The holiday season doesn’t end on Christmas Day—or even at the end of December. The ripple effects of the holidays can be felt well into the New Year. In acknowledgment of the special conditions that exist from the day after Christmas through mid to late January, many brands recognize this period as Q5, the fifth quarter.

Q5 is characterized by a variety of negative and positive events that all cross-influence each other, including:

- After-Christmas sales

- Gift returns

- Gift card redemptions

- Self-gifting

- The accumulation of holiday consumer debt

Let’s talk about ways to reduce the negative impacts and boost the positive impacts through smart marketing and other strategies, and end by sharing an on-demand webinar about email marketing performance during the 2023 holiday season.

For year-round advice on getting ready for the holidays, check out our Holiday Marketing Quarterly guides.

After-Christmas Sales

While they briefly all but disappeared during the inventory-crunches of the pandemic, after-Christmas sales are back now that inventories are back to normal levels. Even after strong holiday seasons, there are always seasonal, gift-oriented, winter-related, and other products that retailers would rather have off their store shelves to make room for fresh, spring-related inventory.

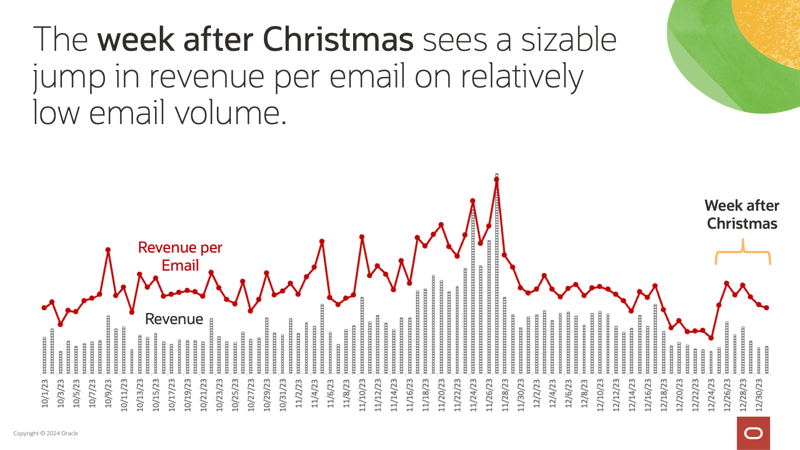

In coordination with other channels, email marketing is a core way of promoting these sales to your most loyal customers. Moreover, performance data from an anonymized rollup of Oracle Responsys customers in retail and ecommerce indicate that marketers have an opportunity to increase their revenue during the week after Christmas by increasing email volume. That’s because while revenue per email during the week after Christmas is comparable to mid-December, email volumes are significantly lower. Reducing that gap will boost revenues.

After-Christmas sales—and sales in general well into January—are assisted by two other components of Q5: gift returns and gift card redemptions.

Gift Returns

Returns of unwanted, wrong-sized, and damaged presents have always been part of the messy aftermath of the holidays. The upside of returns is that they bring customers back to your stores or to your website, where they tend to buy additional items.

The downside of returns is that they’re expensive to manage. Even worse, returns have been rising because of growing ecommerce sales, which now represent about 15% of all retail sales, according to The Census Bureau of the Department of Commerce. The issue is that online orders are returned at much higher rates than purchases made in stores. While the return rate for in-store purchases is 5%-10%, the return rate for online orders is 15%-40%, says Happy Returns.

And return costs are substantial. Between transportation costs and markdowns, it costs on average 66% of the price of a $50 item for retailers to process a return, according to Optoro.

To help reduce both online returns and the costs associated with those returns, we recommend a variety of strategies that span operations and marketing:

- Collect and display social feedback on product fit on your site, so shopping can hear from past purchasers whether a shirt, for instance, is true to size, runs small, or runs large

- Offer augmented reality, so shoppers can see, for example, how apparel or makeup looks on them or how furniture or art will look in their home

- Recognize and respond to “bracketing,” where shoppers put multiple sizes of a garment in their cart, for instance, referring them to tools that can help them choose the right item

- Recognize and try to discourage “showrooming,” where shoppers by expensive products to use briefly and then return them, such as buying a huge TV to watch the Super Bowl or a fancy dress to wear to a wedding

- Identify customers who return items at high rates and try to target them with promotions and messaging that reduce returns

- Adopt a “no returns” policy on clearance items

- Offer shoppers an additional discount if they waive the right to return the product (unless it’s defective or damaged in shipping)

- Tell consumers who try to return inexpensive items to keep them to avoid a further loss on return shipping fees, especially those customers who rarely return things

- Incentivize and promote low-cost return channels, such as stores

Reducing returns even a little can be seriously beneficial to retailers’ bottom lines.

Gift Card Redemptions

Because of their flexibility and ease-of-gifting, gift cards remain incredibly popular gifts. But the revenue from gift cards can’t be formally recognized until card values are redeemed.

About 65% of gift cards are redeemed within 180 days, according to InMarket. However, Q5 is peak holiday gift card redemption time.

As you look to spur redemptions, here are some opportunities to consider:

- Be aware of gift card sales and redemption levels so you have a sense of when the gift card redemption opportunity is above average

- Pay extra attention to sales and marketing campaign performance during Q5, when gift card redemption levels are high

- Explicitly suggest in your post-holiday marketing and ad campaigns that people redeem their gift cards

- Ask your digital marketing subscribers if they received a gift card during the holidays via progressive profiling and then message them appropriately in subsequent marketing campaigns

- Offer incentives when customers pay with a gift card, particularly after post-holiday sales are over

- If you offered free “promotional gift cards” with holiday purchases, consider the tracking and redemption strategies above for those as well before those cards expire

With 61% of consumers spending more than a gift card’s value when they redeem them, according to CapitalOne, these efforts can really pay off.

Self-Gifting

Going hand in hand with gift card redemption is self-gifting. Retailers tap into this by using messaging like “Get what you really wanted.”

According to Google research, self-gifting accounted for 57% of holiday shopping occasions between Dec. 26, 2022 and Jan. 4, 2023, and that rate has increased steadily in recent years, driven primarily by millennials and Gen X. Moreover, Google found that search volume for gift-related queries, like “gifts” and “presents,” remained high in January 2023—up 45% and 15%, respectively, compared to the months of September and October 2022.

For more marketing messaging themes to consider, check out our Content Calendar Assistant.

Holiday Debt Overhang

While consumers have always experienced financial holiday hangovers, where they tend to overextend themselves, it’s different now for a couple of reasons. First, after consumers paid down debt early in the pandemic, they’re now packing it back on. In fact, US consumer credit card debt has topped a record $1 trillion, according to the Federal Reserve Bank of New York.

And second, while that credit card debt is worrisome, it doesn’t account for so-called “phantom debt” that’s being accrued by the soaring use of Buy Now Pay Later (BNPL) services from Affirm, Afterpay, Klarna, and others. According to Adobe, BNPL usage increased 14% year-over-year this holiday season—and 43% year-over-year on Cyber Monday—with consumers racking up $16.6 billion in purchases through BNPL services.

Use of BNPL is particularly high among younger consumers, who find these services much more attractive than credit cards because they charge little to no interest and have predictable payments. So, if your audience skews young, you may see even higher usage of BNPL.

For retailers and ecommerce brands, the opportunities are to better understand:

- Your audience’s price sensitivities and payment preferences so you can thoughtfully manage your messaging to various segments

- The buying patterns of customers who use BNPL, especially the likelihood of repeat buying during BNPL repayment windows at different debt levels

With consumers carrying record debt into the first quarter, it’s likely to depress consumer spending.

More Holiday Trends

For a deeper discussion of those trends and others, as well as a breakdown of email marketing performance and opportunities during the 2023 holiday season, watch this on-demand webinar.

We hope you enjoyed our “2023 Email Marketing Holiday Season in Review” webinar. Some of our other on-demand webinars include:

- Creating & Maintaining Effective Automated Campaigns

- Content Planning: Advice from Oracle’s Global Digital Marketing Agency

- How to Transform Your Customer Experience with a CDP

- Priorities for a Mail Privacy Protection World

- Modular Email Architecture: The Next-Generation Template

—————

Need help with your email marketing campaigns? Oracle Digital Experience Agency has hundreds of marketing and communication experts ready to help Responsys, Eloqua, and other Oracle customers create stronger connections with their customers and employees—even if they’re not using an Oracle platform as the foundation of that experience. Our award-winning specialists can handle everything from creative and strategy to content planning and project management. For example, our full-service email marketing clients generate 24% higher open rates, 30% higher click rates, and 9% lower unsubscribe rates than Oracle Responsys customers who aren’t.

For help overcoming your challenges or seizing your opportunities, talk to your Oracle account manager, visit us online, or email us at OracleAgency_US@Oracle.com.

Now substantially updated, this blog post was originally published on Feb. 3, 2023 by Clint Kaiser, Kaiti Gary, and JT Capps.