Subledger Accounting supports multiple accounting representations. Each representation is compliant with a different accounting standard or uses a different accounting currency. It does this by applying sets of accounting rules (accounting methods) to subledger transactions in parallel.

Cloud ERP’s seeded accounting method supports accrual basis and its variations. Cash basis is a great example of an alternative accounting method. Under cash basis, accounting recognizes financial transactions based on actual inflows and outflows of funds. Consider the example of a payables invoice for office furniture. The expense is not accounted until the payables department issues the payment to the supplier. The liability between the time that the furniture (and in our example, the invoice) is received and when it is paid is not recognised at all. Cash basis is therefore a cash flow focused alternative to accrual basis accounting.

Public sector entities often wish to analyse their financial position using both accrual and cash basis accounting methods.

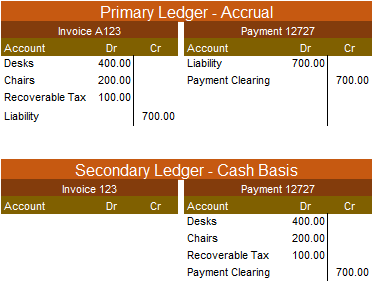

In the above diagram, invoice A123 and its payment are accounted using the accrual accounting method in the primary ledger, and according to cash basis in the secondary.

Cloud ERP doesn’t include pre-configured cash basis accounting rules. So, to aid customers and system integrators meet this requirement, Teresa McGoldrick has published How to use Subledger Accounting to Configure Cash Basis Accounting for Payables and Receivables on Customer Connect.

It contains detailed instructions on how to copy and modify Subledger Accounting’s accrual accounting method to generate cash basis accounting. Once you have followed the steps, Payables and Receivables transactions will generate both accrual and cash basis accounting representations.