One of the features delivered in PeopleSoft Update Image #48 was in response to an Idea Space request for Expenses to close the loop on escheated payments in Accounts Payables by recognizing the escheatment and adjust the Expenses records accordingly.

Escheatment is the process of transferring unclaimed property to the state. For the PeopleSoft system, this can mean uncashed expense report reimbursements to employees or contractors that have been unclaimed or uncashed for a long period of time.

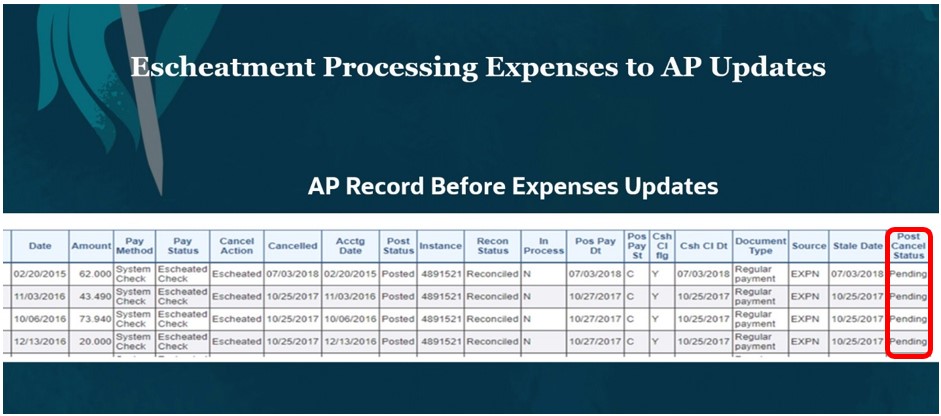

Prior to PeopleSoft Update 48, when a payment was escheated in Accounts Payable, the Expenses system was unaware of the transaction. In the Accounts Payable system, the escheated payment shows a status of “Pending” which indicates it has not been recognized by the source system, in this case Expenses.

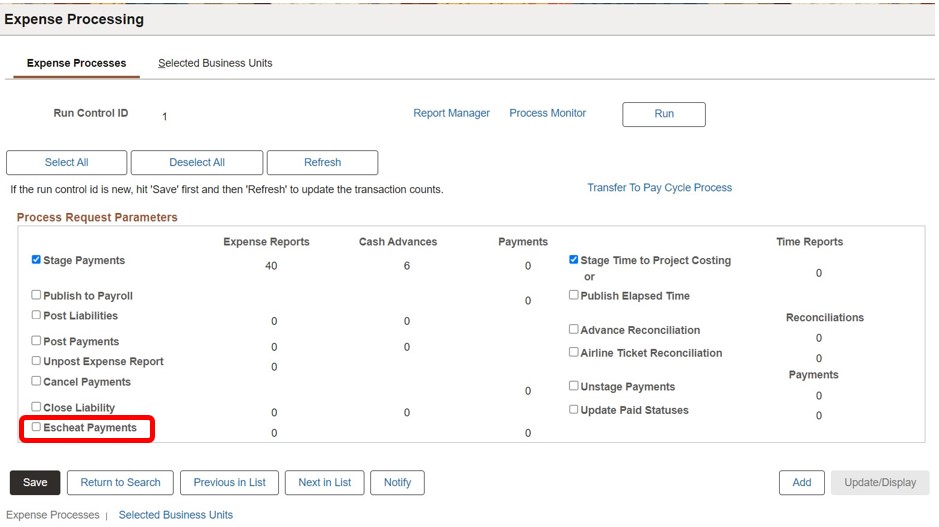

With PeopleSoft Update 48, if enabled, the updated Process Expenses run control page can now check the Accounts Payables system for any escheated Expenses payments.

Using the Expense Processing page, you can select the Escheat Payments option.

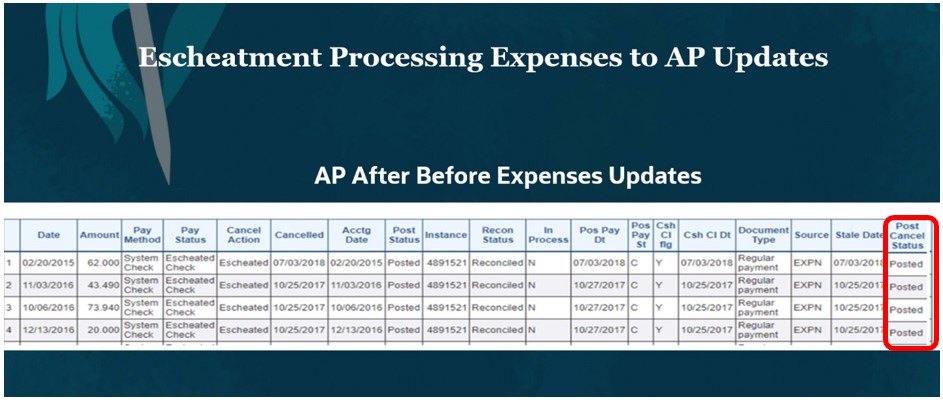

The system generates accounting entries to reverse the liability in Expenses and updates the status of the Expense Report Header to indicate the payment was escheated.

We also close the loop in Accounts Payable by updating the Accounts Payable payment record to indicate the Expenses system has recognized the escheatment by setting the Post Cancel status to “Posted”.

By adding the escheatment processing feature to the Expenses module, we completed a necessary and beneficial step for any organization. It not only ensures compliance with escheatment laws and regulations, but also helps improve financial reporting accuracy and safeguard unclaimed property. By closing the loop with Accounts Payable for the escheatment process through the Expenses module, organizations can enhance their overall financial management and provide the correct status and audit control these transactions require.

To see highlights of the PeopleSoft Travel and Expenses features delivered in Images 45 thru 48, please visit the Oracle Video Channel and click on this Video Feature Overview: