With Oracle Consulting’s help, a retail customer who typically spent weeks hunting down discrepancies in monthly general ledger balances can now match over 120,000 transactions a day from 260 shops using four systems – in about 12 minutes. Tim Cheney CA and Charles Pinda CA explain.

The business challenge

Many retailers have point-of-sale systems (POS) that process hundreds of thousands of cash and credit sales transactions per day. Organizations not only need to account for these POS transactions but ensure the money received is banked correctly and promptly.

Small discrepancies can compound into much larger cash or reporting issues if not identified quickly and correctly.

Manual data matching is a painful – and painfully-slow – process. Large teams are employed, spending days and days poring over spreadsheets to manually match huge volumes of data from differing sources, and still miss deadlines due to mismatches and other anomalies.

Oracle’s Account Reconciliation Cloud Solution (ARCS) Transaction Matching can help.

Saving time is only one of the benefits of transaction matching

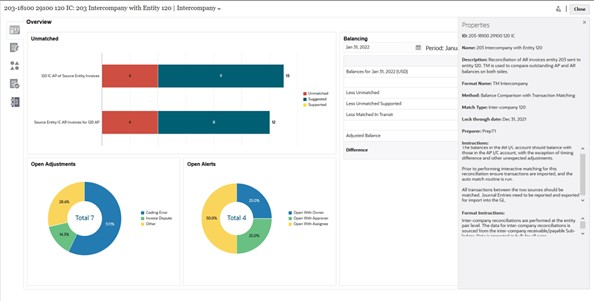

ARCS Transaction Matching enables organizations to automate the preparation of high volume, labor-intensive, and complex reconciliations. These can then be seamlessly integrated with the tracking features within ARCS Reconciliation Compliance, giving your audit team a head start on your reconciliation analysis.

The goal of Transaction Matching is to load transactions from one or more data sources, match the transactions using pre-defined rules. It identifies confirmed matches, where no further action is required. It also creates suggested matches, where the user can either confirm or discard the match.

Other valuable features include visibility of matched transactions including the intelligent automated match feature which will suggest matches for you plus our automated journal process which will create journal entries to resolve variances found in the matching process to save you even more time.

It lays the groundwork for organizations to close their books faster – Oracle itself, for example, closes and reports results to the stock market in 10 days or less, with the help of its own solutions.

In Australia, peak corporate “earnings season” is in mid-August for full year results to the end of the financial year on 30 June – a significant delay in a split-second trading environment where fortunes are made and lost, time is money and knowledge is power.

Automation helps to enable finance teams to devote more time to adding value by cutting the time spent polishing the rear view mirror for a clearer reflection of the road already travelled.

In the case of our client at the start of this article, the process of implementing transaction matching also helped them to identify data errors being introduced by POS systems so that these could then be fixed by the system owners, contributing to match rates that then rose as high as 99%.

It’s also relatively quick to implement – within six months for most situations – and brings benefits immediately during the following month-end cycle.

Business benefits of using Transaction Matching

Business benefits of using Transaction Matching in Oracle Cloud EPM Account Reconciliation include:

- Saving time and labor spent on manual preparation of complex reconciliations

- Reducing risk and improving the quality of your reconciliation process

- Removing inefficiencies in your daily or monthly reconciliation process

- Reducing human error and speeding up your reconciliation process

About Transaction Matching in Oracle Cloud EPM Account Reconciliation

Transaction Matching module sits within the well-established Account Reconciliation Cloud Solution (ARCS), which is part of the Oracle Cloud Enterprise Performance Management (EPM) suite of products.

Transaction Matching is tightly integrated into your period-end balance sheet reconciliation process (ARCS Reconciliation Compliance module) to provide evidence of reconciliation at month-end and to meet compliance and governance requirements.

Transaction Matching can work with data from any source system, on premises or in the Cloud, and from Oracle as well as those offered by competitors.

Scenarios where Transaction Matching can be beneficial include:

- Balance sheet-related reconciliations

- Suspense and clearing accounts

- Intercompany

- Cash

- Credit card receivables

- Detailed subledger reconciliation

- Operational, off-balance sheet, reconciliations

- System-to-system reconciliations (which typically involve two third-parties whose accounts must be in sync with each other)

- Stock or share settlements

- Expense reimbursements

How Oracle Consulting can help

Oracle Consulting has implemented Oracle Cloud Account Reconciliation Transaction Matching at many complex retailers worldwide, and can bring the learnings of these projects to you, to help you achieve real business outcomes.

Contact the authors: Tim Cheney CA on tim.cheney@oracle.com or Charles Pinda CA on charles.pinda@oracle.com

Sources:

Account Reconciliation | EPM | Oracle

Releasing earnings in 10 days or less (oracle.com)

Innovation Guide: Accelerating an Automated, Connected Financial Close (oracle.com)

About Transaction Matching (oracle.com)