It’s crunch time for large multinational enterprises in over 130 countries that are introducing new global minimum tax rates under the “Pillar Two” international agreement designed to prevent a race to the bottom on corporate tax.

From our perspective working with companies in Australia, multinational enterprises know what the emerging new regime requires but many are still grappling with how they will comply with the changes under the Organisation for Economic Co-operation and Development (OECD) agreement.

In this piece, we’ll explore Pillar Two, and discuss how Oracle’s Pillar Two solution can help automate the associated end-to-end requirements with a robust and auditable process.

What is the Pillar Two OECD agreement?

The OECD Pillar Two agreement represents a major change to tax process and tax planning strategies. It generally applies to multinational enterprises (MNEs) with annual turnover of EUR750 million or more.

Under the OECD Global Anti-Base Erosion (GloBE) Model rules, MNEs are required to pay at least 15 per cent tax in each country they operate in. If they fall short, they need to pay a top-up tax.

As noted during consultations in Australia, extensive data points are required, posing a challenge that MNEs need to manage to meet their obligations, whether through system changes and/or manual interventions.

There are several safe-harbor exceptions to the law, as well as carve-outs, that companies are exploring – and it does not apply to governments or not-for-profits. Nevertheless, the OECD estimates that Pillar Two will see around US$150 billion in extra tax revenues paid globally.

“The cumulative impact of these initiatives means that ‘tax havens’ as people think of them would no longer exist.” – OECD

How can multinational enterprises (MNEs) comply with Pillar Two?

Pillar Two data requirements go beyond the general ledger, and will need to be sourced from various sources including financial consolidation system, tax provision, enterprise resource planning (ERP) and sub-ledgers, human resources systems, sales systems etc.

Some MNEs are outsourcing this work on an ongoing basis to tax service providers, who are developing custom tools, mainly based on common spreadsheet programs.

Other MNEs are bringing the capability in-house by updating core systems and processes, which is a more robust and reliable approach as well as more cost effective in the medium term.

“The complexity, novelty, and uncertainty that Pillar Two presents compounds the existing global compliance and regulatory challenges for MNEs… MNEs will need to focus on data, systems, technology, and processes as the foundation for global and statutory compliance.” – PWC

About the Pillar Two module in Oracle Cloud EPM’s Tax Reporting Cloud Solution

To help customers automate data collection, calculation, forecasting, modelling, analysis, and reporting in a robust way and with a strong audit trail, Oracle developed the Pillar Two module.

The Pillar Two module adds functionality Oracle’s well-established Tax Reporting Cloud Solution (TRCS), part of the Oracle Cloud EPM suite of products.

For many years, organizations have used TRCS to automate corporate income tax calculations, manage deferred tax schedules, manage their effective tax rate (ETR), and undertake country-by-country (CbCR) reporting under earlier OECD base erosion and profit shifting (BEPS) “Action 13” rules.

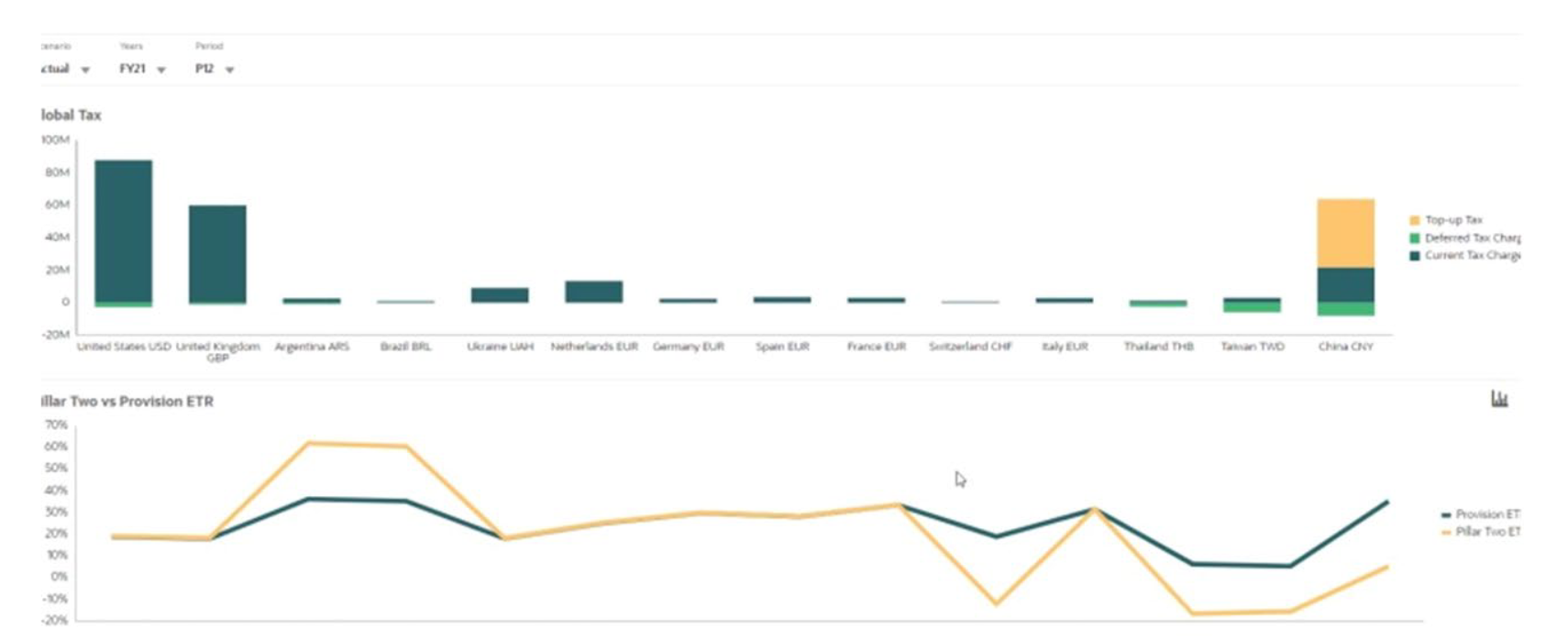

Now, TRCS has been further enhanced with added functionality in the Pillar Two module. This module helps customers calculate their top-up taxes, safe harbours and GloBE income calculations – including the Income Inclusion Rule (IIR) and Undertaxed Payment Rule (UTPR), the covered tax expense calculation, and the ETR reconciliation.

The Pillar Two module also includes pre-built dashboards, reports and analytics while Oracle Cloud EPM has a task manager to assign and monitor tasks from a central dashboard to help ensure coordination and collaboration between different parts of the operation.

While designed for Oracle Cloud EPM, the Pillar Two module can also work with Oracle customers’ on-premises systems, or draw data from any source system, including those offered by competitors.

Business benefits of using the Pillar Two module

Business benefits of using Pillar Two in Oracle Cloud EPM’s TRCS include the ability to implement quickly, keep tax reporting connected to the broader financial close process, leverage existing investments in Oracle Cloud EPM, and automate processes by taking advantage of features for tax provision, country-by-country reporting, transfer pricing etc.

When do the Pillar Two rules start?

Under the 2021 OECD agreement, countries agreed to implement the Pillar Two rules in their respective tax legislations and introduce minimum taxes in their jurisdictions using a common approach.

In Australia, for example, the government announced in May 2023 that 15% minimum tax will apply for large multinational enterprises on income years starting from the beginning of 2024, meaning that MNEs with operations here need to act promptly, with the first lodgments due by June 2026.

The European Union has formally adopted Pillar Two rules and, as at March this year, 25 countries had already introduced draft legislation or adopted final legislation based on Pillar Two, according to PWC.

The Pillar Two module in Oracle Cloud EPM’s TRCS has best practices built in that allow companies to get up and running relatively quickly. For example, we are currently implementing Pillar Two for an Australian customer which already has Oracle Cloud EPM over a timeframe of three or four months.

“A global minimum corporate tax rate of 15% prevents a ‘race to the bottom’ on corporate tax rates.” – Australian Taxation Office

For more information, contact Tim Cheney on timothy.cheney@oracle.com or Rahul Kohli on rahul.k.kohli@oracle.com

Sources

https://www.oracle.com/au/a/ocom/docs/applications/epm/pillar-two-in-oracle-cloud-epm.pdf

FAQs: Global Anti-Base Erosion Model Rules (GloBE Rules) – Pillar Two (oecd.org)

Draft legislation for domestic minimum tax released – BDO

https://www.pwc.com/gx/en/services/tax/assets/pwc-pillar-two-data-input-catalog.pdf