You have multiple legal entities per country and you need to produce distinct reporting, with document sequencing for each legal entity. In this post we outline how you easily fulfill this requirement with the appropriate legal entity setup. This configuration impacts document sequencing and intercompany accounting.

Definitions

Legal Entity

A legal entity is a real-world enterprise structure that has property rights and obligations that can be enforced through courts of law. A legal entity is responsible for paying and collecting transaction-based taxes and submitting detailed transaction and accounting reports to the authorities. A legal entity must comply with local regulations applicable to financial processing and reporting.

Legal Employer

You should define a legal entity as a legal employer in the Oracle Fusion Legal Entity Configurator. The legal entities identified as legal employers are available for use in Human Capital Management (HCM) applications.

You capture the legal employer at the work relationship level, and all assignments within that relationship are automatically with that legal employer.

Legal Reporting Unit

Each legal entity has at least one legal reporting unit (LRU). Legal reporting units can also be referred to as establishments. You can define either domestic or foreign establishments.

Define legal reporting units by physical location, such as sales offices or warehouses. Set up legal reporting units to represent your company and its locations for tax reporting, when you must report under different registration numbers.

Balancing Segment

Balancing segments ensure all journals balance per balancing segment value or combination of multiple balancing segment values. The General Ledger application automatically calculates and creates balancing lines as required in journal entries.

In ledger processing and reporting (i.e., journals and balances), the primary balancing segment value represents the legal entity. Ideally, you should have a direct relationship between the real-world legal entity and the primary balancing segment value.

Sequencing

Sequencing assigns unique numbers to Cloud ERP transactions (customer and supplier invoices) and journals. It has its roots in recording transactions manually in ledgers, where accountants entered the transactions one after the other without the ability to insert some in between at a later stage.

Sequences have a scope: ledger, legal entity, and time (usually a financial year). Sequentially numbering the journals simplifies the task of tracing the journal entries and is a legal requirement in some countries, especially in Europe, Asia, and Latin America.

With sequencing, fiscal authorities easily verify the completeness of a company’s accounting record. Typically, fiscal authorities pay more attention to sequencing of invoices than payments. This is because invoices carry VAT and complete and accurate reporting of invoices reduces opportunities for misreporting VAT.

In many countries, you assign sequence numbers sequentially and without gaps.

Identify Your Real-World Legal Entities and Legal Reporting Unit

Consider the definitions above to define your legal entities and legal reporting units.

You must keep in mind that the objective here is to partition journals, sequence journals and transactions per the requirements of the countries where you operate. Countries differ in how closely they expect information systems to replicate manual systems. Some countries mandate gapless, chronological sequencing since this is a natural consequence of manually recording sequences in ledgers. Others simply want a gapless or unique sequence number as a means to uniquely identify a transaction.

In Brazil, use different LRUs when you need to report one tax in one jurisdiction under two different registration numbers. For example, for movements between two warehouses within one legal entity.

Use different LRUs in Europe when you have a legal entity in one country, registered for tax in multiple countries and the geography is an attribute of the tax rules.

You could also have one single LRU if the geography is not important if it is not used in tax rules conditions.

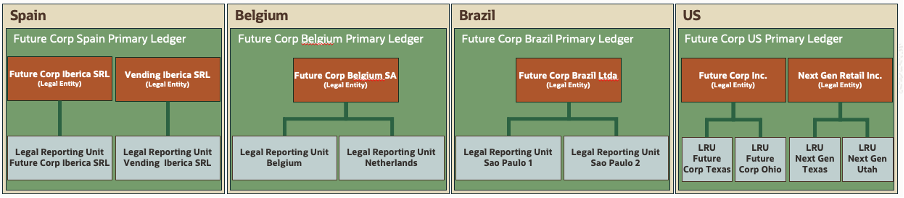

Spain – 2 legal entities, each one has 1 LRU

Belgium – 1 legal entity registered in both Belgium & the Netherlands. Future Corp doesn’t have any LE in the Netherlands

Brazil – 1 legal entity with 2 warehouses in Sao Paulo (tax must be calculated and reported for movements of goods between the warehouses)

US – 2 legal entities, each one has 1 LRU per state

Partition Accounting Data by Legal Entity

You must partition the journal entries (i.e. sequence and report them separately) by legal entity in Southern and Eastern Europe, Latin America, and some Asian countries. In these regions a journal can impact only one legal entity.

In United States the regulation is directed at a group of companies under common ownership or control. Within a group of companies, journals may contain lines for multiple legal entities with the constraint to always balance accounting entries by legal entity.

In Cloud ERP, the following sequencing features address the requirement to assign unique sequential numbers to journals and transactions.

Sequence Journals by Legal Entity

General Ledger offers two journal sequencing features.

Accounting Sequences

The system assigns the accounting sequences when you post the GL journals or complete the subledger journals. You must setup the sequences before you create journals.

Sequence numbers simplify tracing of the journals. With the sequence numbers, you demonstrate to auditors that you create journals timely.

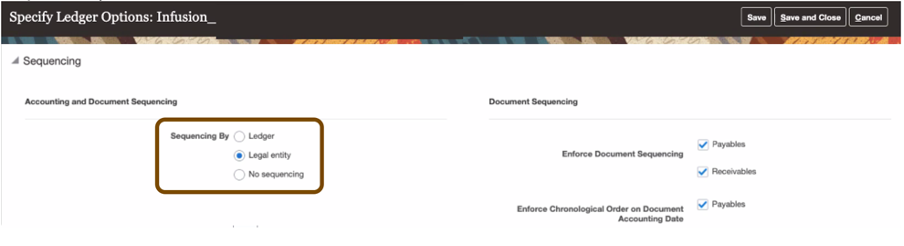

General Ledger journals are sequenced without gaps by journal category and / or journal source within a legal entity or a ledger. The sequencing level (legal entity or ledger) is a ledger level option. Chose the “Legal Entity” option to sequence by LE (Figure 2 below).

Reporting Sequences

Reporting sequences differ from accounting sequences. The system assigns reporting sequences to journals when you close the period. The two sequences are not mutually exclusive. They can coexist in the same journal entry.

You can setup the reporting sequence after the creation of the journals, but before you finally close the period.

The Subledger journals and the journals created in General Ledger are sequenced without gaps by legal entity in GL accounting date order (chronological).

In the French Audit File:

- Use either the accounting or the reporting sequence.

- Use the reporting sequence to report detailed subledger journals and journals created in General Ledger within one single sequence.

- Use the reporting sequence to also ensure all reported journals are sequenced.

The Italian Libro Giornale uses both accounting and reporting sequences:

- The reporting sequence is used for chronological and gapless ordering.

- The accounting sequence is used to easily identify the journal entry in the system.

Sequence Supplier Invoices and Payments by Legal Entity

On the Payables side, supplier invoices are assigned numbers as they are registered in the system. Supplier payments as they are issued.

You enable the Enforce Document Sequencing ledger option for Payables to ensure you sequence all transactions. You set the sequencing level ledger option to Legal Entity as per image1.

The system sequences the supplier invoices and payments without gaps within the legal entity, by the document sequence categories you define (e.g. Domestic Invoices, Foreign Invoices).

Chronological Sequencing is an additional requirement to sequence the supplier invoices in GL Date order.

- Payables will prevent invoices creation if the accounting date violates the chronology, when the option Enforce Chronological Order on Document Accounting Date is enabled.

- The chronological sequencing option is available only for sequencing by legal entity.

Sequence the Customer Transactions by Legal Entity

On the Receivables side, customer invoices are assigned document numbers as they are issued. Receivables also have a transaction number. The transaction number can be distinct from the document number, but customers often consider the document number as the transaction number. The system offers the ability to use the document numbers as invoice number.

You may want to sequence the customer transactions without gaps even if this is not a statutory requirement.

You can configure gapless document sequencing for customer transactions, by enabling the Enforce Document Sequencing option for Receivables.

Generate Intercompany Accounting when one Legal Entity Pays or Collects on Behalf of Others

You have multiple legal entities within one country. One of the legal entities pays and / or receives payments on-behalf of others. You can automatically generate the required intercompany accounting if these different legal entities are defined within the same ledger.

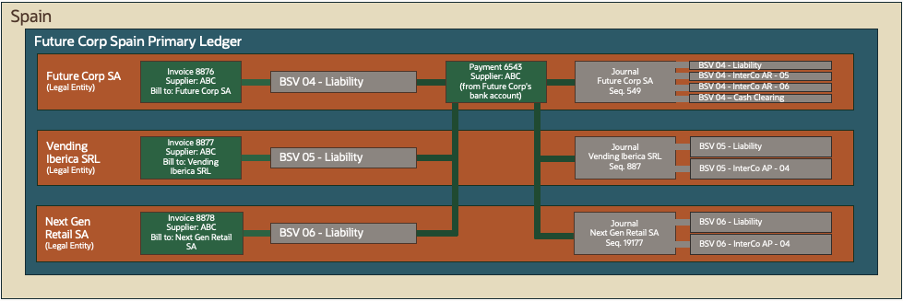

Procure to Pay Flow

In the enterprise structure described in figure 2 below, the Future Corp SA legal entity issues payments to suppliers on behalf of other legal entities in the same ledger. The configuration is done via the service provider relationship. Each legal entity has one single balancing segment value.

For the paid invoices which belong to legal entities different from the owning the bank account from which the funds are drawn, subledger accounting detects the accounting crosses legal entities and generates the required intercompany accounting.

Configure the gapless sequencing at legal entity level to go one step further and automatically generate separate journal entries for each legal entity involved in the payment.

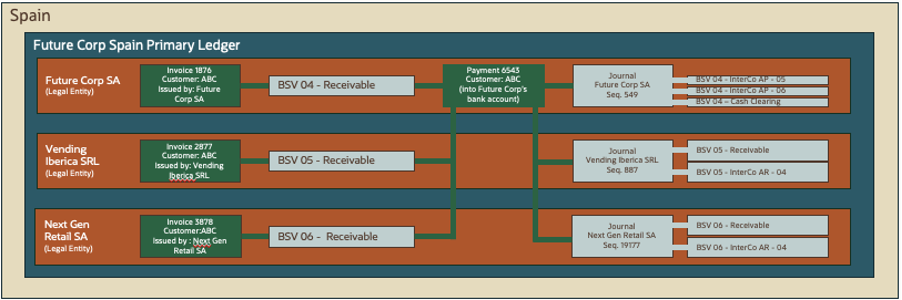

Order to Cash Flow

Similar intercompany accounting is generated for the Order to Cash flow when one legal entity collects funds from customers for invoices issued by different legal entities.

With gapless sequencing configured at the legal entity level, separate journal entries are created for each legal entity.

Best Implementation Practices

Define Legal Entities only for Real-world Legal Entities

A legal entity is a real-world enterprise structure with property rights and obligations potentially enforced through courts of law.

Define legal entities with this in mind. Each real-world legal entity must be represented as a Cloud ERP legal entity. Many Cloud ERP global and localization features assume this is the case.

Define Primary Balancing Segment Value

Primary balancing segment value (BSV) should reflect real-world legal entities.

Ideally, a direct relationship between the real-world legal entity and the primary Balancing Segment Value should exist.

Cloud ERP supports up to three balancing segments. Use the primary balancing segment only for the legal entities. Don’t overload the primary balancing segment with management dimensions such as business unit, division, etc. You can use second and third balancing segments for such dimensions.

Exception – consolidation and eliminations: You should assign directly to ledgers primary BSVs used for supra-legal entity processing such as consolidation or eliminations.

Assign Primary Balancing Segment Value

In the Accounting Configuration Manager, assign primary balancing segment values (BSVs) to legal entities and ledgers.

The assignment is optional but, is highly recommended, as it is used by intercompany, sequencing, tax, and country specific Cloud ERP features to default or derive the legal entity.

If primary BSVs are assigned to a legal entity in any one ledger, then primary balancing segment values must be assigned to all legal entities.

Define only one Ledger per Country and Enable Sequencing by Legal Entity

Define only one ledger per country when your enterprise doesn’t require separate ledgers and charts of accounts to handle operations in separate markets with segregated management entities, business processes and performance measures.

Some setups that impact regulatory compliance are at the ledger level (eg sequencing). A primary ledger that spans many countries limits your ability to address country specific requirements. Hence, we always recommend that primary ledgers do not span countries.

A single primary ledger per country offers certain advantages:

- Some features are enabled within a ledger but not across ledgers: cross BU payments, automated intercompany etc.

- Fewer ledgers means less setup and maintenance; fewer reconciliations, ESS jobs, etc.

Nevertheless, if your company has decentralized finance departments at the legal entity or division level with independent close calendars; there is no reason why you can’t choose to define multiple primary ledgers per country.

It’s just that you should be aware that you may not be able to take advantage of all the features available within primary ledgers.

Use Gapless only when Required

Gapless accounting sequences may introduce functional limitations and impact the performance of high-volume journal creation processes. Implement this feature only for countries where you have a regulatory requirement.

Foreign Branches

Cloud ERP features including local regulatory reports assume that Cloud ERP legal entities reflect real-world legal entities.

Exception – Foreign Branches: if an enterprise must submit any type of fiscal reporting or external facing financial statements for a foreign branch (i.e. in the foreign currency), then it should be treated as a separate legal entity (and hence ledger). If there are no external reporting requirement (i.e. in the foreign currency) implying that there is no regulatory reason for a different configuration by country, then it can be a separate BSV within the principal legal entity / ledger.

Conclusion

You can address the requirements to partition journals and produce reporting by legal entity easily.

To achieve this:

- Define only real-world legal entities

- Assign BSVs to legal entities and ledgers

- Enable the sequencing by legal entity

Reference Documentation

- May 7, 2020: ERP – Record to Report Enterprise Structure Best Implementation Practices

- June 10, 2020: ERP – Procure to Pay Enterprise Structures Best Implementation Practices

- July 1, 2020: ERP – Order to Cash Enterprise Structures Best Implementation Practices

- Cloud ERP – Enterprise Structures White Paper (Doc ID 2415848.1)

- Cloud ERP – Procure to Pay Enterprise Structures Best Implementation Practices Blueprint (KB72974)

- Cloud ERP – Order to Cash Enterprise Structures Best Implementation Practices Blueprint (KB73841)

- Cloud ERP – Record to Report Enterprise Structures Best Implementation Practices Blueprint (KB54627)