What is Monte Carlo in financial services?

Virtually all financial institutions use Monte Carlo simulations to support decisions critical for their core business to support innovation, fence off competition, respond to customers, and comply with regulators.

For example, in providing the current value of an option, many variables are used to determine the final result. The evaluation of equity options is one of the most common Monte Carlo use cases, in which the price of an underlying share is simulated for each possible price path, leading to optional payoffs for each path. Finally, to get the equity option price, the payoffs are averaged and discounted to the current day.

Following the same method of calculation, Monte Carlo can simulate the variables that influence the value of subportfolios while the subportfolio value is calculated. Averaging the value of all simulated subportfolios helps us get the value of the complete portfolio.

For the evaluation of fixed income instruments and derivatives, the short rate is always an uncertain variable. Through Monte Carlo, we can mitigate risk by simulating the short rate several times, and each bond or derivative price is calculated for each simulated rate. Using the average of obtained rates, you can get the bond price.

Banking regulators are continuously adding new functional requirements, and the financial instruments are evolving daily to increase complexity.

OCI is the right decision

Monte Carlo simulations, like high frequency trading and risk calculations, run over large compute farms built with thousands of cores and high availability to meet mission-critical applications. Low latency network, performance hardware, scalability, and price are the key points of these architectures.

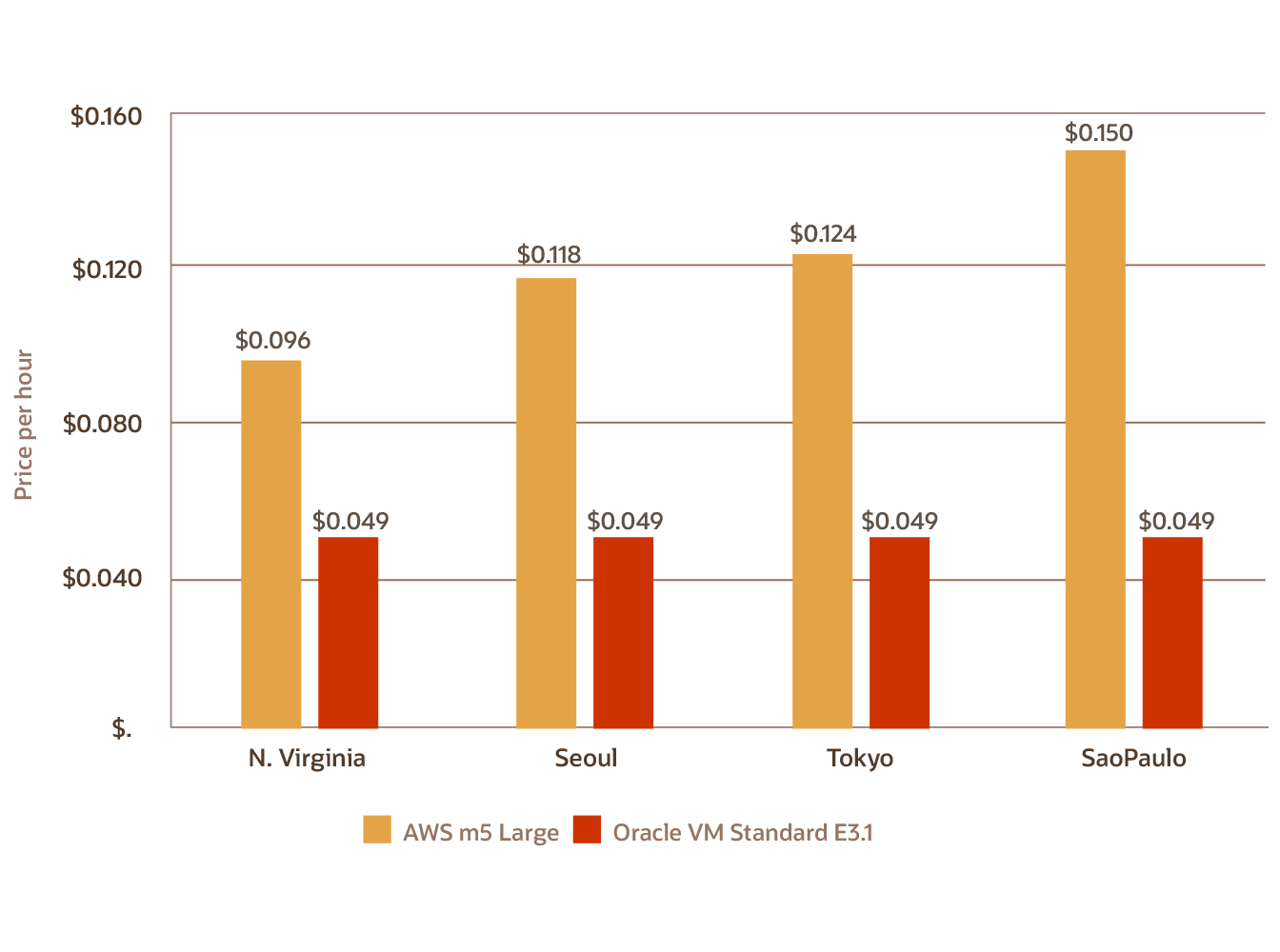

Oracle Cloud Infrastructure (OCI) makes the best cloud economics possible, as close to the market as you need, with more than 36 regions around the world offering the same price.

With OCI, you can reserve capacity based on your needs. With the OCI flexible Computer shapes, you can create capacity reservations according to your workload requirements, making your deployments more flexible and cost-efficient.

For low latency, OCI’s network is the most performant in the market, and you can use bare metal or remain on-premises if you want. With our Compute offering, you get the latest NVIDIA chipsets and can run Ampere processors to maximize your cost savings.

OCI vs. Other

Mission-critical workloads require consistent performance and enterprises need to feel comfortable when managing, monitoring and modifying resources. OCI makes you feel safe by reducing the risks to the minimum with manageability and performance SLAs. Compare our performance against Amazon Web Services, Google Cloud Platform and Microsoft Azure.

For more information about Oracle Cloud Infrastructure, see our reference architectures, such our recently published first rapidly deployable Monte Carlo simulator (GitHub repository), HPC Fintech use cases and identify and prevent fraud in Financial services blogs.

Performance is Oracle.