Introduction

Cloud GL’s Average Daily Balances (ADB) offers more features than its name may suggest. In this brief, we outline ADB’s features and highlight how customers in retail, hospitality, transportation, and other industries can leverage ADB to generate daily profit and loss (P&L) reporting.

Daily Balances Overview

When you create a primary ledger, you can enable average balances (ADB) for both balance sheet and income statement accounts. GL automatically creates an additional cube to store balances for each GL date. Almost all standard balance reporting and data extract features are available for daily balances including a dedicated Oracle Transactional Business Intelligence (OTBI) subject area.

ADB supports the following balances: end-of-day (EOD), daily activity, period average-to-date (PATD), quarter average-to-date (QATD) and year average-to-date (YATD). The average balance buckets address Financial Services Industry (FSI) specific requirements for balance sheet accounts. For a full explanation of how Cloud GL calculates these balances, see the Average Balance Processing section of the Using General Ledger book.

Cloud GL extends ADB to include income statement accounts. You can now leverage ADB’s EOD and daily activity balances to generate daily profit and loss reports.

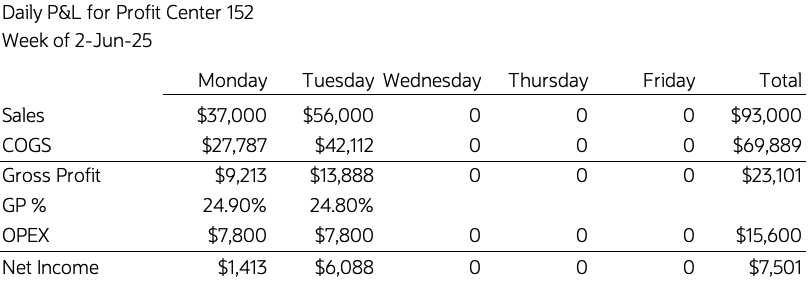

A sample report that displays the P&L for each day of the week. The report calculates the Total and Net Income report buckets.

How Cloud GL Calculates and Stores Daily Balances

For GL journals generated by the Create Accounting program or entered through GL’s user interface, the journal header’s effective date / accounting date determines a balance’s GL Date. For journals imported through FBDI into a ADB enabled ledger, Cloud GL validates that journal lines balance by GL Date.

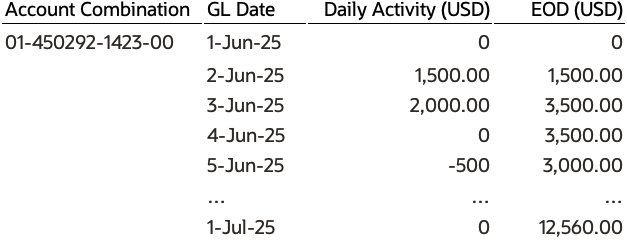

Daily balances automatically manages backdated journals. For example, in the above table a journal posted with a GL Date of 3-Jan-26 would update its daily activity and all subsequent EOD balances.

Like standard balances, GL stores daily balances for entered and ledger currencies.

In the transactional database, GL stores daily balances in the GL_DAILY_BALANCES table. Rather than one row per day, it has one row per accounting period and separate columns that correspond to each day of the period. EOD balances accumulate throughout the year. The GL_DAILY_BALANCES_V view normalizes the table to produce a row for each GL Date.

Average Balance Options

Most average balance options apply only to the specialized average balance calculations.

You can define a transaction calendar to control which days count as business days included in average balance calculations. You can also prevent users from posting journals in the future or beyond a specific cutoff date.

For more details of these options, see the Set Up Average Balance Processing section of the Using General Ledger book.

Notes and Limitations

If you choose to calculate daily balances only for balance sheet accounts, you must enter a special non-postable retained earnings account. GL uses it to track the net impact of all income statement accounts for the day, period, quarter, and year. If you include income statement accounts, GL uses the standard retained earnings account defined in the ledger setup. You calculate daily net income in your report as the difference between revenue and expenses.

Daily balances are calculated only for GL balances. Subledger Accounting does not support daily balances for supporting references or third parties. Address requirements for daily balances in Enterprise Performance Management (EPM) applications by calculating them in GL before propagating them to EPM.

When you create an account combination for the first time, Cloud GL always calculates average balances based on the full count of a period’s business days. It doesn’t matter whether a combination is first used on the 1st, 10th, or 20th of the month.

GL always calculates daily balances based on journals posted in its parent ledger. You cannot directly adjust daily balances by entering journals into ADB. This rule ensures that standard and daily balances always reconcile. Note that this limitation also applies to data migration from a legacy application.

To enable average balances for a secondary or reporting currency ledger, you should also enable it in the primary ledger. Failure to do so could result in unbalanced journals in the secondary and reporting currency ledgers.

Daily balances are primarily intended to address reporting requirements. You cannot directly run translation, revaluation, or allocations on daily balances. Run revaluation daily in the parent ledger for its results to reflect in daily balances.

Daily balances ignores adjusting periods. A journal entry posted to an adjusting period will be assigned to the corresponding non-adjusting period which the GL date falls into.

The parent ledger’s calendar cannot have periods of more than 35 days.

ADB consumes additional resources. Remember to include ADB when you complete the Oracle Applications Cloud – Environment Usage Evaluation spreadsheet.