Introduction

Clearing Accounts Reconciliation is an often overlooked Cloud GL feature that can support initiatives to accelerate period close. With Clearing Accounts Reconciliation, you easily identify the transactions that make up the balance of an account after matching the related “ins and outs” entries.

You will benefit from this feature when you import journals entries to Cloud GL from upstream applications. You don’t use this feature to understand the balances of receivables and payables accounts as subledgers provide you with that detail with reconciliation capabilities.

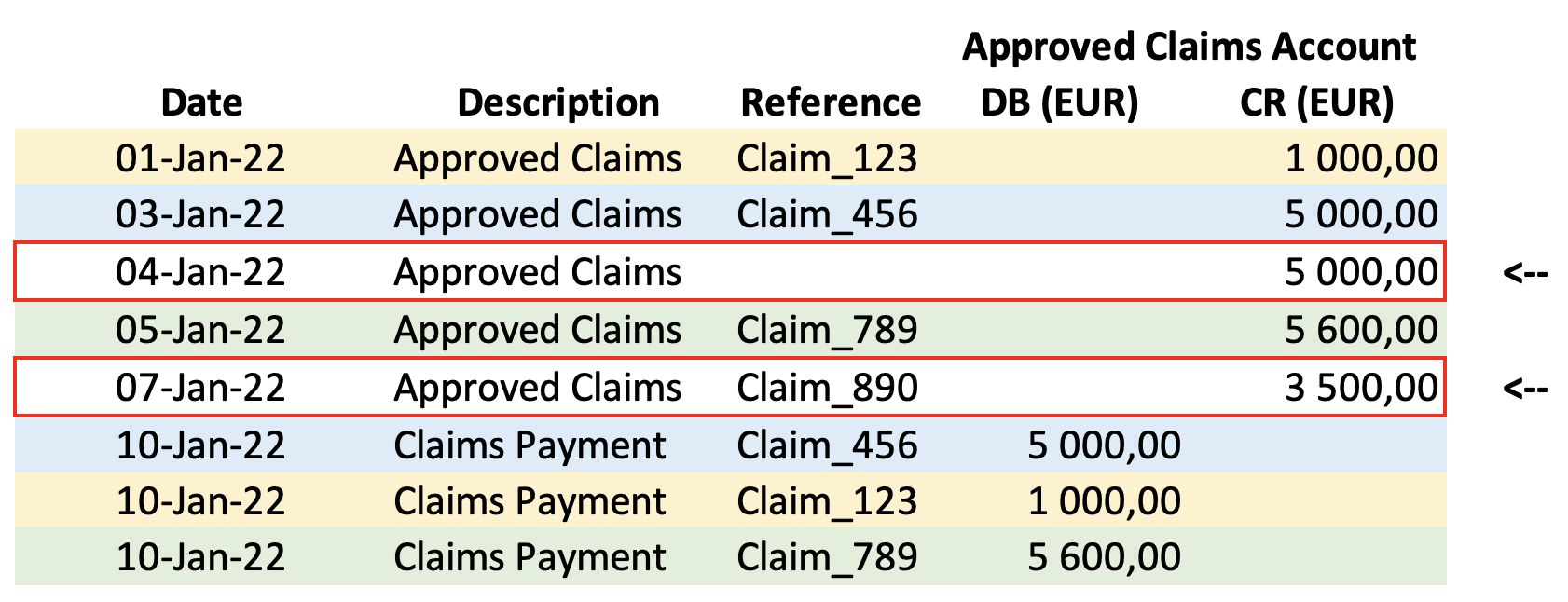

Consider the example of journals that flow into Cloud GL from upstream insurance claims and payment applications that both update the “Approved Claims” balance sheet account.

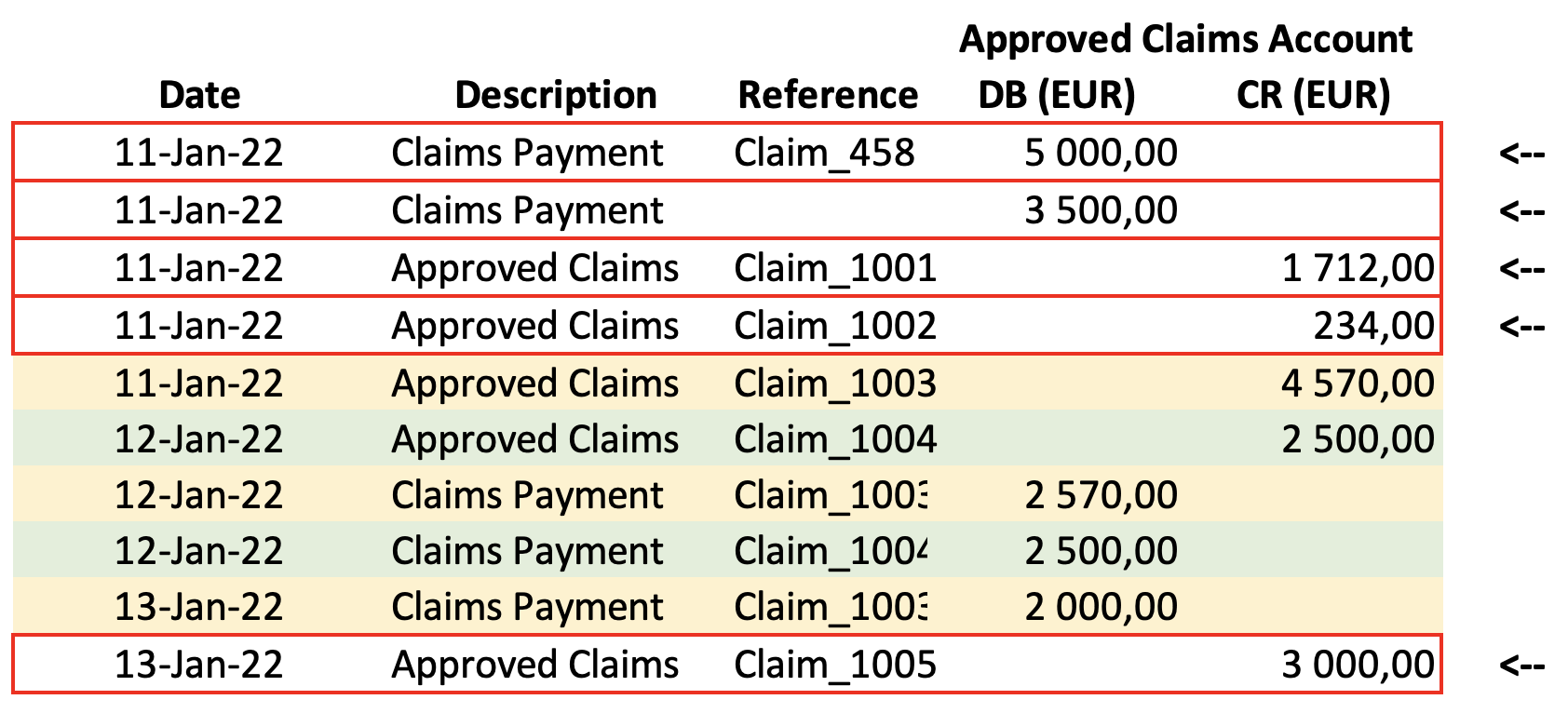

In the example below with a very a limited number of lines, you easily match the corresponding debit and credit, and identify the two remaining lines which make the total. But with 100’s or 1000’s of movements the task becomes very difficult.

Clearing account reconciliation automatically matches debits and credits with the same reference. In an ideal world, the outstanding unmatched journal line(s) will exactly match approved insurance claims that have not yet been paid in the source system. In the example above, Approved Claim 890 and a Claim without a reference.

In the real world, manual adjustments, source system anomalies, integration errors and timing differences complicate the reconciliation. Clearing Accounts Reconciliation automatically eliminates straightforward matches and provides tools to identify and explain exceptions.

There are two main use cases:

Zero balance accounts should have no balance at the end of the period. If, for example, company policy dictates that all approved insurance claims must be paid in the same accounting period, the Approved Claims account would be a zero balance account. Clearing account reconciliation allows you to easily identify, explain and eliminate anomalous entries during period close.

Non-zero balance accounts reflect oustanding transactions. If, for example, approved claims are often paid in the following period, the Approved Claims account balance should reflect the sum of all unpaid approved claims. Clearing accounts reconciliation allows you to justify the balance in terms of outstanding transactions.

In this blog we offer an overview of the Clearing Accounts Reconciliation feature and highlight its business value. To understand Clearing Accounts Reconciliation feature in depth you can refer to the feature documentation https://docs.oracle.com/en/cloud/saas/financials/23a/faugl/overview-of-clearing-accounts-reconciliation.html#s20060374.

Definition of a Clearing Account

A clearing account is a general ledger account whose balance reflects the sum of transactions in transition from one state to another. For example, the supplier liability account reflects the sum of approved invoices that are not yet paid.

How Clearing Accounts Reconciliation Works

Setup steps

-

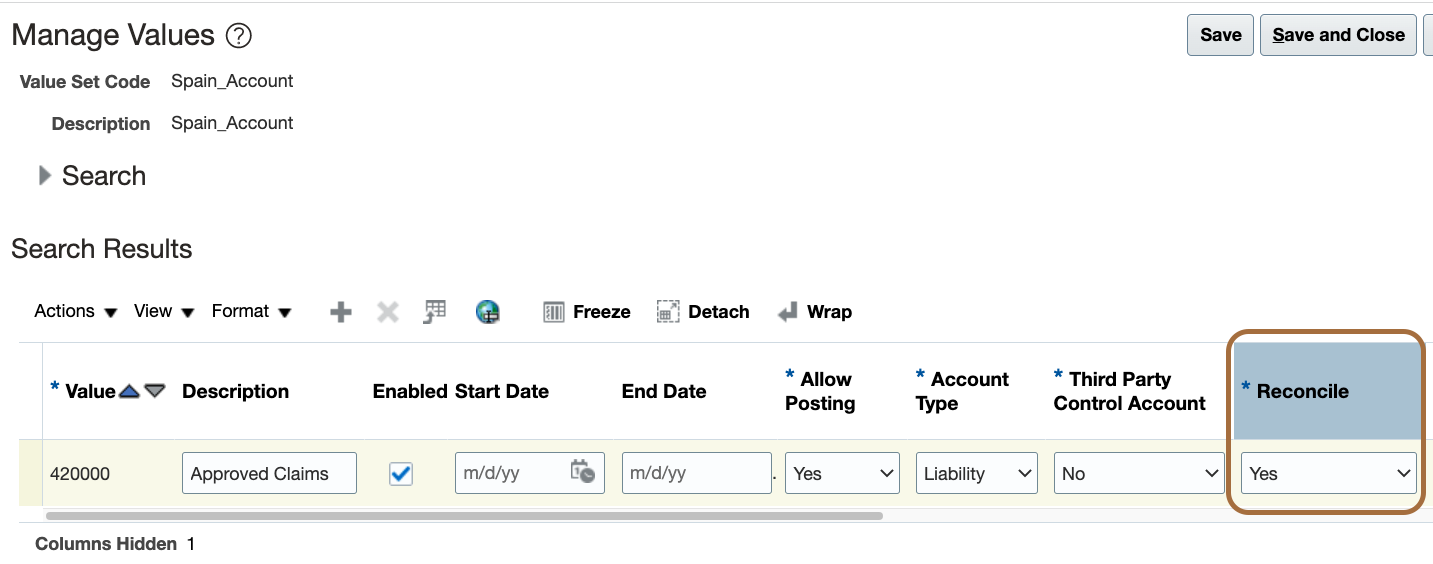

Set the Reconcile attribute to Yes for the reconcilable clearing account values in the natural account value set.

-

Run the Inherit Segment Value Attributes process to make the account combinations using these accounts reconcilable as well.

This step is required if codes combinations exist before you make the natural account reconcilable.

-

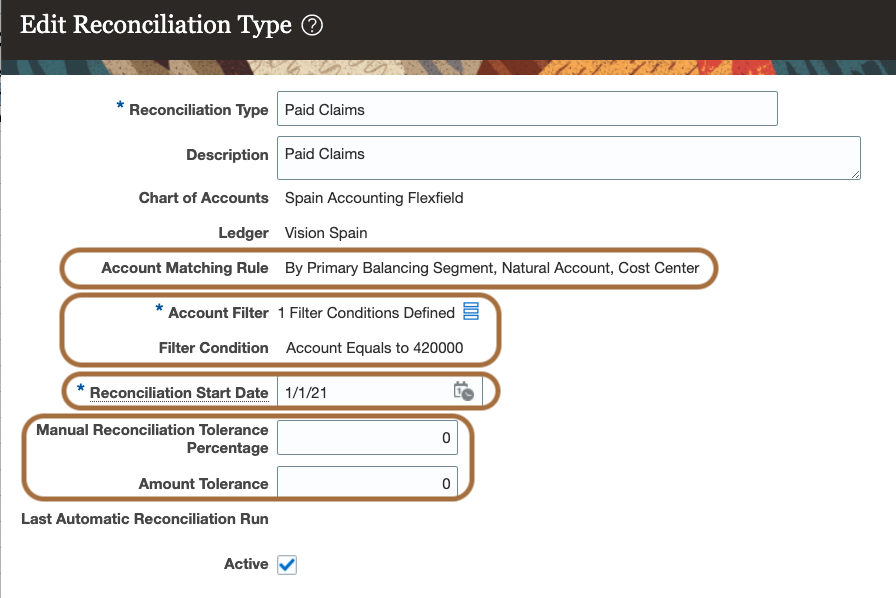

Define Reconciliation Types and matching rules for the clearing accounts.

Reconciliation Types define, for one or multiple reconcilable clearing accounts, the reconciliation rules. Reconciliation Types are used in automatic and manual reconciliations to select journal lines and group them as per the detail of rules.

Additional information about some of the attributes of the reconciliation type.

| Attributes |

Description |

| Account Matching Rule |

The matching rule defines the level at which the debits and credits are grouped and compared. There are three options:

Debits and Credits can be reconciled together across code combinations. Only the balancing segment and the natural account values have to be identical. Other segments can be different.

The balancing segment, the natural account, and the cost center values have to be identical. Other segments values can be different.

Debits and Credits can be reconciled within one single code combination. |

| Account Filter / Filter Condition |

With the Account Filter / Filter Condition you define the segment values and therefore the code combinations to which this reconciliation type applies. |

| Reconciliation Start Date |

The reconciliation start date, and the criteria you specify when reconciling automatically or manually, are used to retrieve the clearing account journal lines eligible for reconciliation. Only journal lines with an accounting date after the reconciliation start date are available for reconciliation. |

| Tolerances |

You can set up amount and percentage tolerances for manual reconciliation only. This allows you to reconcile debits and credits, even if they don’t match, as long as the difference is within the tolerance. If you define both amount and percentage tolerances, the stricter of the two tolerances is applied. Note: The tolerances consider the accounted amounts. |

Reconciliation References

The reconciliation references are used in the automatic reconciliation process to group journal lines and check that for one particular reference the debits and credits are equal.

In the insurance claims example, you can use the claim number, as reconciliation reference for both the approved claims and their corresponding disbursements.

It can be any piece of information, such as a date or a batch number, as long as it is expected to have matching total debits and credits for that reference at a point in time.

- Reconciliation references can be entered on the journal lines for manually created journals.

- Reconciliation references can also be entered for journals created using FBDI (GL Interface) or ADFdi.

- You can set up Subledger Accounting to automatically populate reconciliation references on journal lines and transfer them to GL. (link to documentation)

- You can map the Accounting Hub Reconciliation Reference accounting attribute to one of the data elements from the imported file, to import reconciliation references in GL. (link to documentation)

Automatic Reconciliation

The automatic reconciliation groups debits and credits by reconciliation reference according to the matching rule. If the total debit equals the total credit, the lines are stamped as reconciled.

Manual Reconciliation

You can also manually group the lines on the Manual Reconciliation page or in a spreadsheet. In manual reconciliation, the reference does not need to be the same on all journal lines. See sections “Reconcile Manually on the Manual Reconciliation Page” and “Reconcile Manually in a Spreadsheet” later in this article.

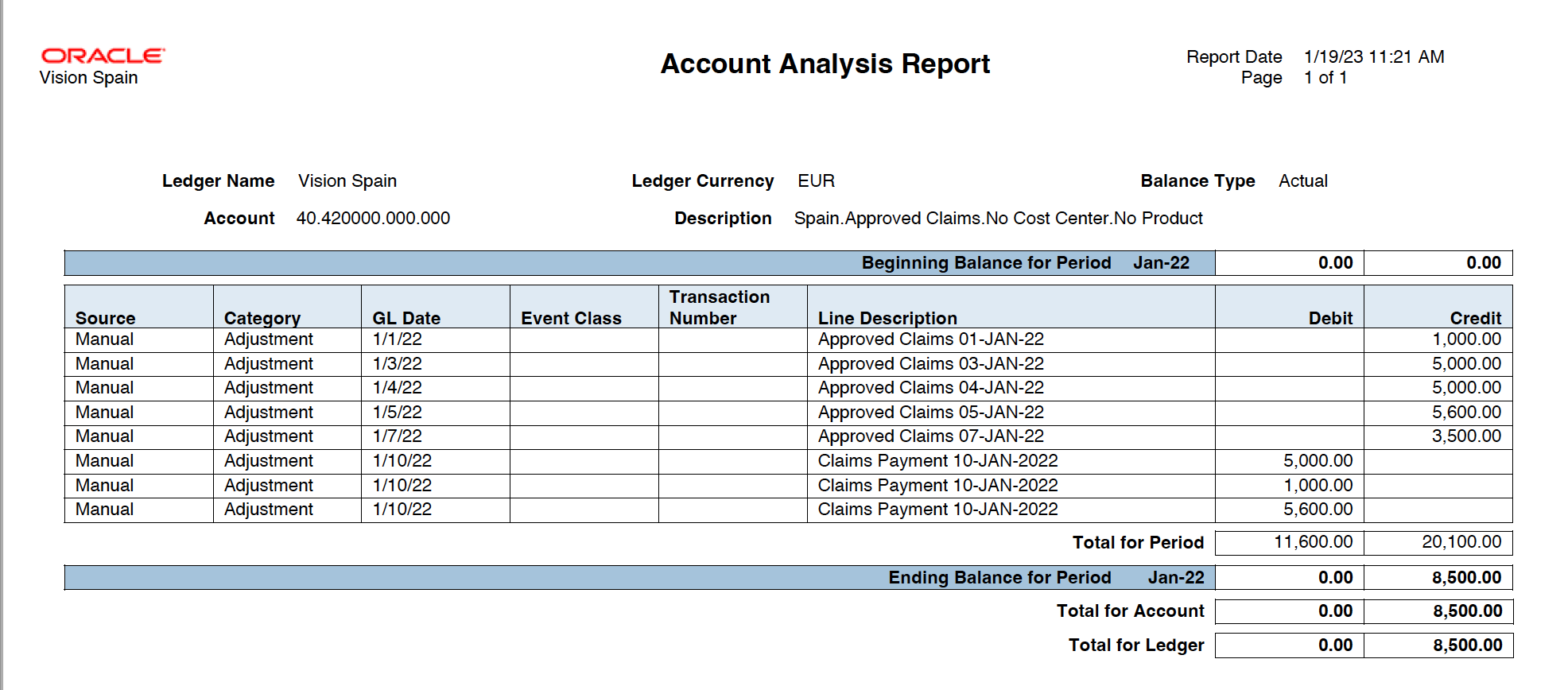

Account Analysis Report

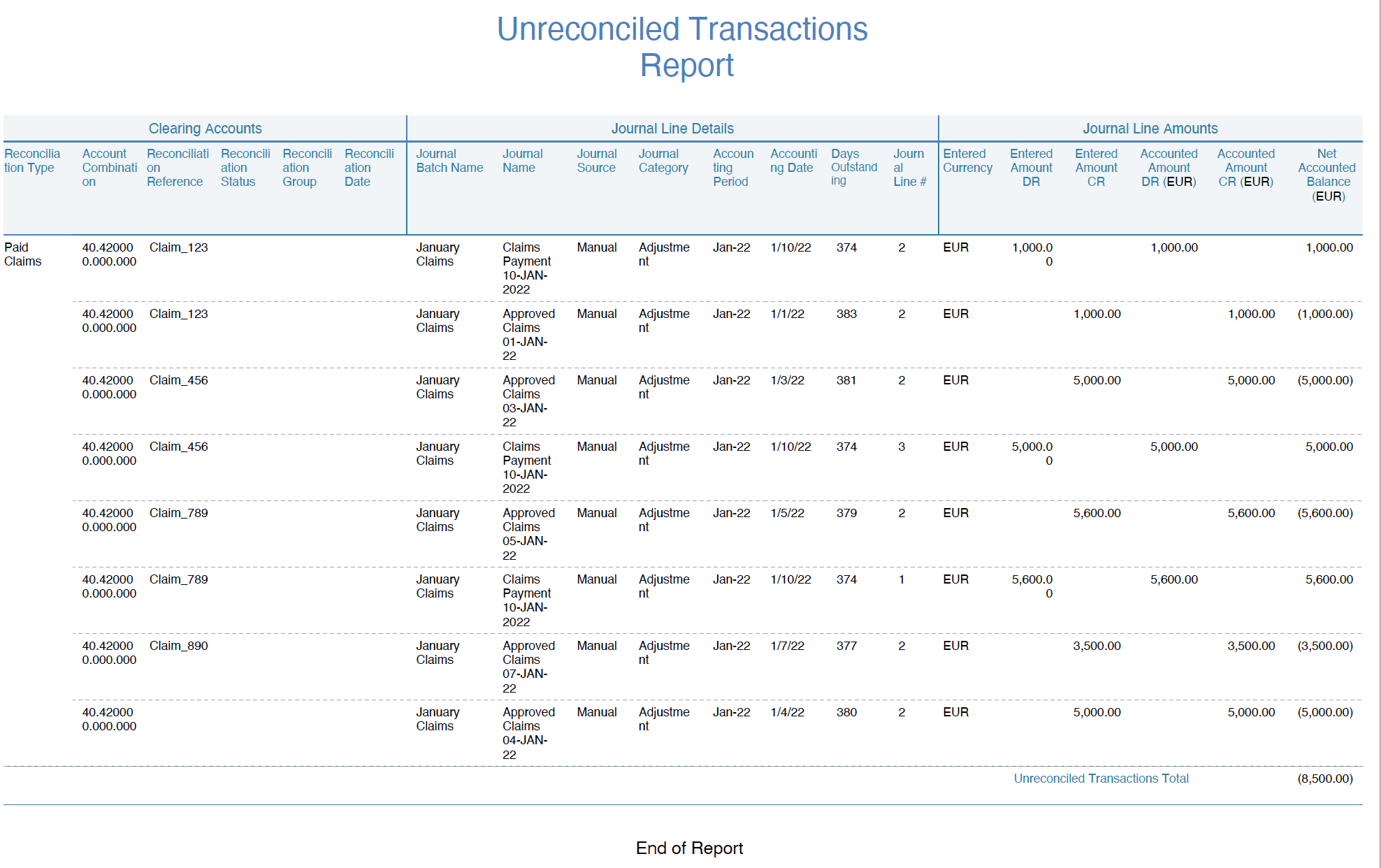

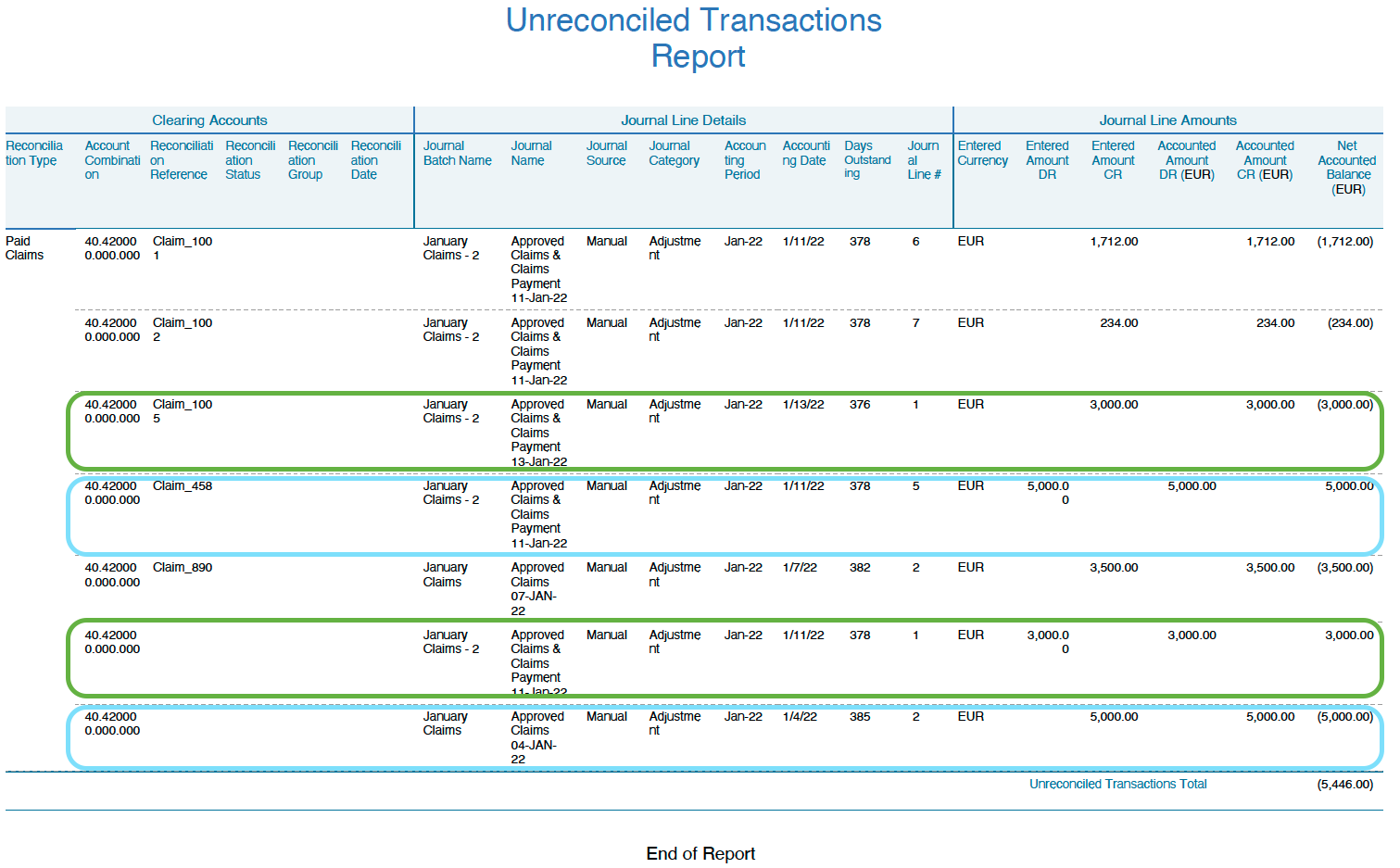

The generic Account Analysis Report, for the code combination “40-420000-000-000 Approved Claims”, looks as below with the entries listed on image 1.

Despite the limited number of entries, you don’t immediately identify the claims adding up to the balance.

Clearing Accounts Reconciliation Reports

Unreconciled Transactions Report

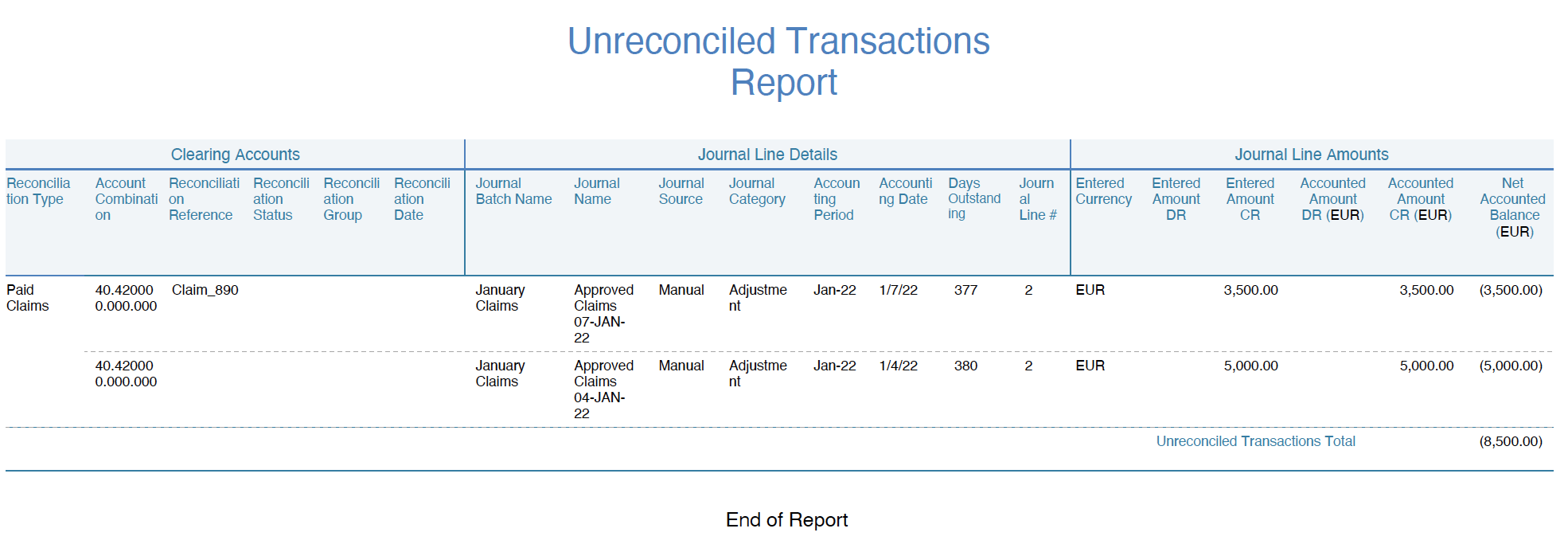

The Unreconciled Transactions Report lists all unreconciled journal lines for the clearing account you select as parameter. These journal lines represent the detail of the account balance.

The Unreconciled Transactions Report below is printed before running the automatic reconciliation. It lists the same detail as the account analysis.

The Unreconciled Transactions Report below is printed after running the automatic reconciliation. It lists only the unreconciled transactions that make up the balance.

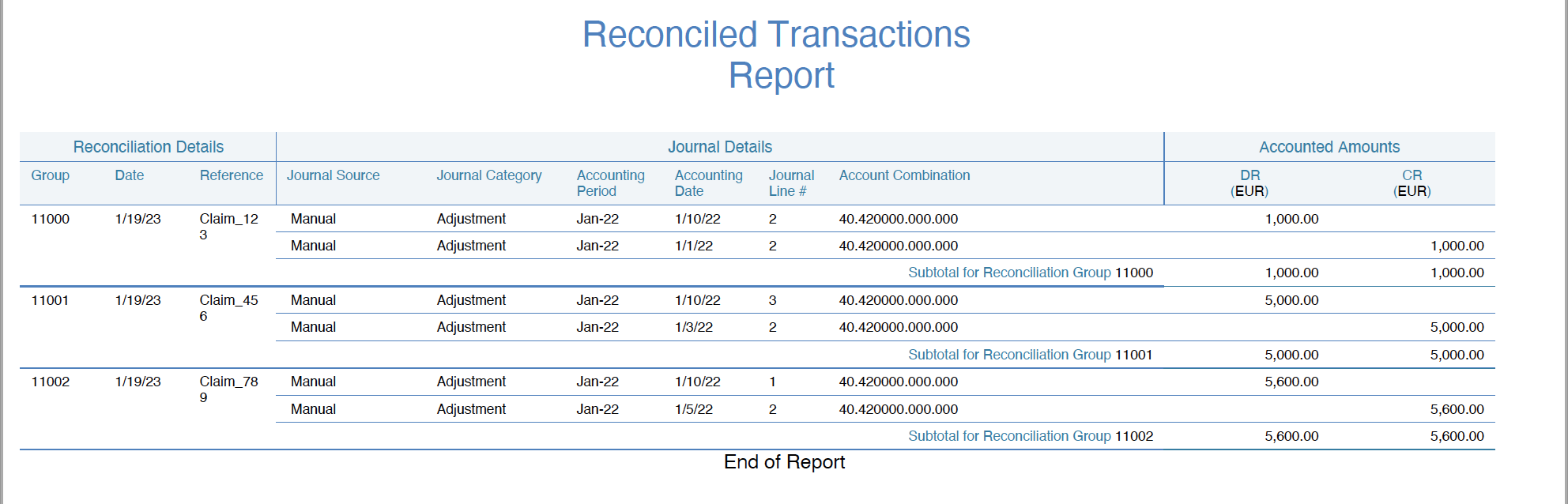

Reconciled Transactions Report

The Reconciled Transactions Report lists journal lines that have been reconciled, either automatically or manually.

Manage Insurance Claims Balances with Clearing Accounts Reconciliation

Reconcile Automatically when Reconciliation References Match

As per introduction, as an insurance company, you manage the contracts and the claims in your legacy system. You also pay the claims within your legacy system. But you need to account for those in Cloud ERP as they must be included in your financial statements.

In Cloud ERP, you don’t create individual third party, but you still want to know which claims are still open.

You can get the detail of the claims balances in Cloud ERP, with Clearing Accounts Reconciliation, without creating a customer for each of your insurance subscribers.

You need to:

- Set the Reconcile attribute to Yes for the GL accounts you want to use for the claims.

- Import the claims, as soon as they are due, as journals lines to these accounts with a reconciliation reference unique to each claim.

- Import the claims payments, when they occur, as journals lines to the same accounts with the same reconciliation references used on the related claims.

- Run the automatic reconciliation process which will stamp as reconciled the claims and payments with the same reconciliation reference with matching total debit and total credit.

- Run the Unreconciled Transactions Report to get the detail of the claims not yet reconciled, therefore not paid.

Reconcile Manually When the Reconciliation References don’t Match

As per Image 6 two claims remain without payment. A new batch of approved claims and payments is created as per Image 8 below.

After running the automatic reconciliation, the Unreconciled Transactions Report looks as per image 9 below. You notice that two lines don’t have a reconciliation references, they were not imported from legacy system. Based on research in your legacy system you identify the other lines to which they must be reconciled.

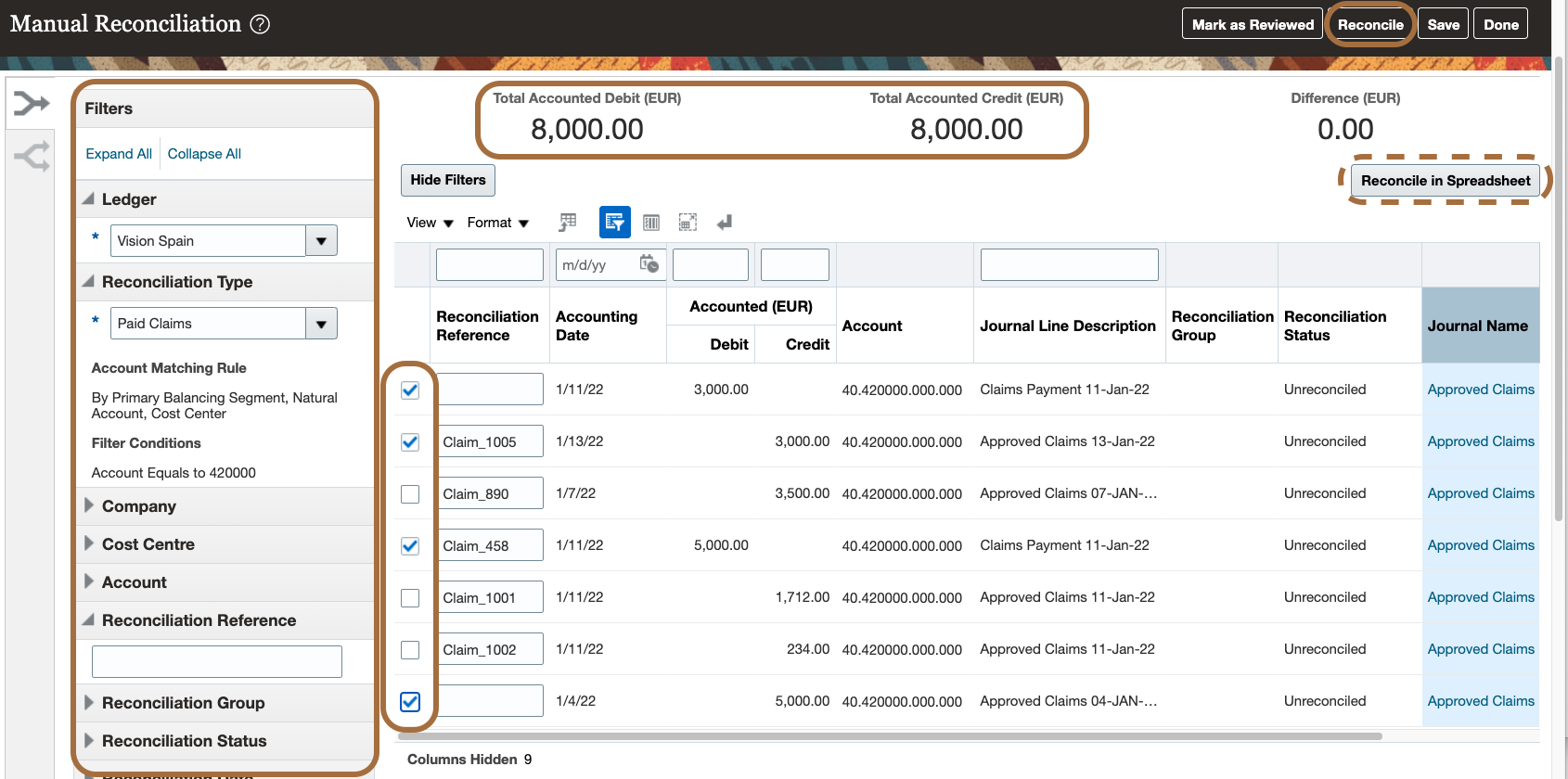

Reconcile Manually on the Manual Reconciliation Page

To reconcile manually on the Manual Reconciliation page, you must first query the unreconciled lines by entering the filters and hitting search at the bottom.

You select the lines and click Reconcile.

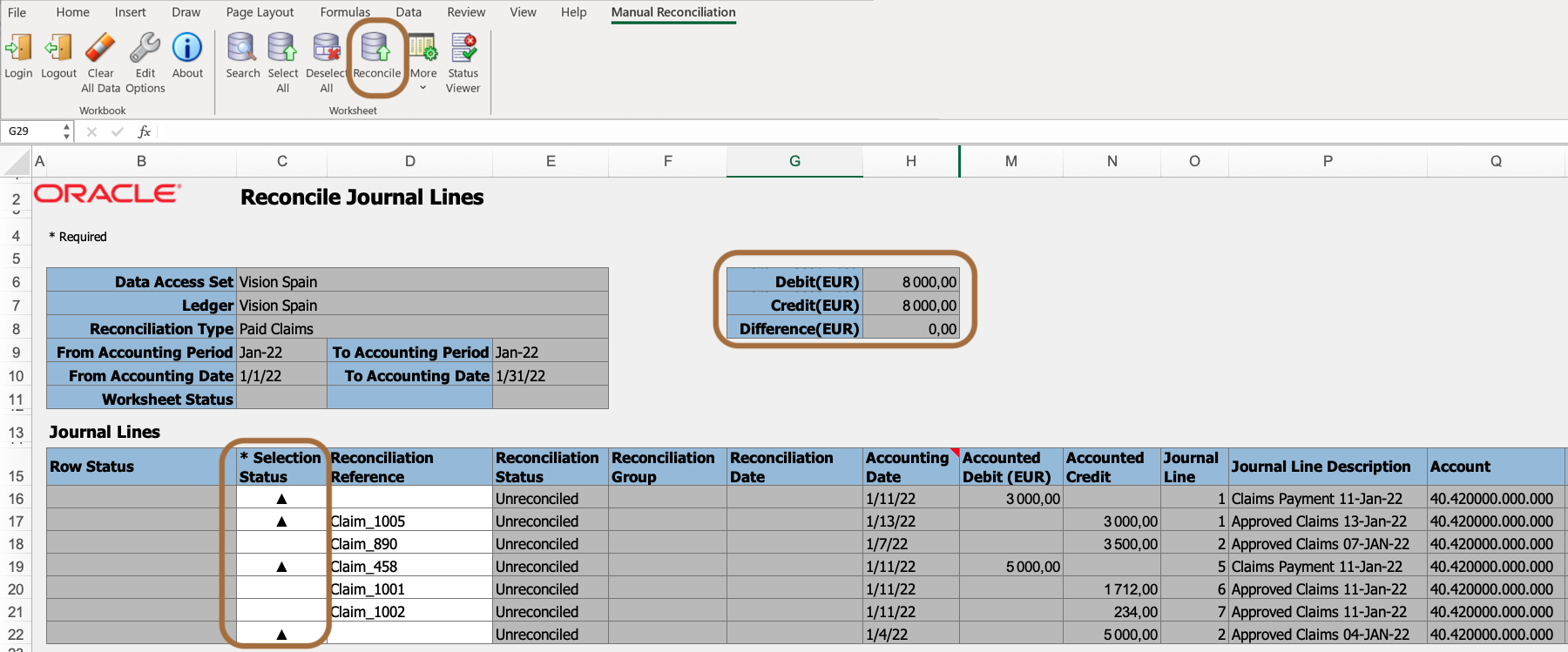

Reconcile Manually in a Spreadsheet

You can also reconcile manually in a spreadsheet. To do so, you click Reconcile in Spreadsheet in the Manual Reconciliation page. An ADFdi spreadsheet opens with the same lines. You select the lines and click on Reconcile.

Manage Purchase Vouchers with Clearing Accounts Reconciliation

Another use case below illustrates how you can benefit from the Clearing Accounts Reconciliation feature.

As a retailer, you issue purchase vouchers from your Point of Sales system, that your customers may use at a later stage for one or multiple purchases.

In Cloud ERP, you don’t create an individual third party for each voucher, but you still need to monitor their balance and account a liability which must be included in your financial statements.

You can manage the vouchers balances in Cloud ERP, with Clearing Accounts Reconciliation, without creating a customer for each voucher.

You can for example:

- Set the Reconcile attribute to Yes for the GL accounts you want to use for the vouchers.

- Import the vouchers, when issued, as journals lines to the credit to these accounts with the voucher number as reconciliation reference.

- When vouchers are used, import them as journals lines to the debit of the same accounts with the voucher number as reconciliation reference.

- Run the automatic reconciliation process which will stamp as reconciled the vouchers (credits) and vouchers usage (debits) with the same reconciliation reference and amounts.

- Run the Unreconciled Transactions Report to get the detail of the vouchers not yet reconciled, therefore not used.

Conclusion

While you may use the Clearing Accounts Reconciliation for month end accounting activities, it can also be used for some of your critical business processes.