“If your CRM system can’t predict your customer’s next need, can’t serve seamlessly across channels, or can’t evolve faster than your competitors’—it’s not a competitive advantage. It’s a liability.”

The digital stakes have changed

2025 marks a dramatic turning point for financial services. Banks and insurers that once depended on robust but aging CRM systems now face a clear strategic dilemma: adapt or be left behind.

The CRM platforms built a decade ago managed relationships and workflows well, but the landscape has shifted. Customer expectations are now fluid, regulations are more stringent, and AI is fully embedded in day-to-day experiences.

COVID accelerated the shift from branch-led engagement and linear customer journeys to digital-first, self-service experiences—raising expectations for seamless interactions across phone, web, chat, and social messaging. Meeting these demands now requires IT agility, data insights, and AI-driven assisted service—it’s a new paradigm for understanding pains and gains.

So it’s not surprising that the applications built yesterday have resulted in new pain points for business users: relationship managers lack a true 360-degree customer view, new products take months to launch, servicing time remains high, and CxOs struggle with the growing costs of complexity and compliance.

If your CRM has become a bottleneck instead of a business enabler, transformation isn’t just an option—it’s overdue.

Why CRM transformation is different in 2025

In the last few years, four forces have converged to make CRM transformation a priority rather than a roadmap footnote:

- Regulatory acceleration: Regulators demand sharper data localization, auditable service models, and real-time transparency in complaint resolution and service levels.

- AI becomes operational: From lead scoring to churn prediction and risk profiling, AI is no longer confined to labs—it’s running in production across fintechs and digital-native banks.

- Experience-first thinking: B2B clients now expect the same personalization, speed, and contextuality they enjoy in consumer apps. CRM is the frontline of experience, not just a database of record.

- Cloud pragmatism: While “cloud-first” was once a strategy, in 2025 it’s about “cloud-right.” Institutions are embracing hybrid models—containerized systems coexisting with SaaS and microservices that can adapt to changing geopolitical influences.

Reality check: Where most banks actually are

Siebel CRM has long been established in financial services institutions as a system of record for client and customer information. Its unparalleled scalability, reliability, and performance have made it a solid choice for managing sensitive data in line with regulatory and compliance requirements—and, especially in our current geopolitical climate, a safe haven for business-critical information.

But let’s be honest: as an Oracle Siebel customer, have you taken advantage of the modern experience it can deliver to your business, or have you consigned your users to a 2015 experience while deliberating over the high costs, business impact, and risks of a transformation?

Do any of these seem familiar?

- Outdated repositories stuck on older versions of the Siebel platform and missing out on recent innovations like Redwood UI, AI integration points, and DevOps pipelines.

- Heavy customizations that cannot be updated without rework.

- Data silos where relationship managers lack a single view across retail, commercial, and investment lines.

- Lengthy manual test cycles when you could be taking advantage of embedded automated testing.

- Costly upgrade projects and downtime—characteristic of older versions, but now a thing of the past.

- Manual, multi-hop service workflows, reliant on tribal knowledge rather than automation.

These systems are stable. But stability now comes at the cost of agility. And in a world where trust, speed, and personalization define loyalty, agility is everything.

How to convert challenges into opportunities

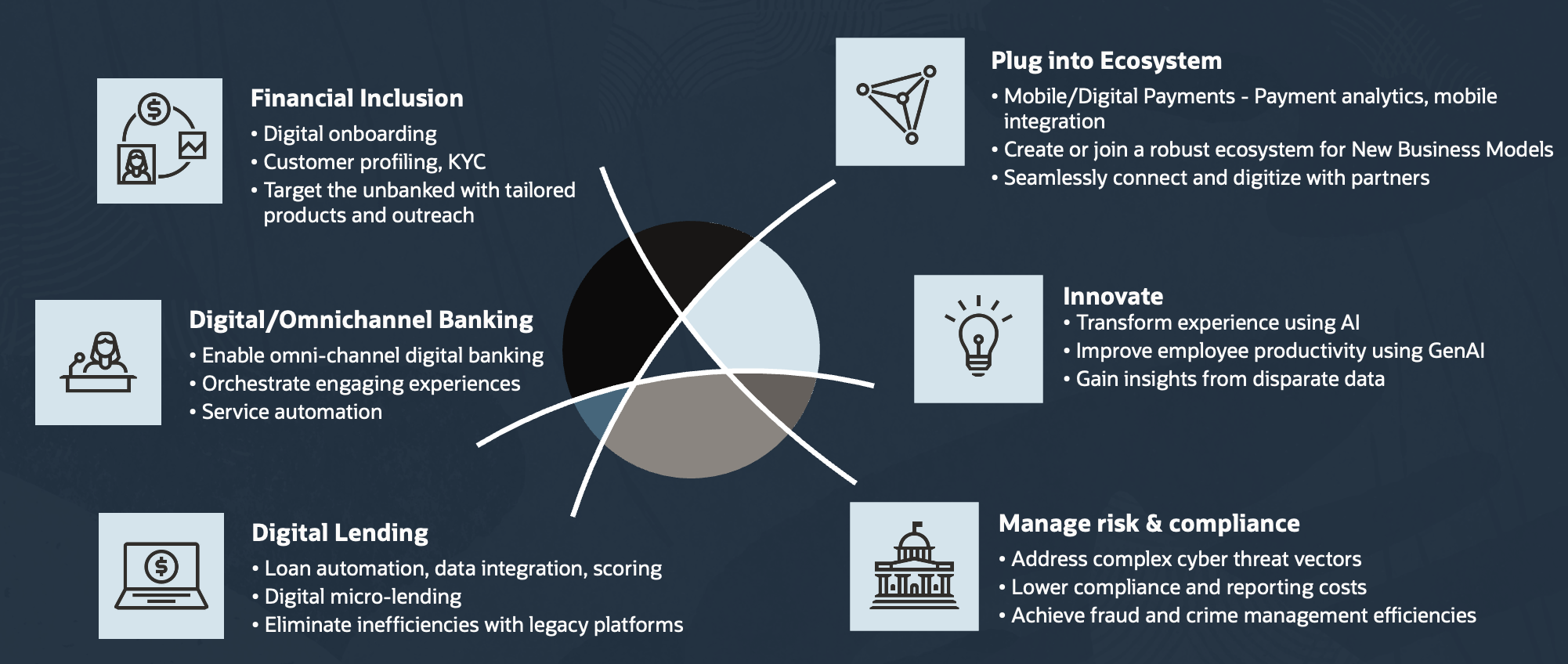

Building a robust digital financial services organization involves overcoming barriers and leveraging opportunities. In growth markets, the CX platform has to support financial inclusion and orchestrate digital onboarding/KYC processes for first-time account holders through mobile or agent-based delivery. The platform should deliver unified omni-channel experiences across mobile, online, and agent-driven channels, to deliver tailored products and services.

Digital micro-lending and mobile-based credit scoring is rising across regions. CX platform has to seamlessly automate loan origination, approval workflows, and documentation for fast digital lending and support integration with alternative data sources (mobile usage, digital footprint) in credit scoring.

In addition, the platform should help in developing differentiation via AI and data to transform user experiences and improve employee productivity. And of course, risk and compliance posture is required not only to address various threat vectors, but also do so in a cost effective way.

To become future-ready, banks and financial institutions must activate three critical transformation levers:

- Modernize what matters: Modernization is not about throwing away the old – it’s about upgrading strategically.

- Upgrade Siebel (binaries + repository) to leverage the latest Open UI, workspace-based development, and REST services.

- Refactor the 20% of customizations that drive 80% of rigidity.

- Enable a responsive, mobile-first CRM experience for RMs, field agents, and service staff.

- Data-led innovation: Data has always been CRM’s promise. Now it must become its product.

- Build a 360-degree customer view by stitching data across loans, deposits, insurance, and complaints.

- Put data to work using AI. Enable predictive insights, identify the opportunities to intervene proactively and improve productivty.

- Modularize the architecture: Future of app platforms is modular.

- Containerize Siebel components for cloud-readiness and scalability.

- Introduce event-based integration patterns and create an API-first CRM layer that exposes customer, product, and interaction data to external systems and partners.

The tough questions CRM leaders must ask in 2025

- How many CRM enhancements did we deliver last quarter?

- Can our CRM workflows be changed in days, not quarters?

- Is our CRM a system of insight—or just a system of record?

- Do we know what our top 100 customers did last month across all channels?

- Are we shaping relationships or just servicing transactions?

If the answers raise concerns—it’s time to act.

Modernize or migrate? Two paths, one decision

Transformation isn’t always a binary choice between modernizing and migrating, but clarity is key.

Here’s how a phased modernization approach with Siebel CRM compares:

- Time to value: Faster, reusing existing investments

- Domain fit: Strong for banking operations and DMS

- Innovation readiness: Medium (modular and API-based)

- Ongoing cost predictability: More controllable

- Change management: Easier, with familiarity retained

For banks heavily invested in Siebel, a phased modernization often delivers better ROI and lower risk.

With Siebel CRM, become the adaptive bank.

Let’s talk

Contact your Oracle representative for a personalized transformation discussion. If you’re evaluating Siebel modernization, considering CRM transformation, or just wondering where to begin, drop us a note. We’ll be happy to discuss your needs, share templates, frameworks, or real-world stories to help guide your next steps.