cost-effective, reliable, and high-performance solution to update its IT environment. Key requirements included sustaining a positive income-to-budget ratio and improving operational efficiency while scaling its hybrid, multicloud capabilities and navigating a shrinking skilled workforce.

First step: Migrate to Zero Data Loss Recovery Appliance

DZ Bank’s first pressure point was backups. On the legacy stack, some jobs stretched to 24 hours, squeezing maintenance windows. The bank’s answer wasn’t to rip and replace everything, but to fix the biggest pain points first.

The team moved from Tivoli Storage Manager to Oracle Zero Data Loss Recovery Appliance, joining many customers who start their transformation projects at the backup and restore layer. It immediately shifted the rhythm of protection. The bank gained fast and space-efficient incremental forever backups; daily virtual fulls plus redo logs for point-in-time restores, immutable and encrypted backup copies, and the freedom to spread backup jobs across the day.

Some noticeable results:

- Reduced backup/restore windows by up to 60% and achieved better alignment with the needs of business continuity

- The required storage for backups was also reduced significantly, by up to 50%, thanks to storage capacity savings due to space-efficient backups

- Immutable, encrypted backups

Confidence in engineered systems grew as operations got smoother, more time-efficient, and more predictable.

Second step: Exadata implementation to standardize and simplify

Only then did Oracle Exadata Database Machine enter the picture. With current SPARC systems facing end of life, the team weighed virtualization and open source paths, but the diversity of workloads and the positive experience with Recovery Appliance nudged them toward another Oracle Engineered Systems platform that would be simpler to manage with limited in-house resources.

Space and power had to be lined up, but the philosophy stayed the same: “Don’t change everything at once.” The team brought databases onto the Exadata while reusing their standardized operational framework and used the opportunity to consolidate on Oracle Database 19c across the board. The result wasn’t a noisy leap forward but rather a quieter kind of progress—fewer moving parts to worry about, a consistent baseline, and a smoother run state that aligned with the bank’s efficiency targets. Overall responsibilities were simplified as the DBA team could manage the Exadatas and RAs under one umbrella.

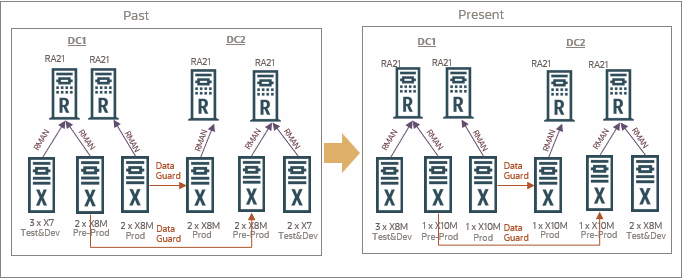

Third step: Exadata refresh for resilience and efficiency

When the time came to refresh again, performance wasn’t the issue, but rising service costs and delays in getting replacement parts on the older systems were raising concerns. Through a nondisruptive migration to X10M, the team focused on resiliency uplift and maintenance simplification. They pursued footprint consolidation while preserving service consistency—delivering steadier uptime and easier operations on a smaller, stronger platform.

Some noticeable results:

- Moved from four X8M racks to two X10M racks, cutting the footprint and reducing power, space and support overhead via a 2X consolidation

- Increased resiliency with high redundancy enabled rolling updates that improved uptime and shortened/reduced maintenance windows

- Minimum disruption thanks to using Oracle Data Guard for the migration to X10M

- Achieved three times faster backups by adopting an incremental forever strategy on the Recovery Appliance, ensuring a daily virtual full backup is always available for restoration

- All database backups can be spread throughout the day, with minimal impact to database operations

Alongside these platform moves; the bank kept an eye on the horizon. The team is preparing to harden data protection further with an airgapped Recovery Appliance, reflecting the heightened focus on minimizing ransomware risk. Its hybrid strategy spans Azure and Google Cloud Platform, with adoption of Oracle AI Database 26ai aligned to software vendors’ certification timelines, complemented by ongoing internal testing and available cloud services such as Oracle Database@Azure, Oracle Database@Google, and Exadata Exascale remain in view.

Step by step, DZ Bank chose steady improvements over big changes: fix backups first, standardize the database estate, refresh the infrastructure for resiliency and maintainability, and align cloud ambitions with real-world compatibility. Each move set up the next, as a measured journey toward a simpler, sturdier, and more future-ready operation.