At Money 20/20 in Las Vegas this week, the buzz about stablecoins and digital assets has been building not only among the fintech innovators, but also across many established financial institutions such as Mastercard, JPMorgan, HSBC, Fiserv, and Visa. On Tuesday (10/28), the excitement reached a new level with Oracle’s announcement of the new Digital Assets Data Nexus – an enterprise-grade platform that leverages Oracle Blockchain, Oracle AI Database 26ai, and AI agent workflow orchestration to enable financial organizations to issue and govern digital assets securely and at scale. If you are reading this blog on the morning of 10/28 and are at Money 20/20, Oracle is sponsoring a lunch 1pm – 2pm as part of its announcement event: registration at: https://us.money2020.com/experience/hosted-meals. The event is at the Venetian Ballrooms Level 1 | Marco Polo 702

If you’ve been following this blog, you know that Oracle has first launched its Oracle Blockchain Platform in 2018 to support enterprise blockchain use cases across many industries. In recent years, Oracle has expanded those capabilities with tokenization and digital asset functions, powered by low-code smart contract generation through the Blockchain App Builder and the tokenization smart contract library for multiple token standards.

So what’s new—and how does Digital Assets Data Nexus take things further?

A New Focus: Bringing Digital Assets into Mainstream Financial Products

The new solution is not only about issuing tokenized assets and managing their lifecycle—it’s about integrating digital assets into regulated financial institutions and embedding them into financial products that operate at scale.

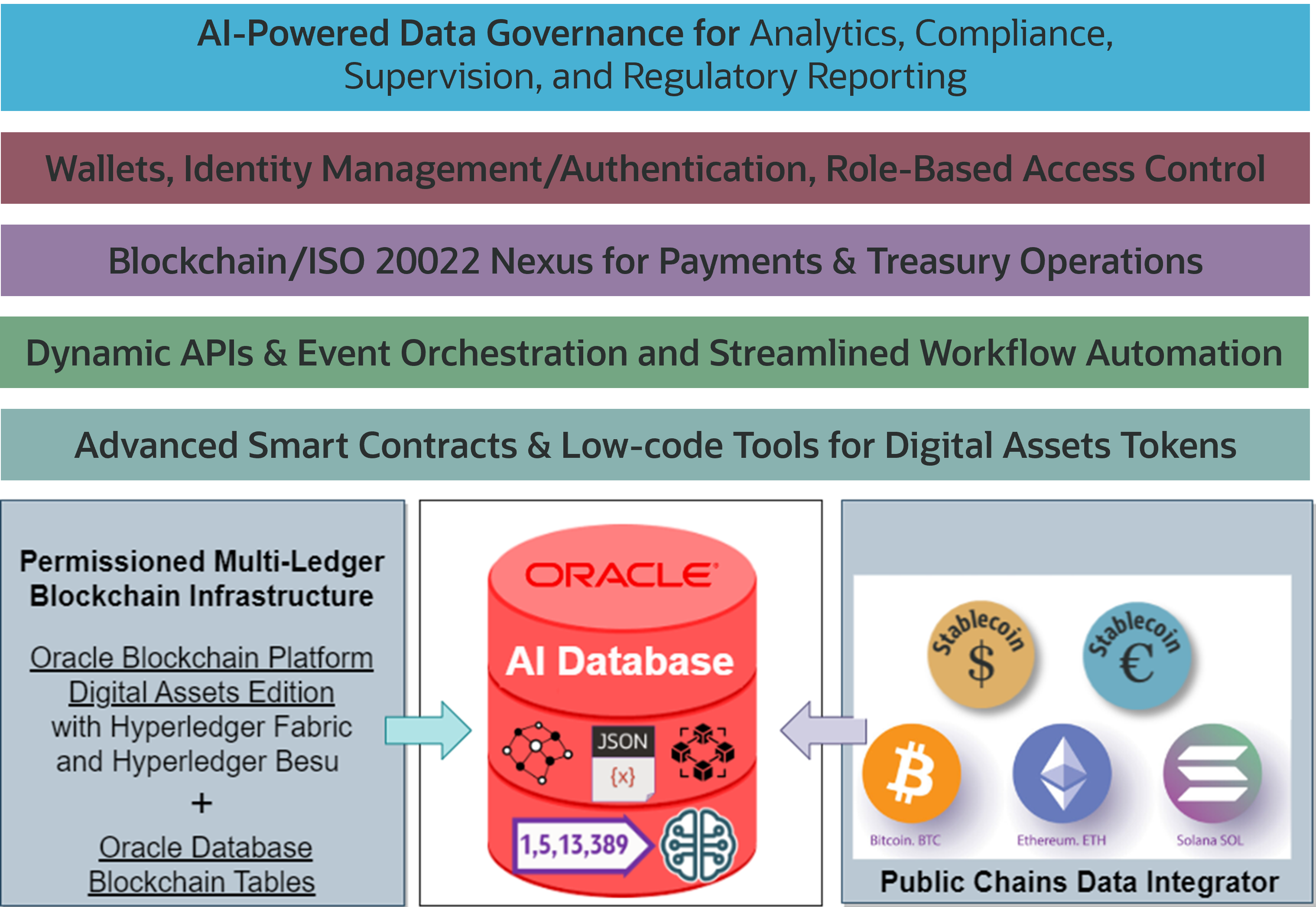

To achieve this, Oracle’s new solution targets several key priorities:

- Rapid, secure smart contract deployment as part of “fast-start” architecture: Enable customers to quickly and securely configure, tailor, and launch smart contracts specifically designed to provide required controls, permissions, and auditing capabilities required to meet regulatory controls.

- Flexible blockchain choices: Support for Hyperledger Fabric with advanced confidential transaction and privacy capabilities, Hyperledger Besu (Ethereum) for interoperability with public or permissioned Ethereum-based networks, and Oracle Database Blockchain Tables for immutable, cryptographically verifiable ledger directly in Oracle AI Database.

- Pre-built smart contract libraries: Tokenization templates for Stablecoins, Deposit Tokens, CBDCs, Bonds, Real-World Assets, and more—automatically generated with advanced policies and easily customized.

- Embedding in financial products: Expose domain-specific APIs and event subscriptions to embed digital assets into solutions such as B2B payments, liquidity optimization for treasury, and programmable trade finance payments.

- Seamless enterprise integration: A rich integration framework extends workflow capabilities with agentic and generative AI, orchestrating cross-ledger operations across systems like core banking, general ledger, and KYC/KYB.

- AI-powered compliance and supervision: Embed risk management, compliance checks, fraud detection, and regulatory reporting. Leverage AI Database vectorization to enable Retrieval-Augmented Generation (RAG) and similarity searches for anomaly detection, while triggering automated control actions such as suspending accounts or adjusting limits when suspicious activity is detected.

Oracle Digital Assets Data Nexus

A Comprehensive Solution for Launching Digital Assets and Using Them in Financial Products and Services

Financial institutions now can deliver digital asset solutions faster, more securely, more cost-effectively, and with reduced risk — all while meeting stringent regulatory and operational requirements.

| Digital assets compliance and insights with Oracle AI Database 26ai |

Enhances risk management, oversight, and regulatory reporting with AI-driven anomaly detection and embedded supervision for greater efficiency and control |

| Agentic AI workflows |

Automates digital asset creation and multi-asset/multi-ledger operations (e.g., Delivery-vs-Payment) using AI-driven transactional workflow orchestration with pre-built integrations and automation libraries. |

| Choice of popular blockchains |

|

| Low-code Blockchain App Builder |

Accelerates innovation with rapid Digital Asset app development and auto-generation of smart contracts using pre-built chaincode SDKIs and tailorable templates. |

| Blockchain / ISO 20022 Flow Nexus |

Enables ERP & Payment systems to leverage blockchain rails for faster, lower-cost, transparent, programmable payments and transfers. |

| Bi-directional data and transaction integration |

Provides cohesive data connectivity fabric for unified data and transaction flows between enterprise systems & multiple blockchains, reducing integration complexity, time, and cost. |

| Fast-start Architecture |

|

| Flexibility, scalability, and resilience of Oracle infrastructure |

|

Overcoming Common Challenges in Digital Asset Deployment

Many institutions have attempted to build a production-grade digital asset platform, but a few that have managed to deploy one spent a long time and had to invest heavily in reaching this goal. The challenges include::

- Shortage of specialized skills

- Technology complexity in balancing performance, scalability, confidentiality & privacy

- Integration hurdles across multiple vendors and internal systems

- Rapidly evolving interoperability standards and approaches

- Security risks in wallets & key management (ByBit hack is a recent example), centralized and hackable “bridges” used for cross-chain transfers (historically there’s been a number of breaches)

- Diverse jurisdiction requirements by regulators

How Oracle’s Digital Assets Data Nexus Addresses These Challenges

- Comprehensive architecture: Integrated multi-ledger infrastructure, pre-built tokenization apps and controls, and rich enterprise integration through APIs, workflow engine, and transaction coordination.

- Pre-built application modules and rapid customization: Low-code/no-code tools and AI capabilities accelerate token, workflow, and reporting customization

- Integrated data nexus with built-in auditing and supervision capabilities with low-code AI-assisted tooling to tailor compliance checks and reporting. Extending this will be AI-powered regulation scans mapping latest regulatory requirements to embedded supervision controls and reporting requirements across jurisdictions.

- Secure interoperability: Eliminates reliance on vulnerable cross-chain bridges by using atomic 2-phase commit (2PC) protocols such as XA/LRC and SATP, ensuring transactions complete safely across ledgers or funds remain in place.

Business Impact

With Oracle’s Digital Assets Data Nexus, customers can enter the digital assets market faster and with greater confidence—supported by Oracle’s trusted enterprise infrastructure and security.

Customers will gain from instant domain expertise and faster innovation cycles provided by the “fast-start” architecture, leveraging auto-generation of smart contracts, and easy tailoring and extensibility over time using low-code tooling. They will also gain bank-grade security and compliance with confidentiality/privacy regulations as well as real-time insights and supervision.

Finally, seamless enterprise and cross-ledger integration will enable support for the Unified Ledger vision promoted by the Bank for International Settlements (BIS) .

As tokenized money—Stablecoins, Deposit Tokens, CBDCs, and more—proliferates, Oracle’s platform addresses one of the industry’s biggest challenges: overcoming fragmented ledgers to preserve the “singleness of money” essential to a well-functioning financial ecosystem.

Oracle Digital Assets Data Nexus is planned for availability next calendar year. Follow this blog for ongoing updates as we approach general availability.