This is part 2 in our series of blogs highlighting the Market Data partnership between BCC Group and Oracle Cloud Infrastructure (OCI).

Introdcution

Financial market data applications play a critical role in the trading ecosystem by providing real-time data that enables traders, institutions, and market participants to make informed decisions. As we discussed in our previous blog, market data must be delivered with ultra-low latency and high reliability to ensure optimal performance in trading environments.

In today’s fast-paced financial markets, the cloud has emerged as a powerful enabler for market data applications. With the right network and infrastructure, firms can achieve faster execution times, higher availability, and robust security. But firms have been slow to adopt, or in some cases, halted their plans to move workloads to the cloud. This is where the partnership between BCC Group and Oracle Cloud Infrastructure (OCI) comes into focus.

BCC Group has deployed its flagship market data application, the ONE Platform, on OCI. In this blog, we will:

- Explore why this partnership is so synergistic,

- Touch on what makes OCI’s networking uniquely equipped to handle market data feeds,

- Share insights on this particular “market data in the cloud” deployment, and

- Perform latency testing between regions associated with some of the world’s most significant financial markets and compare those results vs. Amazon Web Services (AWS).

How the OCI and BCC Group Partnership Improves Market Data Access

A highly performing, low-latency network is critical in financial market data use cases. Any delay or packet loss in financial transactions can lead to significant losses, missed trading opportunities, and compliance risks. This makes ultra-fast, distributed, resilient network infrastructure a competitive necessity. However, some of the major cloud providers are handcuffed by their commercial strategy (such as substantial data egress fees) or their Gen-1 data center topology (multi-tier leaf-spine architecture with many hops from source to destination).

OCI stands out as a premier cloud platform for financial market data applications due to it’s

A) consistent low-latency networking gen-2 design featuring a n-tier clos topology,

B) no oversubscription of the network, offering guaranteed, SLA-backed bandwidth,

C) dynamic compute options that help ensure efficient processing of market data,

D) standardized pricing across its regions, with minimal-to-no data movement fees,

E) strong security and compliance framework aligning with regulations from FINRA, SEC, and other governing bodies, and finally

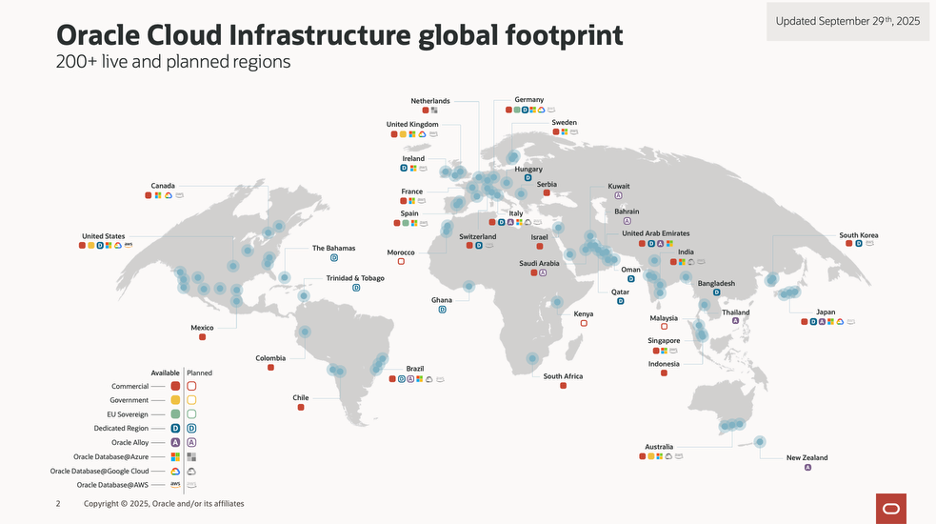

F) its global data center presence. As of October 2025, Oracle has over 200 live or planned regions globally making it one of the most globally distributed cloud providers.

Figure 1: Oracle Data Centers by Country

Additionally, through its single-tenant Dedicated Region offering, Oracle can deploy an entire OCI region anywhere in the world with a very low physical footprint requirement. This enables partnerships with exchanges, data providers, and trade execution services to co-locate cloud regions as physically close as possible to where the data is originating, minimizing data travel. For example, Nomura Research Institute (NRI) supports the Tokyo Stock Exchange by providing back-office support to more than 70 brokerage firms and banks that manage hundreds of millions of trades a day. NRI leverages Dedicated Region to not only co-locate its data center to the exchange’s data center but also reap the benefits of cloud native technologies such as managed container services like Oracle Kubernetes Engine.

Moving Down From the Infrastructure Layer to the App Layer

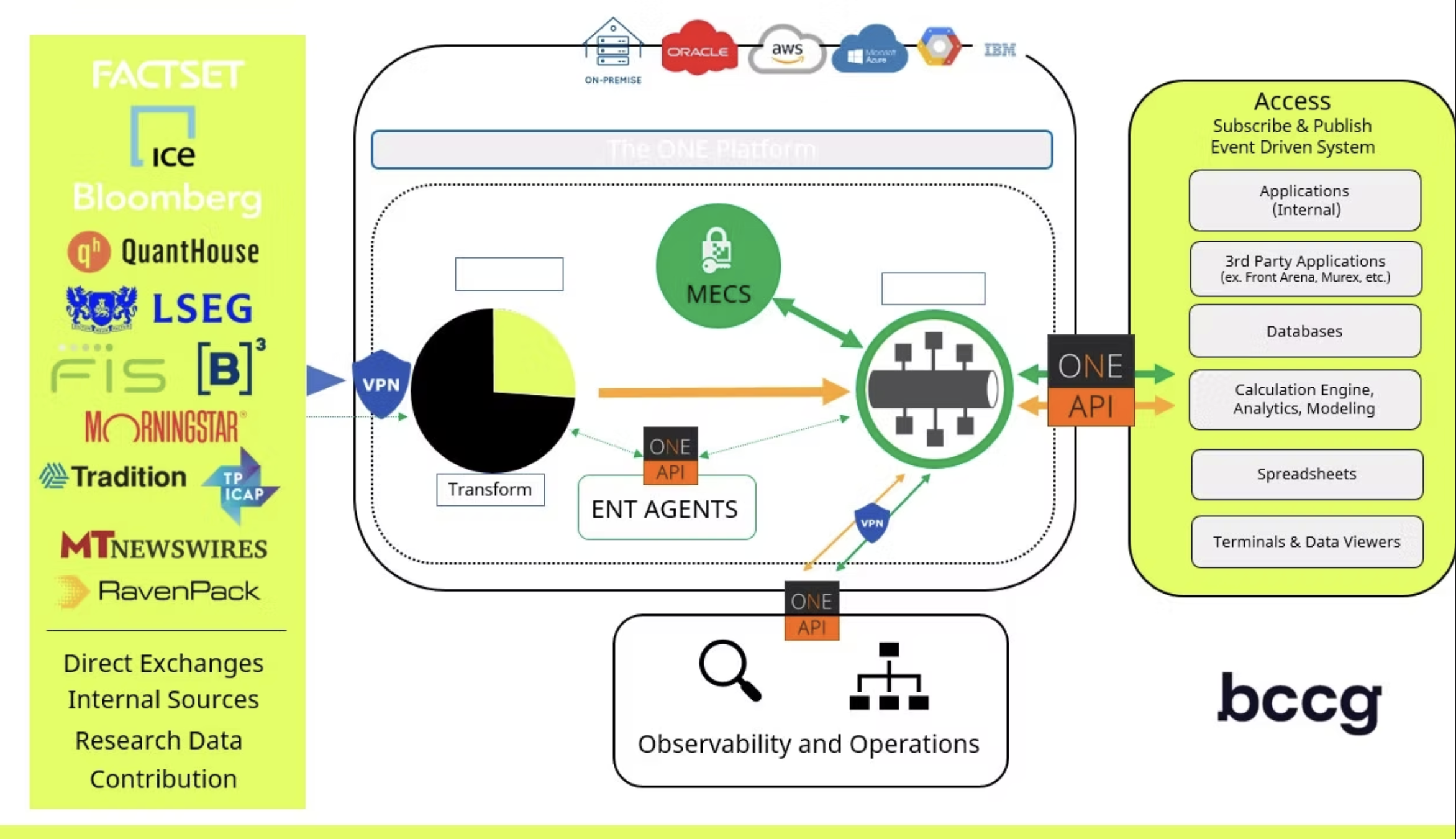

BCC Group provides market data distribution and management services through its ONE Platform. The ONE Platform is a cloud-based, vendor-agnostic market data platform that enables financial institutions, trading firms, and other market participants to efficiently distribute, access, and manage real-time market data unified under a single API. It can run on either containers or virtual machines in the cloud.

Figure 2: ONE Platform Architecture

BCC Group’s ability to manage a myriad of data feeds (LSEG, Bloomberg, FactSet, and many more) via the ONE platform combined with the global distribution of OCI’s data centers means data consumers can centralize their market data feeds under a unified API all while ensuring that access is physically close and running on a highly performant network. By making it a cloud-first solution, it can take advantage of elastic infrastructure and autoscaling capabilities that simply isn’t feasible in a traditional on-premises system.

For this deployment, BCC provisioned instances of the ONE Platform and established connections in regions associated with some of the most significant stock exchanges: the New York Stock Exchange (NYSE)/US-East, the London Stock Exchange (LSE)/UK-South, the Frankfurt Stock Exchange (FWB)/EU-Frankfurt, and the Saudi Exchange (Tadāwul)/ME-Jeddah*. They then observed and measured the latencies between these regions and compared those same paths between the two clouds, OCI and AWS, in order to draw conclusions about the data center fabric as well as the quality of the backbone between the regions.

*Note that at the time of this publishing, AWS does not currently own a public data center in the Kingdom of Saudi Arabia (KSA). As such, the public region UAE-1 has been used as a proxy.

Setting Up the ONE Platform In OCI

Spinning up an instance of the ONE Platform is incredibly simple. Once networking is in place, all an admin must do is navigate to the OCI Marketplace to find the BCC Group’s ONE Platform application. Once there, the region, shape and OS configurations can easily be chosen via the configuration wizard or via Terraform. For this deployment we ran 12 OCPU, 96GB memory Intel shapes in OCI and a m5zn.6xLarge shape in AWS. In production, we can leverage flexible compute shapes in OCI to dynamically scale and react to changing market demands, but BCC chose a static environment here for comparison purposes (and since customizable compute shapes are not available in AWS). Also, bandwidth is directly related to the number of OCPUs of an OCI instance. As such, BCC can use the compute sizing as a lever to increase their expected bandwidth driven by their customer’s market data feed needs. Since OCI’s network is non-oversubscribed by design and 1 OCPU equates to an additional 1 Gbps of bandwidth, BCC is allocated 12 Gbps (12 OCPUs = 24 Gbps) of bandwidth for this environment.

For the testing suite, we leveraged a C-based latency testing toolkit and observed the source-destination and back roundtrip latency performance. For each hyperscaler, we used London as our source and tested each of the three other regions as destinations. It is important to note that no optimization was done on either environment.

Results and Analysis

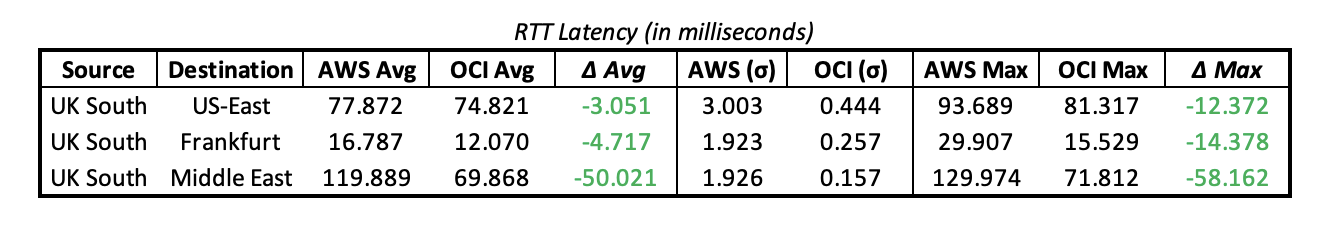

Figure 3: Summary Statistics of Latency Results

The latency measurements observed demonstrated that inter-region communication within OCI’s network consistently performs at a very high level. Not only that, it’s very consistent in its performance with low standard deviations. In all three scenarios, the round-trip times (RTT) between the selected OCI regions took less time than to travel on a similar path through AWS and with less jitter. This improvement in latency validates Oracle’s claims of a flat, non-oversubscribed network and can be attributed to OCI’s performance of the data center fabric, which includes low-latency interconnects and optimized backbone routing. This is even before any additional optimizations that could be applied such as FastConnect private interconnects and system enhancements.

Let’s take a quick look at each of the three tests before concluding.

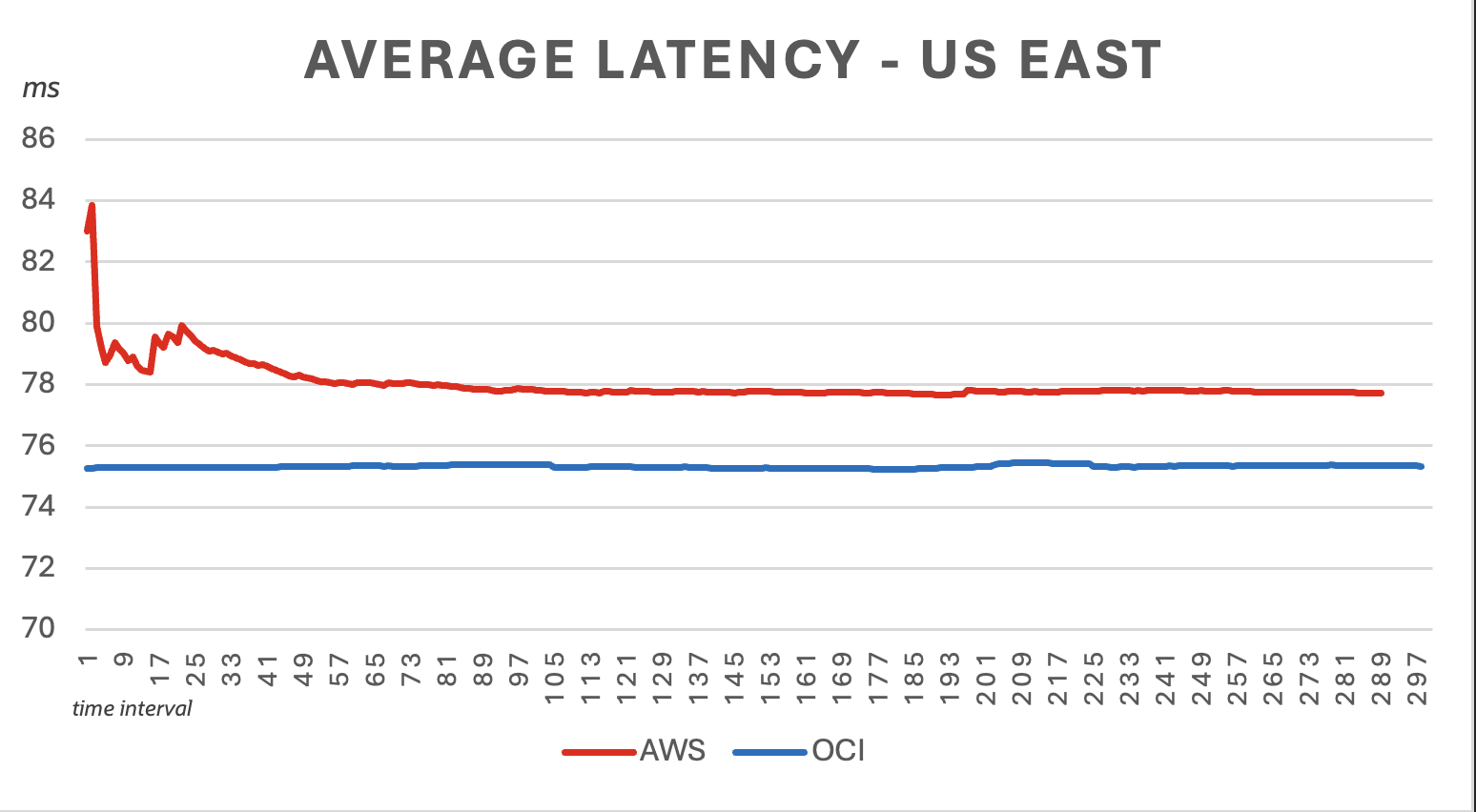

Chart 1: UK South → US East (Average Latency Over Time)

The data shows that OCI maintained an exceptionally stable average latency of approximately 74.8 ms across the full 300-interval test, with almost no observable jitter. In contrast, AWS exhibited some oscillations, hovering around 78 ms but with noticeable variance in the first 20 intervals. The stability of OCI’s line confirms the benefits of its flat, non‑oversubscribed network fabric, resulting in more deterministic performance during sustained inter‑regional traffic.

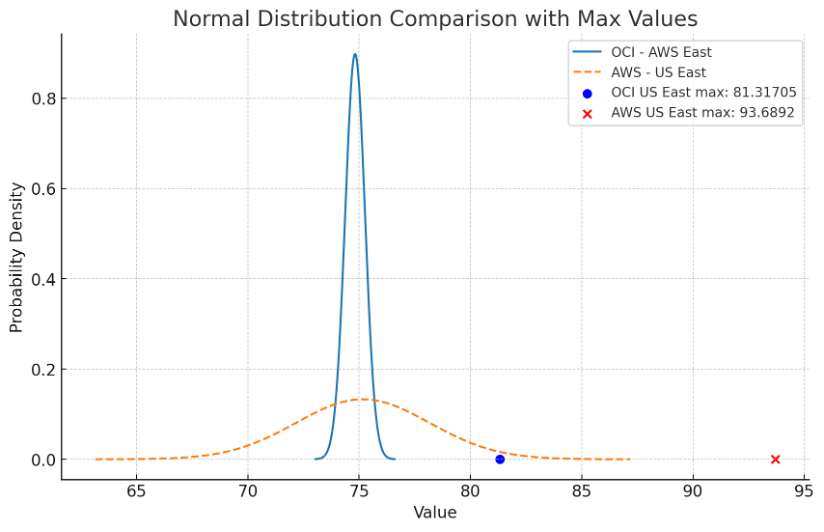

Chart 2: UK South → US East (Latency Distribution)

In the normal distribution view, OCI’s curve is tall and narrow, with a maximum latency of 81.3 ms, while AWS’s curve is significantly wider and flatter, peaking at roughly 93.7 ms. This tighter distribution indicates lower jitter and greater consistency in packet delivery—key for applications that rely on predictable round‑trip performance. OCI’s network demonstrated a smaller standard deviation (0.44 ms vs. AWS’s 3.00 ms), showing its advantage in stability under identical test conditions.

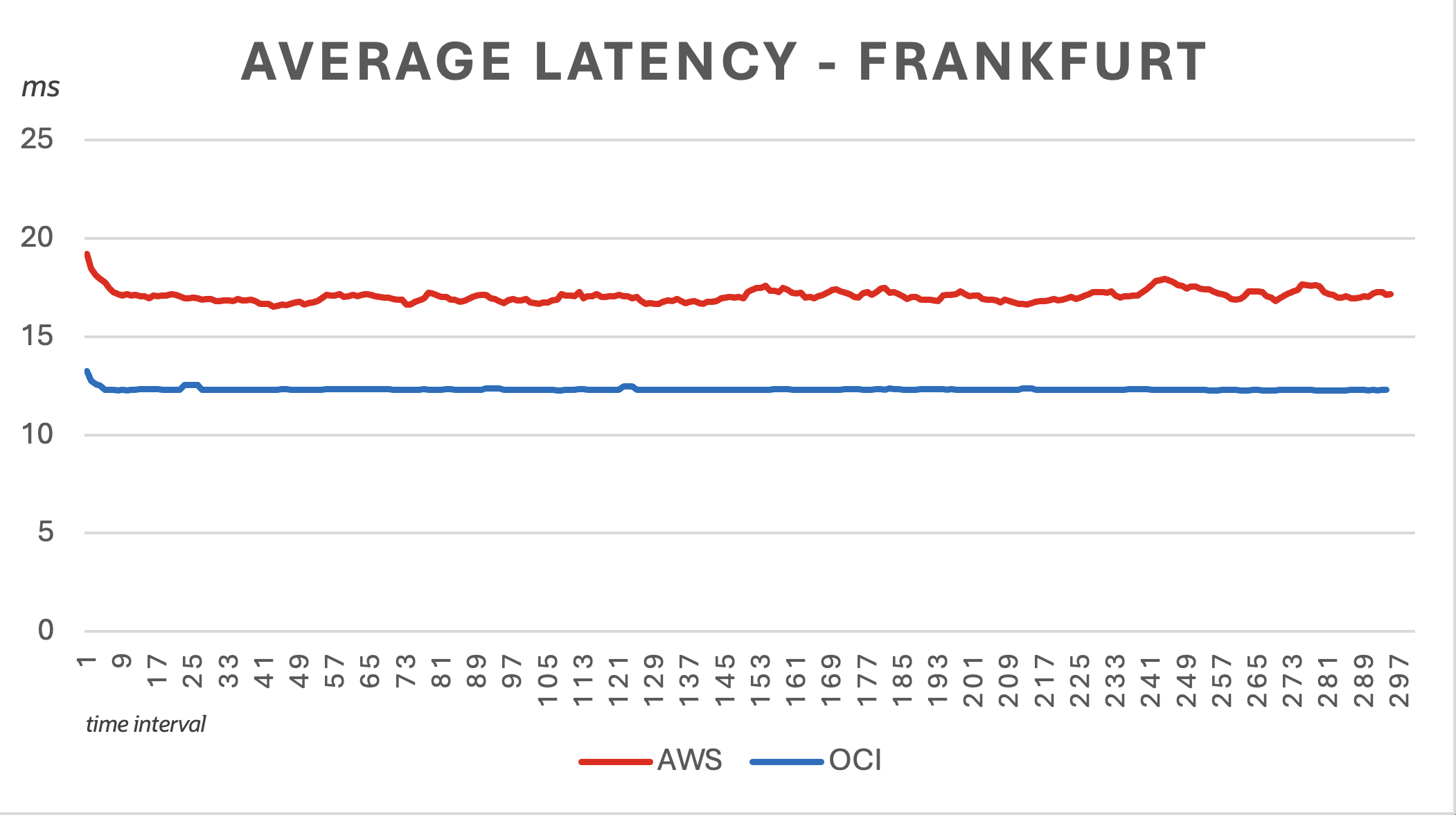

Chart 3: UK South → Frankfurt (Average Latency Over Time)

For intra‑European connectivity, OCI again outperformed AWS. OCI’s latency held tightly around 12.0 ms with minimal deviation, while AWS fluctuated near 17 ms. The smoother OCI plot demonstrates the value of Oracle’s regional peering design and optimized backbone within Europe, which reduces multi‑hop routing and network congestion compared to AWS’s architecture.

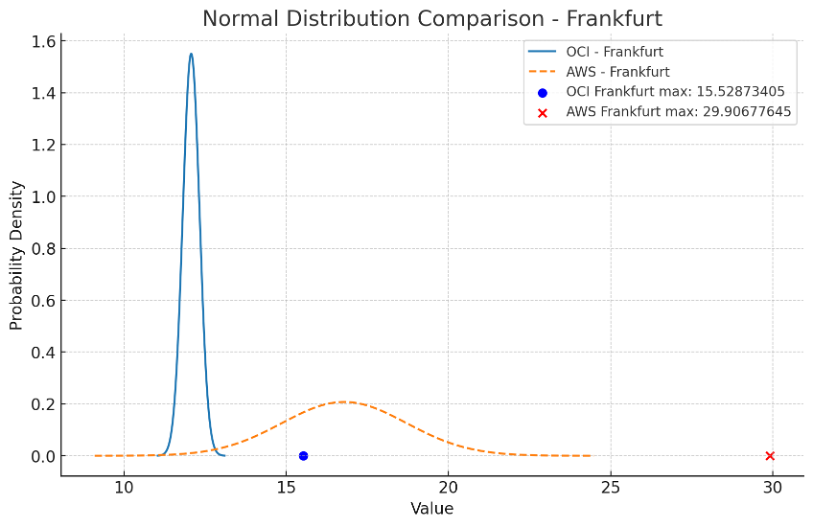

Chart 4: UK South → Frankfurt (Latency Distribution)

The latency distribution for OCI was notably compact, peaking at approximately 12 ms and never exceeding 15.5 ms. AWS’s curve was broader, peaking near 17 ms with a long tail extending to nearly 30 ms. This again highlights OCI’s predictability and reliability—two attributes critical to time‑sensitive market data feeds traversing European exchanges.

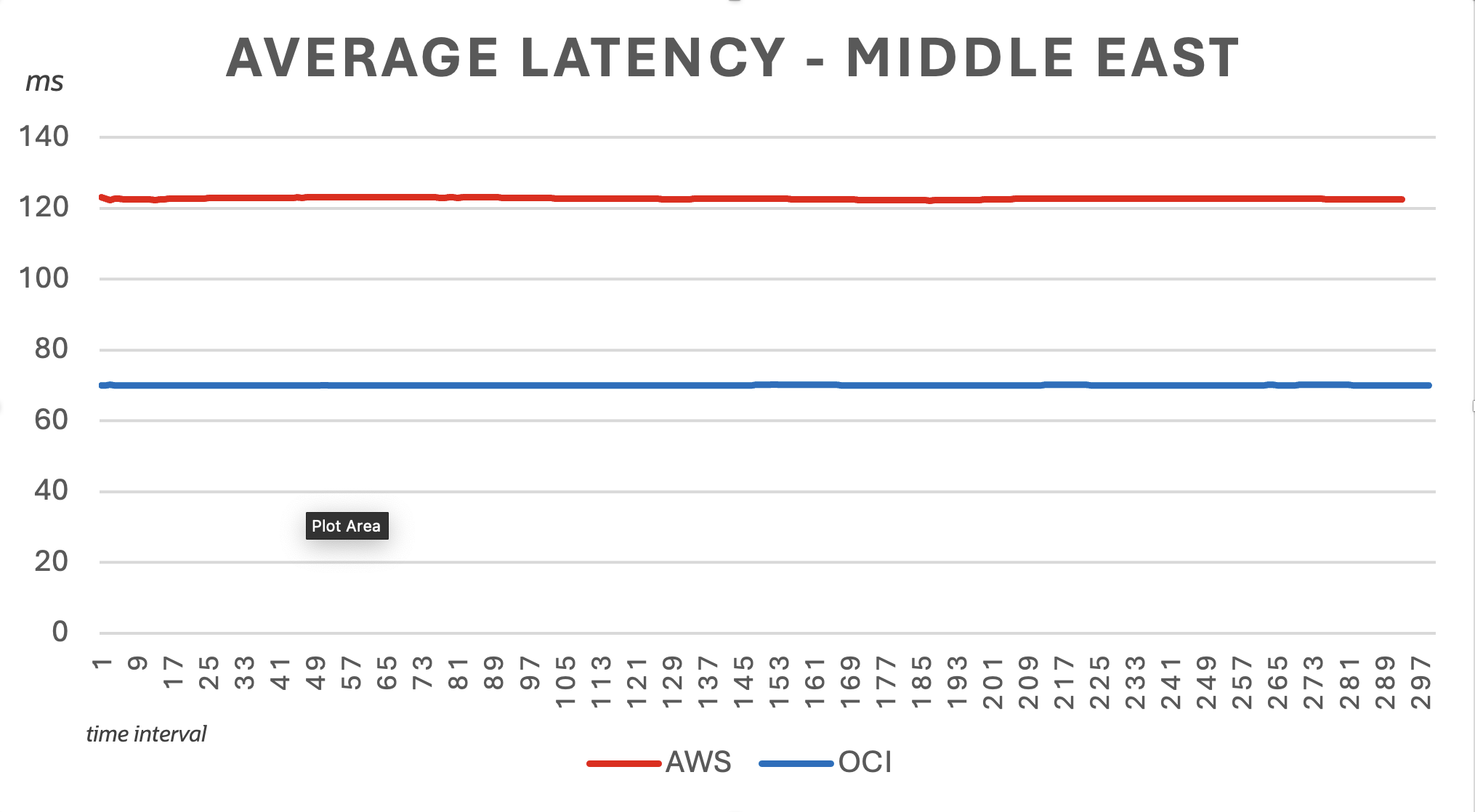

Chart 5: UK South → Middle East (Average Latency Over Time)

When extending to the Middle East, the difference widened significantly. OCI maintained a flat latency profile around 70 ms, while AWS averaged roughly 120 ms. Such a gap—over 50 ms—illustrates OCI’s more efficient backbone routing into the MENA region. The size of this gap (a near 50% delta) in stable market conditions, much less adverse ones.

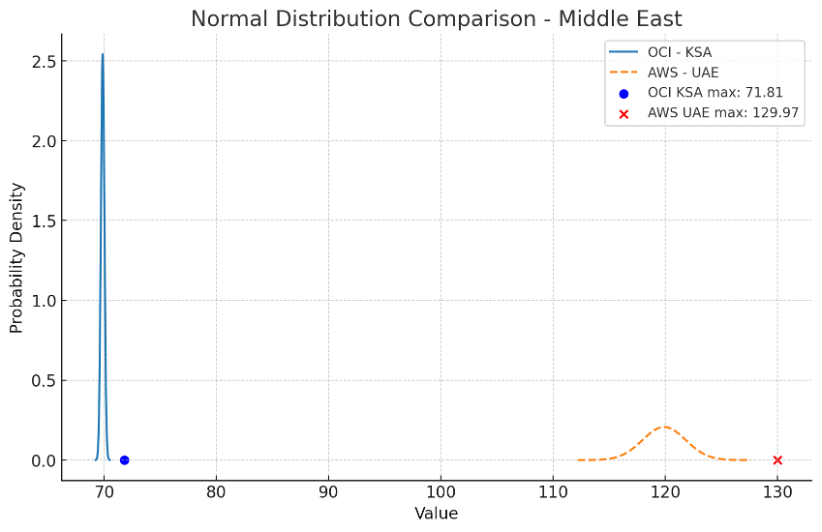

Chart 6: UK South → Middle East (Latency Distribution)

The corresponding probability density chart reinforces this result. OCI’s latency distribution was tall and narrow, peaking at about 70 ms with a maximum of 71.8 ms and probability density near 2.5. AWS’s curve, on the other hand, was low and wide, peaking at roughly 120 ms with a max near 130 ms and probability density around 0.2. That represents a massive gap in market data reaching its destination if an extreme market condition occurs that hinders performance. The difference confirms OCI’s deterministic behavior and minimal variance even across greater geographic distances.

Summary of Findings

Across all six test scenarios, OCI consistently outperformed AWS both in average latency and in stability. Based on the RTT latency table, OCI demonstrated an average latency improvement of approximately 7.5% compared to AWS. More importantly, OCI’s tighter standard deviations and lower maximum values show its network is not only faster on average but also more reliable and predictable—key for workloads like market data distribution that depend on microsecond‑level timing accuracy.

This analysis validates the design advantages of OCI’s non‑oversubscribed, n‑tier Clos network topology and its direct backbone connections between major financial hubs. It also suggests that deploying market data applications such as BCC Group’s ONE Platform on OCI can provide measurable performance gains with minimal jitter across transcontinental paths.

These findings further validate OCI’s position as the most deterministic and performance‑optimized cloud platform for market data distribution. This not only helps us infer that we can get data between major markets but also feel confident that we can rely on alternative instances in a disaster recovery scenario.

Conclusion

The partnership between BCC Group and Oracle Cloud Infrastructure is transforming how financial institutions deploy market data applications in the cloud. By leveraging OCI’s high-performance, secure, and globally distributed infrastructure, firms can optimize trading strategies and enhance decision-making all with the peace of mind that they are not adding undue latency to their ecosystem.

Look out for the next installment in our series highlighting how OCI and BCC Group are addressing market data access in developing markets and is prepared for the current rise in data residency regulations. We’ll also get into deploying the stack of cloud resources via infrastructure-as-code (IaC). Interested in deploying the ONE Platform on OCI? Go to the OCI Marketplace or contact the Oracle FSI team (steven.riley@oracle.com) and BCC Group today to learn more about how we can help accelerate your cloud adoption and improve market data performance.

To get started with Oracle’s cloud services, you can open an Oracle Cloud Free Tier tenancy with US$300 credits for a 30-day free trial. Free Tier also includes several Always Free services, such as Compute and Autonomous Database that are available for an unlimited time, even after your free credits expire. See https://www.oracle.com/cloud/free/ for full details.