Introduction

In most countries, periodic transaction tax returns summarize taxable and tax amounts according to different criteria. These criteria can be tax rates, input and output tax, goods, services, domestic versus export and so forth. The tax return determines your overall net position. The amount you need to pay to the tax authority or the refund you can claim. In this post we outline how you easily prepare this reporting with the Tax Box Allocation feature. You can use this feature whether you report for one entity only or a group of entities.

Definitions

Legal Entity

A legal entity is a real-world enterprise structure that has property rights and obligations that can be enforced through courts of law. A legal entity is responsible for paying and collecting transaction-based taxes. It must also submit detailed transaction and accounting reports to the authorities. A legal entity must comply with local regulations applicable to financial processing and reporting.

Legal Reporting Unit

Each legal entity has at least one legal reporting unit (LRU). Legal reporting units can also be referred to as establishments. You can define either domestic or foreign establishments.

Set up legal reporting units to represent your company and its locations for tax reporting, when you must report under different registration numbers.

Tax Regime

A tax regime is used to group one or more taxes that are similar in nature. In many cases, all taxes for a country are defined under a single tax regime.

- Polish VAT

- United Arabic Emirate VAT

- Argentina VAT

- India GST

Within that geography, the tax regime includes rules for domestic and foreign transactions.

Tax Registration Number

The tax authority provides a tax registration number (TRN) at the time a legal entity, or a legal reporting unit within a legal entity, registers for tax. In most countries you must record this number on transactions and use in the reporting.

In many countries, you produce your tax reporting for a tax registration number.

Reporting Identifier

The reporting identifier is the entity for which you run the Tax Box Allocation process. It can be a ledger, a tax registration number, or a tax registration number within a legal entity.

Determining Factors Set

The Determining Factors Set is a set of transaction attributes evaluated in condition sets to determine the allocation to boxes. For example a Determining Factors Set can include the following attributes:

- Transaction Type

- Tax Rate

Condition Set

A combination of values for one Determining Factors Set that determines the allocation to boxes. For example, considering the determining factors Transaction type and Tax Rate:

- Condition Set 1: If the Transaction Type is “Invoice” and the Tax Rate “standard”, amount is allocated to box 123.

- Condition Set 2: If the Transaction Type is “Invoice” and the Tax Rate “reduced”, amount is allocated to box 234.

Tax returns content

In many countries the tax return is a summary, at different levels, of taxable and tax amounts. Consider the following examples:

UK

There are 9 boxes in the UK VAT return.

- Box 1: VAT due in the period on sales and other outputs

- Box 2: VAT due in the period on acquisitions of goods made in Northern Ireland from EU member states

- Box 3: Total VAT due

- Box 4: VAT reclaimed in the period on purchases and other inputs (including acquisitions from the EU)

- Box 5: Net VAT to pay to HMRC or reclaim

- Box 6: Total value of sales and all other outputs excluding any VAT

- Box 7: Total value of purchases and all other inputs excluding any VAT

- Box 8: Total value of all supplies of goods and related costs, excluding any VAT, to EU member states.

- Box 9: Total value of all acquisitions of goods and related costs, excluding any VAT, from EU member states.

France

There are 73 boxes (called lines) in the French CA3 return, only a few examples are listed below.

Output VAT

- Line 08: Taxable and VAT amounts at standard rate

- Line 09: Taxable and VAT amounts at intermediary rate

- Line 9B: Taxable and VAT amounts at reduced rate

- Line I1: Taxable and Self-Assessed VAT amounts at standard rate on imports

Input VAT

- Line 19: Recoverable VAT on assets purchases

- Line 20: Recoverable VAT on goods and services purchases

- Line 24: Recoverable VAT on imports

Poland

There are 50 boxes in the Polish return, called JPK_V7m only a few examples are listed below.

- Box P_10: Taxable base for the tax-exempt supply of goods and/or services in the territory of the country

- Box P_11: Taxable base for the supply of goods and/or services outside of the territory of the country

- Box P_13: Taxable base for the supply of goods and/or services in the territory of the country subject to the 0% VAT rate

- Box P_19: Taxable base for the 22% or 23% VAT taxed supply of goods and/or services in the territory of the country, subject to the amendment referred to under Art. 89a sec. 1 and sec. 4 of the Act

- Box P_20: Output tax charged on the supply of goods and/or services in the territory of the country, taxed at the 22% or 23% VAT rates, and the amendment made according to Art. 89a sec. 1 and sec. 4 of the Act

Prepare the indirect tax returns with Tax Box Allocation

The tax box allocation feature automatically calculates the taxable and tax amounts that you must report on your tax return. All you must do is complete the tax return and submit it to the authorities.

It consists of the following components and steps:

- Tax boxes definition and rules for allocating taxable and tax amounts to these boxes.

- Transactions selection considering their tax point basis, determining when they must be reported. Depending on the tax regulations, transactions can be reportable based their creation, accounting, or payment dates.

- Allocation to boxes of transaction taxable and tax amounts.

- Report which displays the taxable and tax amounts for each box which you use to complete your tax return. The report also gives the detail of the transactions.

- Management of transactions and periods reporting status.

In other words, the tax box allocation feature is a bridge between the way input and output taxes are calculated and stored on individual subledger transactions, and the way they are summarized and reported to the tax authorities.

Manually assigning individual transaction taxable and tax amounts to boxes based on transaction detail or accounting is complex and error prone. The feature allows you to automate it and therefore eliminates the effort and risk of doing it manually. The tax returns preparers role changes from significant manual effort to monitoring and reconciling automated processing.

With the tax box allocation feature you report the Oracle subledger transactions, and the taxable transactions and journals imported in the tax repository. You can therefore prepare your tax returns including the tax calculated in legacy systems. You don’t need to import each individual transaction from legacy system. You only need to import the summary with tax info in the tax repository, instead of only journals in general ledger.

Note: You shouldn’t import transactions only for the purpose of tax reporting consolidation if you wouldn’t import them for accounting purpose.

Setup the Tax Box Allocation

You setup Tax Box Allocation rules to assign invoices and transactions lines to boxes depending on their attributes.

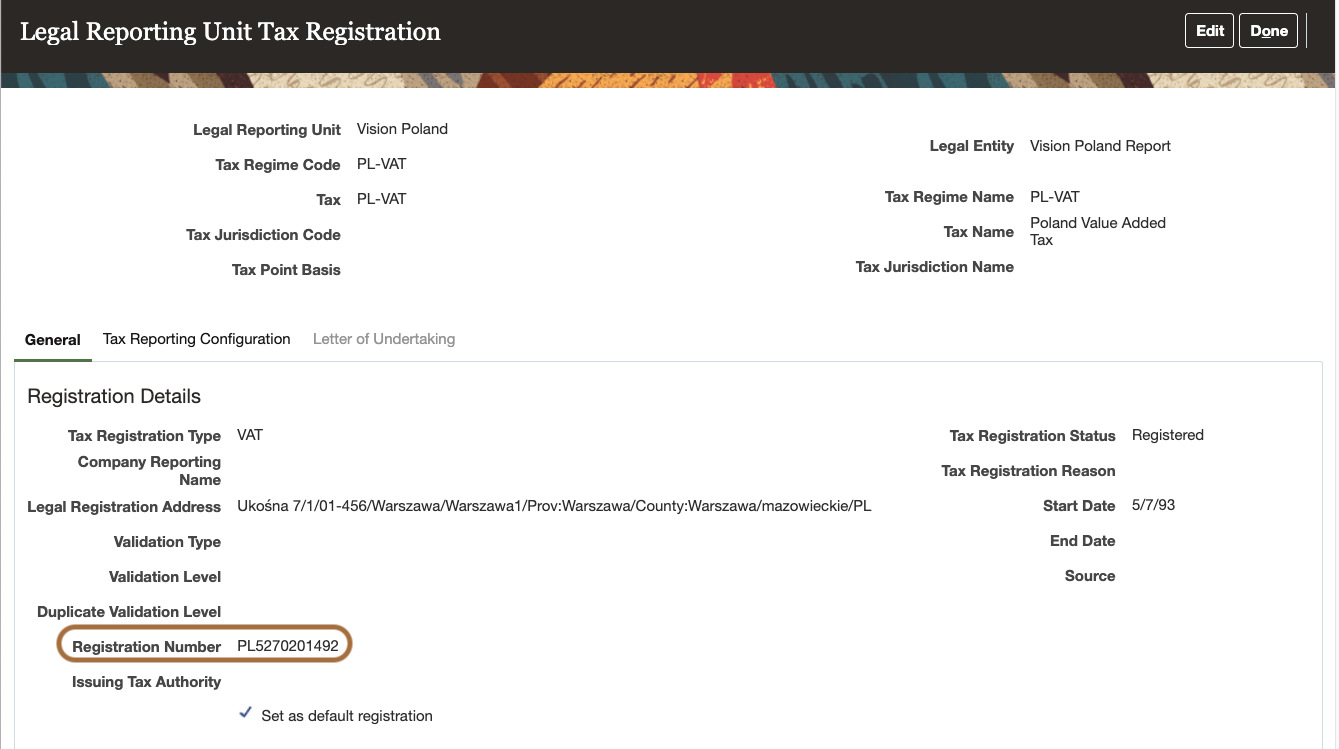

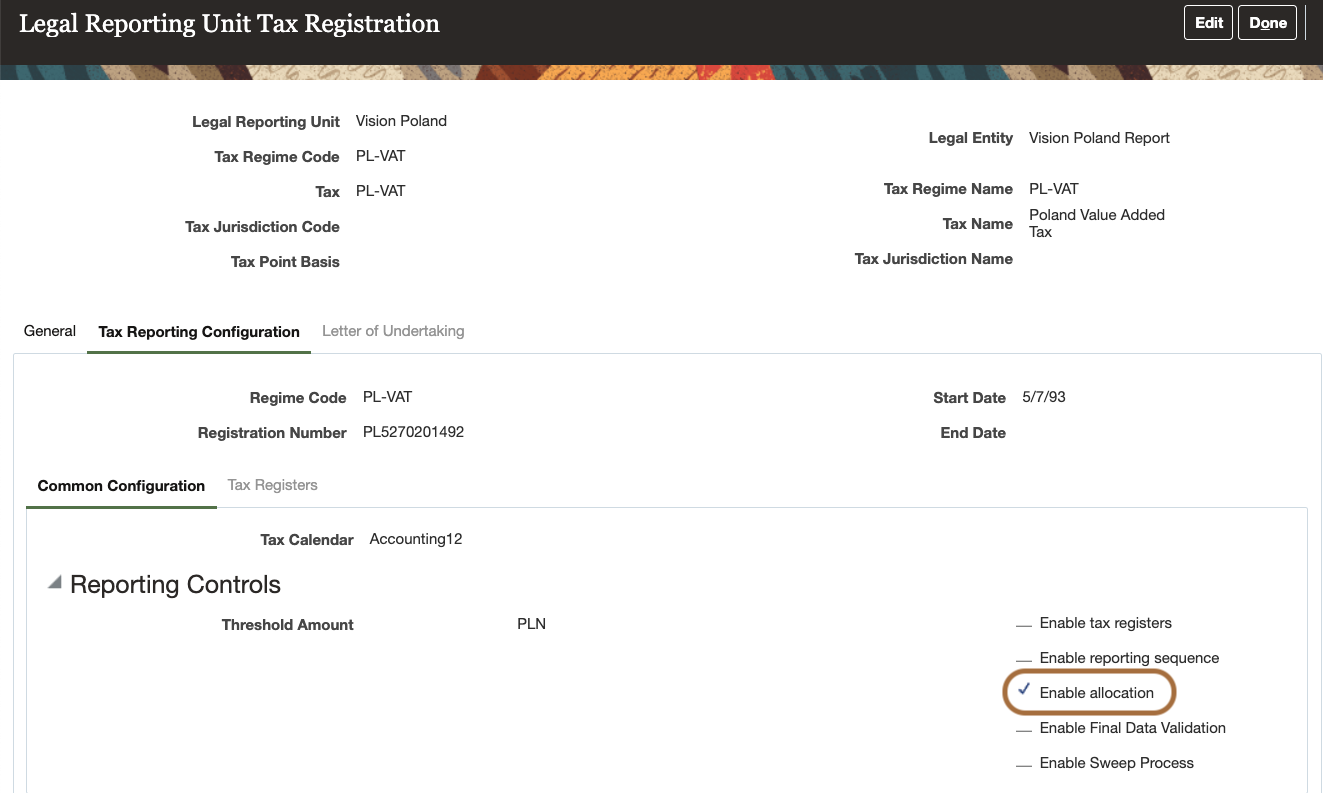

The pre-requisites steps are to:

- Complete the tax setup, and especially for the Tax Box Allocation the

- Define a Registration Number for the Legal Reporting Unit

- Enable the Allocation capability

The Tax Box Allocation setup steps are:

- Define Tax Reporting Type and Codes to represent the boxes

- Define Tax Determining Factors Sets

- Define Tax Condition Sets

- Define Tax Box Allocation Rules

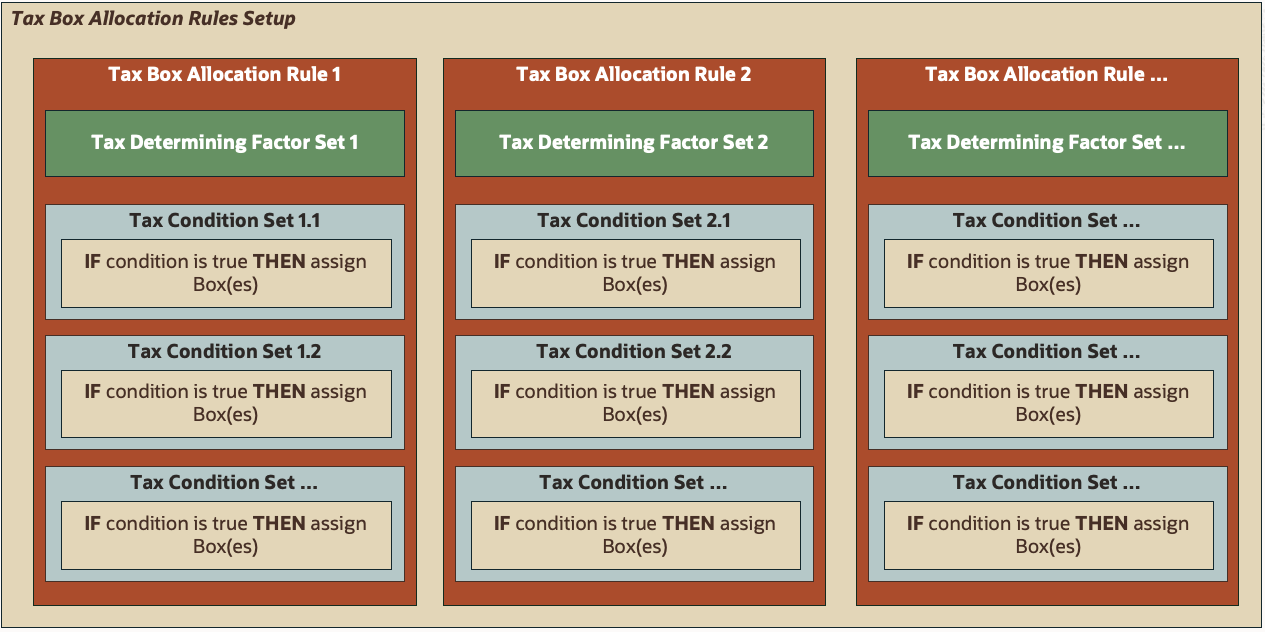

Overall, the Tax Box Allocation setup looks as below. One or multiple rules with Tax Condition Sets based on Tax Determining Factor sets. If the transactions conditions are met, the amounts are allocated to boxes, otherwise they are not allocated.

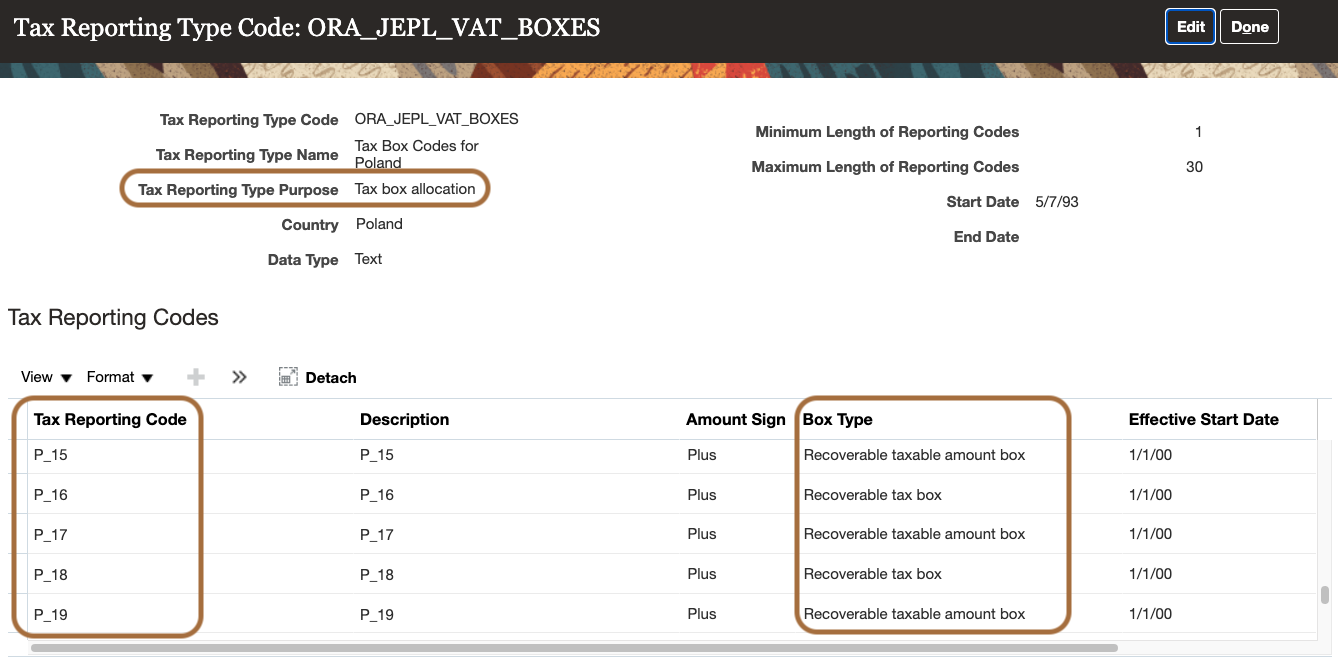

Define Tax Reporting Type and Codes to represent the Boxes

You define the various boxes as Tax Reporting Codes under a Tax Reporting Type with purpose “Tax box allocation”.

Note: A Tax Reporting Type Code starting with ”ORA_” is delivered out of the box, but you can define your own.

The boxes may have different types used for different amounts:

- Recoverable Taxable Amount Box

- Recoverable Tax Box

- Non-Recoverable Taxable Amount Box

- Non-Recoverable Tax Box

- Total Amount Box

Define the “Tax Determining Factors Set” to do the allocation based on variation of those determining factors

You can use several of the available attributes to allocate transactions. These attributes are related to various aspects of the transactions, such as:

- Process: Document Type, Line Class, Transaction Business Category

- Product: Product Type, Product Category, Asset Flag

- Third Party: Registration Status, Party Fiscal Classification

- Geography: Country, State

- Tax: Rate, Status, Jurisdiction, Self-Assessed Flag

Note: The list above is not complete, refer to documentation links provided at the end of this article. You need to identify the attributes necessary for a country tax return to define the appropriate Tax Determining Factors Sets.

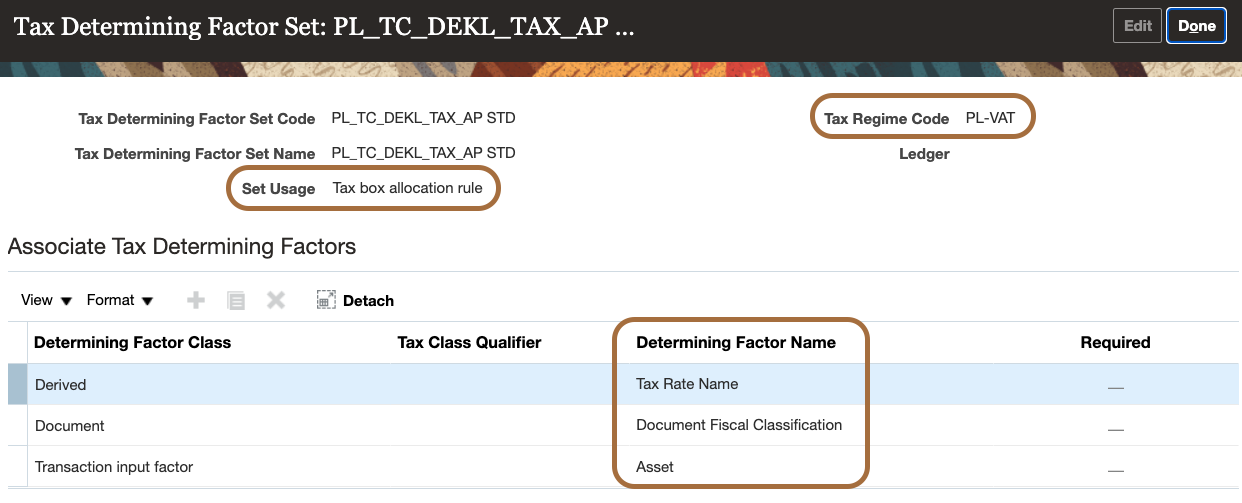

If you need to allocate payable invoices to different boxes based on:

- The Tax Rate Name

- The Document Fiscal Classification of the invoice

- Whether it is an asset purchase

You define a Tax Determining Factor Set with these three determining factors

Define rules for payables invoices

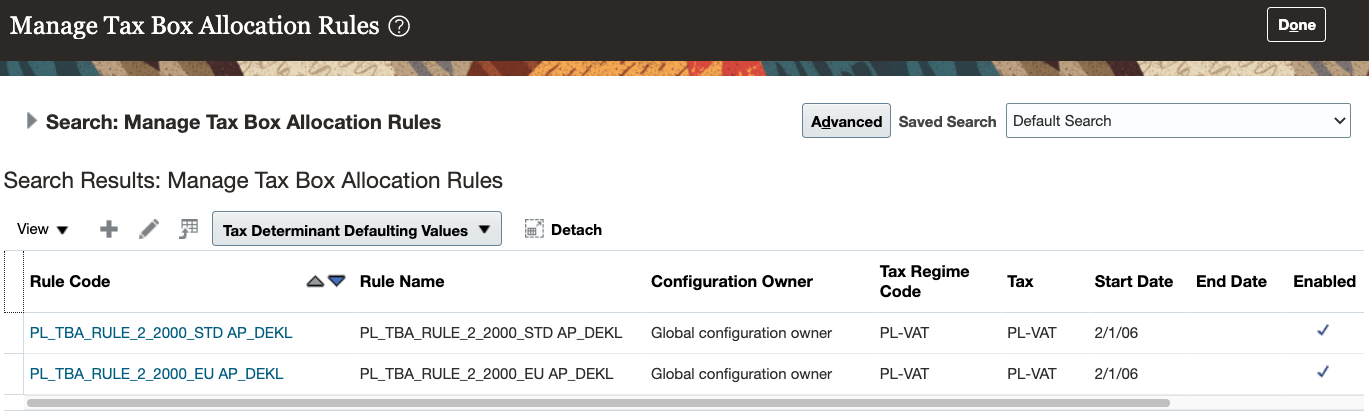

Based on your needs, you may define different rules for domestic and intra-EU invoices. In the example below you define two rules:

- PL_TBA_RULE_2_2000_STD AP_DEKL for domestic invoices

- PL_TBA_RULE_2_2000_EU AP_DEKL for intra EU invoices

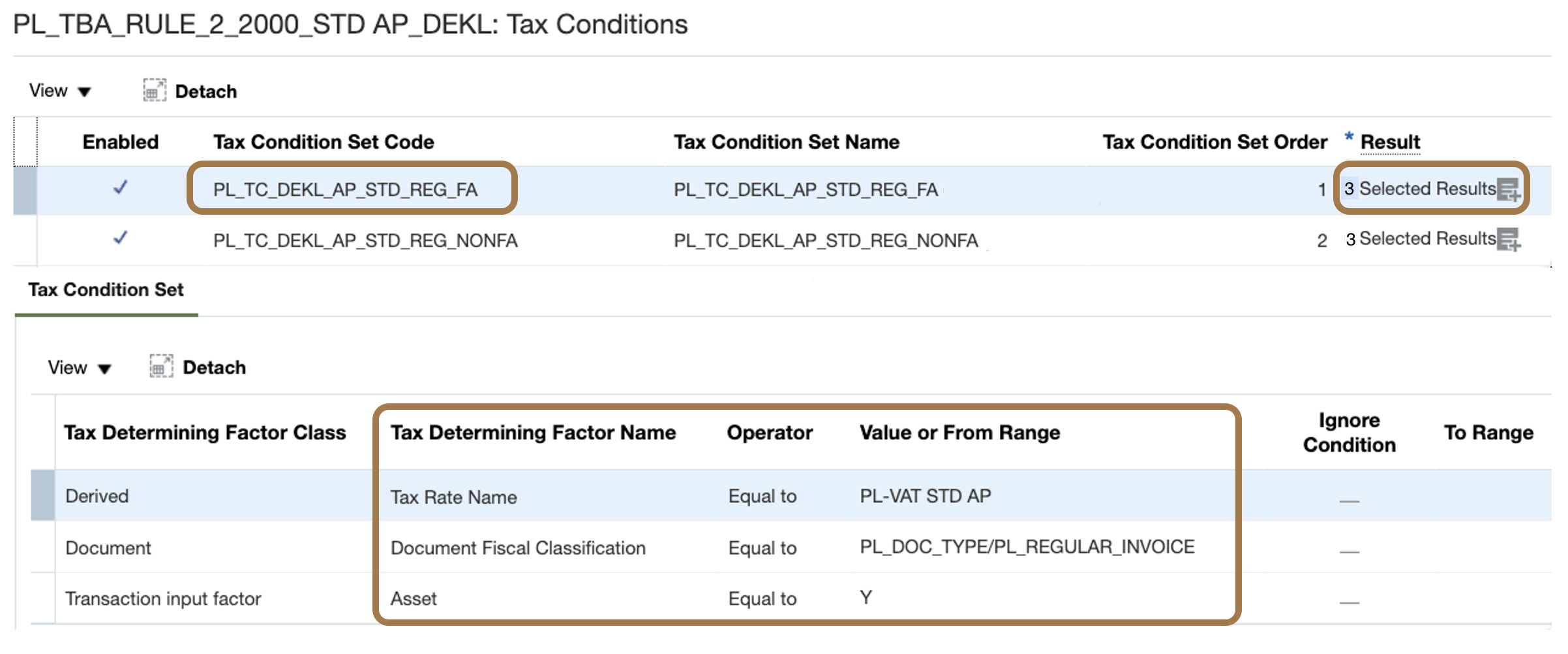

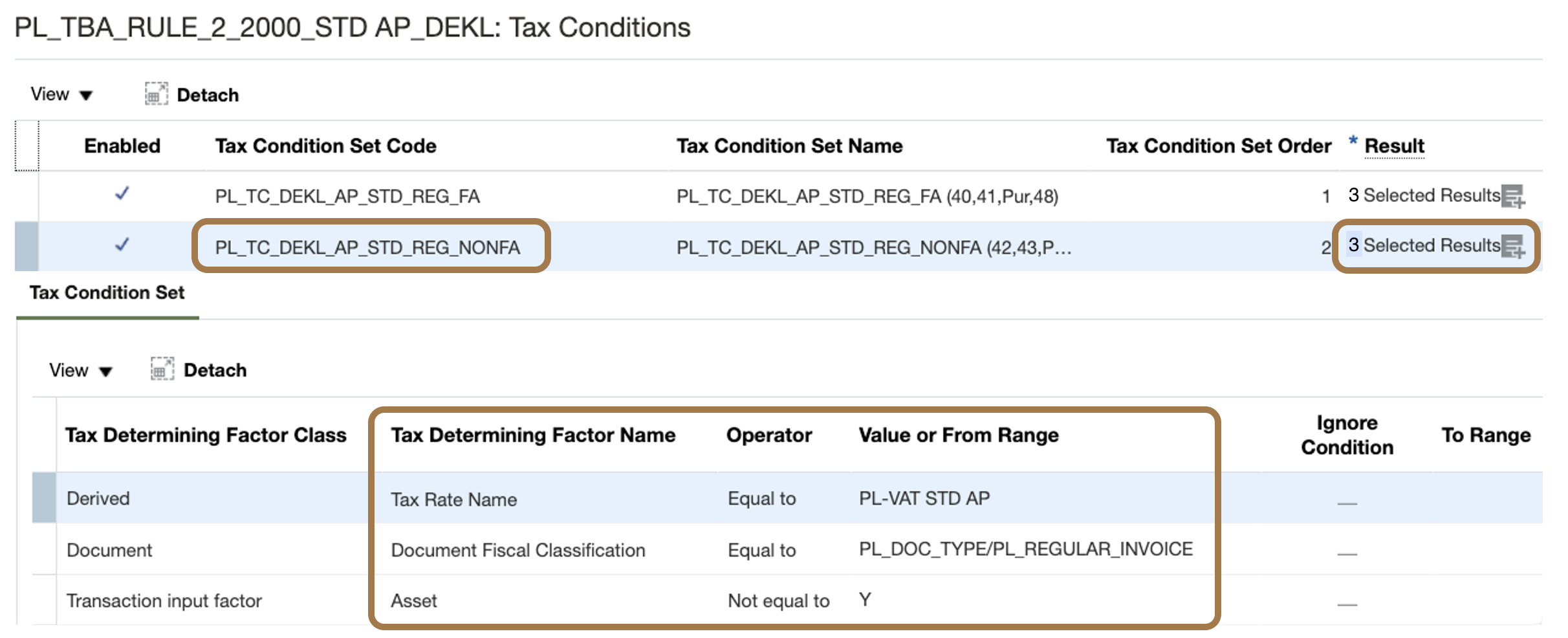

You define two condition sets to allocate the assets domestic invoices and the other domestic invoices to different boxes.

In the example below you define:

- The condition set PL_TC_DEKL_AP_STD_REG_FA for the assets purchase standard invoices with standard VAT.

- The condition set PL_TC_DEKL_AP_STD_REG_NONFA for the other purchases with standard VAT.

Note the different setup (operator) for the “Asset” determining factor.

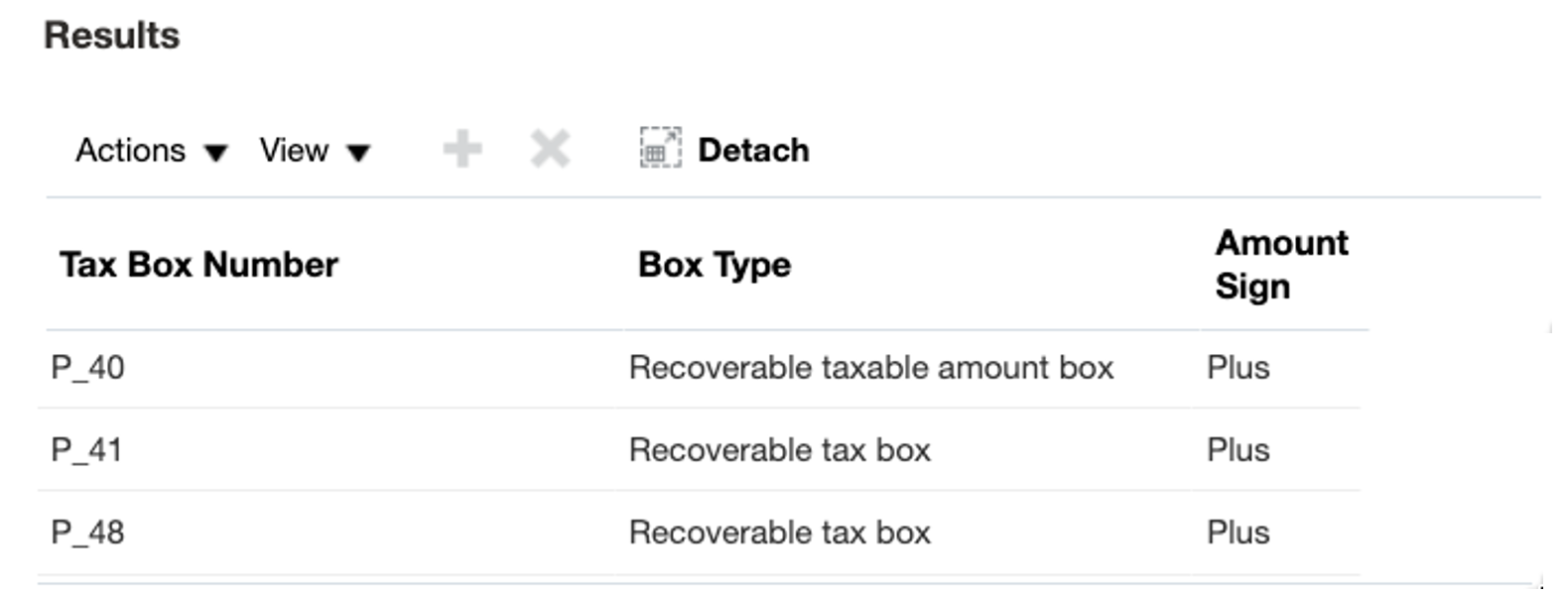

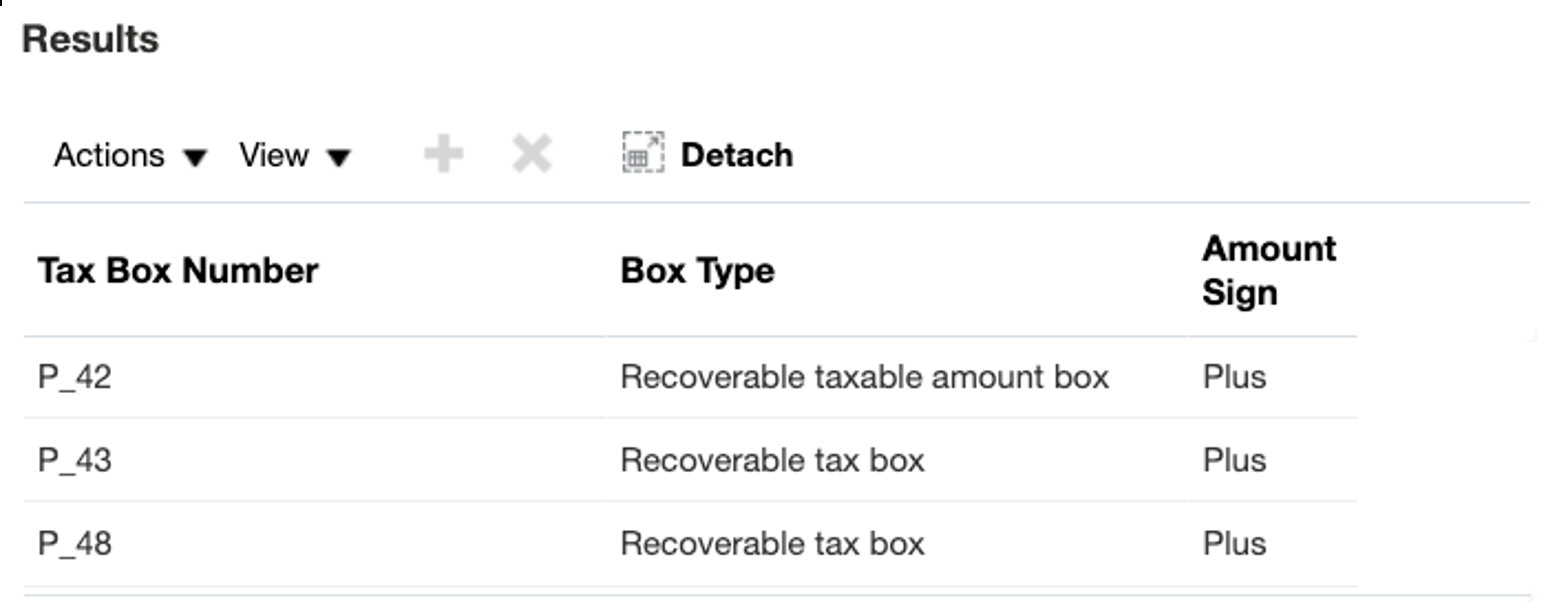

You allocate:

- The asset purchases taxable and tax amounts to boxes P_40 and P_41.

- The other purchases to boxes P_42 and P_43.

- The tax amounts to box P_48 in both cases as you want to have the total of the recoverable tax at standard rate.

With allocation to 3 boxes

For example, for the non-assets purchase standard invoices with standard VAT:

With allocation to 3 boxes

You do similar setup for the receivables transactions.

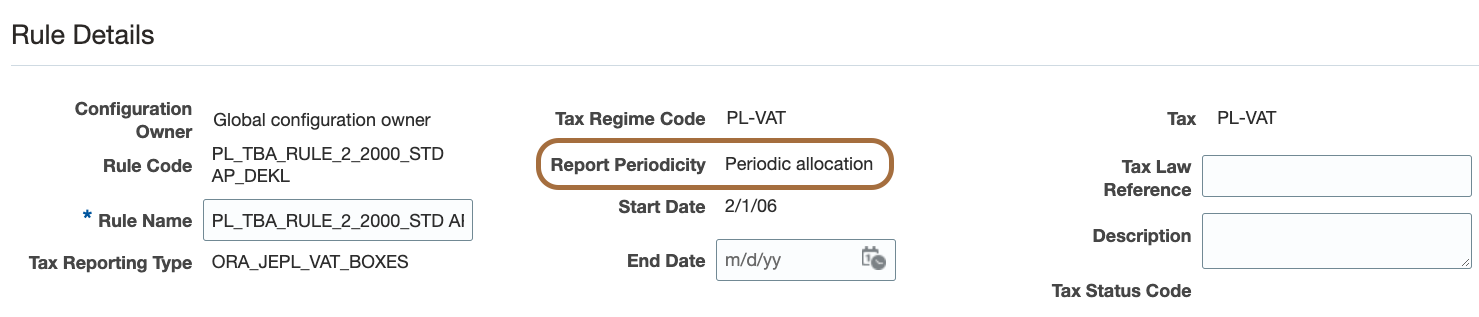

Define the periodicity of the rules

In many countries you need to submit monthly and yearly returns. For example in Spain you must submit the Modelo 320 monthly and the Modelo 390 yearly. Modelo 390 is a summary with less detail. You use 2 sets of rules to satisfy this requirement. Periodic rules to determine the amounts used in Modelo 320 and annual rules for Modelo 390.

When you run the Tax Box Allocation for a period, the system does both monthly and yearly allocations.

Run the Tax Box Allocation process

You run the allocation process for a reporting identifier and a period, to allocate amounts to boxes as per the rules you defined. Prior to allocation, you must select the transactions reportable in that period.

You can execute the selection and allocation processes in two steps:

- Select Transactions for Tax Reporting

- Submit the Tax Allocation process

You can also launch both processes in one single step after enabling this capability. If you report at Ledger or TRN level (detail further down), you must have launched the Select Transactions for Tax Reporting process independently at least once, prior to using the one step submission.

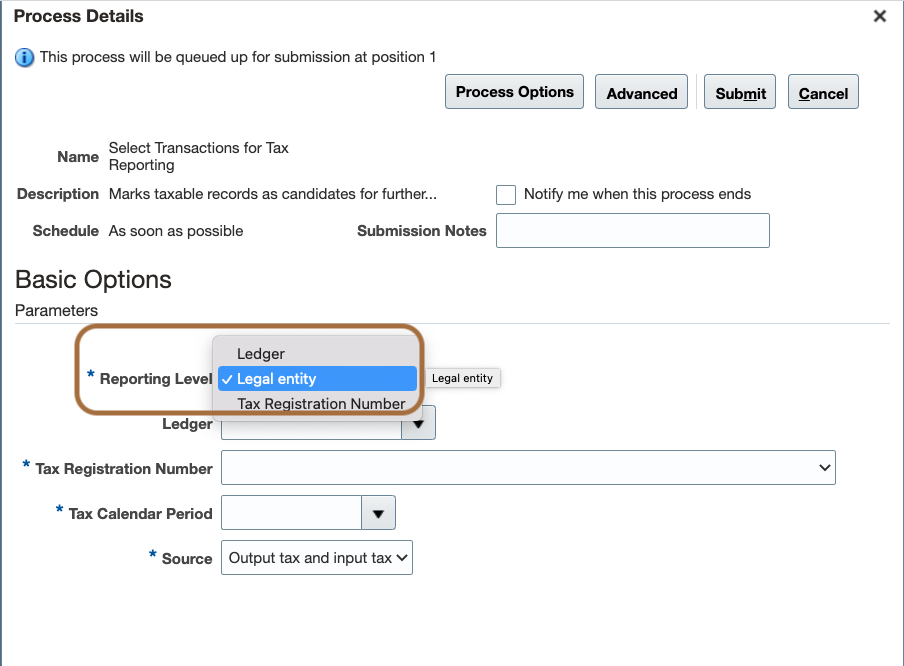

Select Transactions for Tax Reporting

You run the Select Transactions for Tax Reporting (aka selection process) at different reporting level for different use cases. The Select Transactions for Tax Reporting identifies the transactions reportable as per the parameters you are using.

| Reporting Level | Use Cases and Behavior |

|---|---|

| Ledger | Use the Ledger reporting level if you need to include all Legal Entities (LEs) / Legal Reporting Units (LRUs) from one ledger in one consolidated reporting. These LEs / LRUs having different Tax Registration numbers.

|

| Legal Entity | Use the Legal Entity level to report transactions for one Tax Registration Number within a Legal Entity. |

| Tax Registration Number | Use the Tax Registration Number level for a consolidated report for multiple legal entities with the same tax registration number. This is the case when you have subscribed to the group reporting in a county. |

Run the Tax Allocation process

With this process you allocate the transactions to boxes per the rules you defined.

Note: At the end of the allocation process check the “Tax Allocation Exception Listing”, to review the non-allocated reportable transactions. Transactions may not be allocated if, for example, they are a new type of transactions for which you haven’t defined a rule yet. You can run the Tax Box Allocation with additional logging detail explaining why these transactions don’t satisfy existing rules.

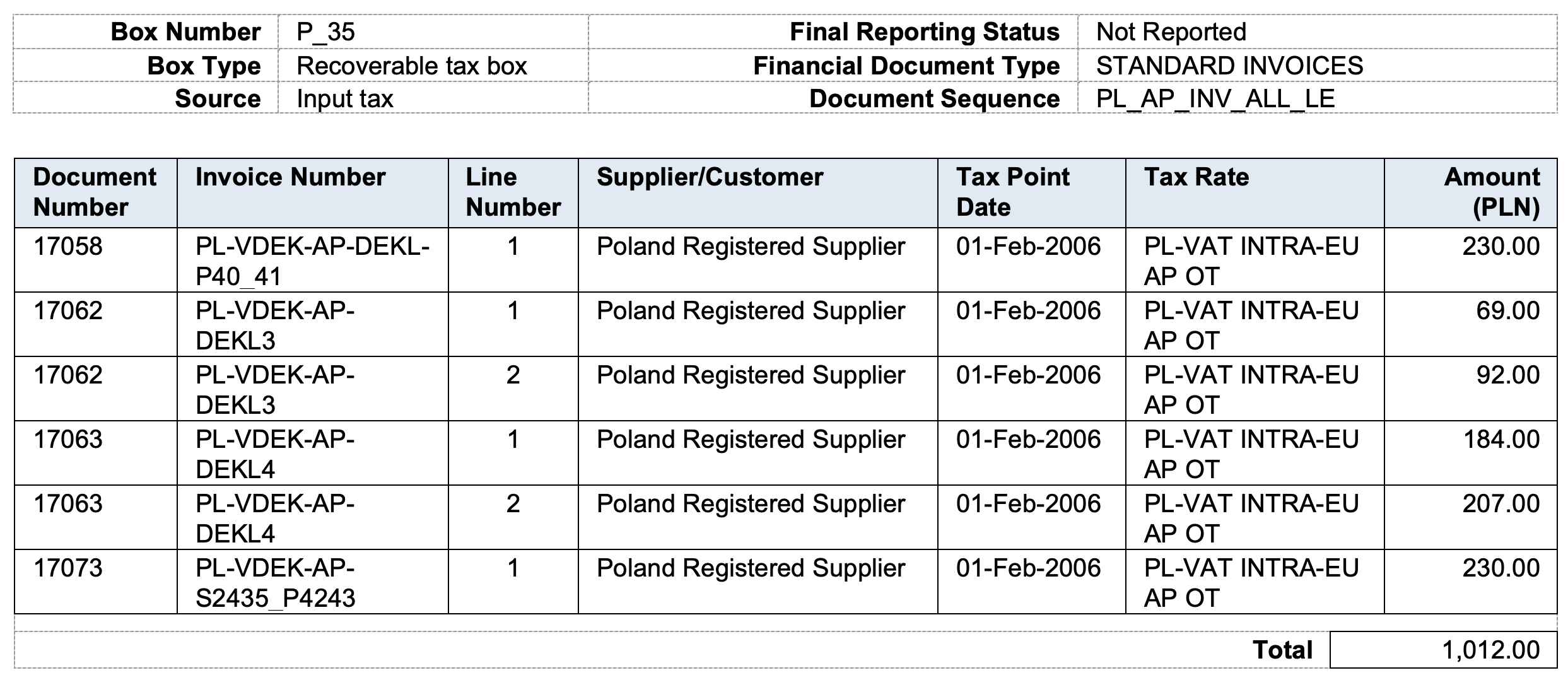

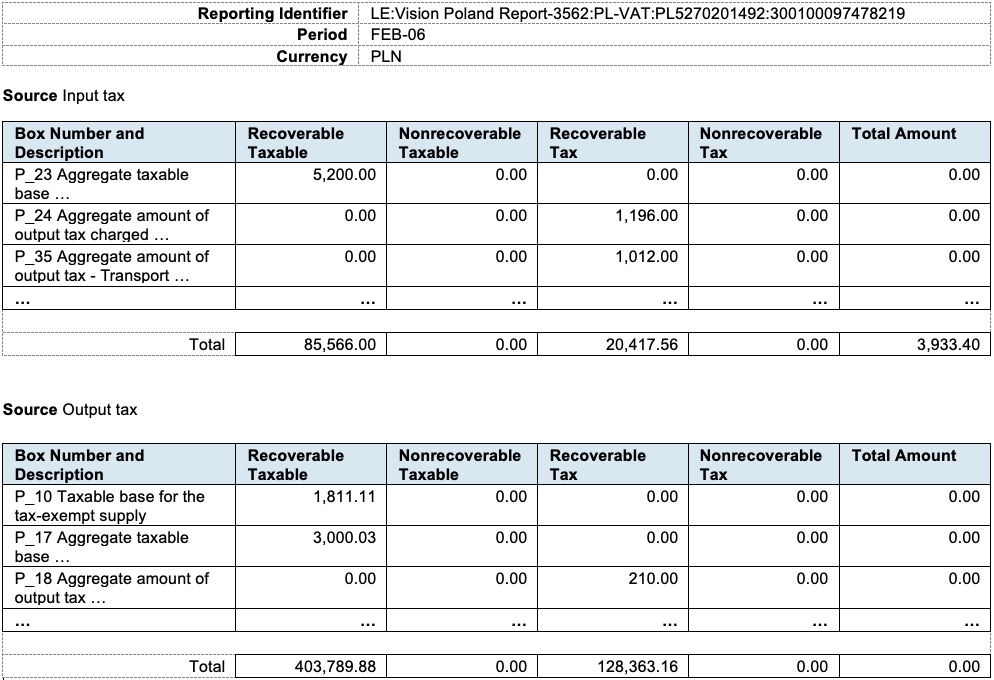

Run the Tax Box Preparation Report

The Tax Box Return Preparation Report displays the result of the allocation and for each box the detail of the allocated transactions.

You can complete the tax return using the summary available at the end of the report which gives the total per box.

Note: The column “Total Amount” is not the sum of the preceding columns. This column displays amounts when you allocate the total amount of a transaction to a box not splitting the taxable and tax amounts.

Close the tax reporting period

You can run the Selection and Allocation processes and the Tax Box Return Preparation report multiple times for one period if needed. You may need to do so if for example:

- You create new reportable transactions, or modify some transactions, and you want to include those in your in-progress reporting

- You modify the allocation rules

Once you consider your Tax Box Return Preparation report as final, you run the Finalize Transactions for Tax Reporting to close the tax reporting period. This process also stamps the transactions as finally reported.

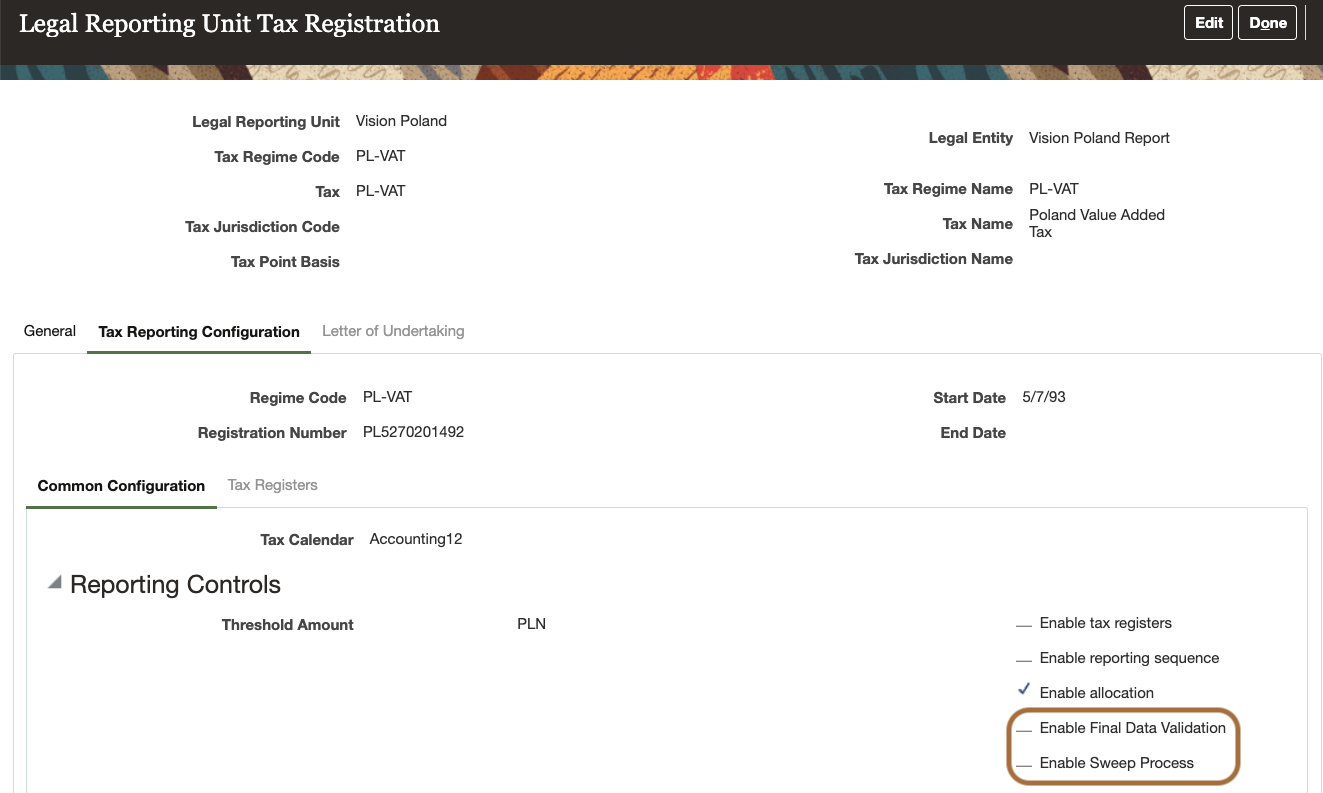

You can enable 2 options in the Tax Reporting Configuration (see figure 15 below), for finalization process.

| Options | Description |

|---|---|

| Enable Final Data Validation | You enable Final Data Validation to check for any transaction, reportable in the period, created or modified after the Selection Process run. If you want to report these transactions in the current tax period, re-run the Selection process. You must also re-run the Tax Box Allocation process before the Tax Box Return Preparation Report |

| Enable Sweep Process | If you have already reported to tax authority for the current period, you may want to report these new and modified transactions in next period. Select the Enable Sweep Process checkbox to do so. Please note that the system disables the Enable Sweep Process checkbox after you run Finalize Transactions for Tax Reporting process. You must consider sweeping on a period-by-period basis, not as a default approach. |

Conclusion

With Tax Box Allocation process and reports, you easily prepare your tax returns in many countries around the globe. You can use these whether you report for an individual entity or for a group of entities.

Reference Documentation

- Tax Box Allocations <https://docs.oracle.com/en/cloud/saas/financials/23a/faitx/tax-box-allocations.html#s20046231>

- VAT Registers and JPK Extracts for Poland Topical Essay <https://support.oracle.com/epmos/main/downloadattachmentprocessor?attachid=2576459.1%3AVATRGSNJPKEXT_POLD&docType=REFERENCE&action=download>

- 21B – Transaction Review Before Finalization of the VAT Period <https://www.oracle.com/webfolder/technetwork/tutorials/tutorial/cloud/r13/wn/fin/releases/21B/21B-financials-wn.htm#F17776>

- 22B – Single step submission of Select Transactions for Tax Reporting and Tax Allocation processes <https://www.oracle.com/webfolder/technetwork/tutorials/tutorial/cloud/r13/wn/fin/releases/22B/22B-financials-wn.htm#F22639>