Financial institutions continue to face profitability headwinds, accelerated by declining interest rates, capital inefficiencies, and the cost of keeping up with regulations. To overcome these challenges in a critical time of growth, financial institutions and healthcare payers need to closely examine their revenue drivers. To offset the complex, expensive management of on-premises facilities, many are turning to large-scale adoption of cloud infrastructure services. They’re also focused on recapturing revenue by driving more customer-centric deal pricing and efficiently managing complex billing scenarios.

Manage complex billing in the cloud to boost revenue

Oracle has invested in developing a leading-class, revenue management cloud solution, powered by analytics, to arm financial institutions and healthcare payers with the insights that they need for intelligent decision-making around all their pricing and billing scenarios. Oracle Revenue Management and Billing is a suite of integrated cloud services designed to drive incremental revenue and profitability for the enterprise. The modules in the suite empower you to closely focus on core business objectives, including dynamic pricing, revenue uptick, and driving more flexible and innovative billing options for customers.

Available both on-premises and SaaS delivery, the solution offers rule-based pricing calculations, billing and invoicing, receivables and collections, payment arrangements, financial control, and revenue insights. The cloud service delivers functionally rich, highly scalable pricing, billing, and collections capabilities on Oracle’s secure public cloud infrastructure to help its customers streamline operations.

A large North American healthcare group deployed Oracle Insurance Revenue Management and Billing for Healthcare Payers to transform their premium calculations, billing, and account receivables management processes. The company consolidated five systems onto Oracle Revenue Management and Billing, cutting its infrastructure costs by 50% and reducing manual processes in the billing cycle by 93%.

The entire suite of Oracle’s Banking products, including Oracle Financial Services Revenue Management and Billing, are now powered by Oracle Cloud Infrastructure (OCI) to provide high performance, scale, availability, security, and data protection requirements that regulated industries demand. Top banks and healthcare payers across the globe depend on Oracle’s cloud for Revenue Management and Billing.

Benefits

Revenue Management and Billing on OCI includes the following benefits:

-

Smart security controls: Oracle Identity Cloud Service (IDCS) manages authentication of Oracle Revenue Management and Billing application users, including the ability to set up federated authentication and SSO. Authorization is managed within the application using an inbuilt role (application roles) security model. The application provides advanced capabilities for security maintenance.

-

High availability for business continuity: Oracle Revenue Management and Billing is deployed on resilient computing infrastructure designed to maintain service availability and continuity if an incident affecting the services occurs. Disaster recovery services provide service restoration capability if a major disaster occurs, as declared by Oracle, which leads to the loss of a data center and corresponding service unavailability. Upon Oracle’s declaration of a disaster, Oracle begins the disaster recovery plan to recover production data to the most recently available state to reconstitute the production environments with the recovery time and recovery point objectives.

-

Superior performance, scalability, and elasticity: Experience real-time elasticity powered by Oracle’s autonomous services, integrated security, and serverless compute with more security, scalability, and control and with a much better cost structure.

-

Easy data integration and transformation: Inbound data integration uses file-based or REST services. For file-based integration, Oracle Revenue Management and Billing provides a file upload interface module for data conversion and data integration with the ability to transform and upload files and map file records to Oracle Revenue Management and Billing services. Outbound data integration uses data extracts or REST services.

-

Data migration: Configuration Migration Assistant (CMA) provides implementers with a flexible, extensible facility for migrating configuration data from one environment to another environment. The application provides more than 125 base configuration objects delivered out-of-the-box that you can use as it is or as a template for building more specific configuration for an implementation.

Experience best-in-class performance and availability with security built-in

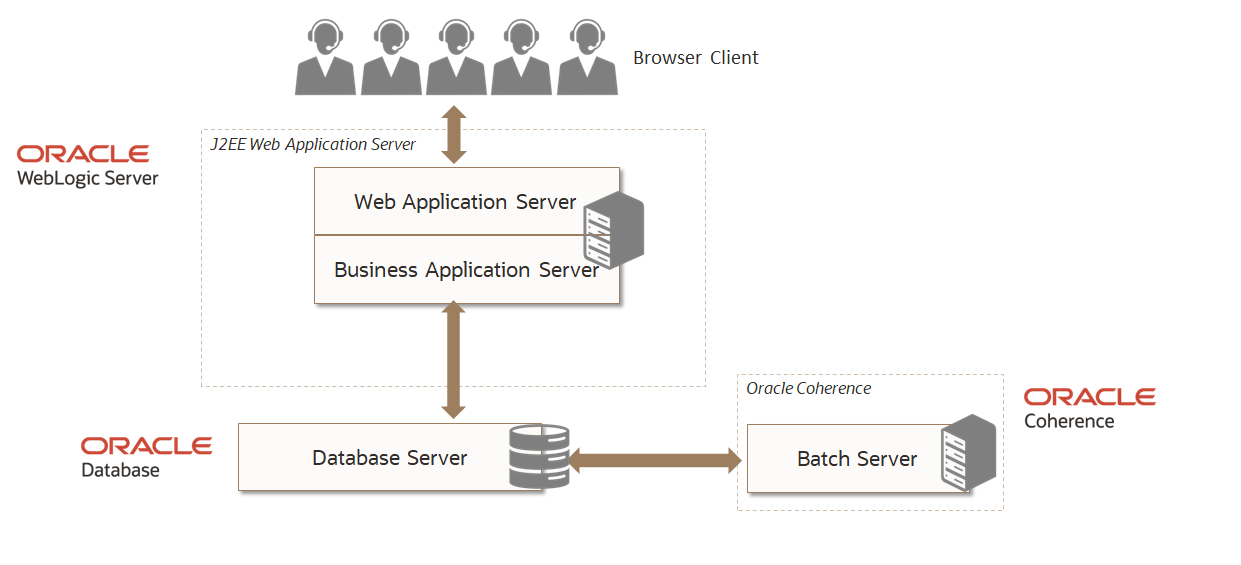

Transitioning to the cloud can help banks and healthcare payers support customer centricity, cut deployment times, accelerate time to market, and drive innovation. Oracle Revenue Management and Billing is subscribed on annual application revenue (pay as you grow), ensuring scalability matching to your business need. Customers are hosted in a single tenancy and capacity is reserved for your peak usage. A typical Oracle Revenue Management and Billing deployment consists of a web application server, batch server, and database server.

The underlying deployment architecture delivers the following features:

-

Increased scalability and reliability: The web application and business application components of the Oracle Revenue Management and Billing application are deployed in a WebLogic server cluster, which provides increased scalability and reliability.

-

Enhanced performance: The batch server is a set of Java virtual machines, clustered using Oracle coherence to enhance performance. It supports multi-threaded background processes processing records in bulk across a cluster.

-

High availability: The database server is deployed in an Oracle real application clusters (RAC), considering the performance benefits and high availability option.

-

Security built-in: Multi-layered security, data encryption, and state-of-the-art data centers. It provides customers with a private cloud environment including multiple instances for configuration, testing, production, and disaster recovery.

Take the first step

With Oracle Revenue Management and Billing, banks and healthcare payers benefit from streamlined operations, improved performance, and reduced costs, which enables businesses to focus on winning their business every day. The ease of consumption, immediate improvement in earnings before interest, taxes, depreciation, and amortization, a highly scalable and secure environment that meets stringent regulatory requirements, and single-vendor setup for applications and infrastructure help companies immensely.

To learn about their options for cloud migration, existing Oracle Revenue Management and Billing customers can discuss their infrastructure plans and product roadmap with their Oracle representative. The entire migration process uses a light touch, which enables customers to realize immediate cost and performance benefits.

Unlock your full revenue potential and access a preconfigured version of Oracle Revenue Management and Billing online, anytime, free of charge for a three-month period! Sign up for a cloud trial.