Subledger accounting rules allow customers to configure how Cloud ERP accounts for subledger and external transactions. The power and flexibility of the functionality potentially entails some complexity too, especially if rules are managed by different teams over time.

We have functionality that lets you drill into accounting entries and understand how they are created.

The Analyze Journal Entry feature exposes transaction source values and how the accounting engine interprets them. Use it to develop and troubleshoot your accounting rules. It can help you diagnose potential setup issues, understand why accounting was generated that way and identify the cause for any accounting errors. You can use it for both draft and final accounted journal entries, as well as for invalid journal entries. All you need is a role with the Review Accounting Diagnostic privilege assigned.

In this blog post we review some common use cases.

Unexpected Segment Value

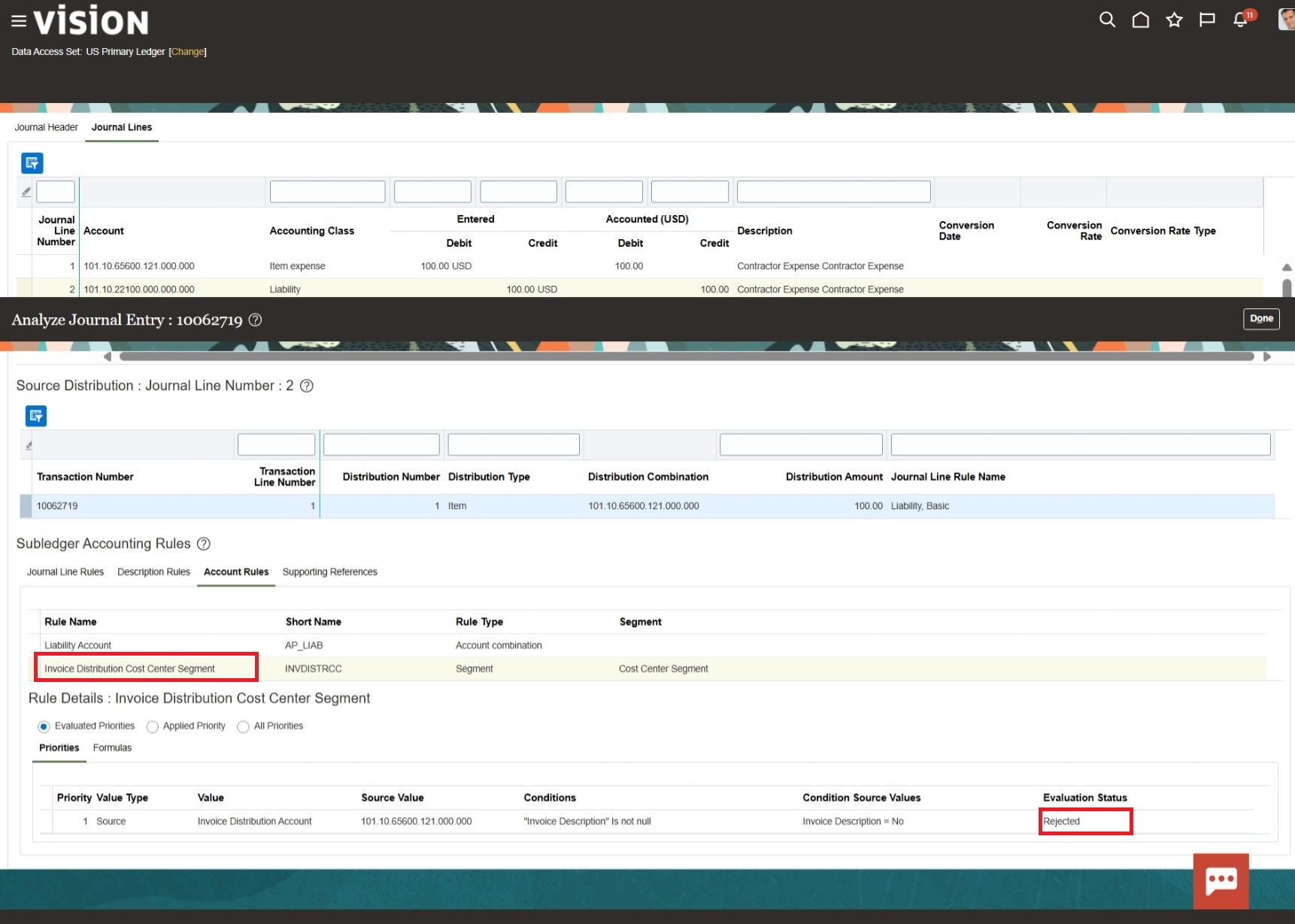

One of the entities in your organization requires tracking of supplier liabilities by cost center. They implemented an additional segment rule to derive the cost center on the liability line from the invoice distribution account.

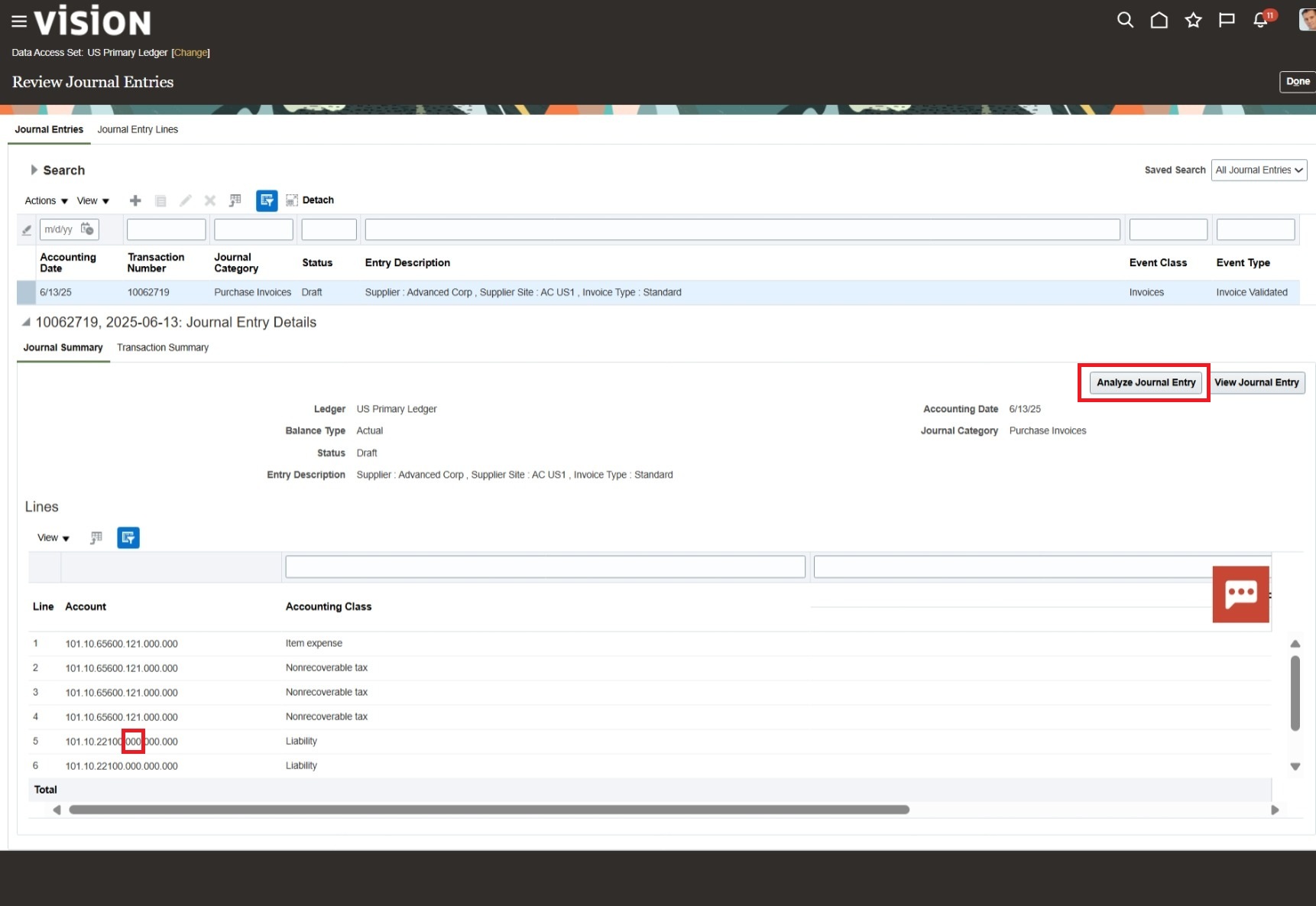

You review a journal entry where the Liability account combination is not populated as expected.

From the Review Journal Entries page, you can go directly to Analyze Journal Entry and see the segment rule did not apply due to its condition evaluated to false.

When reviewing the journal entry, you notice the receivable line is still generated with the default segment value.

No Value

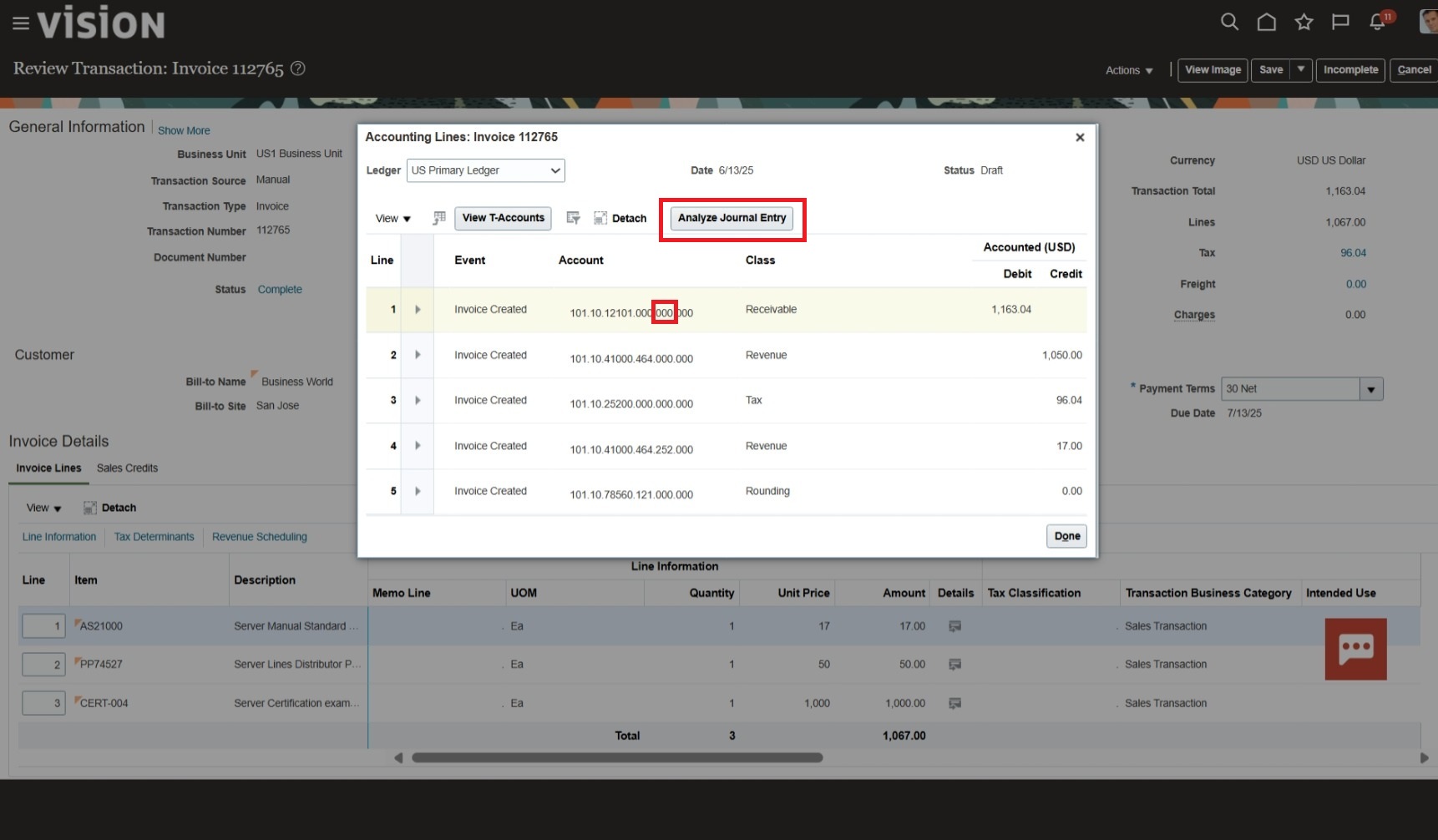

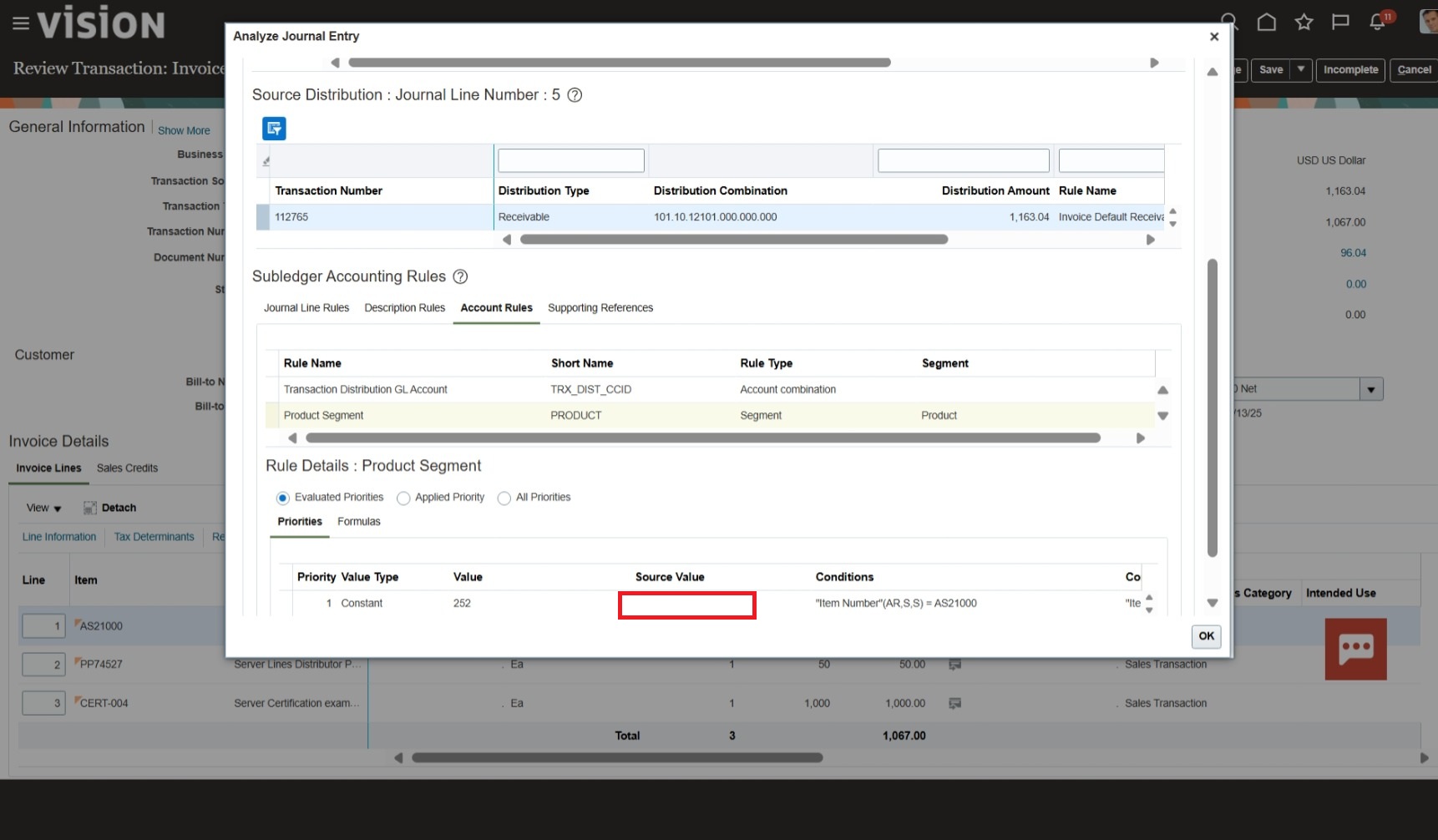

You are trying to implement rules to detail receivables accounting by product. You’ve defined a product segment account rule and assigned it to all journal lines, yet it is only working for revenue lines.

When reviewing the journal entry, you notice the receivable line is still generated with the default segment value.

From the View Accounting window, you navigate directly to Analyze Journal Entry and notice the source value is null on the receivable line for the Item Number source which the product segment rule is based on.

Note: Accounts Receivable passes Receivable and Revenue distributions separately to Subledger Accounting. You would normally use header level sources to derive accounting for the Receivable line and line level sources for the Revenue lines.

Line level sources won’t work for the Receivable line, and vice versa.

You can check source assignments from the Manage Subledger Application Transaction Objects page – select the Event Class you are interested in and click on View Source Assignments.

Why This Line

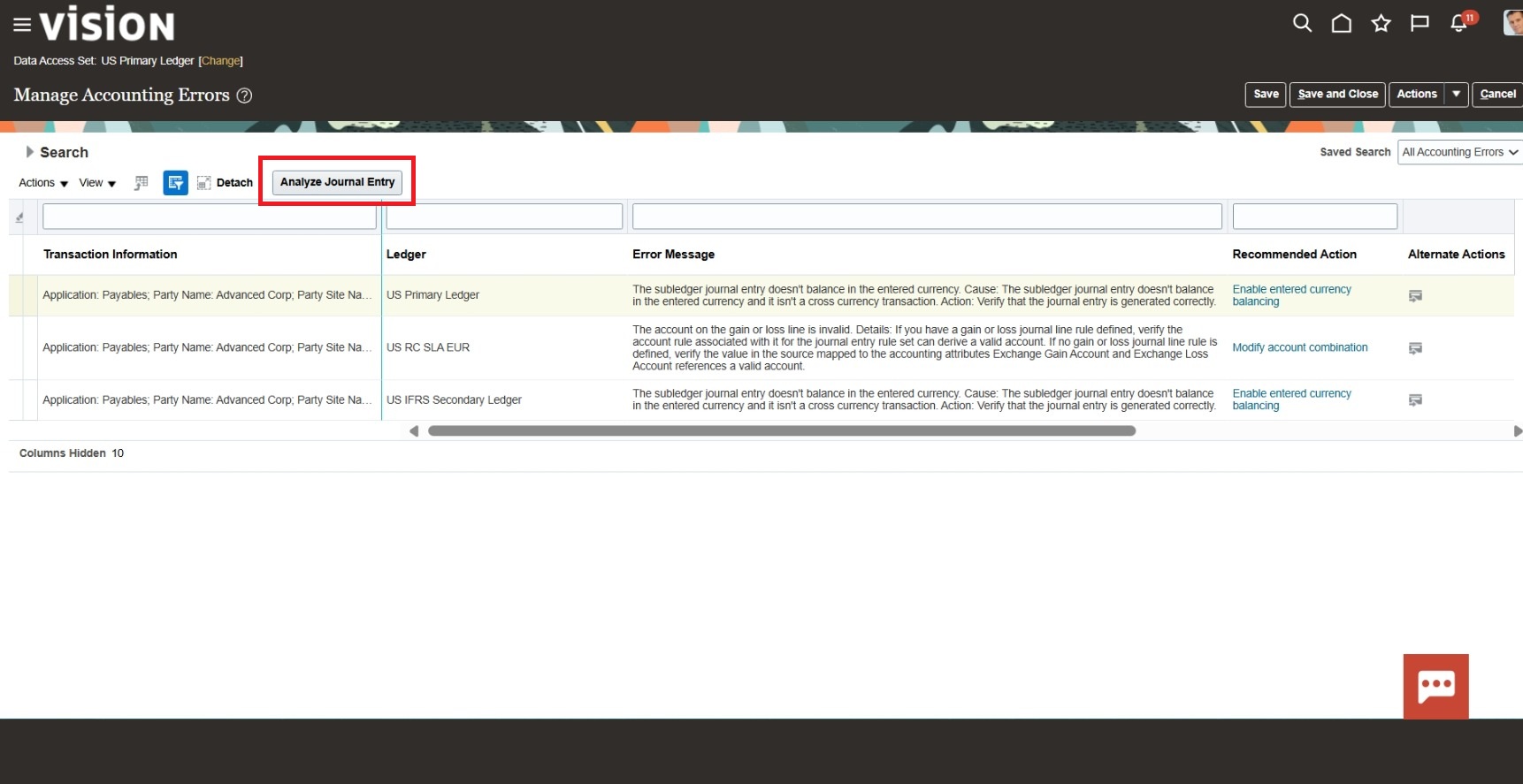

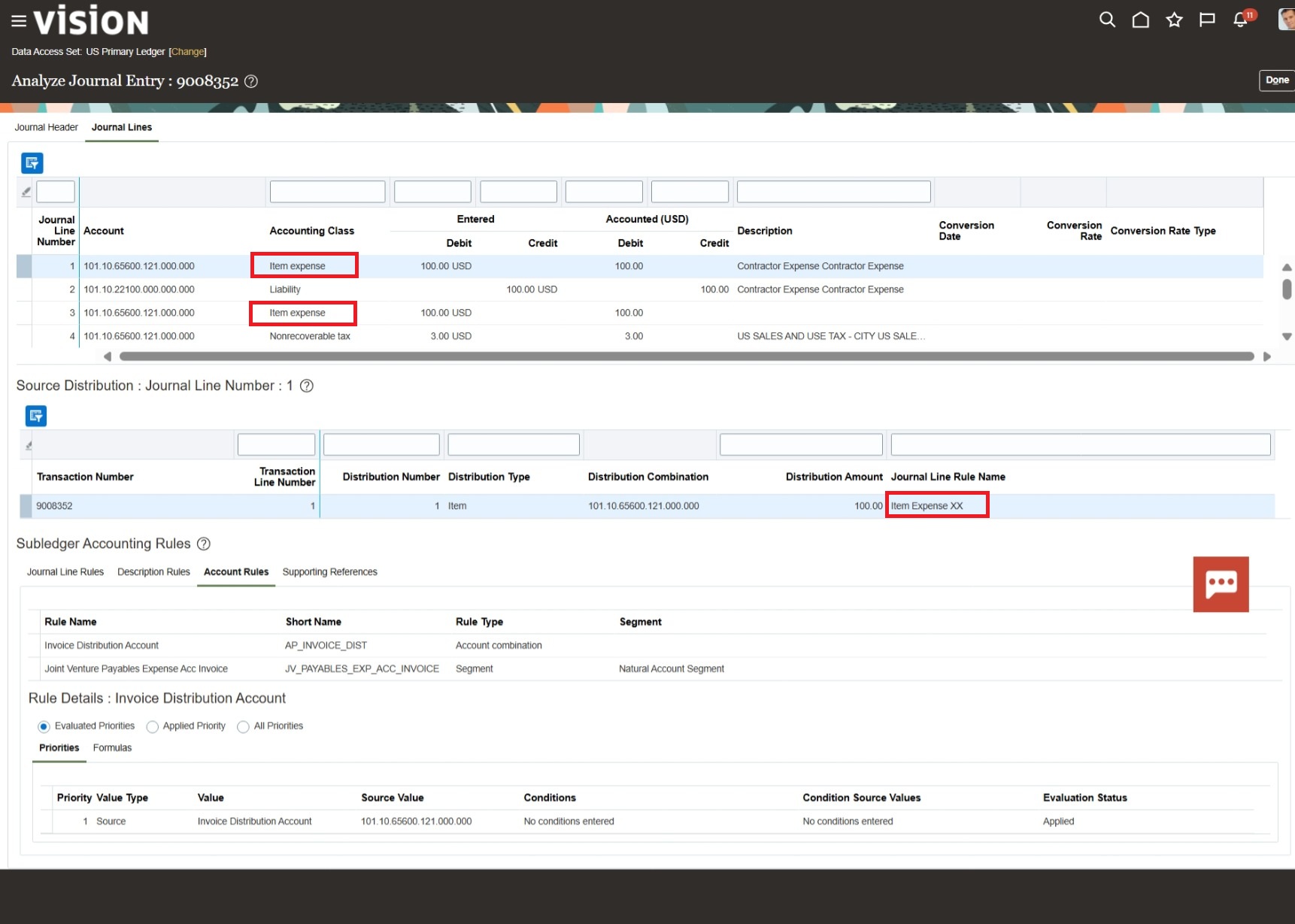

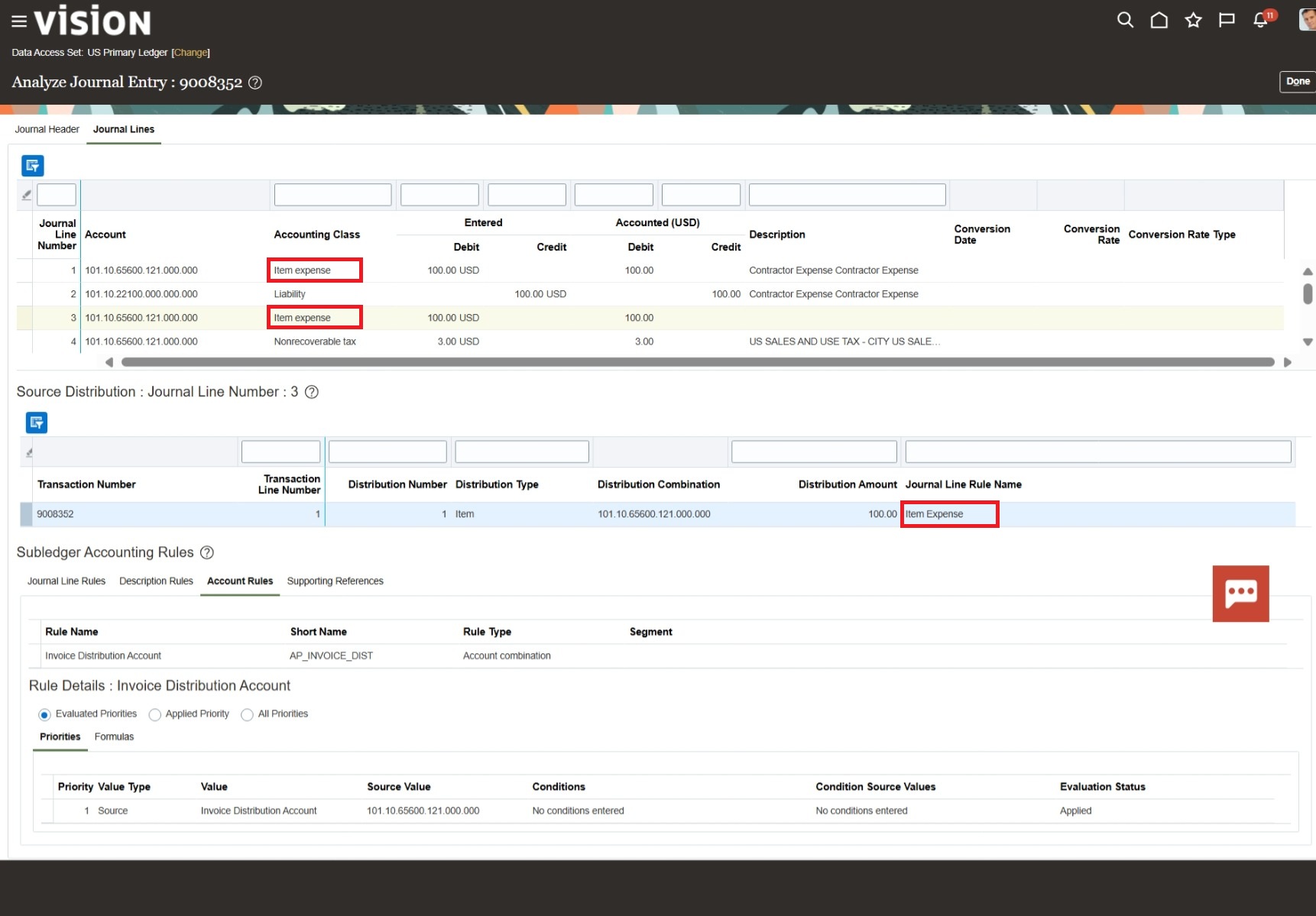

Following a recent change in accounting rules, users are encountering errors due to accounting entries unbalanced in entered currency. While reviewing the errors, you drill to the Analyze Journal Entry page for an unbalanced invoice accounting entry.

Note there are two item expense lines. It seems, the user who did the setup added a custom Item Expense XX journal line rule but forgot to remove the seeded Item Expense rule resulting in incorrect setup.

References

Check out the Using Subledger Accounting documentation for details about the feature: Analyze Journal Entry.

If in doubt, you can ask questions in the Subledger Accounting & Accounting Hub community on Cloud Customer Connect.