Today’s business leaders constantly look for ways to streamline the order-to-cash (O2C) process in an attempt to improve bookings, reduce backlogs, and manage other shipping-related bottlenecks. One great example is Wavetronix, a manufacturer of radar vehicle detection technologies that was facing challenges managing its orders and inventory due to long lead times and supply chain disruption. If a single component wasn’t available on time, the entire order could be delayed, leading to order fulfilment issues that could ultimately impact the business.

Many of today’s operations struggle with these same challenges. But what if you could identify potential delays in your supply chain before they adversely affect your cash flow? What if you could predict customer collection risks to avoid overdue payments? And what if you had a way to tame the complex challenges requiring the integration and analysis of data from various departments and the collaboration of multiple teams to prevent costly delays in a coordinated manner? These processes can take several days to complete, but with a unified, prebuilt analytics solution, such as Oracle Fusion Analytics, anyone can access a single view of all data, quickly and easily analyzing the impact of the O2C process on their business and taking the appropriate actions. Here are few uses cases on how to tackle the O2C challenges with Oracle Fusion Analytics:

Use Case 1: Quickly assess business health with self-service insights

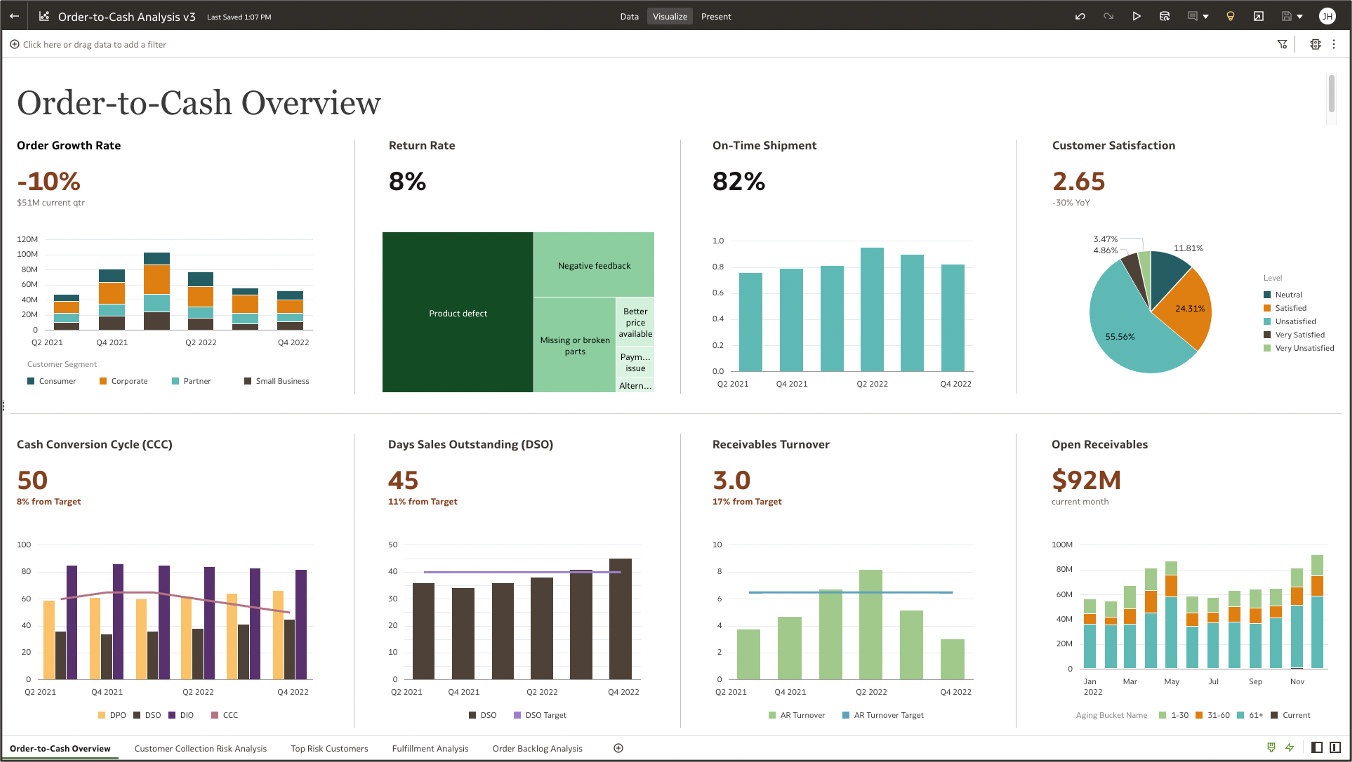

Utilizing the end-to-end O2C analysis provided by Fusion Analytics, users can quickly assess the health of their business by tracking critical Key Performance Indicators (KPIs) such as inventory, sales, orders, and accounts receivable. This enables teams to continuously monitor the O2C cycle and compare it to historical benchmarks. With self-service access to prebuilt KPIs, finance teams can easily access meaningful information about customer orders and take action to improve Key Result Areas (KRA).

For example, the O2C dashboard as shown above reveals that the cash-to-cash conversion days and receivables turnover ratio are trending downward compared to historical benchmarks, while the days sales outstanding (DSO) is trending upward. This could indicate that customers are taking longer to pay for goods, requiring investigation to identify customers defaulting on payments. Some of the key questions that can be answered with Fusion Analytics include:

- How is DSO trending lately?

- What is the ordered amount versus the invoiced amount for this month?

- How were accounts receivables for the last quarter compared to the current quarter?

- How many days does it take for cash collection to be completed from the order fulfillment day?

- What is the customer collection risk for next month?

- How has the customer satisfaction rate been so far?

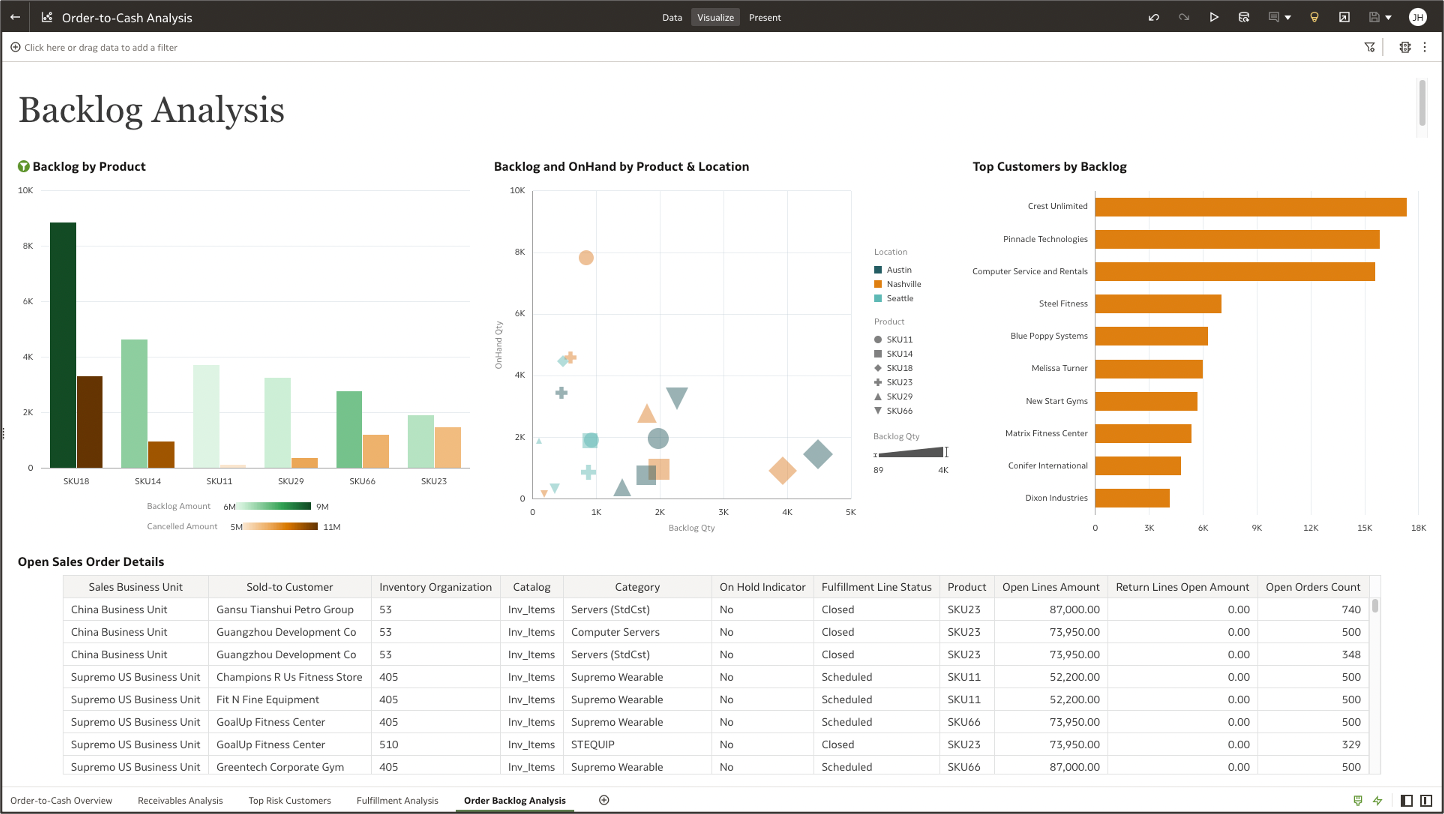

Use Case 2: Understand the impact of supply chain business processes on cash flow

With Fusion Analytics, executives can also understand how supply chain disruptions impact cash flow. For example, a business user can set up alerts if accounts receivable (AR) is trending below target benchmarks, and with self-service visualizations, users can create data stories to understand and explain if AR aging has been affected by collection issues or order fulfillment concerns. By having a cross-departmental view of the O2C process with Fusion Analytics, users can identify deviations in order trends, inventory status, collections, and backlogs by location, customer, and product. And with the ability to drill down to transactional level details, managers can easily find open orders that need to be fulfilled in a timely manner to maintain cash flow.

Overall, Fusion Analytics offers easy to build visualizations that allow business users on the finance and supply chain teams to easily find answers to complex queries such as:

- How has on-time shipment affected our cash conversion?

- Has DSO been impacted by poor inventory management?

- Did AR suffer due to order backlogs?

- What are the cost-saving opportunities with suppliers based on their performance?

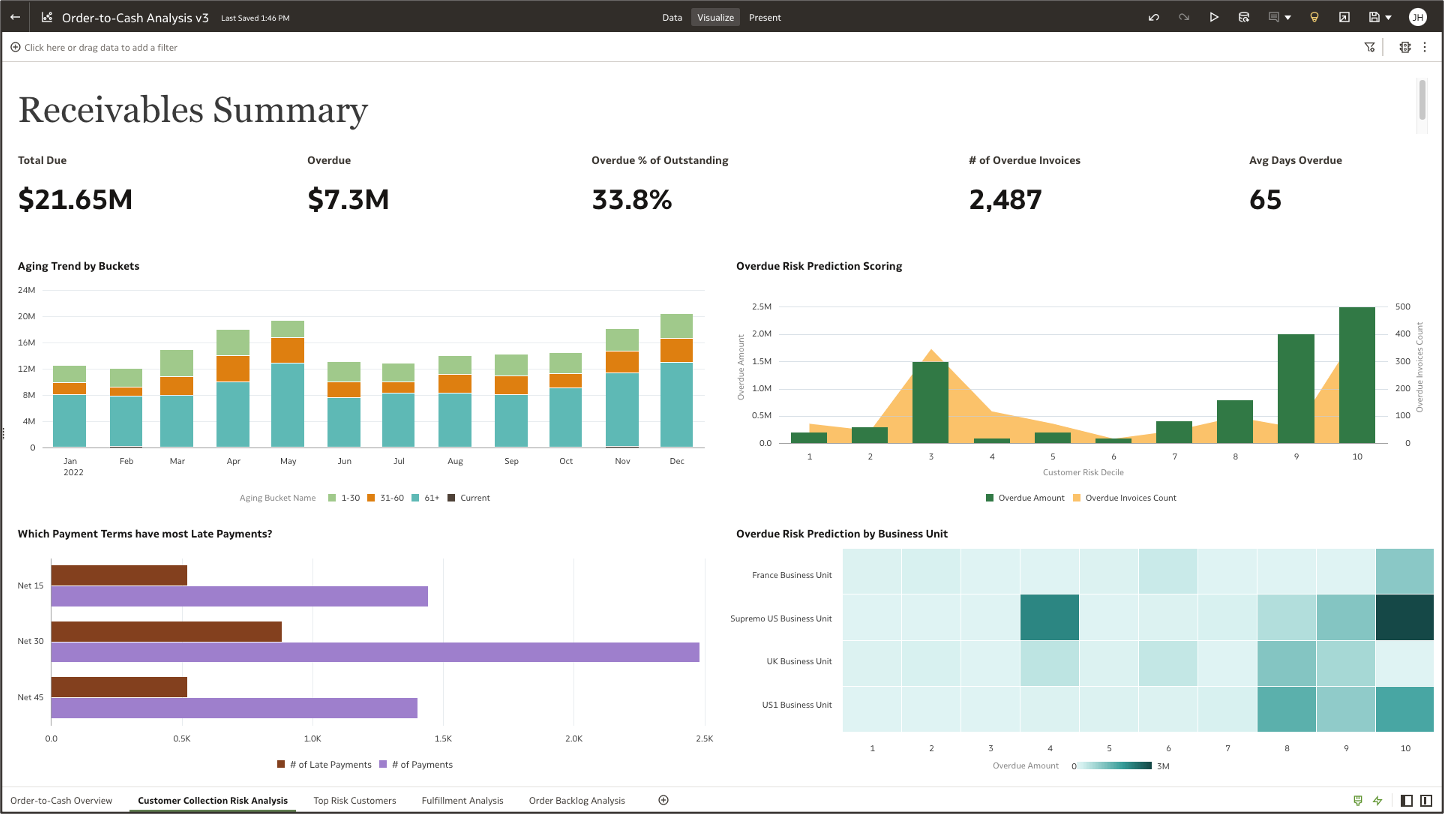

Use Case 3: Mitigate customer collection risk with predictive analytics

Predictive analytics can be a powerful tool for finance teams looking to mitigate collection risk. With Fusion Analytics, users can employ prebuilt machine learning features to identify patterns and trends that can help predict which customers are most likely to default on payments. By analyzing historical data, Fusion Analytics can score customers based on their collection risk, allowing organizations to take action to mitigate risk before it becomes a problem.

For example, finance teams can use Fusion Analytics’ predictive visualization to identify the overdue amount risk for each customer, with scores ranging from 1 (lowest risk) to 10 (highest risk). This can help organizations identify which customers pose the greatest risk and take appropriate action, such as offering payment plans or incentives to high-risk customers or taking action against those who are unlikely to pay.

Gain visibility with prebuilt analytics for Finance and Supply Chain

Implementing Oracle Fusion Analytics for Oracle Fusion Cloud ERP can greatly improve visibility into a company’s business and across supply chain. With over 2,000 prebuilt KPIs, metrics, and dashboards, Fusion Analytics allows users to easily analyze data from Oracle Fusion Cloud ERP and predict anomalies across the order-to-cash cycle. The analytical data model for Oracle Fusion Cloud Applications also makes it easy to combine ERP, SCM, HCM, CX data for analysis, saving time and resources on data management tasks.

By adopting a cross-departmental analytics approach with Fusion Analytics, organizations can ensure that everyone has access to the insights they need to explain trends, control variations, and make reliable business predictions. This enables management to make agile decisions based on a complete understanding of the organization’s operations. Just like Wavetronix, companies can consolidate systems and redirect time previously spent on data maintenance to more strategic activities.

Learn more about how Oracle Fusion Analytics can accelerate time-to-analysis and improve cross-departmental collaboration.

Check out a demo video on how to identify and predict bottlenecks across your order-to-cash.