Updated 29-Apr-2025

Chief Financial Officers (CFOs) of enterprises typically revisit their chart of accounts (COA) as part of their journey to Cloud ERP. They may have struggled with lack of financial insight as their enterprises have grown and diversified.

This blog focuses on how to best design your chart of accounts in Oracle Cloud ERP.

From a business perspective you would assess current and future requirements and look to:

- Design your COA to address accounting standards applicable to your business.

- Take this as an opportunity to clean-up a potentially outdated chart of accounts.

- Examine current practice to consolidate financial results and how COA re-design can speed up this process in future.

- Identify future financial report needs, business metrics, and KPIs for actionable business decisions.

- Structure your COA with recognizable and meaningful COA segments. Categorize your financial data logically to support balance sheets and profit and loss statements.

- Design a flexible and scalable COA to allow for business growth and change.

Once you’ve established the foundation for your COA, plan your configuration in Oracle Cloud ERP.

- Design Oracle Cloud ERP Enterprise Structure and the Chart of Accounts together as they are closely related.

- Chart of Accounts are intrinsically linked to Primary Ledgers, Secondary Ledgers and Reporting Currencies.

- Implement a corporate chart of accounts structure for your world-wide operations. We recommend, where possible, you assign the corporate COA to your primary ledgers. A common corporate chart of accounts eases consolidation at group level for all subsidiaries in the enterprise.

- For more information, refer to related blogs on Improve Financial Insight with a Corporate Chart of Accounts and Address Multiple Accounting Standards Easily with Oracle Cloud ERP and Structure Your Account Hierarchies for Optimal Processing.

Determine Your Chart of Accounts Structure

In Oracle Cloud ERP the chart of accounts structure provides the general outline of the chart of accounts.

The segments in the COA structure represent legal, fiscal and management dimensions that your enterprise uses to measure its activities.

You determine the number of segments. A segment should be unique. For each segment you define a value set and the valid list values that reside within each value set. Labels identify segments associated with special system features outlined later on in this blog. This sets the foundation for the chart of accounts.

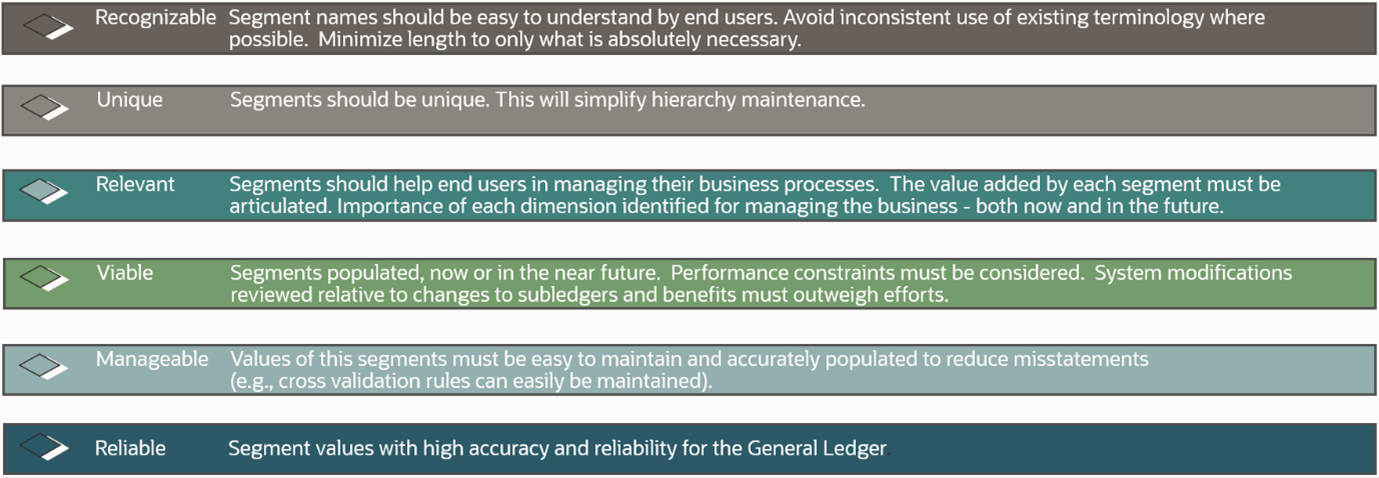

If you follow the guidance in figure 1 above, your system users will benefit. Use meaningful segment names with relevant values for data accuracy and trust in financial statements.

Be careful not to overcomplicate your COA or it will become hard for your finance staff to use. Decide on the key segments of your COA structure and the order in which to display them. Most common order of segments in a COA structure starts with company, cost center, and the natural account. In addition, you’ll most likely define another 3-4 segments to address your business analysis needs such as by line of business, product line, intercompany, or location.

Ensure that you:

- Standardize your corporate COA world-wide so it is understood by your finance staff for accounting accuracy.

- Minimize number and length of COA segments for simpler transaction entry and visibility in UIs. Ideally, define up to 8 COA segments with each segment length not exceeding 8 digits.

- Value sets for chart of accounts must use the Value Data Type of Character. The Value Subtype is set to Text. These two settings support values that are both numbers and characters, which are typical in natural account segment values. If segment value contains characters, ensure they are always uppercase. If segment value contains only numbers ensure you zero fill by default.

- If you define alphanumeric values, whether all letters, or a combination of letters and numbers in a value set, consider implications such as:

- users may not benefit from reduced keystrokes afforded by the zero filled by default setting.

- increased complexity when you define ranges for cross validation rules, allocation rules, and COA parameters for reports.

- where your finance users are accustomed to use the numeric keypad to enter COA values. Entering letters may slow down them down.

- Child values should be the same length within a segment. Otherwise sorting and display of the COA values can be very confusing.

- Parent values within a segment can be a different length than the child values.

- Adhere to the guidelines on Essbase Character and Word Limitations to mitigate errors.

- Align the segment order between COA structure setup definition and the display in UIs. This will minimize confusion.

- Identify summary level management reporting dimensions to ensure your chart of accounts structure will address such needs. For instance, configure account hierarchies for natural accounts, lines of business, sales channel, and product line segments. Such segments support insightful reporting.

- Define one or two spare segments in your chart of accounts to support future potential reporting needs. Create a default value for each segment to mitigate data entry need.

- Avoid using short-lived or rapidly changing operational management segments such as customer or project. Using such segments would not be viable as they could result in high volumes and potential performance issues.

- Choose the delimiter value for concatenation of your account combination carefully so that it doesn’t conflict with the segment values. For example, if your segment values frequently contain periods (full stops), don’t use a period as your segment separator.

Minimize Data Entry Errors with Account Aliases

When you define General Ledger accounting setups, the chart of accounts structure and structure instance are fundamental constructs. You must carefully consider all accounting and analysis requirements that pertain to the design of the chart of accounts.

You define a chart of accounts structure instance. A simplified illustration is displayed in figure 2 below. The chart of accounts structure is also referred to as the Accounting Key Flexfield.

Define an account alias with a recognizable name to represent a general ledger account combination. When you enter a transaction, you can use the account alias to minimize data entry errors and increase productivity.

- Warning: You cannot alter the chart of accounts structure and structure instance once in use. The number of segments, the order, each segment label, length, type, and value set assignment can’t be changed. These components form the foundation to account data within each ledger.

Assign labels to COA segments to automate features and improve reporting

Balancing Segment Value (BSV) label:

- The system automatically balances accounting journals by BSV.

- Primary BSV: Mandatory and usually represents the real-world first party legal entity. You typically produce reports by legal entity such as balance sheet and profit and loss statements.

- Second and third BSV: Optional labels that usually represent management entities.

- Tip: Define intercompany balancing setup to minimize risk of unbalanced journals.

- Warning: Do not use a segment already qualified as a natural account or intercompany segment in any of the three BSVs.

Intercompany (IC) segment label:

- The intercompany segment label is optional.

- If, however, you define more than one legal entity in your ledger, then you’d usually include an intercompany segment in your COA structure.

- It represents the counterparty to the primary BSV.

- Configure intercompany rules ‘Due From, Due To’ to generate intercompany accounting entries. ‘Due From, Due To’ represent the rules between the primary BSV and other legal entities in the intercompany segment.

- Intercompany rules create additional balancing lines for each unique value of the Second and Third BSVs. No counterparty exists for Second and Third Balancing Segments. Therefore ‘Due From, Due To’ balancing setup is not required here.

- When you configure intercompany rules, the system automates intercompany accounting entries.

- Tip: Use a separate value set for the intercompany segment instead of sharing it with the primary balancing segment. That way you can define separate Segment Value Security (SVS) rules for each of the 2 segments. Furthermore, Data Access Set to the Primary Balancing Segment value set would be secure.

Natural Account segment label:

- Assign this mandatory segment label to only one segment. The system ensures that the segment set with this label can’t be set with another label.

- The natural account segment number is the portion of the COA structure that identifies what the financial activity is in pure accounting terms.

- Your natural accounts should align with your financial statements. It supports profit & loss- and balance sheet reporting.

- Identify the natural account segment value to classify the transaction as an asset, liability, equity, revenue, or expense.

- Assign Account Type (asset, liability, equity, revenue, or expense) to each natural account segment value.

- The system transfers the balances with Account Type of revenue and expense to the retained earnings (equity) account at the start of a fiscal year.

- If you’ve defined multiple BSVs within a ledger, Cloud GL populates the retained earnings account for each balancing segment value.

- Tip: You improve your user experience if you plan your natural account value numbers in a logical order for assets, liabilities, and equity as well as revenue, and expenses. Though note, that for certain countries this may not be feasible where the regulations are highly prescriptive.

Cost Center segment label:

- The segment label usually represents a department, division, or line of business.

- While it is an optional segment label, you need the cost center segment label for key features to work in Assets, Expenses, and Approval processes.

Example:

- Capture the default Cost Center for expense reports on the Employee Assignment.

- Identify the Cost Center manager.

- Route expense reports to the correct manager for approval.

Revaluation Gain/Loss Track segment label:

- You can assign the label to one or more segments.

- Track revaluation gain and loss for foreign currency conversion rate changes between a transaction’s accounting and revaluation dates.

- Track up to maximum 5 distinct segments for revaluation gain or Loss. You’d already use at minimum one for the primary BSV so that leaves 4 segments.

- Tip: Don’t assign the revaluation tracking segment label to the Natural Account or Intercompany segment. This is because the natural account balances form the basis of revaluation, and the intercompany segment serves a specific purpose, as explained above.

Custom label:

- Oracle Transactional Business Intelligence (OTBI) can reference custom segment labels. For example, you define a custom label for the account class to classify specific natural accounts. You define an OTBI report and include the custom label for reporting.

Consider Impact for Essbase and EPM Cloud Integration

- Differentiate calendar name and values used in COA segments for dimensions used in the GL Essbase cube. Also applicable for integration with Cloud EPM to prevent Essbase cube failures.

Example:

COA Segment2 is 2 characters with values: 20, 21, 22,23. At system dimension level that is tracked as 2-20, 2-21, 2-22 etc. Your fiscal calendar may be period 2 -20, period 2-21, period 2-22. Therefore, you will encounter Essbase cube failure.

You can instead design your calendar as a 4-digit year: 2020, 2021 etc. Then you’d need to ensure that wouldn’t conflict with another 4-digit COA Segment.

- Consider EPM when you design the COA.

EPM dimension members must be unique.

You define unique COA segment values

Or

You define a mapping between COA segment values and EPM dimension members that render them unique.

Examples:

Unique ERP COA segment values.

You can define unique ERP COA segment values as follows:

- ERP COA segment ‘Entity’ with value E1000

- ERP COA segment ‘Product’ with value P1000

In that case no mapping would be required between ERP and EPM.

The IC segment is an exception. It must have the same values as the primary BSV hence, it can’t have a different prefix.

Unique length for each COA segment

You can define unique lengths for each of the segments of the ERP COA as follows:

- ERP COA segment ‘Entity’ with value 1001

- ERP COA segment ‘Product’ with value 10011

- ERP COA segment ‘Account’’ with value 100111

In that case no mapping would be required between ERP and EPM.

The IC segment is an exception. It must have the same values as the primary BSV hence, it can’t have a different length.

Define Mapping between COA segment values and EPM dimension Members for Uniqueness

If two COA segments exist in Oracle Cloud ERP and they both contain segment values ‘1000’ or ‘1000’, you’ll encounter errors in Cloud EPM

Define dimension mapping between ERP and EPM, if you cannot change the values in the COA Segments, such as:

ERP COA segment ‘Entity’ with value 1000 maps to EPM dimension value C1000

ERP COA segment ‘Product’ with value 1000 maps to EPM dimension value P1000

The IC segment must always be mapped to a different value in EPM.

If you implement Oracle Cloud EPM applications that write back to Oracle Cloud ERP you also need to consider the reverse mapping.

Useful Resources

Chart of Accounts chapter in Implementing Enterprise Structures and General Ledger guide.

Conclusion

Plan a corporate chart of accounts that’s agreed for your world-wide business. Make it easy to understand for accuracy and to speed up consolidation. Plan the chart of accounts to align with fiscal statements but also to support insightful management reporting.