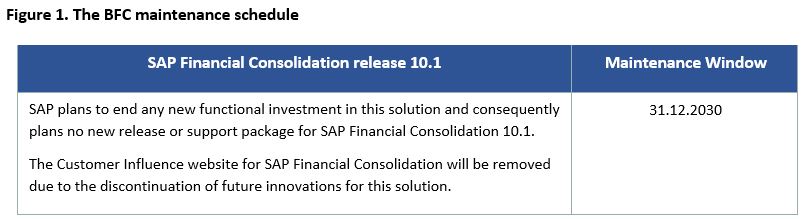

Due to SAP’s fast-approaching end of support for SAP BFC (See Figure 1), many SAP BFC users are considering what direction they will take. They have the option to migrate their BFC consolidation processes to SAP S/4 HANA, and other SAP partner tools for extended financial close and reporting processes, or they can consider other modern and complete Cloud EPM Financial Close solutions that are available today.

You may be a more recent SAP BFC customer, or a long-time user back when it was known as Cartesis Magnitude. Cartesis was a Paris France-based company that was founded in 1990[1] and its flagship product was known as Cartesis Magnitude, which was one of the few web-based solutions for strategic financial management, more popularly referred to as enterprise performance management (EPM) today.

Fast forward 17 years and Cartesis built a customer base of approximately 1300[2], mostly in France and parts of the European region, but then in April 2007, they were acquired by the legacy business intelligence software company, Business Objects for $300 million[3], and six months later Business Objects was acquired by SAP[4] which then renamed Cartesis to SAP BOFC, and then to SAP BFC[5], and finally to SAP Financial Consolidation (SAP FC)[6] which is most likely what you are familiar with and using today.

Since 1990, SAP BFC (formerly Cartesis) has been the primary solution for SAP customers, but like several other Business Objects acquired products such as SAP BPC, BFC has not kept pace with EPM innovation. As organizations worldwide continue to migrate to modern cloud financial consolidation and close platforms, Oracle Cloud EPM has become a leading solution[7] suite that potential SAP BFC users have or are considering migrating to.

Source: SAP

SAP BFC customers realize that they need to transition to a modern financial consolidation solution supported by a complete and unified EPM platform to meet their goals of modernizing their financial consolidation and reporting processes. Today’s CFO’s are investing significantly in AI-driven financial consolidation solutions in addition to implementing additional integrated EPM business processes to support their modern finance initiatives and achieve enterprise-wide financial consolidations that generate high-value and strategic business insights.

Examples of some questions SAP Financial Consolidations users are asking:

- How do we meet current statutory consolidation regulation requirements?

- Is SAP S/4HANA our only option to migrate from our legacy SAP Financial Consolidation platform?

- How do we leverage AI and Machine Learning to modernize and automate leading financial consolidations and reporting best practices?

- How do we leverage modern and innovative consolidation reporting capabilities without using a mix of disparate SAP and 3rd party partner tools and platforms?

- How do we leverage the modern capabilities of Microsoft Office integration?

- How do we incorporate innovative, intelligent integration and advanced enterprise data management capabilities with source systems?

- How do we quickly and cost-effectively migrate to a modern and complete cloud EPM platform?

- Where do we start? What resources are available to help us migrate successfully?

As an SAP BFC user, you have the choice of either reimplementing your legacy SAP Financial Consolidation processes using SAP S4/HANA combined with 3rd party SAP partner tools to address your financial consolidation and reporting requirements or, you can move to a modern and fully complete Cloud EPM platform that has everything you need for modern financial consolidations and regulatory reporting delivered in one common and integrated Cloud EPM platform. Let’s look at these two options a more detail.

Migrating to SAP tools

Rather than building a complete, purpose-built cloud EPM solution suite that addresses all financial consolidations, reporting, and extended EPM business processes in a single integrated and unified platform, SAP has taken a siloed approach by providing financial consolidations in S/4HANA in addition to other SAP and third-party partner tools to support processes such as Account Reconciliation, Tax, and Narrative Reporting.

SAP may offer several migration options for BFC customers, but careful consideration of the various costs and effort associated with migrating from your current SAP BFC platform is recommended as you may be introducing more complexity and costs by implementing and managing multiple platforms and tools.

Technically, and with enough time, money, and specialized resources, these SAP and added partner tools could conceivably be made to work together, but SAP BFC customers would likely need to deal with potential challenges such as:

- Different user interfaces (UI)

- Different tool technologies (languages, platforms, etc.)

- A mix of Cloud and on-premises deployments

- Multiple points of vendor support

- Multiple points of tool integration

- Multiple tool administration

- Different skill set requirements

- Different and questionable underlying AI capabilities

- Multiple tool upgrade cycles and version control efforts between tools

All of these can drive higher TCO and overall implementation and ongoing administration complexity while potentially impacting system stability and availability if any one of these disparate tools develops issues.

Oracle Cloud EPM as the better migration path

Oracle Cloud EPM delivers a complete, integrated, and unified software-as-a-service (SaaS) EPM suite. The depth of Oracle Cloud EPM’s complete end-to-end financial close delivers intelligent process automation (IPA) using advanced AI to enable you to automate consolidations, orchestrate a connected close, and automate narratives in reports.

With Oracle Cloud EPM, SAP BFC customers can migrate and optimize their legacy BFC applications to run in a unified, single platform that is purpose-built to support all your current and future financial consolidation and close use case requirements without having to depend on multiple tools, platforms, and vendors. This can significantly lower your migration, integration, and administration costs while speeding up time to value and making it easy for you to implement Oracle Cloud EPM financial consolidations and other EPM modules at your own pace.

Why Oracle Cloud EPM is the smart alternative for SAP BFC customers

- Oracle Cloud EPM covers the entire end-to-end close process including financial consolidation, account reconciliation, tax provision, narrative reporting, and more in one solution without the need for additional 3rd party tools.

- Oracle Cloud EPM Financial Consolidation and Close is a fully mature and proven solution that is part of the complete Oracle Cloud EPM developed and supported by one vendor, Oracle.

- Oracle Cloud EPM is a mature, proven, intelligent performance management platform with leading AI and ML innovation to deliver modern, Intelligent process automation (IPA) for your entire end-to-end financial close use case requirements.

- If you are considering extended EPM capabilities in the cloud such as enterprise connected planning, these purpose-built capabilities are already part of the complete Oracle Cloud EPM suite.

- Oracle Cloud EPM has built-in Analytics, advanced reporting, and real-time integration with Oracle Analytics Cloud if you require more comprehensive analytics capabilities across your enterprise.

- Oracle has experienced SAP BFC migration partners to help you migrate successfully.

- Oracle helps you develop your own EPM Center of Excellence (CoE) which helps drive continuous innovation. Learn how to create and run an EPM center of excellence.

Discover Oracle Cloud EPM today

Take the first step to migrate to Oracle Cloud EPM. Customers are choosing Oracle for our complete and purpose-built cloud EPM platform instead of struggling with the complex implementation, administration, and added costs related to other vendors’ incomplete and fragmented tools and technologies. Oracle Cloud EPM helps address all your requirements in a single, unified, and complete cloud EPM platform developed and supported by Oracle.

Why settle for an incomplete SAP portfolio that may have you implement multiple tools from different vendors to fill financial close and reporting gaps, or wait for a costly, time-consuming, integration, and customized development effort? We invite you to take the next step and allow us to explore with you the vast benefits thousands of Oracle Cloud EPM customers are experiencing today with the leading complete cloud EPM suite for an end-to-end financial close.

Contact us today to get started on your migration path to Oracle Cloud EPM Financial Consolidation and Close.

Additional resources:

- Oracle Cloud EPM for Financial Consolidation and Close

- Why companies choose Oracle Fusion Cloud EPM over the competition

- Compare Oracle EPM to SAP for more details

- Why migrate from SAP to Oracle Cloud EPM?

[1] https://www.cbinsights.com/company/cartesis

[2] https://www.cbinsights.com/company/cartesis

[3] https://www.cfo.com/news/business-objects-to-buy-cartesis/674911/

[4] https://www.sap.com/investors/en/financial-news/ad-hoc-news/2007/10/238209.html

[5] https://answers.sap.com/questions/8382735/bpc-vs-bfc.html

[6] https://support.sap.com/en/product/support-by-product/01200314690800000356.html

[7] https://www.oracle.com/ca-en/corporate/analyst-reports/applications/