Catch-up Contributions for savings plans is not new. Most employers allow employees age 50 and over to make additional contributions. Under the current IRS regulations, the limit is $7,500 for 2024.

But beginning in 2025, Section 109 of the SECURE 2.0 Act, allows employees who are 60 to 63 years old to contribute at a “super” catch-up rate. All other catch-up contributions eligible employees, those who turn at least 50 years old but will not reach age 60 during the given year, or who will reach age 64 or older in the given year, will continue to only have the regular catch-up contribution limit.

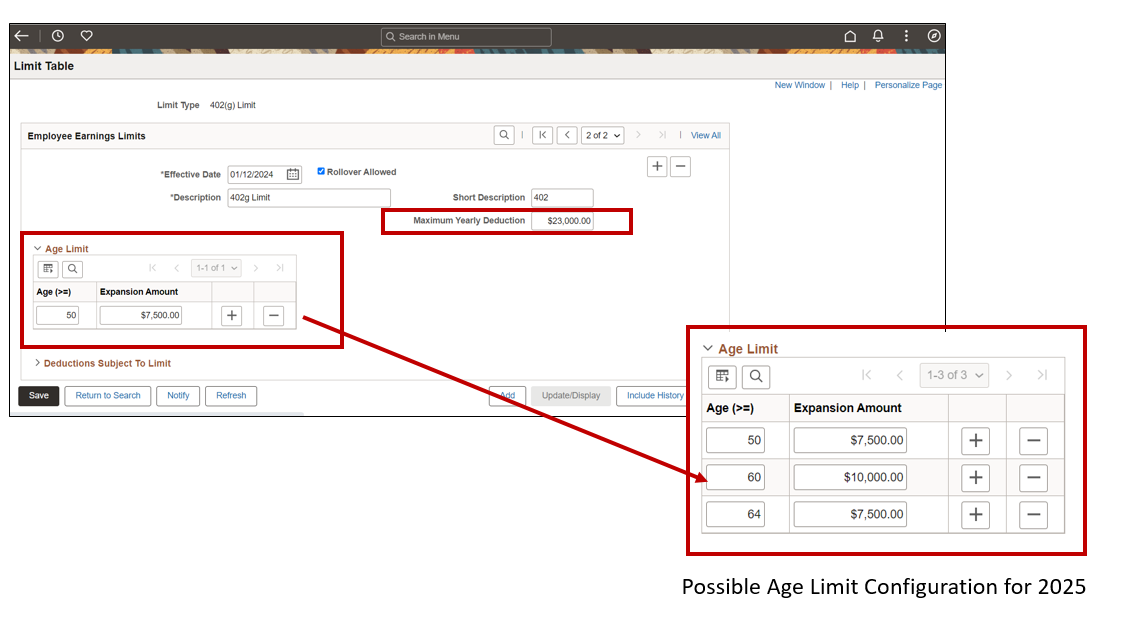

In the past we only tracked one age and one limit. Beginning in 2025, we need a mechanism to track employees between the age of 50 and 59 with the regular contribution, 60 to 63 with the super contribution, and age 64 and over returning to the regular contribution.

To help you meet this condition, we have updated the Limit Table, the Savings Age Catch Up Extension process, and the Benefits Savings Management page.

On the Limit Table, we added a new section for the Age Limit. This applies to 415, 402g, and 457 limit types.

Below is an example of how the Limit Table would look in 2024 and what it may look like in 2025. Every year, you will need to update the Maximum Yearly Deduction and the Age Limit based on the IRS guidelines. (Please note that the 2025 limits could be different than what I am illustrating.)

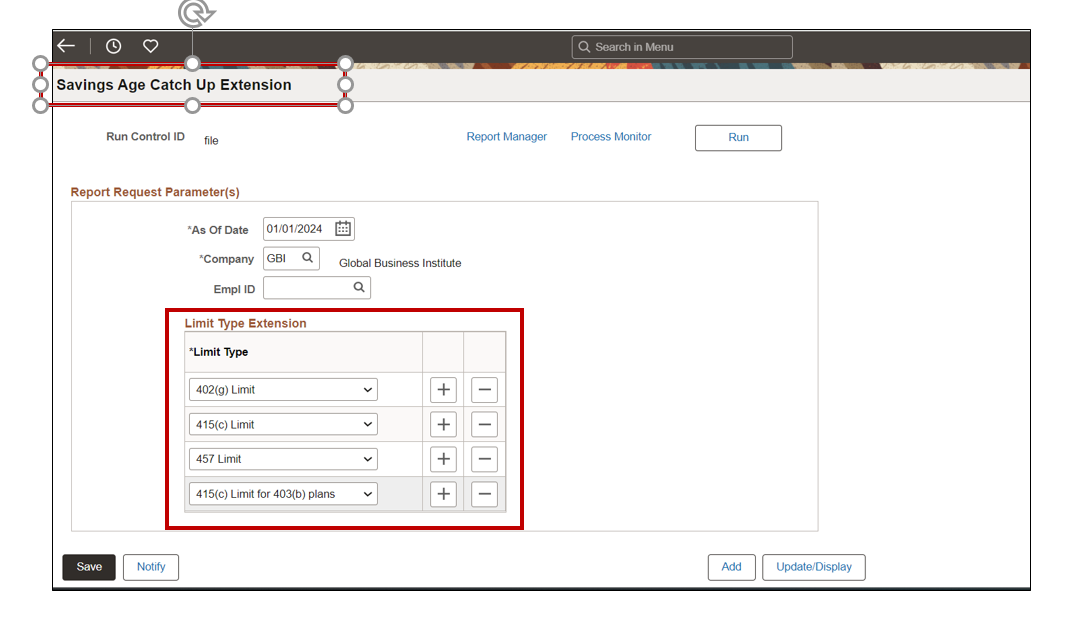

Once you have updated the Limit table, you will use the Savings Age Catch Up Extension process to update employees who meet the age criteria. We have made a number of updates to this process including:

- Updated the name of the process to Savings Age Catch Up Extension, previously the name included Age 50 in the title

- Deleted the Annual Cap Extension field. The process will now use the Age Limit Expansion from the Limit Table

- Allow you to run multiple Limit Types at one time

- You can continue to run by Company or by individual employee

- As most customers will run this multiple times in the year to accommodate for new hires, the process will only update an employee one time per year

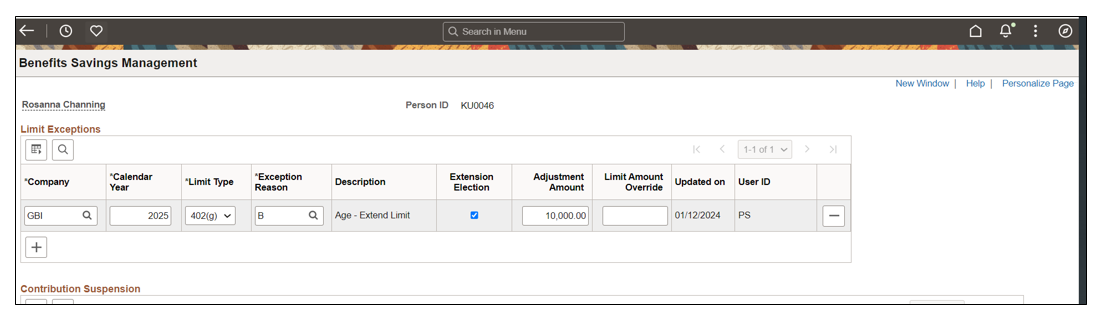

If the employee will be at least age 60 but not older than 63 during 2025, then the Adjustment Amount will be based on the new age bracket.

In addition to the Section 109, we have added a 415c age limit in Image 48. While this is not part of the SECURE 2.0 Act, it was a request on the Ideas Lab. This will assist employers in tracking the employees limit through the Savings Age Catch Up Extension process.

More information can be found in the Image 48 Highlights video and MOSC Document 35345717.

Note: This document should not be considered as legal advice to our customers. Each organization should consult their own Legal team before determining what steps are required to attain compliance.