Oracle Cloud ERP lets you automatically replace disabled codes combinations used in accounting entries with valid ones. You therefore ensure the accounting process completes without issue.

As the business re-organizes itself to respond to new market challenges and opportunities, the accounts used to record and report your results evolve.

In this context, you disable accounts, cost centers, or other segment values that are no longer active to ensure they are no longer used. Then you run the Inherit Segment Value Attributes process from the Scheduled Processes page to automatically disable all account combinations containing those values. Users will not be able to select them in manual entries. You change the setup of automated processing to generate the entries with the new expected values.

However, there may be inflight transactions, such as purchase or sales orders, payable invoices, or receivable transactions, for example, with code combinations already defined. Subsequent accounting for those inflight transactions will fail after you disable those combinations that would be re-used. You want to avoid these issues, in particular at period end when deadlines are tight.

In this blog we highlight how alternate accounts can help remove these roadblocks during period close.

Use Alternate Account to Ensure the Accounting Process Completes Without Issue

Define alternate accounts to replace invalid combinations in generated accounting entries. That way, the accounting process will not stop because of invalid combinations. This automatic replacement applies to journal import and subledger Create Accounting process but not to manual transaction entries.

Often users don’t choose the account combinations, the values are defaulted from setup or generated by the subledger accounting rules engine. In cases such as these listed below, you can end up with invalid combinations:

- Entries created by the accounting engine according to the rules still pointing to old accounts, not yet modified. (read related blog article “Mapping Defaults vs Subledger Suspense Accounting”

- Corrections or reversals of existing transactions, that reference the original accounts.

- Entries imported from legacy systems.

- Subsequent processing of open transactions such as purchase and sales orders, payable and receivable invoices.

In such cases the accounting process may fail because of invalid account combinations. Identifying the source transaction to correct is time consuming. It may be within Oracle Cloud ERP or in a legacy system, which will be even more time consuming. This delays the entire close process.

When you define alternate accounts, you streamline the accounting process. The invalid combinations are automatically replaced. You ensure that the accounting process doesn’t fail because of invalid combinations. You save users efforts to analyze errors, identify source transactions, correct them, and re-run the process.

This contributes to a faster close and gives users the ability to focus on more business activities.

Setup the Alternate Account

You can setup the alternate account in two different ways, through the user interface (UI) or by bulk upload using file-based data import (FBDI).

Manage Account Combinations

Use the Manage Account Combinations UI to setup alternate accounts if you only need to do a handful.

You can setup the alternate accounts in the Manage Account Combinations UI for low volume.

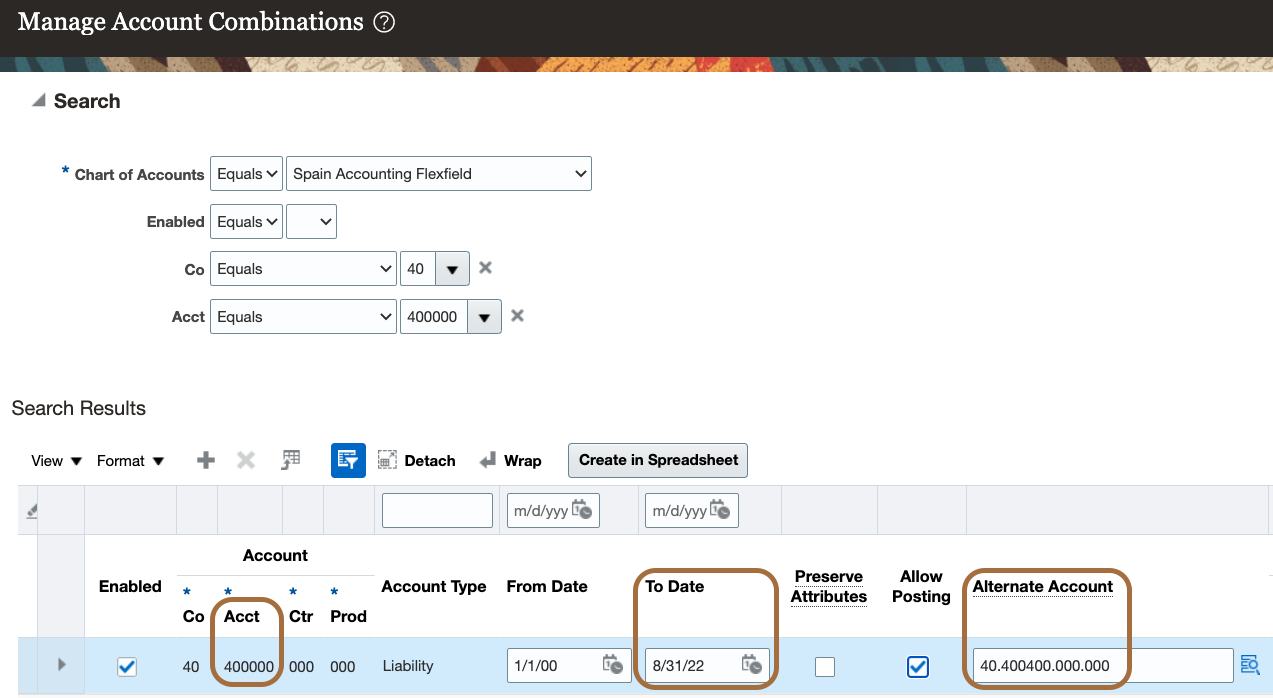

In the example below, after August 31st 2022, you must use account 400400 instead of 400000. For account combination 40-400000-000-000, we define 40-400400-000-000 as alternate account.

If after August 31th 2022, a newly generated entry uses the code combination 40-400000-000-000, the system will automatically replace it with 40-400400-000-000.

You can setup alternate account for one or multiple segments. The balancing segments cannot have alternate value, you must use the same value as that in the original combination.

Import Account Combinations FBDI

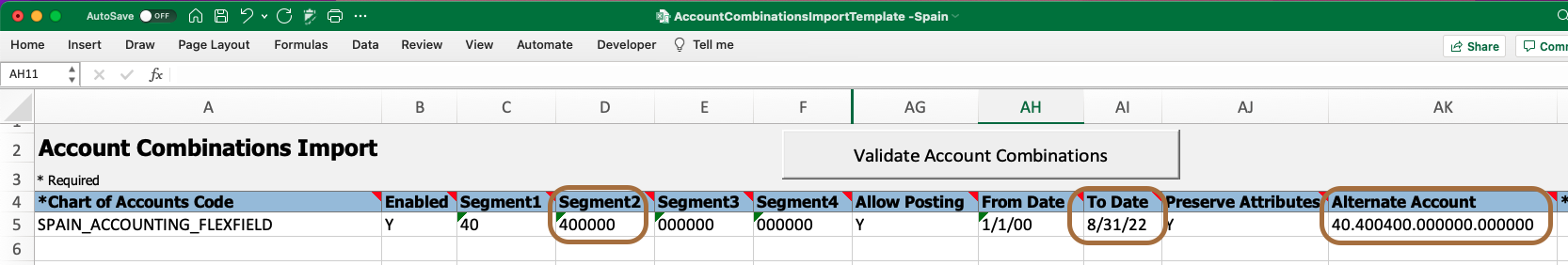

You can use the Import Account Combinations FBDI spreadsheet to bulk update existing account combinations with alternate accounts.

The example above would be handled as follows.

Choose Alternate Accounts

Correct Account

Use a new account value instead of an old one, 400400 instead of 400000 in the example above. For existing combinations with account 400000, define alternate accounts substituting 400000 with 400400 and keeping the other segments.

Suspense Account

Use a suspense account for cases which may not be straight forward with a clear single alternate account. When you use a suspense account and a balance exists, you need to review the detail and potentially reclassify the data.

Identify the Account Replaced by Alternate Account

Subledger transaction – Online Accounting

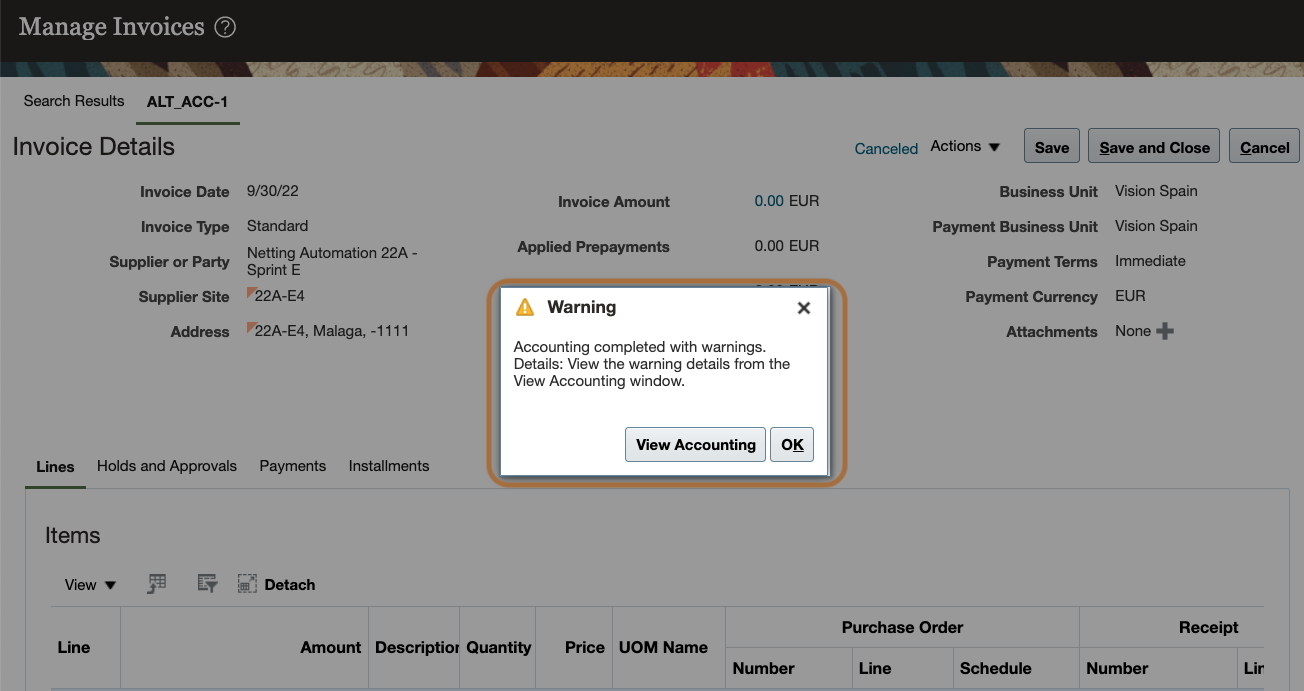

When you create accounting online, e.g. through Account in Draft or Post to Ledger in Payables, if an account is replaced by an alternate account, a warning message will pop up: “Accounting completed with warning. Details: View the warning details from the View Accounting window.”

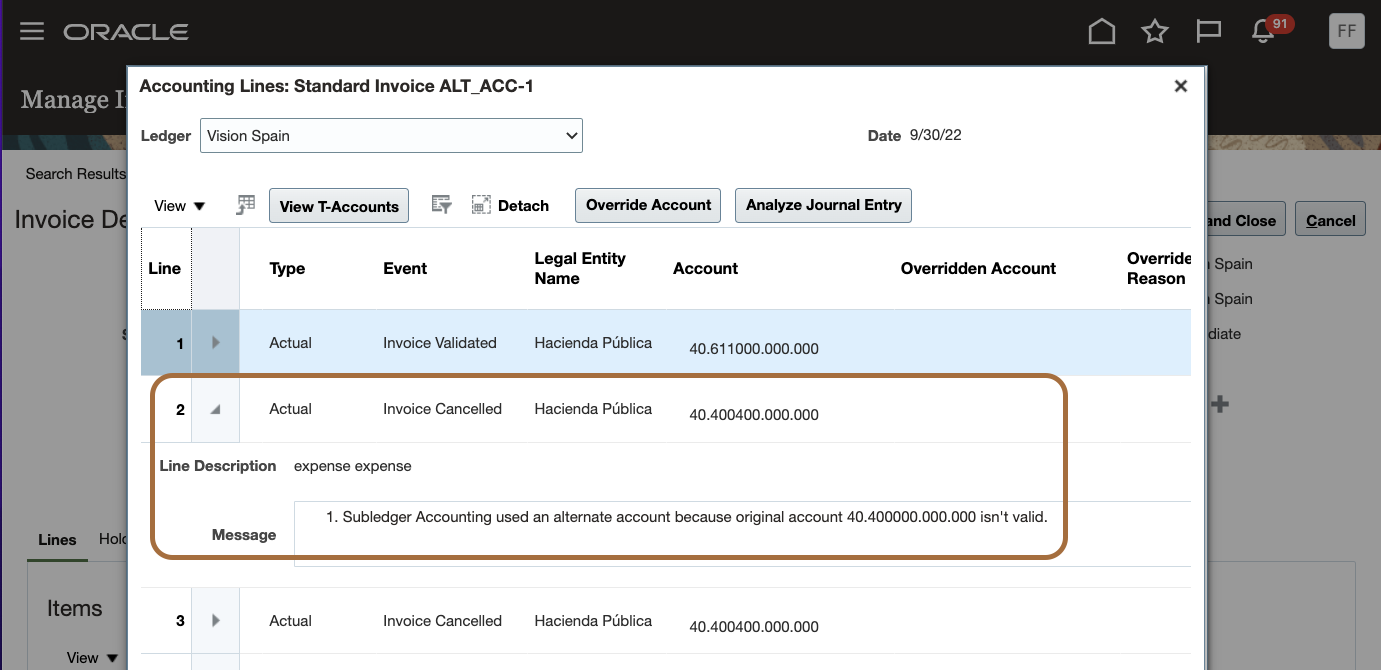

You see the detail in the Accounting Lines UI when you click on View Accounting. The account used is 40.400400.000.000. There is a message with detail: “Subledger Accounting used an alternate account as the original account 40.400000.000.000 is invalid”.

Subledger transaction – Batch Accounting

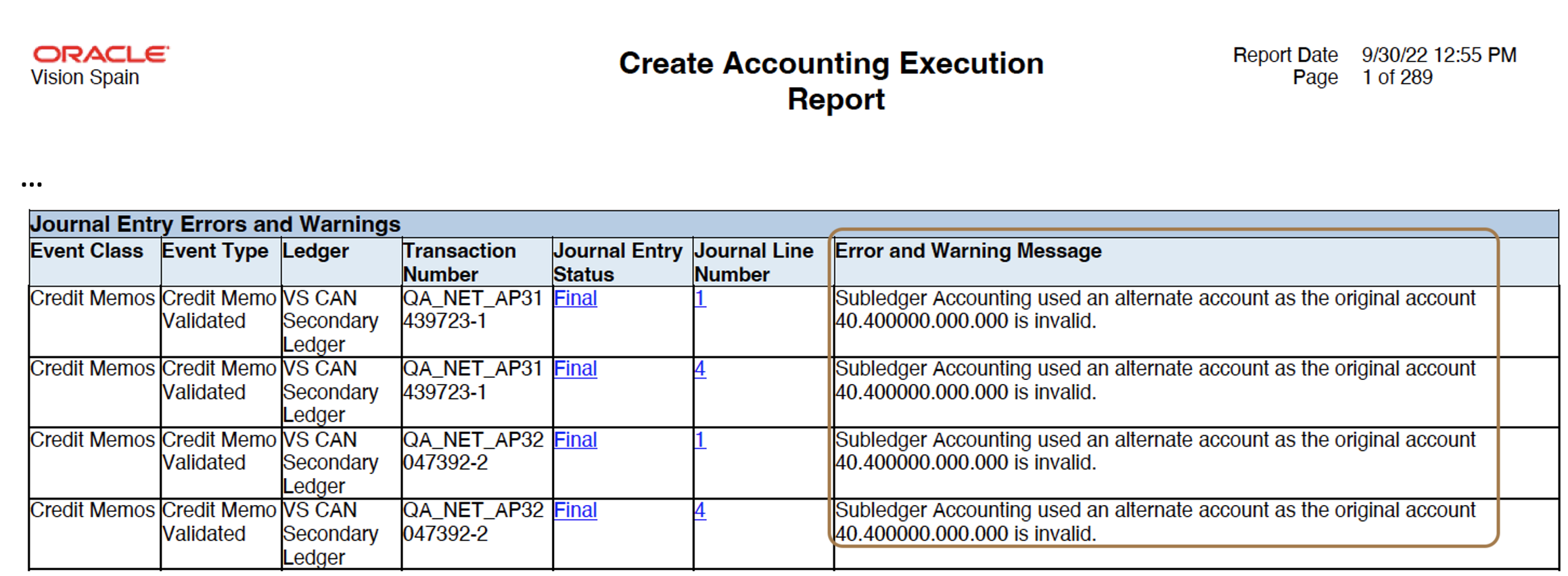

For batch accounting, the Create Accounting Execution Report displays the warning messages in the “Journal Entry Errors and Warnings” section.

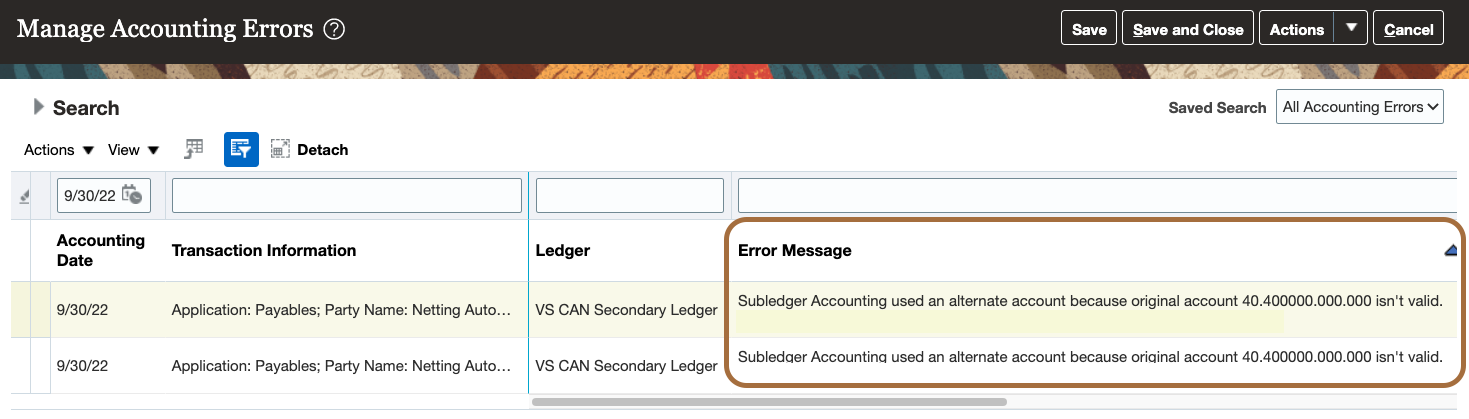

You’ll also see alternate account warnings in the Manage Accounting Errors page, Error Category: Warning.

General Ledger – Imported Journals

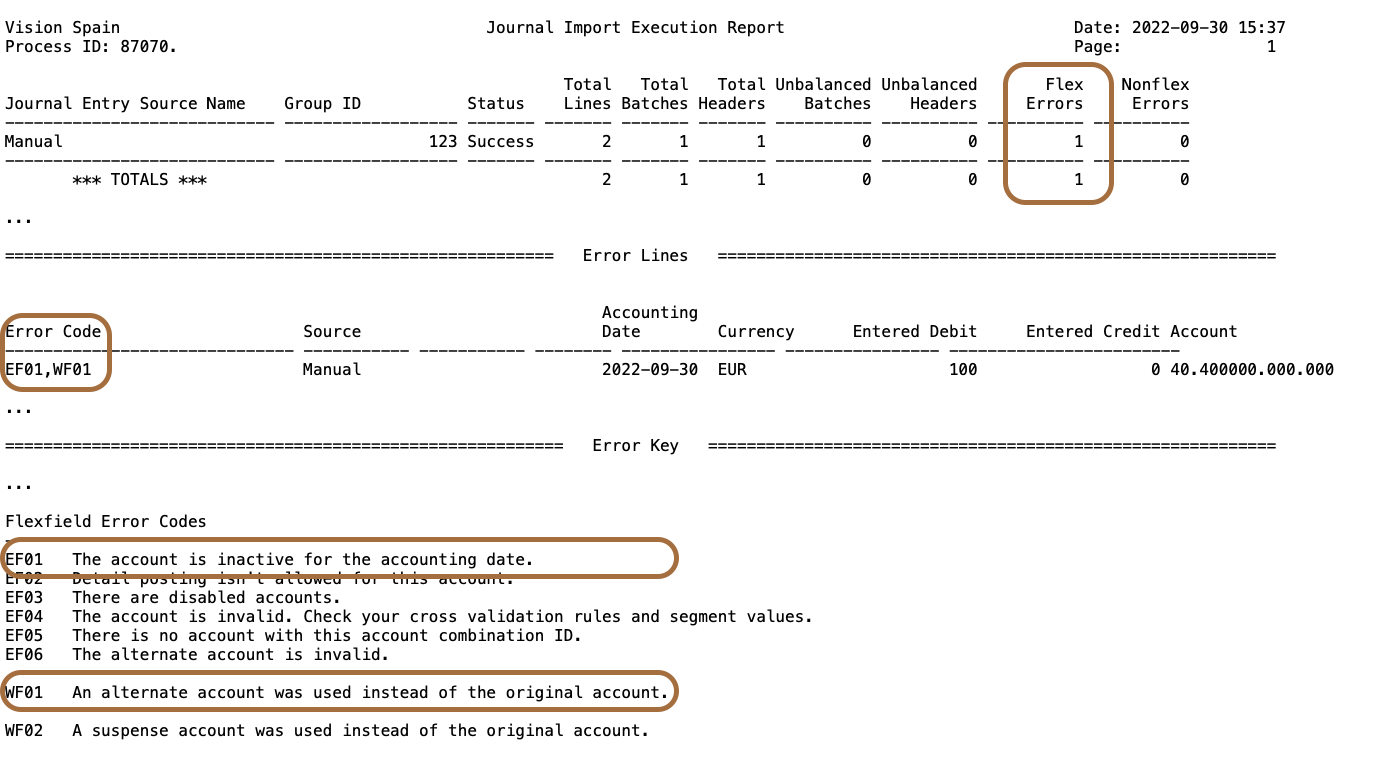

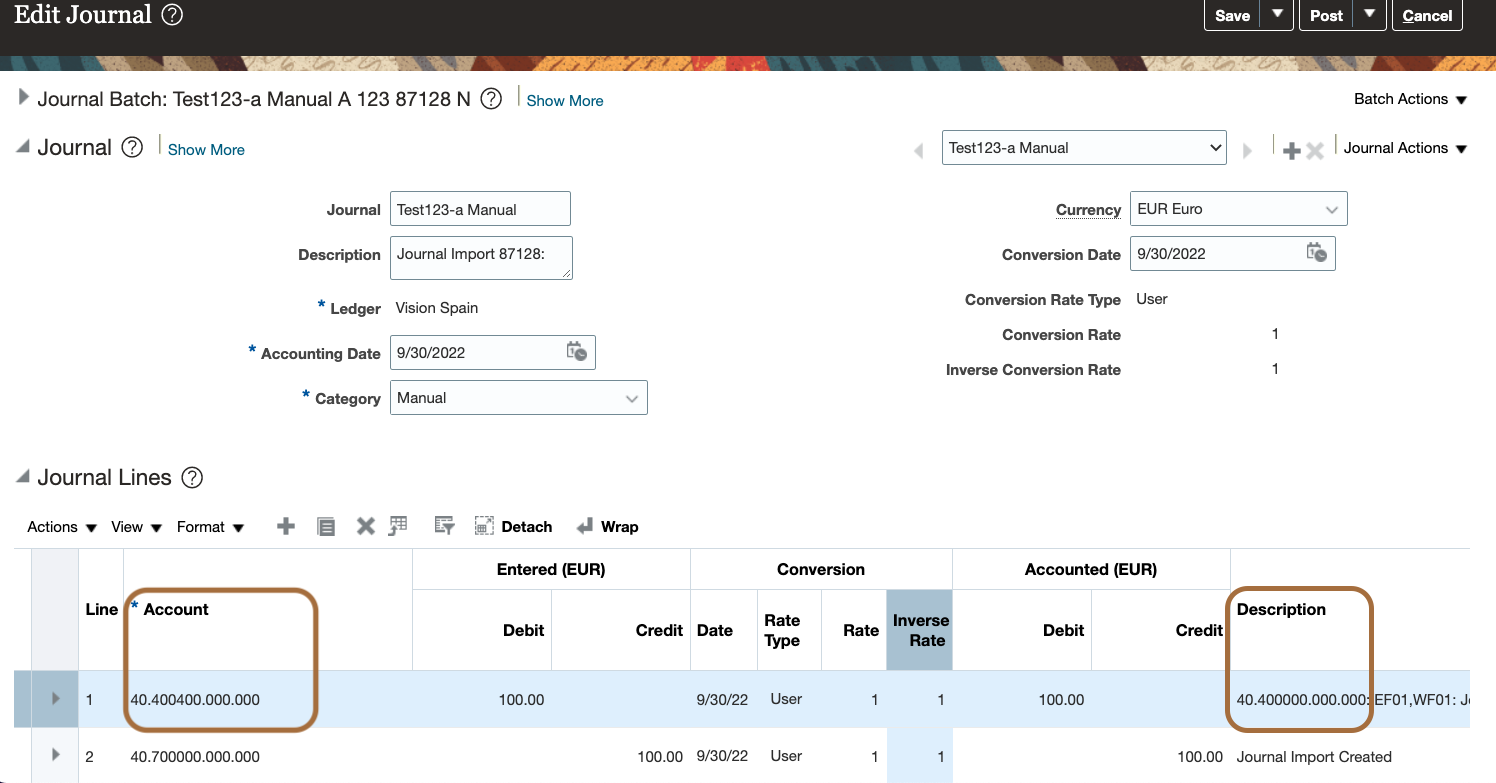

For imported journals, you’ll see error codes in the Journal Import Execution Report (the output of the Import Journals process) when an alternate account is used instead of the original.

The journal line description stores the original account replaced by the alternate account.

Balance the Original Account

Please note that when you disable an account combination, the accounting of subsequent operations on inflight transactions may use the updated setup or the alternate account. For example, if you disable a liability account used on an open payable invoice, the payment will be accounted to a different liability account. If you need to balance the original account, you will need to create a manual journal after re-enabling the old account temporarily.

Conclusion

When you disable segment values and related account combinations, you update the setup to ensure that new transactions will not be processed with these values anymore. However, inflight transactions or corrections to existing transactions can result in accounting entries generated with invalid combinations.

Setup alternate accounts to ensure straight-through processing of accounting entries. You remove the burden of analysis and corrections during the time critical period end.