Not all reconciliation issues are data related. To rule out whether it is a report code issue, it is always important to keep your code versions up to date.

REPORTS

AR Reconciliation Report [ARXRECON, ARRECONB.pls]

Aging – 7 Bucket By Account Report [ARXAGMW, ARAGBKTB.pls]

AR to GL Reconciliation Report [ARGLRECB, arglrecb.pls]

AR Journal Entries Report [ARRGTA, arjigl.lpc]

GL Account Analysis Report – 132 Char [GLACTANL, glijeapb.pls]

JOURNALS

Sales Journal [ARSJGLARPT, ARXLARB.pls]

Applied Receipts Journal [ARXAPPJR, ARGLRECB.pls]

Unapplied Receipts Journal [ARUNAJR, ARGLRECB.pls]

Adjustment Journal [ARXADJJR, ARRXOTHB.pls]

REGISTERS

Transaction Register [ARRXINVR, ARRXTXB.pls]

Applied Receipts Register [ARRXARRG, ARRXRCB.pls]

Unapplied and Unresolved Receipts Register [RXARUNAR, ARRXUNAB.pls]

Adjustment Register [ARRXARPB, ARRXADJB.pls]

How to check file versions:

a) Using UNIX command

strings -a |grep ‘$Header’

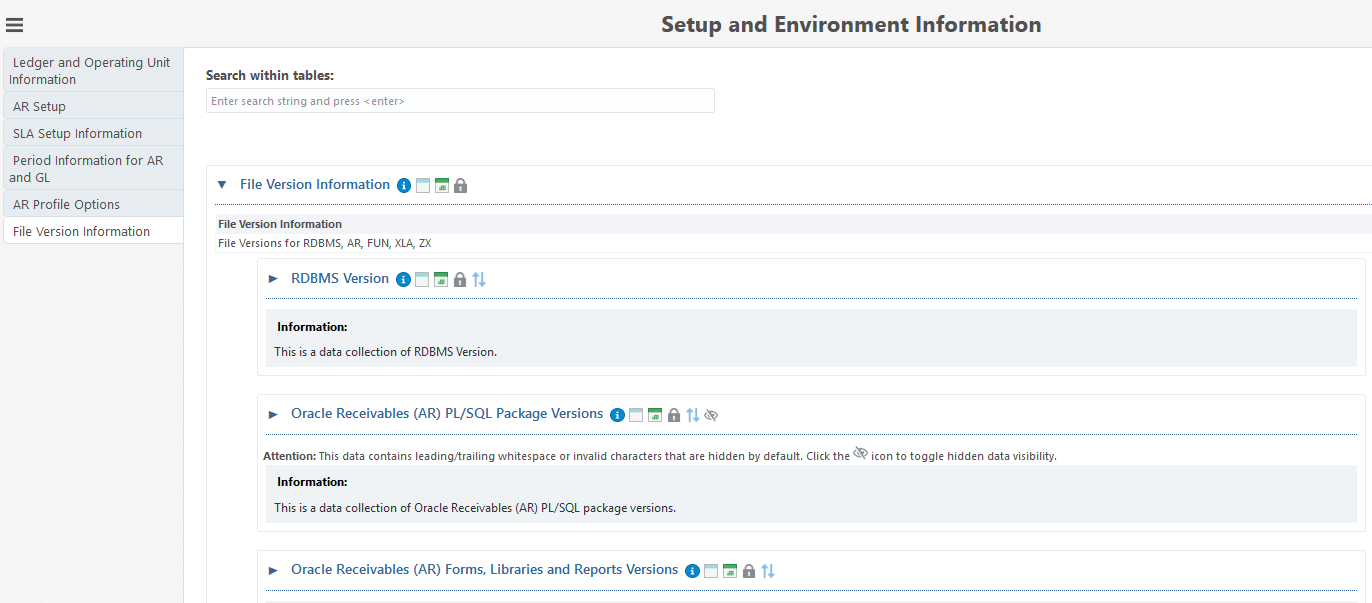

b) Via Analyzers under Setup & Environment Information Window

File Version Information > AR Forms, Libraries and Report Versions

To access & install E-Business Suite (EBS) Analyzers, see

Get Proactive with Oracle EBS – Product Support Analyzer Index (Doc ID 1545562.1)

EBS Support Analyzer Bundle Menu Tool (Doc ID 1939637.1) – Install all, some, one Analyzer

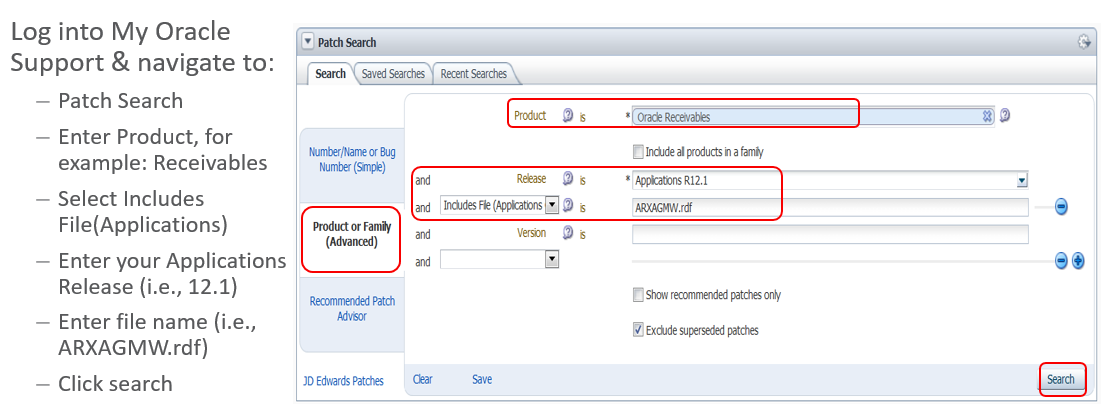

c) Using My Oracle Support To Find Latest Report Version

Additional References for non-code issues:

AR to GL Reconciliation Report Shows DIFFERENCE_DR = DIFFERENCE_CR for Upgraded Data (Doc ID 1616730.1)

AR to GL Reconciliation Report Showing Wrong Headings Debit / Debit Should Be Debit / Credit (Doc ID 1551873.1)