The move from on-premises to cloud is now simpler than ever for financial services organizations. Oracle Banking Digital Experience, a versatile digital banking platform, has been validated on Oracle Cloud Infrastructure (OCI). Banks can now run their digital banking solutions on OCI and benefit from the elasticity provided to optimize database usage.

Oracle provides banks a next-generation cloud designed to deliver the following features:

-

Security: FIPS 140-2 Security Level 3

-

Reliability: Disaster recovery and high availability

-

Ability to run large, complex deployments

OCI beats industry performance and pricing standards, offering about 50% lower total cost of ownership (TCO) than on-premises deployments and offers a bring-your-own-license (BYOL) model for all database services.

Oracle Banking Digital Experience: A cloud-ready digital banking platform

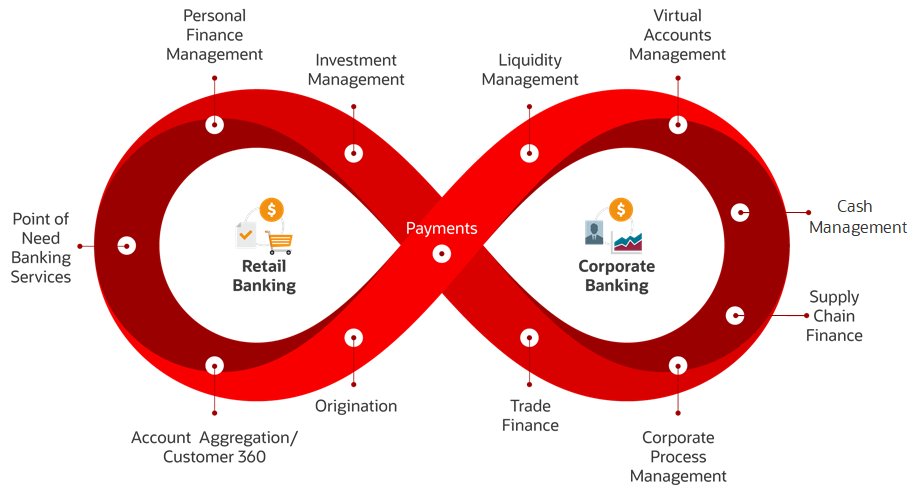

Oracle Banking Digital Experience is a full-spectrum, full-stack solution that offers ready-for-business retail, SME, corporate, and Islamic banking functionality through omnichannel touch-points in a modular environment. The platform offers a personalized user experience across all contemporary digital banking channels on mobile phones, tablets, desktops, and wearables through mobile applications and web interfaces.

The solution offers AI and neurolinguistic programming (NLP)-driven product origination, which pairs with live video interactive support to enable banks to reach their customers at key decision-making moments in their financial journey. Personalized customer engagement with ready-to-go consumer functionality like chatbots, support on personal digital assistants like Siri and Alexa, and peer-to-peer payments through iMessage and Facebook Messenger help subliminally embed banks into a customer’s everyday life. Built-in personal finance management and account aggregation tools allow banks to offer customers a 360-degree view of their financials within the bank and other financial institutions. This availability helps the bank’s customers to plan their financials efficiently and provides banks opportunities to cross-sell and up-sell.

Corporate banking has been revolutionized with the platform’s specialized corporate banking modules. The platform supports cash management with cash flow forecasting, real-time liquidity management, virtual accounts management, trade finance, supply chain finance, corporate loan originations management, trade, and credit facilities request management. Forex, bulk file upload, corporate payments, and merchant payments supercharge today’s hyper-connected corporate ecosystem.

Oracle Banking Digital Experience is a standalone digital platform that’s product processor agnostic and can run on multientity and multihost systems. This capability helps banks source customer information from anywhere within their organization and from the cloud.

Oracle Banking Digital Experience on OCI

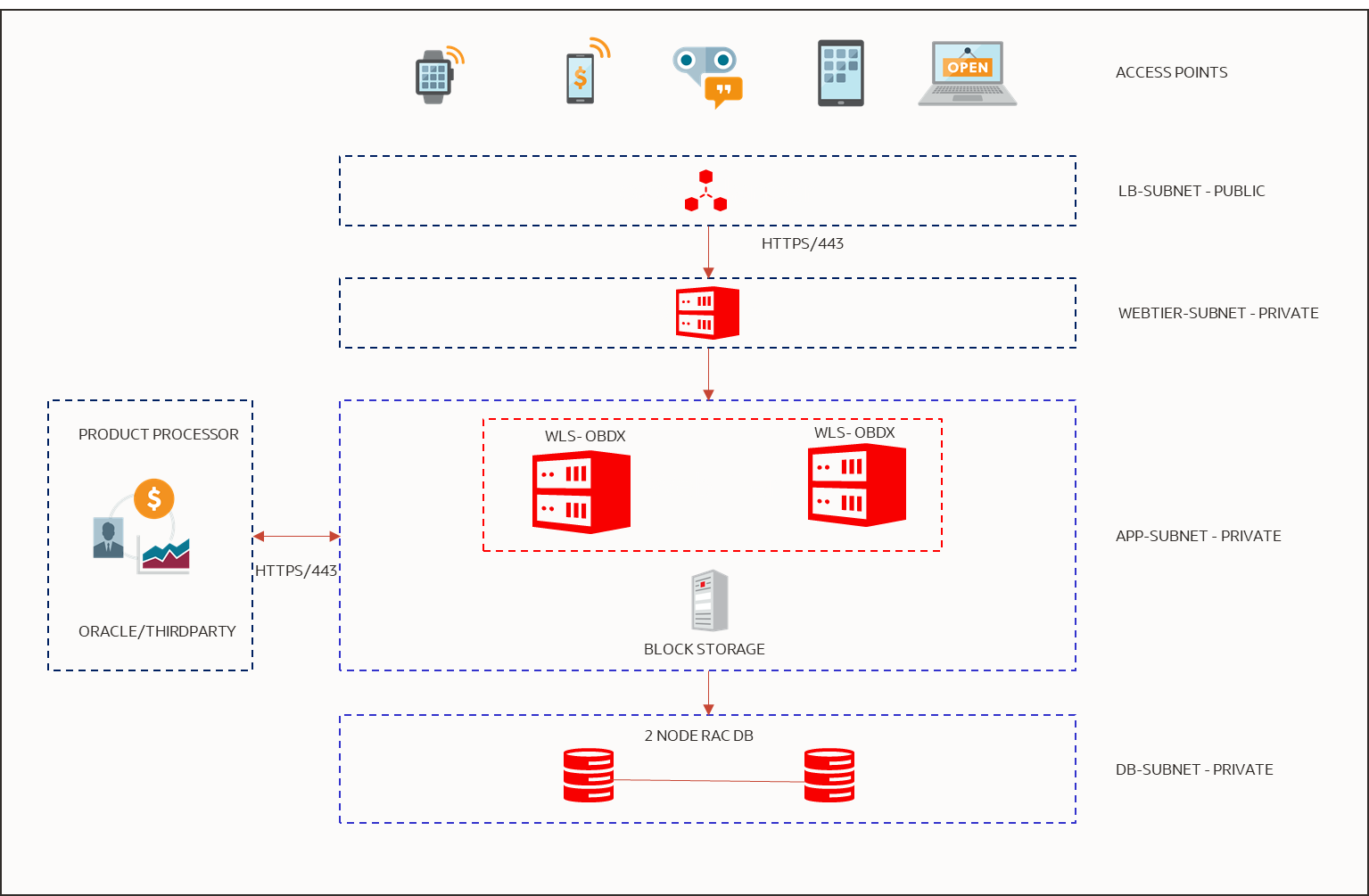

Customers can deploy Oracle Banking Digital Experience in a matter of weeks and employ exclusive Oracle Cloud products, such as Exadata Cloud, Database RAC, and Autonomous Database, designed for unmatched performance, reliability, and autonomous operations. Oracle Cloud’s global footprint and validated reference architectures ensure data sovereignty, disaster recovery, and enhanced availability, so banks can improve user experience tremendously.

The shift to the OPEX model can help banks realize an immediate positive impact on their EBITDA by transitioning to a lower-cost, consumption-based operating model. Compared to on-premises, customers benefit from dual savings when scaling up infrastructure to handle greater business demand and scaling down infrastructure during quieter periods. The modular design of Oracle Banking Digital Experience offers banks further flexibility to manage peak and lean time loads. These loads can be volatile in digital banking systems.

Oracle understands the importance of quality support and business continuity for enterprises. Oracle applications on OCI ensure engineering alignment, crucial for quick diagnosis and resolution of hardware, application, and network issues to mitigate the risk of business interruptions.

Oracle Banking Digital Experience Deployment on OCI

A typical Oracle Banking Digital Experience deployment consists of a centralized database layer with redundancy through cross-region or availability domain replication and application layer, consisting of the following Oracle Financial Services Global Business Unit (FSGBU) products based on customer requirements:

-

Oracle FLEXCUBE Universal Banking

-

Oracle Banking APIs

-

Oracle FLEXCUBE Onboarding

-

Oracle Banking Payments

-

Oracle Banking Corporate Lending

-

Other Oracle banking applications

Banks can also deploy Oracle Banking Digital Experience with any third-party product processor when they want to deploy the solution as a frontend to their existing technology landscape.

Your path to cloud flexibility, security, and economics

OCI offers an opportunity to streamline operations, improve performance, and reduce costs. The ease of consumption, immediate improvement in earnings before interest, taxes, depreciation, and amortization (EBITDA), high scalability and security, ability to meet stringent regulatory requirements, and single-vendor setup for applications and infrastructure help customers focus on their business while Oracle takes care of the technology.

Try Oracle Cloud Infrastructure today. You can select Oracle Cloud’s Always Free services or a 30-day free trial, which includes US$300 in credit to get you started with a broader range of services. Existing Oracle Banking Digital Experience customers can discuss their infrastructure plans and roadmap with their Oracle representative to learn about their options for cloud migration. The entire migration process is light-touch and takes only a few weeks, enabling customers to realize immediate cost and performance benefits.