**UPDATED JUNE 2025**

Introduction

The past decade has seen large investments in technology infrastructure programs centred on the digital transformation of key areas of the business world. One such area of focus has been the Procure to Pay (P2P) process and more specifically Account Receivable Billing e-invoicing and digital transaction tax reporting. Governments are turning their attention to the use of electronic invoicing and mandating it on the Order to Cash (O2C) side for B2B. Fifteen countries in 2022, and sixty countries by 2025 will be going paperless invoicing – i.e., forbidding pdf and paper invoices and replacing them with electronic structured e-invoice files. To promote the use of electronic invoicing in both the private and public sector, governments are incentivizing the adoption of e-invoicing.

Based on the PEPPOL technical specifications, e-invoicing simplifies the exchange of standardized electronic documents such as invoices between trading partners. In essence, an e-invoice is structured invoice data exchanged in Electronic Data Interchange (EDI) or XML (Extensible Markup Language) formats. The benefits of adoption include cost savings, productivity gains (upstream and downstream touchless processing), accuracy and enhanced security.

Purpose

The purpose of this blog post is to introduce the main concepts that make up Oracle’s e-invoicing solution and present the collateral that’s available to assist in setting up this solution. Key components and terminology will be explained and links to implementation sources will be provided. Lastly, we’ll highlight Oracle’s continued investment in this area and keep updating the blog as more information becomes available. Note: navigation paths, screen shots and other implementation steps can be found in the source documents and will not be replicated here.

Key Terms and Components

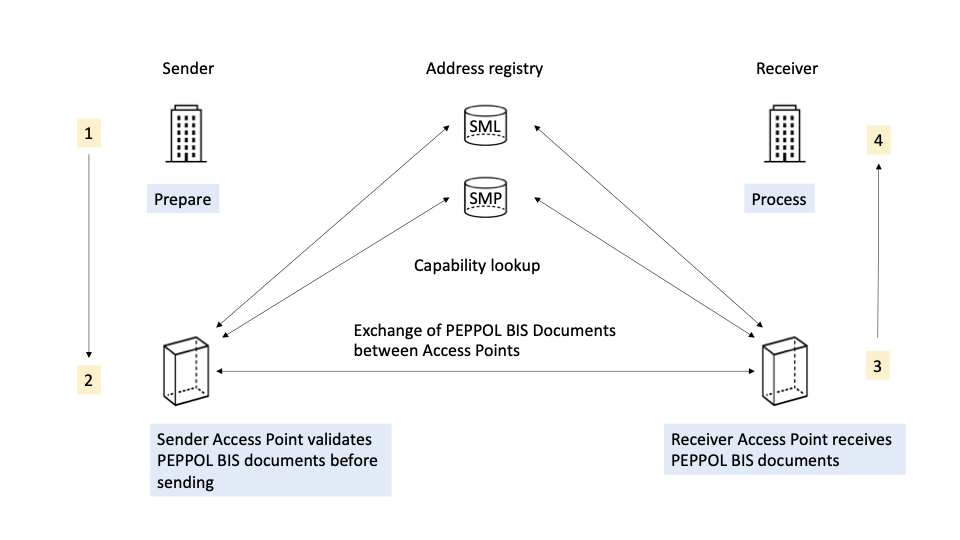

PEPPOL Authority – a body appointed by a country’s government to oversee and manage the use of PEPPOL in their domain/geography. The PEPPOL Authority provides a country wide electronic registry of all companies in their domain/geography. This facilitates network agnostic routing and ensures that Access Points (AP) and Service Metadata Publisher (SMP) services conform to the technical standards and service specifications within their jurisdiction.

Access Points – usually PEPPOL Authority certified Service Providers that connect users to the PEPPOL network and allow for the exchange routing of electronic documents to all companies.

Business Interoperability Specifications (BIS) – developed by PEPPOL to provide implementation guidelines (utilizing the Universal Business Language (UBL 2.1) – ISO.IEC 19845).

Service Metadata Publisher (SMP) – similar to a business registry containing details of PEPPOL participants. These are normally maintained by a central government department or agency.

Service Metadata Locator (SML) – defines which SMP to use for identifying the delivery details of any PEPPOL participant.

Three corner model – is where the supplier and buyer use the same third-party Access Point/ Service Provider to process e-documents.

Four corner model – where the supplier and buyer use different Access Point/ Service Providers to process e-documents that pass between them.

The PEPPOL eDelivery Network: source link

Oracle Cloud Financials e-invoicing solution

Oracle Receivables and Oracle Payables process transactions by leveraging Collaboration Messaging Framework (CMK) functionality. You can send electronic invoices to customers in UBL 2.1 format, use CMK to format messages, and execute transmission and statuses. Additionally, CMK automates the reception of UBL 2.1 e-invoices and then upload in Oracle Payables after validation. For high level information and a list of countries where this functionality addresses local legal requirements, please refer to the Global Catalog (Oracle Payables on p. 27; Oracle Receivables information on p. 31).

Gain insight of the CMK framework and how e-invoices are exchanged between service providers or trading partners through the following Event recording on Oracle Cloud Customer Connect.

- AR: e-Invoicing B2B Support in Oracle ERP and SCM Cloud

- AP: ERP – Electronic Invoicing in Oracle Payables Cloud

- ERP: Electronic Invoicing in Oracle Cloud ERP with Avalara as a Service Provider

Steps to configure e-invoicing functionality are categorized as follows:

- CMK setup – includes details of the service provider, the delivery method and message; set up of the trading partner and associated site and account

- Oracle B2B setup – create the B2B partner and assign this to the CMK service provider; add the document for the trading partner (such as the UBL invoice), adding channels and agreements with the trading partner

- Customer (for outbound invoices) and Supplier (for inbound invoices) setups

Configuration details, with navigation paths and screen shots can be found in the following two documents:

– UBL 2.1 Electronic Invoicing in Oracle Payables Cloud-Overview, Configurations and Frequently Asked Questions [KB173919]

– UBL 2.1 Electronic Invoicing in Oracle Receivables Cloud-Overview, Configurations and Frequently Asked Questions [KB177838]

For France mandate to be enforced in 2026, review the “How To Do E-Invoicing and E-Reporting in France – Oracle Cloud Financials” document available as an attachment to note [2928701.1] – Oracle Fusion Cloud ERP: France B2B Electronic Invoicing, September 2026.

Oracle’s Continued Investment

Oracle’s e-invoicing solution is continuously being enhanced. Below is a brief list of this development investment:

18C – Receivables Invoice in UBL 2.1 (XML format)

19A – Payables Invoices receiving in UBL 2.1 XML format

19D – Validate Business Number for Australia and New Zealand

20D – Invoice attachment

21A – CMK Attachments support

21C– Receive UBL PEPPOL Invoice Responses; for Australia see here

22A – Automatic Notifications of Suppliers for rejected e-invoices

22B – Enhanced Customer Account level setup

22C – Send UBL PEPPOL Invoice Response messages

23A – Send and Receive UBL PEPPOL Electronic Invoices – New predefined UBL-2.1 PEPPOL messages

23D – Exchange B2B Messages with Your Trading Partners Using Avalara

24A – Additional Electronic Invoicing Requirements in the New UBL PEPPOL Invoice Message

24A – Electronic Invoicing Enrichment for Legislative Updates

24B – Streamline Your B2B Setup for the Avalara and TIE Kinetix Service Providers

24C – Electronic Invoicing Attributes in JPK VAT Register for Poland

24C – Transaction Printing After Electronic Invoice Generation

25B – E-reporting for France

25C – Redwood: Comply with French E-Reporting Requirements

25C – Redwood: Eliminate Account and Site Specific Setup for E-Invoicing

Furthermore, you can also reference the work and solutions that some of our partners have delivered by visiting Oracle Cloud Marketplace. (Search on “e-invoicing” to find the relevant solution providers).

Footnote: Although this blog centers on our Cloud ERP solution and the bulk of our development investment is on this platform, it should be noted that Oracle also provides e-invoicing function for our E-Business Suite, PeopleSoft & JD Edwards on-premise customers. More information regarding these solutions can be found here:

E-Business Suite – Oracle Receivables solution;

PeopleSoft – Generating Electronic Invoice Files

JD Edwards –

European Union Electronic Invoice MOS Document