Updated November 18th, 2024.

In this post, we highlight how Lease Accounting addresses operating revenue lease requirements for properties.

A lessor provides the right for an entity to use an asset in exchange for a consideration. For example, a revenue lease agreement involves a lessor renting out a property to another entity for a period of time. Property leases are typically operating leases with revenue spread evenly over time.

Since the 23C quarterly update, Lease Accounting enables lessors to process operating revenue leases for properties.

Since the 24D quarterly update, you can also create operating sublease contracts for properties.

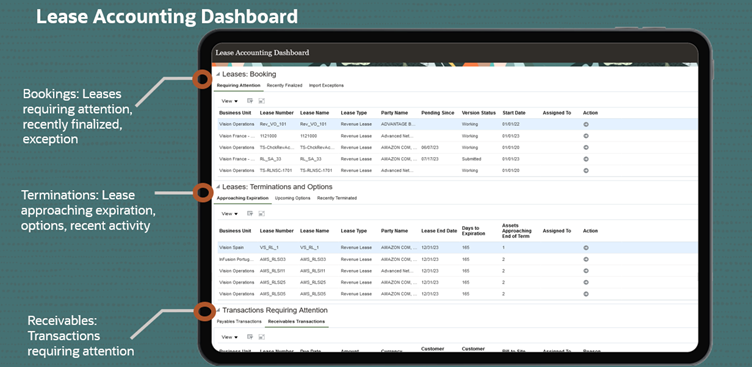

Lease Accounting uses a common repository for all your leases, whether you are the lessee or the lessor.

More specifically, for an operating revenue lease on a property you can:

- Create and activate revenue leases, including details of:

- Lease term and classification

- Parties

- Property details

- Billing schedules

- Accounting definitions (at payment level)

- Milestones, rights, and obligations

- Options

- Associate properties with assets on revenue leases

- Track property details such as property name, address, size, contact information and tenure

- Create a sublease and link it to a head lease property

- Track details of the sublease such as terms of lease, property details, parties, billing schedules, and sublease-related options, rights, and obligations.

- Define payments and options

- Approve leases

- Amend leases

- Increase or decrease scope

- Exercise and cancel options

- Expire or terminate leases early

If you enable integration between Lease Accounting and Receivables you can generate invoices.

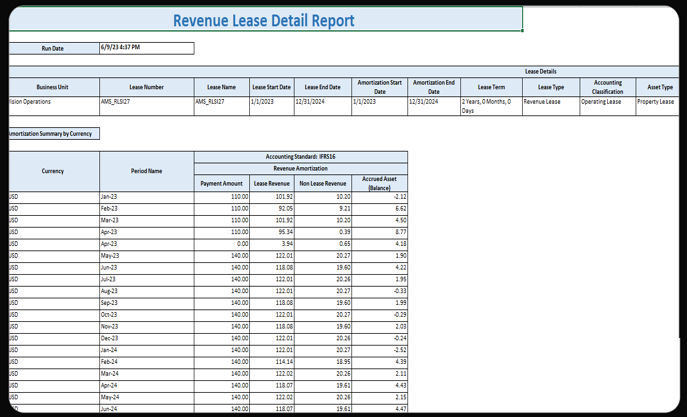

Lease schedules contain all lease payments and the periodic amortization of lease and non-lease revenue.

Lease Accounting automatically generates:

- payment and accrual schedules at the summary and payment levels

- payment streams, derived from the user entered schedules

- revenue lease accruals, calculated for each payment based on the payment schedule and the revenue method

- accrued asset balance

- all relevant accounting entries for operating revenue leases and subleases on properties

Submit the Revenue Lease Detail report to review details of payments and amortizations. The report breaks down to the asset and payment level for the operating revenue lease.

Conclusion

With Lease Accounting capabilities you can

- Standardize lease information in a single repository.

- Ensure compliance with IFRS16 and ASC842 for operating revenue leases and subleases on properties.

- Increase productivity and reduce the risk of error with automated ASC 842 and IFRS 16 lease processes for operating revenue leases and subleases on properties.

- Reduce effort to bill and collect from lessees through automated integration with the Oracle Receivables module.

- Improve transparency with Receivables invoices initiated from Lease Accounting visible on the lease.

Useful Oracle Documentation and Webcasts

To gain more insight into Lease Accounting capabilities, refer to the documentation links below:

Lease Accounting User Guide:

https://docs.oracle.com/en/cloud/saas/financials/24d/faula/index.html#COPYRIGHT_0000

Lease Accounting Implementation Guide:

https://docs.oracle.com/en/cloud/saas/financials/24d/faila/index.html#COPYRIGHT_0000

Recorded release readiness training for Lease Accounting: https://www.oracle.com/webfolder/technetwork/tutorials/tutorial/readiness/offering/index.html?product=financials-21