About Mauritius Commercial Bank:

Founded in 1838, Mauritius Commercial Bank (MCB), is the oldest and largest banking institution in Mauritius. Oracle had the opportunity to discuss in more detail with MCB’s Patrice Herve, Head of Technology, and Jailand Myandee, Infrastructure Lead on their choice to move to Oracle Exadata to support their core banking system.

MCB has been steadily growing with 50% of the market in Mauritius. Patrice stated, “We are doing more than just banking, as we have various subsidearies such as: capital market, leasing, micro-finance, and for the past 15-20 years we have also had a regional presence in Seychelles, Maldives, and Madagascar, with significant market shares in those countries. And we are still growing with an advisory office in Dubai and other Representative Offices across Africa and Europe.”

MCB started its digital transformation back in 2018 to change the way they were delivering their products to customers. Going digital, but also doing their jobs differently by changing the roles of their technical staff, upskilling, and reorganizing the way they were working as a collective team leading to productivity gains. With their digital transformation they enhanced customer services and have seen great results. This includes a steady increase in their digital channels with more than half a million users on their mobile app. Patrice adds, “Customers effect 350,000 transactions online per day on this app. We do online loans and overdrafts, so we have quite a success story in delivering digital products to our customers, and on the technical side we changed the stack, looking how we could streamline the way we manage and deliver services.”

Why Oracle Exadata?

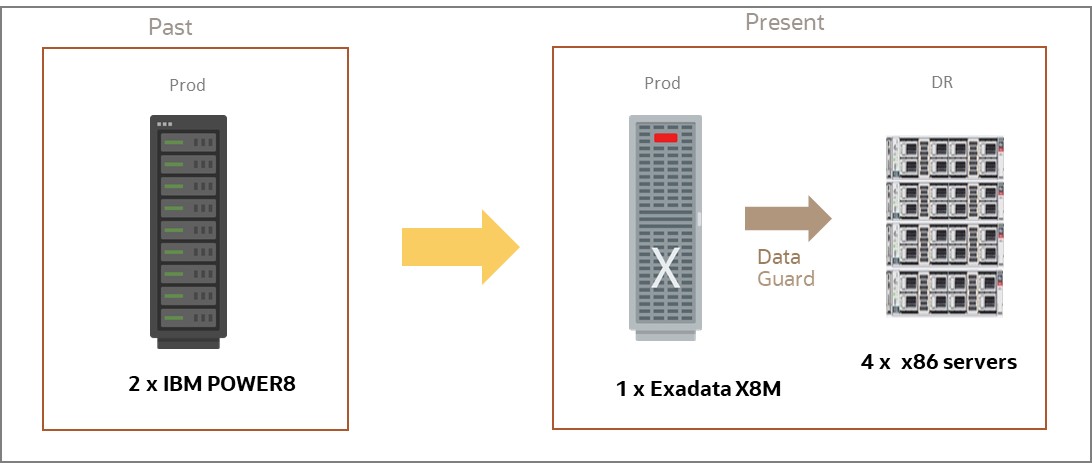

MCB had business and technical challenges with their two IBM Power Systems to run a 40TB Oracle Database for their core banking system. Jailand adds, “The close of business was very long to finish. In addition to these issues, Oracle Database licensing costs were increasing and thinking about increasing resources would have meant even more licenses.” It was at this time that Patrice went to an Oracle conference where he learned about Oracle Exadata and started to consider how the new Oracle Database platform could improve their business performance. MCB was the first customer in Mauritius to acquire an Exadata. Patrice explains, “The first application that we migrated was a Regulatory Reporting Application, called Fintellix. The performance was very good – the batch run for this core application was improved by approximately 70%. So, we concluded that is was worth investing in this equipment and we then gradually migrated all the databases.” MCB also improved batch times for other critical applications by 50%.

The main reason MCB chose Exadata was to run the 40TB core banking database. Jailand adds, “After migration our daily batch run for core banking reduced from 7 hours down to 2.5 hours, so I would say that we were pleased.” In addtion, MCB was not using Oracle Data Guard for disaster recovery (DR) before moving to Exadata, so they had to involve several groups such as storage and OS management to recover their crucial databases should a problem arise. Now with Exadata and Data Guard, the DBAs can do the switch over themselves, and DR failover of Oracle databases has improved. Jailand adds, “The way Exadata is designed you don’t have to pay for the storage licenses which give you extreme performance and you don’t have to allocate so much to database server CPUs, resulting in significant savings. This is because today the number of CPUs is an important thing in Oracle Database licensing.

The benefits achieved:

When asked, what can you do now that you couldn’t do before the Exadata implementation? Jailand explains, “The big gain for my team is they don’t have to worry about patching. The Oracle Advanced Customer Support team is doing this every quarter, we just need to plan for it.” In the past, it would take MCB 3 to 4 months or more to patch all eighteen of their Oracle databases. With Exadata, it only takes 6 to 7 hours to patch all their databases, a greater than 99% reduction.

Regarding performance, before Exadata, they had to wait for the core banking system to finish before starting anything else, so all the downstream application processes were late. It was leading to delays in regulatory reporting, delays in all their internal MIS reporting, delays in updates that they were giving to their customers on statements, and mamy other deliverables. Patrice adds, “And now, since we are on Exadata it is much faster for our core banking platform and also much faster to many other applications because we moved the databases of other applications to the Exadata platform as well.” As an example, their Risk and Profitability system was taking 5 hours at the end of the day to complete processing and very often it wasn’t finished until the evening of the next day, which meant they were not able to see the values at the start of their day. MCB’s CFO, Bhavish Naeck further adds, “Following the implementation of Oracle Exadata, our Financial Reporting team now has their dashboards and reports (general ledger, regulatory, etc.) available early in the morning when they come to the office, and this is a game changer for us. We are now much more efficient, and we can make informed decisions early in the morning and be more productive in our day-to-day work.” The fact that statements and notifications are delivered much faster has increased customer satisfaction.

Recommendation:

When asked how they would recommend that to other Financial Services organizations who are going through similar evaluation cycles or starting a new journey on Exadata like MCB, Jailand stated, “We recommend taking the Oracle learning subscription to understand how everything works and to train your people. In the beginning, you have some resistance, people fear losing their jobs, fearing the box will do everything, but after they learn how much benefit we can get from it they feel more at ease.” MCB is looking forward to receiving the latest generation Exadata X10M. They are planning for the new set up and excited to experience the innovations that enable extreme scale with dramatically improved cost performance.

To learn more: https://www.oracle.com/engineered-systems/