Replacement VAT number six figure identification number of firms (FDI) with the VAT extension

The federal law on business identification number has changed with effect from 1 Jan 2014. The old registration number format was 8 characters but the new format supports 19-20 characters.

Old Behavior

The current VAT number validation format is CH + 6 digits (the six

digits after the prefix should be numeric). Example: CH123456. Swiss companies

can continue to use the current VAT number format until the end of 2013.

New Behavior

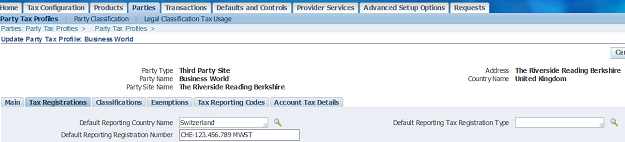

Effective from January 2014, there are changes in the validation of Tax

Registration Number. The new VAT number validation is formatted as CHE + nine

numeric positions + extension. Example: CHE-123.456.789 MWST.

The following validation is implemented.

- CHE – is a fixed value. It represents the country code.

- to separate the country code

and the tax number portion. - 123.456.789 – nine numeric positions, separated by periods.

- (Blank) – blank position that separates the numeric portion and the

extension portion. - XXXX : Depending on the

specific part of Switzerland the company address belongs to. The three possible

extensions are: MWST, TVA or IVA.

The total length of the new VAT number, therefore, can be 19 or 20

digits.

Recommendation

a) Apply Patch 15964400 as detailed in Doc ID 1521534.1 – New Swiss (CHE) Tax Registration Number

and

b) Enter/update existing tax registration number as

per new format before January 2014 to avoid any user interface, reporting or

data issue. The tax registration number as per old format will not be valid

effective from January 2014.

You can enter the registration number using multiple

navigations but the most common interface is: Tax Manager > Parties: Party Tax Profiles > Tax Registrations

References

For full details on this change in legislation, please review the Federal Administration website.