Multinational organizations are in constant motion, moving fast to stay ahead of competition and juggling a myriad of challenges, including supply chains disruptions, staffing shortages, economic instability, and geopolitical dynamics to name a few. Just when one disruption is in the rear-view mirror, another one is approaching.

One of the biggest recent disruptions and the most substantial change to corporate global tax rules in the last 50 years is Organization for Economic Cooperation and Development (OECD) Pillar Two. Pillar Two brings in a whole new set of challenges including, complex tax calculations, compliance risks, new requirements related to data accuracy and data aggregation, and new processes. Pillar Two can materially impact the business. Executing on Pillar Two has to be done right in order to have an effective financial close as well as improve financial and operational planning and inform better strategic decisions.

Yet while tax executives have been asked to do more and provide more transparency in their processes, they have traditionally not had the benefit of technology-enabled solutions to help with efforts such as Pillar Two. When tax asks finance for the data to meet these challenges, they are generally told it’s unavailable or difficult to gather. The mindset of a tax department is captured in the mantra, “roll up your sleeves and manipulate the data in Excel to get what we need.” That simply can’t be done effectively when addressing Pillar Two which needs finance and tax departments to work even closer together.

There are estimated to be over 100 Pillar Two data points per entity, jurisdiction, branch, etc., and gathering and making sense of all that data is challenging. Hundreds of hours are often spent gathering and manipulating data to upload into Excel and other point solutions. That is simply not going to do justice to the Pillar Two process.

Did you know that only about 55% of those surveyed in a recent Deloitte tax survey were somewhat confident that they have readily available tax and accounting data necessary to comply with Pillar Two?

In another survey led by KPMG, 57% of tax leaders were contemplating hiring more tax staff at the junior level while 46% of the respondents were planning to hire at the managerial level to comply with Pillar Two requirements.

Finance leaders need a purpose-built, finance-driven technology platform that will not only help solve the many Pillar Two challenges they face but if leveraged fully, will allow them to focus on more strategic initiatives and make quicker decisions to help grow the business and reduce unnecessary additional costs to prepare and report on Pillar Two. Oracle Cloud Enterprise Performance Management (EPM) Pillar Two Tax Reporting delivers on this need:

- Ensures Pillar Two data accuracy with speed

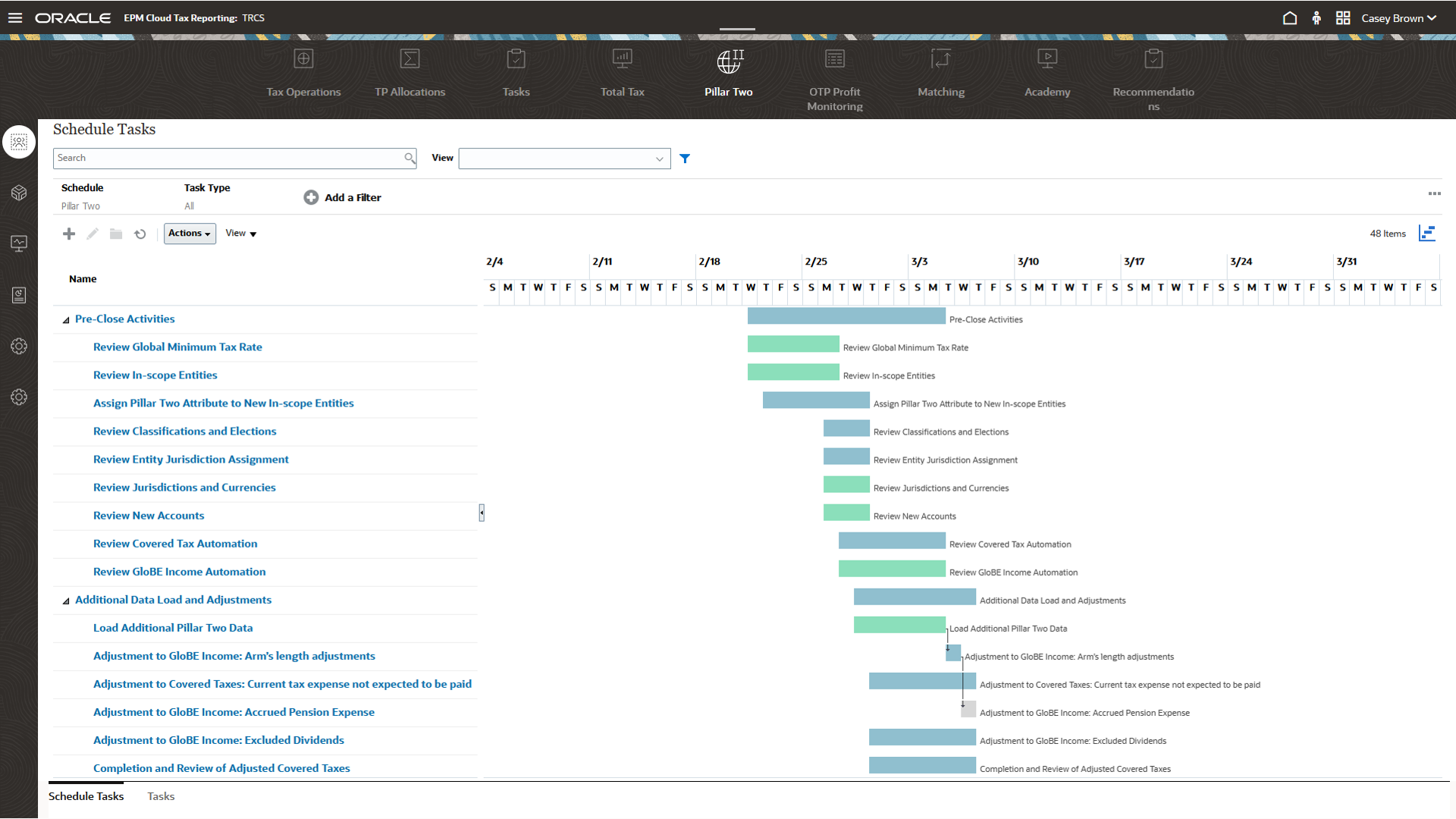

- Enables a faster financial close with less effort

- Automates complex Pillar Two calculations

- Forecasts future financial impacts of Pillar Two

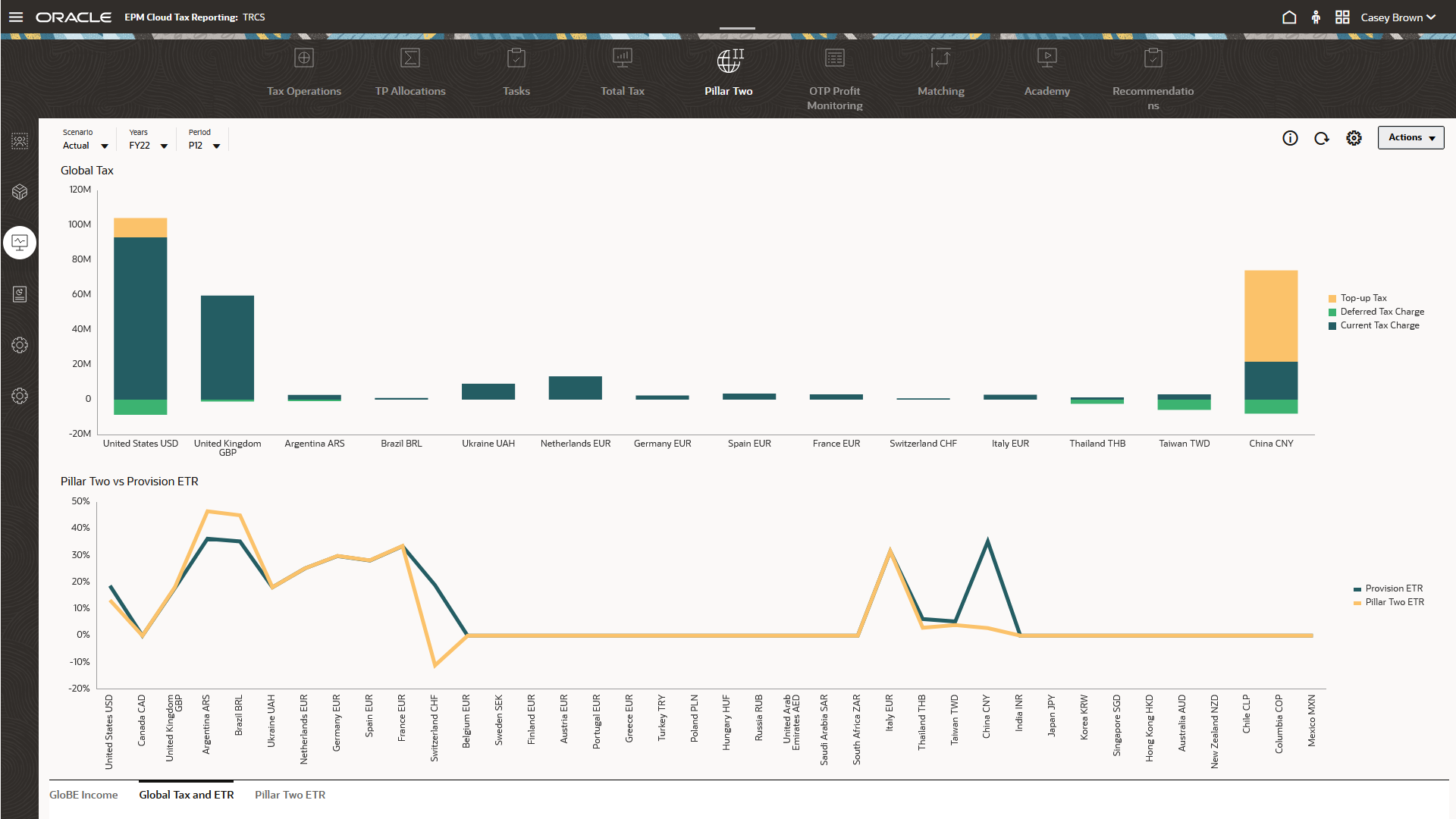

- Tracks Pillar Two performance with pre-built dashboards for comprehensive oversight

Aggregating the data from disconnected systems and outside of finance can be difficult. And there is additional risk for audits and meeting reporting deadlines because validating the Pillar Two data and ensuring accuracy can be very time-consuming. Cloud EPM mitigates that risk. It streamlines the entire compliance process, from data collection to reporting, ensuring you’re not just surviving but thriving under the new regulations. It’s built with:

- Automated data handling: Say goodbye to manual drudgery. Automate every piece of data collection, from source systems to manual entries

- A comprehensive tax model: Dive deep into the GloBE Income calculation, ETR Reconciliation, and more with pre-built dashboards and reports

- Best-practices for quick implementation: With preconfigured best practices, your transition to Pillar Two compliance can be swift and seamless.

The global tax landscape is changing dramatically with Pillar Two and Oracle Cloud EPM’s Pillar Two capability offers you a way to navigate these changes with confidence and compliance. Embrace Oracle Cloud EPM today and turn this challenge into your competitive advantage.

To learn more visit Oracle.com/EPM or request a Tax Reporting and Pillar Two demo today.